Category: INCOME TAX

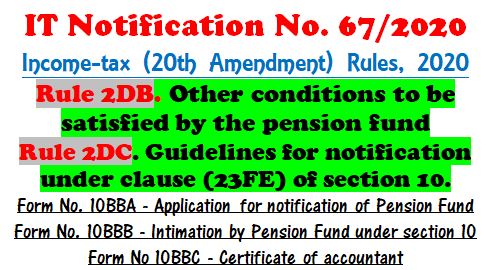

IT Rules 2DB & 2DC – Other conditions to be satisfied by the pension fund, Form 10BBA, Form 10BBB and Form 10BBC – IT Notification 67/2020

IT Rules 2DB & 2DC - Other conditions to be satisfied by the pension fund, Form 10BBA, Form 10BBB and Form 10BBC - IT Notification 67/2020

MINIST [...]

Income Tax Faceless Assessment Scheme – Rules & Procedure of Assessment: Income Tax Notification No. 60/2020

Income Tax Return Faceless Assessment Scheme - Rules & Procedure of Assessment: Income Tax Notification No. 60/2020

MINISTRY OF FINANCE

(Departm [...]

Income Tax Return Faceless Assessment Scheme – Exceptions, Modifications and Adaptations: IT Notification 61/2020

Income Tax Return Faceless Assessment Scheme - Exceptions, Modifications and Adaptations: IT Notification 61/2020 dated

NOTIFICATION

New Delhi, the [...]

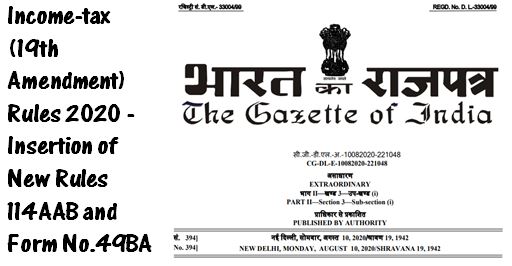

Income-tax (19th Amendment) Rules 2020 – Rules 114AAB and Form No.49BA

Income-tax (19th Amendment) Rules 2020 - Insertion of New Rules 114AAB and Form No.49BA for any income-tax due on income of non-resident has been dedu [...]

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख प [...]

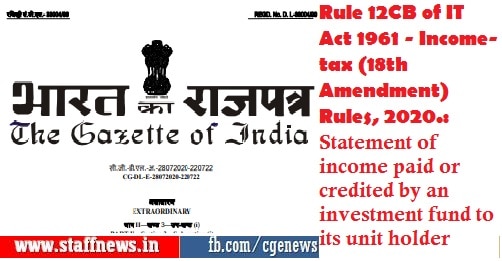

Rule 12CB of IT Act 1961 – Income-tax (18th Amendment) Rules, 2020.: Statement of income paid or credited by an investment fund to its unit holder

Rule 12CB of IT Act 1961 - Income-tax (18th Amendment) Rules, 2020.: Statement of income paid or credited by an investment fund to its unit holder

MI [...]

Section 194N of the Income-tax Act, 1961: Clarification in relation to notification issued under clause (v)

Section 194N of the Income-tax Act, 1961: Clarification in relation to notification issued under clause (v)

Circular no. 14/2020

F.No. 370142/27/202 [...]

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

Press I [...]

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

Press Information Bureau

Government of [...]

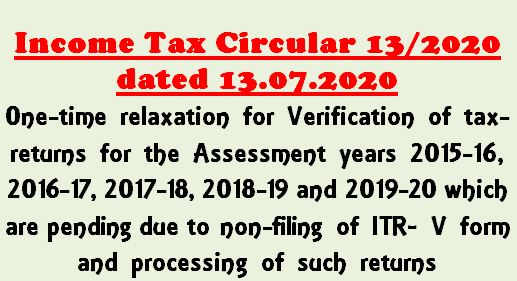

Verification of tax-returns :One-time relaxation for AY 2015-16 to 2019-20 pending due to non-filing of ITR V Form

Verification of tax-returns : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of such [...]