Deduction of Income Tax and Submission of IT Statements for FY 2025-26: CDA, Secunderabad Order dated 15.09.2025

OFFICE OF THE CONTROLLER OF DEFENCE ACCOUNTS

NO.1, STAFF ROAD, SECUNDERABAD – 500 009.

No: PayTech /4058/IT Circular/FY 2025-26

Date: 15.09.2025

To

All Units (Defence Civilians–Non-DAD)

under CDA Secunderabad.

Sub:- Deduction of Income Tax and Submission of IT Statements for FY 2025-26.

Attention is drawn to the section – 115BAC, Income tax Act 1961-2020 under which a tax payer has option for choosing from two types of Income Tax regime w.e.f 01.04.2020.

Income Tax statements for Financial Year 2025-26 in respect of all the Officers and Staff under your administrative control may be forwarded to audit authorities / Pay Accounts Offices for scrutiny and further necessary action alongwith all proof of savings documents ON or BEFORE 31.10.2025 duly exercising their IT option clearly quoting ‘OLD /NEW’ in their IT Statements. It may be noted that the default Income Tax regime is ‘NEW TAX REGIME’. Salient points of Old Tax and Tax Regimes are as under:

I. OLD TAX REGIME

The Old tax regime will continue to take in to all exemptions as applicable IF OPTED. An employee opting for Old Tax Regime should invariably enclose all proof of documents for any kind of rebate / Income Tax savings (viz., Rent receipt, LIC Premium receipts, PPF /NSC receipts, Provisional payment certificate for Home loan, Tuition fee receipts, Health insurance receipts, Education loan interest certificate etc.) duly self attested by the employee concerned specifying the name and personnel number / GPF number. If the employee is living in a rented house HRA exemption is allowed to the extent of the least of the following.

(a) The actual amount of HRA received (b) Rent paid in excess of the 10% of the salary @ 50 % of salary if residing in Mumbai, Kolkata, Delhi, Chennai and 40% if residence is situated at any other place.

Note: If Rent receipt is more than One Lakh per annum, should invariably attach PAN CARD of the House Owner.

The Income Tax (as applicable) will be calculated accordingly. List of some exemptions are us under:

| Exemptions | Amount up to Rs | Exemptions | Amount up to Rs | Exemptions | Amount up to Rs |

| Savings – 80C (GPF/LIC/Tax Saving FDs) | Rs.1,50,000/- | Health Insurance – 80D | Rs.25,000/- | Standard deduction | Rs.50,000/- |

| NPS – Self Contribution – Govt. Contribution | 10 % and 14 % | Professional Tax | 200 x 12 | CEA for 2 children (Max.) | 1200 x 2 |

| Home Loan Interest (max.) Subject fulfilment of IT conditions | Rs.1,50,000/- | 80 DD – Medical Exp. for disability Rs.75,000/- & for severe disability Rs.1,25,000/- | Education loan interest US 80E | No max limit | |

| NPS 80CCD (1B)

– Self contribution for tax purpose :: Rs.50,000/- |

80 TTA – Savings bank Interest Rs.10,000/- | ||||

| Spl. deduction of Actual Exp. Limited to Rs.40,000/- to patient/dependant suffering from Cancer/AIDS and Rs.1,00,000/- for senior citizen dependant US 80 DDB | |||||

| Deduction in r/o interest on loan taken for purchase of Electric Vehicle (Scooter/CAR) subject to (a) deduction shall not exceed Rs.150000/- and (b) Loan must be sanctioned during 01.04.2019 to 31.12.2023. |

|||||

| U/s 80 U – Physically handicapped persons can claim upto Rs.75,000/- and Rs.1,25,000/- for severe disability | |||||

Tax exemption for donations to PMRF/CMRF/charitable institutions under section 80 G are allowed as admissible as per IT rules and any other tax exemptions claims should submit the details, necessary proof of document, TAN No.and mode of payment made.

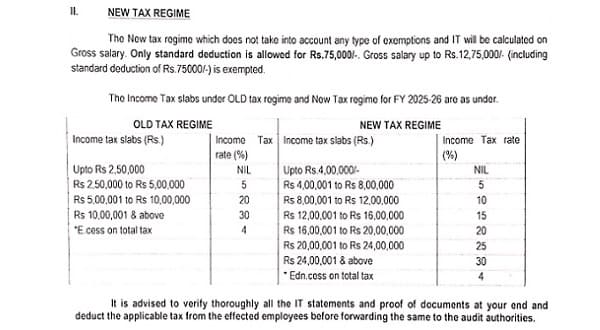

II. NEW TAX REGIME

The New tax regime which does not take into account any type of exemptions and IT will be calculated on Gross salary. Only standard deduction is allowed for Rs.75,000/-. Gross salary up to Rs.12,75,000/- (including standard deduction of Rs.75000/-) is exempted.

The Income Tax slabs under OLD tax regime and New Tax regime for FY 2025-26 are as under.

| OLD TAX REGIME | NEW TAX REGIME | ||

| Income tax slabs (Rs.) | Income rate (%) | Tax Income tax slabs (Rs.) | Income Tax rate(%) |

| Upto Rs 2,50,000 | NIL | Upto Rs.4,00,000/- | NIL |

| Rs 2,50,000 to Rs 5,00,000 | 5 | Rs 4,00,001 to Rs 8,00,000 | 5 |

| Rs 5,00,001 to Rs 10,00,000 | 20 | Rs 8,00,001 to Rs 12,00,000 | 10 |

| Rs 10,00,001 & above | 30 | Rs 12,00,001 to Rs 16,00,000 | 15 |

| *E.cess on total tax | 4 | Rs 16,00,001 to Rs 20,00,000 | 20 |

| Rs 20,00,001 to Rs 24,00,000 | 25 | ||

| Rs 24,00,001 & above | 30 | ||

| Edn.cess on total tax | 4 |

It is advised to verify thoroughly all the IT statements and proof of documents at your end and deduct the applicable tax from the effected employees before forwarding the same to the audit authorities.

(Subash Rathod)

SAO (Pay)

COMMENTS