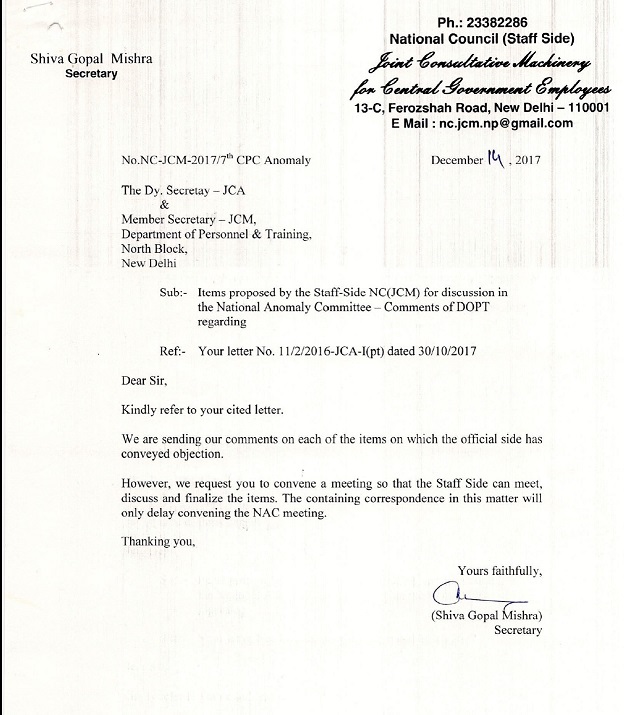

| Shiva Gopal Mishra Secretary |

National Council (Staff Side)

Joint Consultative Machinery for Central Government Employees 13C, Ferozshah Road, New Delhi – 110001 |

| No.NC-JCM-2017/7th CPC Anomaly |

December 14, 2017

|

The Dy. Secretary-JCA,

Department of Personnel & Training,

North Block,

New Delhi.

Sub:- Items proposed by the Staff-Side NC(JCM) for discussion in the National Anomaly Committee – Comments of DOPT regarding

Ref:- Your letter No.11/2/216-JCA-I(pt) dated 30/10/2017

Dear Sir,

Kindly refer to your cited letter.

We are sending our comments on each of the items on which the official side has conveyed objection.

However, we request you to convene a meeting so that the Staff Side can meet, discuss and finalize the items. The containing correspondence in this matter will only delay convening the NAC meeting.

Thanking you,

sd/-

(Shiva Gopal Mishra)

Secretary

7th CPC Minimum Pay, Increment Anomaly, Index Rationalization, Minimum Pension, Date of Effect of Allowances will not discussed in National Anomaly Committee: DoPT

Sno |

Description of Anomaly | Official Comments | Reply by Staff Side |

1 |

Anomaly in computation of Minimum Wage (Item No 1) | As against the Minimum Wage decided to be Rs. 18000/- by the Govt. w.e.f. 01.01.2016, the Staff-Side has said that this should be not less than Rs. 26,000/-and the multiplication factor ought to have been 3.714 and not 2.57. They have further asked for the pay matrix to be changed. Objecting to the methodology adopted by the 7th CPC in computing the Minimum Wage, they have given a number of reasons like the retail prices of the commodities quoted by the Labour Bureau being irrational, adoption of the 12 monthly average of the retail price being contents to the Dr. Avkrovd f ormula, the website of the Agriculture Ministry giving the retail prices of commodities forming the basis of computation of minimum wage provides a different picture, so on and so forth. However, when one compares this item with the three situations given in |

The 7th CPC categorically stated that the principle adopted for minimum wage determination is Dr. Aykhoyd formula. But deviated from the same while actual computation was made. It becomes an anomaly under clause 1(a) of the definition (see OM dated 16.08.2016) |

2 |

3% Increment in all stages (Item No 2) | The Staff-Side argues that in spite of the foreword to the Report making it clear in para 1.19 that the prevailing rate of increment is considered quite satisfactory and has been retained, an illustrative list appended by them shows instances where the pay, gone up after the addition of annual increment by 3%, falls short of what it would have been. They have quoted para-5.1.38 of the report also which states that the rate of annual increment would be 3%. While what the Staff-Side has stated has its own merits, the fact of the For instance, if staying at Rs.46,100/- one gets an increment @ 3%, |

At the stage of admission of the items for anomaly, it is not desirable to go into the merit of the case. That will have to be the subject matter of discussion at the meeting. The anomaly on this item has arisen due to the non-adherence of the principle enunciated by the 7th CPC while actuals are computed. The item becomes an anomaly under clause (a) of the definition (see OM.No. dated 16.08.2011) |

3 |

Remove Anomaly due to index rationalization (Item No vi) | The Staff-Side has taken exception to the index rationalization followed by the 7th CPC while formulating its views as per which the fitment factor varies and moves upward as one goes up the hierarchical ladder with the level of responsibility and accountability also steadily climbing up commensurately. The Staff-Side argues that the multiplication factor should be one, i.e. 2.81. Although the Staff-Side has remonstrated that the vertical relativity |

The vertical relativity between grades that was in existence has been distributed by assigning different multiplication factor for different levels by the commission. The so- called policy decision of the Government has only compounded the anomaly. As stated against item no. (ii) The merit or demerit of the issue is a matter for discussion at the meeting and cannot be employed to decide admissibility or otherwise of an item. The item is an anomaly under clause KO of the definition |

4 |

Minimum Pension (Item No x) | The Staff-Side says the minimum pension fixed after 7th CPC should be corrected and revised orders issued. From the brief explanatory note recorded under this point, it appears that the CPC had sounded out D/o pension on what the latter thought what the minimum pension should be. This is an exclusively pension-related issue on which, as informed by |

Pension related items are not to be excluded from the preview of the anomaly committee. No such specific decision has ever been taken. May be main focus is decided to be on pay related matters. That can be the view of the Govt. The item is clearly within the ambit of definition of anomaly clause I (a) where it is stated that the policy enunciated is deviated without the commission assigning any reason. No reason is adduced by the 7th CPC to fix minimum pension at 50% minimum wage. This is clearly an anomaly and requires to be admitted as such and discussed at the meeting. |

5 |

Date of effect of allowances HRA, Transport Allowance, CEA etc. (Item No xi) |

The Staff-Side has demanded that the grant of the allowances (revised) mentioned alongside should be made effective from 01.01.2016 and not from 01.07.2017. This is a demand and cannot be treated as an anomaly. Moreover, the date |

The Govt. has the prerogative to decide upon on any issue. We have not questioned that authority at all. it is the rationale behind the decision that is questioned. While the 7th CPC has gone on record to state that its recommendations are with effect from 1.1.2016 the decision to give effect to revision of allowances from another date is a deviation and contravenes the principle enunciated. The Govt may have sufficient reason to do so but that can be explained at the meeting. The item is therefore an anomaly under clause 1(a) of the definition. In this connection we may also state that similar decision on earlier occasions were subjected to discussion and having reached disagreement were referred to the Board of Arbitration. The Government lost its case before the Board |

6 |

Anomaly in the grant of D.A instalment w.e.f 01.01.2016. (Item No xviii) | Here the Staff-Side has questioned the methodology adopted by the Government in computing the DA instalment w.e.f. 01.01.2016. It has, however, to be pointed out that even if there is merit in the |

When the Govt. takes decision to deviate from the recommendation of Pay Commission whereby either all or a section of employees are to incur financial loss, it amounts to deviating from the policy or principle enunciated by the commission. In the instant case in the face of recommendation to continue with the existing scheme of DA, the Govt. has taken decision to reduce DA entitlement. Apart from long term impact it also unsettles the principle. The item is covered within the ambit of clause 1(a) of the definition (OM No. Dated 16.08.2016). item has to be admitted |

7 |

Implement the recommendation on Parity in Pay Scale between Sr. Auditor/Sr. Accountant of IA&AD and organized Accounts with Assistant Section Officer of CSS. (item No.xii ) |

The Staff-Side says that although the 5th, 6th and now 7th CPC’s have recommended that the pay-scales of different cadres/categories/grades requiring the same recruitment qualifications should be the same, denial of the same benefit to the Statistical Assistants (SA’s) who are otherwise at par with Assistant Section Officers (erstwhile ‘Assistant’) is a violation of the principle. While ASO’s are placed in the Pay-Matrix of 7, SA’s are in the Pay-Matrix of 6. This arrangement is stated to have disturbed the horizontal relativity between the pay-scales of the SA’s in the Organized Accounts and IA&AD Cadre and ASO’s in the CSS cadre. In conclusion, it has been requested that SA’s should also be placed in Pay-Matrix no. 7. Even if, the present case comes across as one of anomaly, it appears that the interests of the Statistical Assistants only are involved. ASO’s of CCS are coming into the question; but only as a reference point, by way of comparison. Hence the Staff-Side is requested to take up this issue at the Departmental Anomaly Committee concerned. |

Where an item is related to more than one department, the said item shall qualify for admission at the NAC. The item is covered by clause i(c) of the definition |

8 |

Technical Supervisors of Railways (item No.xv) | This particular item is exclusively Railways-specific. The Staff-Side, NC OCM) is requested to take it up at the Departmental Anomaly Committee of MR) Railways |

We shall take up the above issue in Railway DAC |

9 |

Anomaly in the assignment of replacement of Levels of pay in the Ministry of Defence, Railways, Mines etc in the case of Store Keeper (item No. Xvi) |

Staff-Side says that although ‘Store keeper’ is one such category of posts which is common to various Departments like Defence, Mines, Railways etc and in spite of the nature of job, responsibilities being similar, the pay-scale of storekeepers across all the Departments is not the same. It is still less in the M/o Defence even after the entry-level qualifications which were different before the 7th CPC stage, have been revised. If what the Staff-Side remonstrates that even after the requisite changes had been carried out in the R/Rules, the 7th CPC did not take any cognizance of it is true, it has to be assumed that it is a policy decision of the Government. Moreover, the issue appears to be M/o Defence-specific. The Staff-Side is requested to take it up at the Departmental Anomaly Committee meeting of the M/o Defence. |

Where an item is related to more than one department, the said item shall qualify for admission at the NAC. The item is covered by clause i(c) of the definition |

10 |

Anomaly arising from the decision to reject option-1 in pension fixation (item No. Vii) |

As per the ToR of the NAC, anomalies are basically pay-centric. Under this point, the contention of the Staff-Side is pension-centric. Furthermore, the Staff-Side has themselves clarified that post-7th CPC, Government had set up a CoS headed by Secretary(Pension) to look into the first option recommended by the 7th CPC. Eventually, this was not found feasible to be implemented. With such a decision having been taken at the CoS level, it cannot be called an anomaly. In view of this, we may inform the Staff-Side to separately take it up with D/0 Pension without treating it as an anomaly that can be taken up at the NAC. |

It the Govt deviates from the recommendation of the Pay Commission it give rise so anomaly as the Pay Commission recommendations are in consonance with the policy it had enunciated. In the instant case Govt. setup a committee to go into the feasibility of implementation of the recommendation. Feasibility of implementation cannot be the basis for rejecting a recommendation. The very feasibility question itself will have to discussed at the meeting. The issue is well within the ambit of definition of clause i (a) OM Dated 16.8.2016, where the principle enunciated is disturbed by the Government. |

11 |

Parity in Pay Scales between Assistants/Stenographers in field / subordinate officers and assistant Section Officer and stenographers in CSS. (item No. Xiii) |

Although the heading of this item is self-explanatory, the relevant text given in the paper sent is not complete as the pay-scales of Assistants and stenos posted in field have not been mentioned therein. Until their pay-scales are known they cannot be compared to check whether there is indeed any anomaly. The Staff-Side is requested to provide more information that is relevant so that it can be properly examined to find out whether an anomaly arises here or not. |

We shall send further details. |

COMMENTS