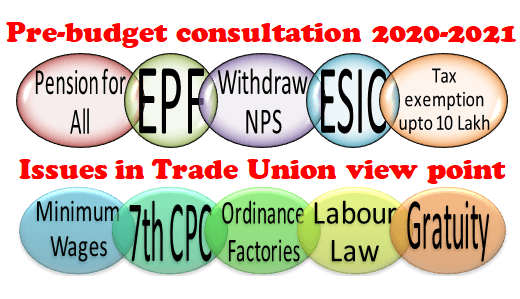

Minimum Wages, 7th CPC, Ordinance Factories, Labour Law, EPF, ESIC, Pension for All, Withdraw NPS, Gratuity, Tax exemption upto 10 Lakh: Issues in Trade Union view point – Pre-budget consultation 2020-2021

Date: 19.12.2019

The Hon’ble Minister of Finance

Government of India North Block,

New Delhi-110 001

Sub: Trade unions view point on issues to be considered for framing budget for the year 2020-2021

Madam,

The joint memorandum being submitted by us, the 10 central trade unions who have been repeatedly raising these issues since several years, covers all the three themes of discussion suggested by you. Hence we are not covering each theme separately. These issues have been repeatedly raised by the central trade unions even during the tenure bf the previous NDA regime. However we are constrained to repeat most of them in the absence of any positive response from the government in its earlier term of five years and again on taking charge for the second time.

- Minimum wage: The Wage Code already passed in the Parliament and later on in the proposed rules for the code, the ILC recommendations as a norm has been mentioned. Hence the Minimum wage, including the National floor level , minimum wage should be decided on the basis of the recommendations of the 15th Indian Labour Conference and the Supreme Court judgment in Raptakos & Brett case (which the Govt has already proposed in the Rules of the Code on Wages Act 2019) and linked to current Consumer Price Index, and the same should be guaranteed to all workers. The 7th Pay Commission has worked this to be Rs 18000 per month, with effect from 1.01.2016, which the government has accepted. It has been four years since that and the prices of all essential commodities have increased . The Expert Committee appointed by the Labour Ministry to decide the methodology of fixing minimum wage has artificially suppressed the minimum wage grossly underestimating the cost of living and arbitrarily cutting down the universally accepted calorie-requirement standard which is totally unacceptable . Hence, the national minimum wage should be fixed at not be less than Rs 2 1000 per month. Need based minimum wage should be considered as an essential part of social security.

- Employment generation : Employment generation has nosedived in the recent period . Massive public investment in infrastructure, social sectors and agriculture would generate employment. The union budget should give priority and allocate the necessary funds for this. Emphasis should be on raising the internal demand rather than exports. All vacant sanctioned posts in the different government departments including in the health, education. departments and institutions, in the Railways, PSUs and autonomous Institutions should be filled up through fresh recruitment. The ban on creation of new posts and mandatory reduction of government posts should be lifted. Denial of level playing field to many PSUs (BSNL, MTNL, ITI etc.) had put thousands of jobs in jeopardy . The policy of merger of BSNL-MTNL and voluntary retirement (which is actually forced retirement) of almost 79000 workers is just opposed to the idea of creation of jobs. The provision of “fixed term employment” also should be done away with and concerned notification should be rescinded forthwith.

- Skill development: Government has been heavily incentivising the employers for engaging apprentices in the name of skill development. The employers, particularly in private sector, including MNCs, are taking advantage of this by deploying apprentices in regular production jobs year after year and gradually cutting down regular employment thereby saving hugely on the statutory social security expenses and wages also. This practice must be stopped by , regularising the apprentices working years together on regular production lines as workers.

Simultaneously the role of the skill development agencies, mostly in private sector, availing government support needs to be inspected and scrutinised. A white paper should be published on the working of these skill development agencies. The government must also intervene to ensure placement in regular jobs, of those getting trained in those agencies.

- Increase budgetary allocations for social sector: The government should increase allocations on social sector and basic essential services like health, education, food security etc in the Union Budget, particularly in terms of improving infrastructure, filling up of all vacancies and creating new jobs to meet the increasing needs of the population. The necessary financial resources should be raised by increasing direct income tax and corporate tax, wealth tax, while reducing the GST, thus reducing the increasing income gap.

- Effective measures against deliberate tax and loan repayment defaults : Effective and firm measures should be taken against deliberate tax default by the big business and corporate lobby to curtail the huge accumulation of unpaid taxes, which have been continuously increasing. Further, wilful default should be made a criminal offence, the list of wilful defaulters should be made public and stringent measures such as fast track Debt Recovery Tribunals ‘ should be implemented for speedy recovery of loans. The easy escape route called Insolvency and Bankruptcy Code (IBC), which denies workers and say and robs banks of their NPAs, should be scrapped. The Government should withdraw its policy to continuously reducing the tax slab of the corporates. Roll back the tax concessions to corporates, reduce the user fee in Banks for common man, increase interest on the savings of common citizens and reduction of interest for loans to micro, small and home based sector to help generate more jobs. Stop merger of banks.

- 7th Pay Commission: Resolve demands of the Government employees regarding 7th Pay Commission.

- Price rise: The rise in prices is matter of grave concern for workers. The retail inflation has already crossed the double digit as on November 2019 as per NSSO estimate. Speculative forward trading and hoarding of essential commodities are major factors contributing to the price rise of essential commodities, particularly of food items. It has become impossible for the workers and other toiling people to meet their basic daily needs. One of the major contributing factors for this is the speculative forward trading and hoarding. The government should ban speculative forward trading in essential commodities, take strong measures to curtail hoarding and strengthen Public Distribution System, making it universal. Stop the system of cash transfer to beneficiaries’ accounts in lieu of PDS. This is leading to exclusion of large number of needy people. Take immediate steps to reduce the price of medicines including life saving drugs.

- Stop disinvestment and s trategic sale of public sector units: The reported pronouncements about disinvestment, closure and sale of the public sector units, by those in governance are a matter of grave concern. The public sector has to be strengthened and expanded. Budgetary support should be provided for the revival of potentially viable sick public sector units. Strategic sale of the profit making PSUs and also potentially viable PSUs in strategic and core sectors like steel, coal, mining, heavy engineering, pharmaceuticals, dredging, airlines, financial institutions etc which is being attempted to at present should be stopped forthright. The immediate example are proposed sale of BPCL PSU, where as Indian Oil-another PSU is ready to take over the BPCL to which Government is not agreeing. The proposed sale of BPCL should be abandoned. The amendments to the Motor Vehicle Act, has already created problems for the general population and paving the way for privatisation of the state – owned public transport system. We want the Government to withdraw these amendments. So also the proposed amendments to Electricity Act 2003 should be shelved.

- Prevent dumping: The increasing import of industrial commodities including capital goods should be contained and regulated to prevent dumping. Protect and promote domestic industries. This will also help in preventing job losses.

- Extend MGNREGA : Expenditure on MGNREOA should be increased to cover all rural areas. Ensure immediate payment of accumulated unpaid wages to workers employed under MGNREGA. It should be amended to include the urban areas as well. The unanimous recommendation of 43rd ILC to extend the scheme to urban areas, guarantee employment for a minimum of 200 days with statutory minimum wage, should be implemented. Payment of wages for the work done, pending for many months should be immediately paid.

- Contract and casual workers: No contract/casual workers should be deployed on jobs of perennial nature. The contract and casual workers doing the same and similar work as the permanent workers should be paid the same wages and benefits as paid to regular workers as directed by Hon’ble Supreme Court of India in 2016. Regularize the existing contract and casual workers in the jobs of perennial nature.

- FDI: The CTUs have been repeatedly demanding that FDI should not be allowed in crucial sectors like defence production, railways, financial sector, retail trade etc. But the government has persisted with this policy and announced for 100 percent FDI in coal which was protested by the coal workers by holding complete strike in the sector on 24lh September . Corporates with large NPAs are allowed to invest in sensitive sectors like defence. We reiterate the demands that FDI should not be allowed in the cruciaJ sectors.

- Defence : Privatisation and/or outsourcing of the defence sector production should be stopped. The order of outsourcing of the 272 items being produced by the public sector ordinance factories should be withdrawn . The proposed policy of corporatisation of 41 ordinance factories be rolled back. The defence unions through their complete strike for six days from August 20th have rejected this proposal of the Government. This policy should be abandoned in the national interest.

- Scheme workers: Regularise the workforce employed in the various schemes of government of India including the !CDS, NHM, Midday Meal Programme, National Child Labour Project, Sarva Siksha Abhiyan etc. Till this is done, at least immediately implement the recommendation of the 45th!LC that these scheme workers should be recognised as workers’, they should be paid minimum wages and provided social security benefits including pension. Increase budgetary allocations to these schemes and stop privatisation of these schemes in any form. The government should implement Gender Budgeting in view of these almost exclusively female workers.

- Domestic workers: The government should ratify the IW Convention 189 and enact a central law and create support system for domestic workers.

- Unorganised workers: Create a National Fund for Unorganised Workers to provide social security for all unorganised workers including contract, casual, migrant workers etc. Direct aJl state governments to frame rules under the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act and allocate funds for developing street vending as livelihood model. Provision of cess collection for welfare fund in Beedi , Mining sector, Cine Workers etc which has been discontinued following introduction of GST should be restored for dedicated funding of the sectors-specific welfare schemes. Management of cess under the Building and Other Construction Workers’ Welfare Board, Beedi Workers Welfare Board etc. should be made the responsibility of Ministry of Finance, which should ensure its proper collection, stoppage of evasion and mis-utilisation. The convention for home based workers be ratified and appropriate law be enacted for these workers for proper piece rate work and ensuring social security coverage to them.

- Labour law reforms: Stop labour law amendments that curtail the basic and trade union rights of workers and provide unhindered ‘hire and fire’ facilities to the employers. The Code on Wages as adopted in the Parliament is adverse to the interest of workers. The anomalies need to be addressed in the rule framing. The Code on Industrial Relations Bill already introduced in Parliament should be scrapped and the same should be redrafted and restructured on the basis of the opinions of the central trade unions expressed unanimously. The code on Safety and Social Security are also very vital to the working conditions and welfare of workers. No labour law amendment should be undertaken without the consent of the trade unions and workers who are the main stakeholders and the most affected.

- EPF: The threshold limit for coverage under EPF scheme should be brought down to 10 employees. Government and employers’ contribution should be increased to provide a minimum pension of Rs 6000 per month and make it sustainable. As an immediate measure Govt should allot more fund to increase the minimum pension under EPS-1995. Stop investing EPF funds in share market. The status of EPF funds placed with IL&FS and others like DHFL etc on investment, gains or loss thereon must be put on public domain for scrutiny and corrective action. The Supreme Court has given a judgment and order for higher payment of pension under EPS – 95. This option should be made available for all workers covered under the said scheme, whether exempted or unexampled.

- ESIC: Government did not honour workers views and reduced the contribution of employers & workers from 6 percent to 4 percent. The share should be raised to earlier level again and the adequate services be provided to insured persons. The option being brought again & again for discussion should be stopped with.

- Pension for all: Pension should be construed as deferred wage and all workers who are not covered by any pension scheme should be ensured a pension not less than Rs 6,000/- per month.

- New Pension Scheme: NPS should be withdrawn. All central and state government employees recruited on or after 01.01.2004 should be covered under the Old Pension Scheme under “defined benefit system”.

- Gratuity: Gratuity under the Payment of Gratuity Act should be calculated on 30 days wages instead of 15 days per completed year of service, without any ceiling.

- AADHAAR :Government should not make AADHAAR linking compulsory.

- Closed and sick factories: Ensure that workers of closed factories get their dues within a fixed time limit. Sudden winding up of the BIFR has left many stakeholders without a remedy. Rules for carrying out the provisions of the Sick Industrial Companies (Special Provisions) Repeal Act, 2003, should be framed immediately to facilitate them.

- Income tax exemption: The ceiling for income tax for salaried persons and pensioners should be raised to Rs 10 lakh per year. Income Tax ceiling for senior citizens should be raised to Rs. 8 lakhs. All perks and fringe benefits like housing, medical and educations facilities and running allowances in railways should be exempted from income tax net totally.

- Political funding: Recently the government removed the limit on the amount companies can donate to political parties and the need to name the political party receiving the funds. This is far from the transparency promised in public life. The earlier regime should be restored. The electoral bonds scheme should be immediately scrapped. It is leading to wide scams.

- Railways: Adequate financial resources should be allotted to the railways to ensure more effective, accessible and affordable transport to the common people, particularly the poor. The capabilities of public sector production units should be utilised fully, further developed and strengthened. All measures taken to privatise the railways should be scrapped and abandoned. The measures to hand over the railway stations across the country to private players should be immediately stopped. Decision to corporatize the railway production units should be scrapped and abandoned. Any property of railways should not be handed over to private sector through lease or sale. The decision for closure of Railway Printing Presses should be withdrawn. The decision to allow 100% FDI in railways should be withdrawn. The pending expansion, track renewal, signals up gradation projects should be completed at the earliest. Adequate financial resources should be allocated to improve safety systems and ensure safe rail travel for the people. All the vacancies in the railways should be filled up. The long pending demands of the railway employees like enhancement of ceiling in respect of running allowance for tax exemption, housing scheme etc should be addressed positively.

To conclude:

We reiterate our strong opposition to the anti-worker measures being undertaken by the government on the pretext of improving the ‘ease of doing business’, to benefit the employers, particularly the big corporates, domestic and foreign.

We once again urge upon the government to take concrete measures to resolve the 12 point charter of demands of the working people, being repeatedly raised by the central trade unions, as well as the pressing issues listed above.

We regret that none of the suggestions of the central trade unions, made in the earlier pre budget meetings were incorporated in the previous budgets. We hope that this would not be repeated yet again and the points raised by us will be given positive consideration while framing budget 2020-2021.

Thanking you,

Yours sincerely

INTUC AITUC HMS CITU AIUTUC

TUC SEWA AICCTU UTUC LPF

COMMENTS