Category: News

Mechanism for redressal of grievances related to GPF Accounts: CGDA

Mechanism for redressal of grievances related to GPF Accounts: CGDA

OFFICE OF THE CONTROLLER GENERAL OF DEFENCE ACCOUNTS

ULAN BATAR ROAD, PALAM, D [...]

EPF recommended 8.8% rate of interest for the year 2015-16

EPF recommended 8.8% rate of interest for the year 2015-16

Press Information Bureau

Government of India

Ministry of Labour & Employment

11 [...]

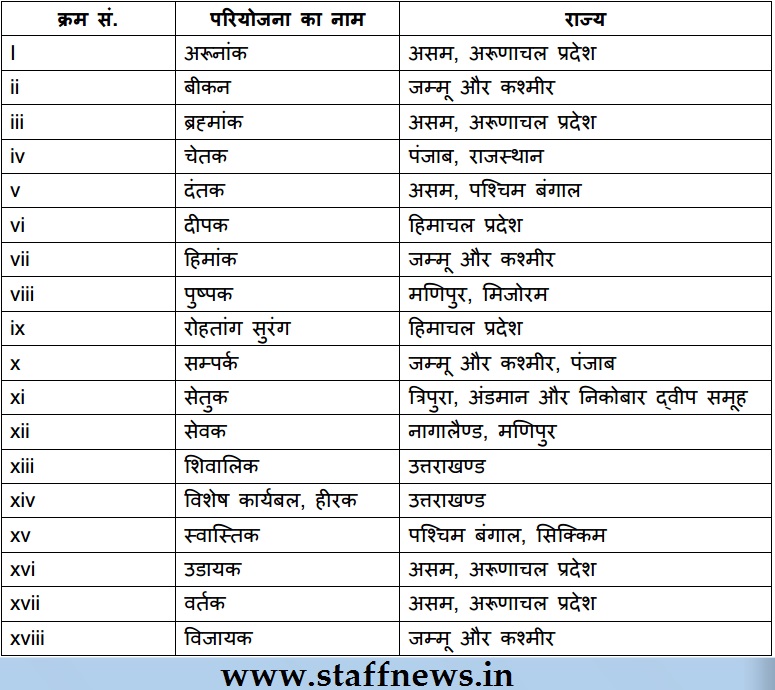

Branches of Border Roads Organisation (BRO)

Branches of Border Roads Organisation (BRO)

GOVERNMENT OF INDIA

MINISTRY OF DEFENCE

LOK SABHA

UNSTARRED QUESTION NO: 2483

ANSWERED ON: 11.03.2 [...]

Withdrawal by Empanelled Hospitals from ECHS

Press Information Bureau

Government of India

Ministry of Defence

08-March-2016 13:19 IST

Withdrawal by Empanelled Hospitals from ECHS  [...]

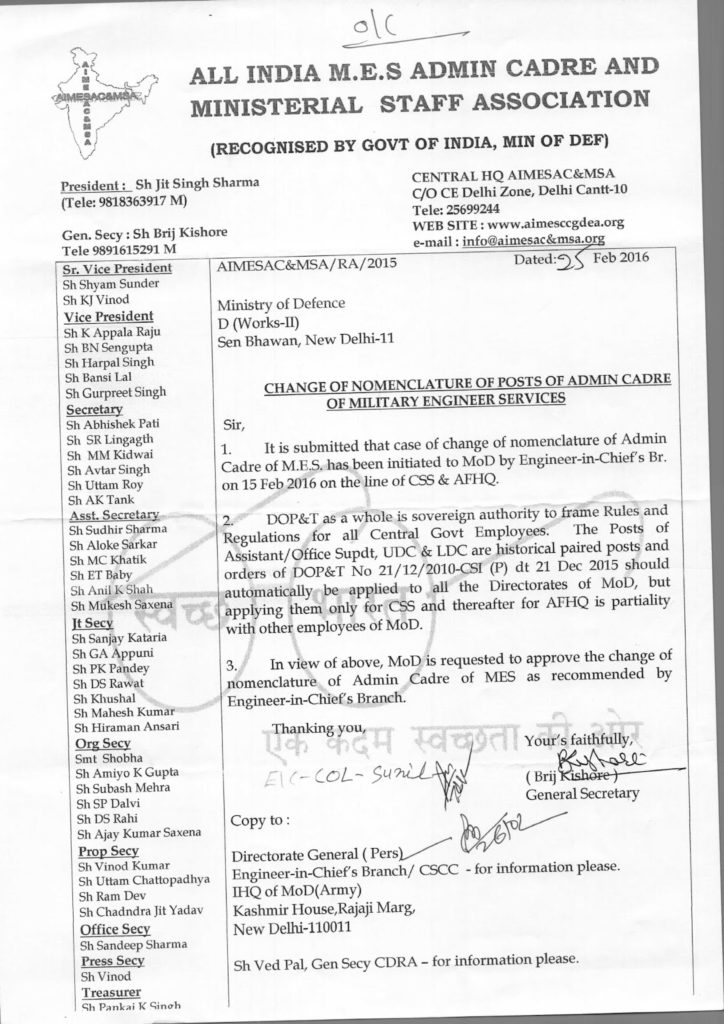

Change of Nomenclature of Posts of Admin Cadre of MES: AIMESAC & MSA writes to MoD

Change of Nomenclature of Posts of Admin Cadre of MES: AIMESAC & MSA writes to MoD

ALL INDIA M.E.S ADMIN CADRE AND

MINISTERIAL STAFF ASSOCIATI [...]

Saransh: Comprehensive Self Review for CBSE affiliated schools and parents

Saransh: Comprehensive Self Review for CBSE affiliated schools and parents

Parent/School Login

Board Exam Statistics

About Saransh

A [...]

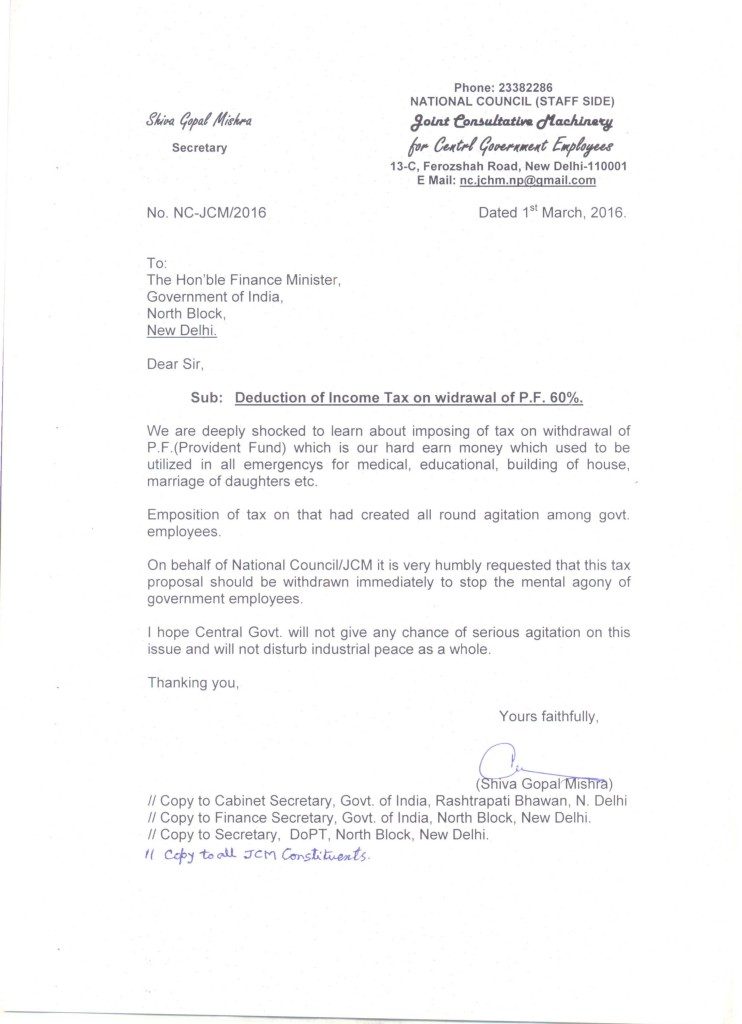

Deduction of Income Tax on withdrawal of Provident Fund 60%: NC JCM reacts

Deduction of Income Tax on withdrawal of Provident Fund 60%

NATIONAL COUNCIL (STAFF SIDE)

Joint Consultative Machinery for Central Government Empl [...]

Prohibition of Display of Aadhaar Number of Residents in Public Domain

Supreme Court Order dated 11.08.2015 - Prohibition of Display of Aadhaar Number of Residents in Public Domain -regarding

Employees’ Provident Fund [...]

Officer can’t withdraw resignation once it is accepted, says tribunal

Officer can’t withdraw resignation once it is accepted, says tribunal

The Central Administrative Tribunal dismissed the plea of an Indian Rev [...]

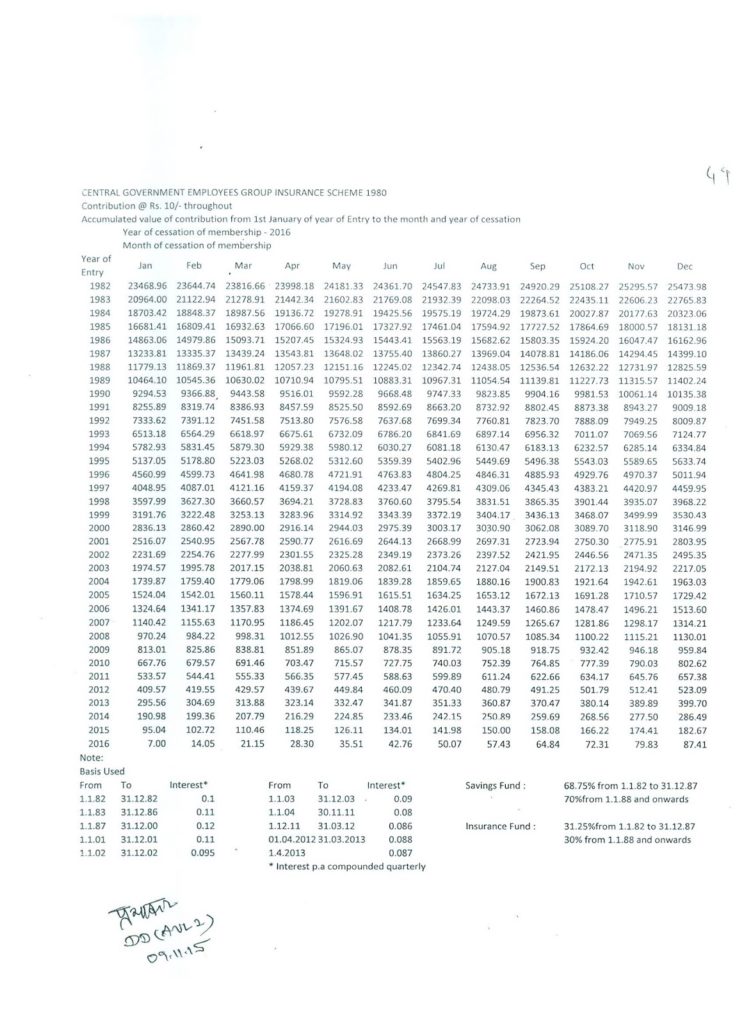

CGEGIS Table 2016 : Fin Min OM dated 26-02-2016

CGEGIS Table 2016 – Tables of Benefits for the savings fund for the period from 01.01.2016 to 31.12.2016

No.7(1)/EV/2014

Government of India

Mini [...]