Procedure of intimating AADHAAR number to ITD by PAN holder and quoting of the same in PAN applications

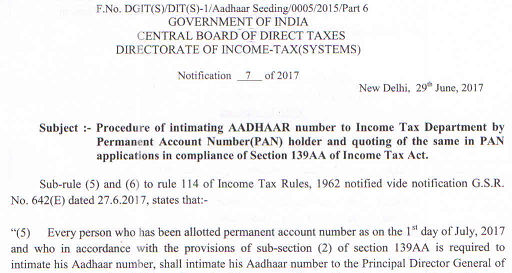

F.No. DGIT(S)/DIT(S)-I/Aadhaar Seeding/0005/2015/Part 6

GOVERNMENT OF INDIA

CENTRAL BOARD OF DIRECT TAXES

DIRECTORATE OF INCOME-TAX(SYSTEMS)

Notification 7 of 2017

New Delhi. 29th June, 2017

Subject :- Procedure of intimating AADHAAR number to Income Tax Department by Permanent Account Number(PAN) holder and quoting of the same in PAN applications in compliance of Section 139AA of Income Tax Act.

Sub-rule (5) and (6) to rule 114 of Income Tax Rules, 1962 notified vide notification G.S.R. No. 642(E) dated 27.6.2017, states that:-

“(5) Every person who has been allotted permanent account number as on the 1st day of July, 2017 and who in accordance with the provisions of sub-section (2) of section 139AA is required to intimate his Aadhaar number, shall intimate his Aadhaar number to the Principal Director General of Income-tax(Systems) or Director General of Income-tax(Systems) or the persons authorized by the said authorities.

(6) The Principal Director General of Income-tax(Systems) or Director General of Income-tax (Systems) shall specify the formats and standards along with procedure, for the verification of documents filed with the application in sub-rule(4) or intimation of the Aadhaar number in sub-rule

(5), for ensuring secure capture and transmission of data in such format and standards and shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relating to furnishing of the application forms for allotment of permanent account number and intimation of Aadhaar number.”

2. In exercise of the powers delegated by the Central Board of Direct Taxes vide above notification G.S.R. No. 642(E) dated 27.6.2017, the authority for intimating Aadhaar number, formats and standards along with procedure, for the verification of documents filed with the application in sub-rule(4) or intimation of the Aadhaar number in sub-rule (5) of Rule 114 of Income Tax Rules, 1962, format and standards for ensuring secure capture and transmission of data, appropriate security, archival and retrieval policies in relation to furnishing of the application forms for allotment of permanent account number and intimation of Aadhaar number will be as follows:-

A. For intimating Aadhaar number by existing PAN holders:-

| S. No. |

Authority to whom Aadhaar

number is to be not informed |

Mode |

Manner through which

Aadhaar has to be informed |

Whether any fee is levied

or not |

| (i). |

Either of the PAN service

providers namely M/s NSDL e-governance Infrastructure Limited (NSDL/eGov)

or M/s UTI Infrastructure Technology And Services

Limited(UTIITSL) |

SMS |

By sending a SMS, in

specified format, to specified ‘Short code’ and using specified Keyword

which are :-

- Short Code:- 567678 or 56161

- Keyword :- UIDPAN

- Format of SMS: Keyword<Space><l2 digit Aadhaar><Space>< 10 digit

PAN>

For Example

Send SMS to 567678 or 56161 in following format:-

UIDPAN<Space>< 12 digit Aadhaar><Space><10 digit PAN>

Example of SMS:

UIDPAN 111122223333 AAAPA9999Q |

Free service.

SMS charges as levied by mobile

operator of the PAN holder will

apply |

| On-line |

By visiting and filling

required information, such as PAN, Aadhaar

Number, Name as per Aadhaar, Date/Year of Birth

etc., through applicable

link provided on the website of either of PAN

service provider i.e. www.tin-nsdl.com for NSDL

eGov or www.utiitsl.com for UTIITSL. |

Free service. |

Through designated PAN service

centre |

By visiting designated PAN

service centre of PAN service provider NSDL eGov or UTIITSL, PAN holder

has to fill prescribed form as provided in

Annexure-I which has to be submitted to

designated PAN service centre along with copy of

PAN card, Aadhaar card and prescribed applicable

fee. PAN holder may authenticate Aadhaar

Biometrically on visit to such PAN service

centre. Biometric authentication shall

compulsorily be required in cases where there are. sufficient mismatches

in PAN and Aadhaar data. Details of designated PAN service centre shall

be published by PAN service providers on their respective websites i.e.

www.tin-nsdl.com for Ms NSDL eGov or www.utiitsl.com for M/s UTIITSL. |

Paid service.

Approved prescribed fee will be levied by PAN service centre on PAN

holder who files request for Aadhaar seeding.

However, there will not be any additional fee on account of Aadhaar

seeding while making new PAN application or Change request. |

| (ii) |

eFiling system of the

Income Tax Department. |

On-line |

By visiting and filing

required information, PAN, Aadhaar Number, Name as per Aadhaar,

Date/Year of Birth etc., through applicable link provided on e-filing

portal of the Income Tax Department i.e.

www.incometaxindiaefiling.gov.in |

Free service |

B. For quoting Aadhaar in new PAN application process:-

|

(i) Guidelines for filling the Column No. 12 of Form 49A

|

| Column No. |

Column Details |

Guidelines for filling the

form |

| 12 of Form 49A |

In case of a person,

who is required to quote Aadhaar

number or the Enrolment ID of

Aadhaar application form as

per section 139AA. |

Aadhaar Number

As per provisions of section 139AA of Income Tax Act, 1961, Aadhaar

number has to be provided. Copy of Aadhaar letter/card shall be

provided as proof of Aadhaar.

Enrolment ID (EID) of application for Aadhaar

Only if Aadhaar is not allotted to the applicant, then ElD (which

includes date & time of enrolment) for Aadhaar shall be provided. Copy

of EID receipt shall be provided as proof of enrolment.

As specified by Ministry of Finance, Government of India notification

No. 37/2017, F. No. 370133/6/2017-TPL dated May 11, 2017, it would be

optional to mention Aadhaar as well as EID for the individuals (i)

residing in the States of Assam, Jammu and Kashmir and Meghalaya; (ii) a

non-resident as per the Income-tax Act, 1961; (iii) of the age of eighty

years or more at any time during the previous year;

Name as per Aadhaar letter/card or Enrolment ID for Aadhaar application

form

- If the Aadhaar is provided by the applicant, then name as per

AADHAAR letter/card has to be provided;

- If EID is provided by the applicant, then name as appearing on

BID receipt has to be provided in this field.

Supporting documents of Proof of Identity, Address and Date of Birth

(other than Aadhaar) as specified in Rule 114(4) of Income Tax Rules,

1962 will be applicable for cases where there is mismatch in PAN

application and Aadhaar data or the PAN applicant has provided Aadhaar

EID or where the PAN applicant has been exempted from compulsory quoting

of Aadhaar as per Ministry of Finance. Government of India notification

No. 37/2017, F. No. 370133/6/2017-TPL dated May 11, 2017. |

B. For quoting Aadhaar in new PAN application process:-

|

(i) Guidelines for filling the Column No. 12 of Form

49A

|

| Column No. |

Column Details |

Guidelines for filling

the form |

| 12 of Form 49A |

In case of a person,

who is required to quote Aadhaar

number or the Enrolment ID of

Aadhaar application form as

per section 139AA. |

Aadhaar Number

As per provisions of section 139AA of Income Tax Act, 1961, Aadhaar

number has to be provided. Copy of Aadhaar letter/card shall be

provided as proof of Aadhaar.

Enrolment ID (EID) of application for Aadhaar

Only if Aadhaar is not allotted to the applicant, then ElD (which

includes date & time of enrolment) for Aadhaar shall be provided. Copy

of EID receipt shall be provided as proof of enrolment.

As specified by Ministry of Finance, Government of India notification

No. 37/2017, F. No. 370133/6/2017-TPL dated May 11, 2017, it would be

optional to mention Aadhaar as well as EID for the individuals (i)

residing in the States of Assam, Jammu and Kashmir and Meghalaya; (ii) a

non-resident as per the Income-tax Act, 1961; (iii) of the age of eighty

years or more at any time during the previous year;

Name as per Aadhaar letter/card or Enrolment ID for Aadhaar application

form

- If the Aadhaar is provided by the applicant, then name as per

AADHAAR letter/card has to be provided;

- If EID is provided by the applicant, then name as appearing on

BID receipt has to be provided in this field.

Supporting documents of Proof of Identity, Address and Date of Birth

(other than Aadhaar) as specified in Rule 114(4) of Income Tax Rules,

1962 will be applicable for cases where there is mismatch in PAN

application and Aadhaar data or the PAN applicant has provided Aadhaar

EID or where the PAN applicant has been exempted from compulsory quoting

of Aadhaar as per Ministry of Finance. Government of India notification

No. 37/2017, F. No. 370133/6/2017-TPL dated May

11, 2017. |

C. For quoting Aadhaar in form titled “Request For New PAN Card Or/ And Changes Or Correction in PAN Data”:-

| (i) |

Following column in place of column no. 10 of

form titled “Request For New PAN Card Or/ And Changes Or

Correction in PAN Data” |

|

| 10 AADHAAR number (if allotted) |

|

|

|

| Name as per AADHAAR letter/card |

|

|

|

|

|

|

|

| (ii) |

Guidelines for filling column no. 10 of form

titled “Request For New PAN Card or/ And Changes Or Correction’

in PAN Data” |

|

| Column No. |

Column Details |

Guidelines for filling the form |

10 of form titled “Request

For New PAN Card Or/ And Changes Or Correction in PAN Data” |

AADHAAR number (if

allotted) |

Aadhaar Number

As per provisions of section 139AA of Income Tax Act, 1961, Aadhaar

number. if allotted shall be provided for the purpose of linking of

Aadhaar with PAN. Copy of Aadhaar letter/card shall be provided as proof

of Aadhaar.

Name as per Aadhaar letter/card

- If the Aadhaar is provided by the applicant, then name as per

AADHAAR letter/card has to be provided;

Supporting documents of Proof of Identity, Address and Date of Birth

(other than Aadhaar) as specified in Rule 114(4) of Income Tax Rules.

1962 will be applicable for cases where there is mismatch in PAN

application and Aadhaar data or where the PAN holder has been exempted

from compulsory quoting of Aadhaar as per Ministry of Finance,

Government of India notification No. 37/2017, F.No. 370133/6/2017-TPL

dated May 11, 2017. |

2. Aadhaar number can be informed to the Income Tax Department by the PAN holder/applicant through the authority and procedure mentioned above.

3. Aadhaar shall be linked to PAN after due authentication of Aadhaar from Unique Identification Authority of India (UIDAI) (hereinafter referred to as UlDAI) through available authentication modes i.e. demographic, biometric, OTP, e-KYC or Multi-factor or as specified by the UIDAI. Aadhaar data shall also be matched with PAN/PAN application data before authentication. PAN applications or request for linking of Aadhaar with PAN may be rejected if mismatches in Aadhaar and PAN data are observed.

4. PAN and e-Filing service providers shall ensure that the identity information of Aadhaar holder, Demographic as well as Biometric, is only used for submission to the Central Identities Data Repository of the UlDAl for Aadhaar authentication purpose. However, demographic information of Aadhaar shall also be sent to Income Tax Department for linking with PAN. Any deviation will be treated as non-compliance. to security and confidentiality clause or similar clause of their respective agreements/contracts and may lead to applicable penalty as per their respective agreements/contracts.

Pr. Director General of Income-tax(Systems)

Form for Aadhaar seeding into PAN database

| PAN |

|

| NAME AS PER PAN CARD |

|

| AADHAAR NUMBER |

|

| NAME AS PER AADHAAR CARD |

|

Declaration:

I hereby confirm that the Aadhaar given above has been issued to me by

UIDAI and same has not been provided by me earlier for the purpose of

seeding with any other PAN.

I hereby declare that Ihave not been allotted any other PAN than the one

mentioned above by me.

I hereby declare that the information furnished above is true to the

best of my knowledge and belief.

I hereby state that l have no objection in authenticating myself with

Aadhaar based authentication system and consent to use my Aadhaar

number, Demographic, Biometric and/or One Time Pin (OTP) data for

authentication for the purpose of fulfilling the requirement under PAN

procedure.

I understand that the Demographic, Biometrics and/or OTP I provide for

authentication shall be used only for authenticating my identity through

the Aadhaar Authentication system for the purpose of seeding of Aadhaar

against PAN and for no other purposes.

I understand that complete security and confidentiality shall be ensured

for my personal identity data provided for the purpose of Aadhaar based

authentication.

|

|

|

|

|

| Date: |

______/______/20_______ |

Signature/Thumb Impression |

|

|

Source: http://www.incometaxindia.gov.in/news/not_7_2017_new.pdf

COMMENTS