Tag: e-filing

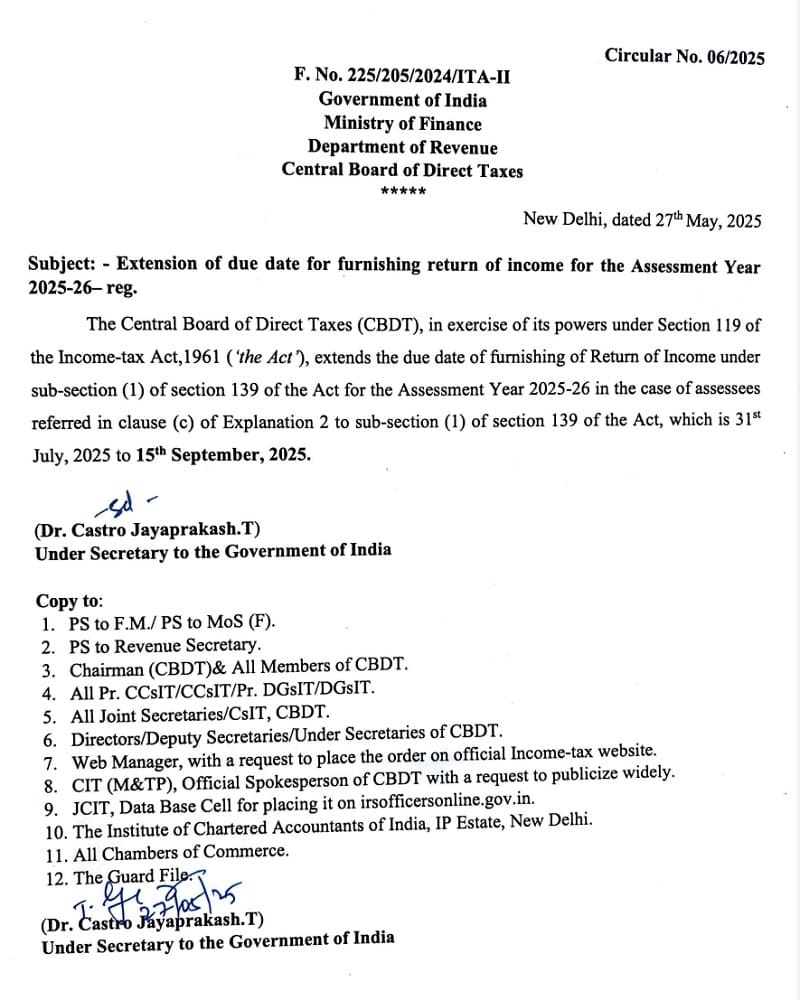

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) – Extension of due date upto 15.09.2025: Income Tax Circular No. 06/2025

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) - Extension of due date upto 15.09.2025 for furnishing of return: Income Tax Circular [...]

Waiver of Interest Charges for Delayed Tax Credit Due to Technical Issues: Income-tax Order under section 119 – Circular No. 5/2025

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Act, as the case maybe, in specific cases - Order under section 119: IT Circular [...]

Bank Account Validation Status for Refund – Income Tax Message dated 13-Sep-2023

Bank Account Validation Status for Refund - Income Tax Message dated 13-Sep-2023

Check Bank A/c validation Status For Refund.

Has your bank merged w [...]

Filing of Income Tax Return by 18-35 Age group: Gross taxes paid before claim of refund is Rs 93,318 crore

Filing of Income Tax Return by 18-35 Age group: Gross taxes paid before claim of refund is Rs 93,318 crore

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

[...]

Co-Browser FAQs – The co-browsing (collaborative browsing) feature of the IT Portal

Co-Browser FAQs - The co-browsing (collaborative browsing) feature of the IT Portal is now available to income-tax payers

Co-Browser FAQs

Wha [...]

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically

Notif [...]

FAQs on top ten clarifications sought by the Taxpayers while filing their Income-tax returns

FAQs on top ten clarifications sought by the Taxpayers while filing their Income-tax returns

Question 1:

Self-assessment tax paid but not reflecting [...]

ABC of Tax – Lets learn the basics : Everything about e-filing made easier

ABC of Tax – Lets learn the basics : Everything about e-filing made easier

Dear Individual Taxpayer,

As we continue making e-Filing easier, faster [...]

Mandatory e-filing of cases/petitions by the Government in all matters from 01.01.2022

Mandatory e-filing of cases/petitions by the Government in all matters from 01.01.2022

भारत सरकार/GOVERNMENT OF INDIA

रेल मंत्रालय /MINISTRY OF RAIL [...]

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing: IT Circular No. 21/2021

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing - One-time relaxation for verification : Circular [...]