Tag: CBDT Order

Compassionate appointment – Relative merit point & revised procedure for selection/Tie breaking formula

Compassionate appointment - Relative merit point & revised procedure for selection/Tie breaking formula

F.No.A.12012/ 8/ 2020-Ad.III.B

Governmen [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

Procedure to process of Medical Reimbursement Claim – Check List for Processing Medical Advance

Procedure to process of Medical Reimbursement Claim - Check List for Processing Medical Advance

By SPEED POST

F.No.D-12015/06/2020-Ad.IX

Government [...]

Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for AY 2016-17 and subsequent years

Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and subsequent year [...]

Investment of fund moneys by Recognised Provident Funds – Rule 67 of IT Rules 1961: Amendment Notification No. 84/2020 dt 22nd October, 2020

Investment of fund moneys by Recognised Provident Funds - Rule 67 of IT Rules 1961: Amendment Notification No. 84/2020 dt 22nd October, 2020

CBDT a [...]

ITR: इनकम टैक्स रिटर्न दाखिल करने की अंतिम तारीख बढ़ी

ITR: इनकम टैक्स रिटर्न दाखिल करने की अंतिम तारीख बढ़ी

केंद्रीय प्रत्यक्ष कर बोर्ड (CBDT) ने कहा, ‘‘जिन करदाताओं के लिये आयकर रिटर्न भरने की समय-सीम [...]

Exercising power of intrusive or coercive action for recovery of tax demand by Assessing Officers or Tax Recovery Officers: CBDT Order

Exercising power of intrusive or coercive action for recovery of tax demand by Assessing Officers or Tax Recovery Officers: CBDT Order under section 1 [...]

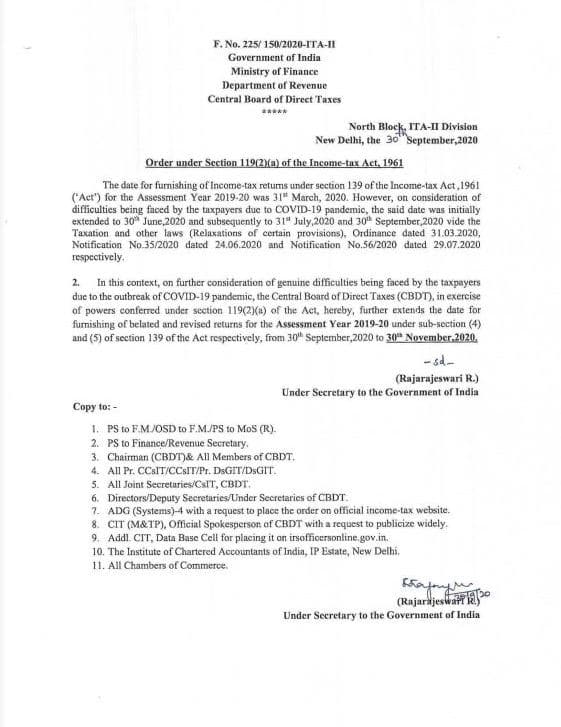

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

F. No. 225/ 150/2020-ITA-II

[...]

Compulsory selection of returns for complete scrutiny during the Financial Year 2020-21 – conduct of assessment proceedings in such cases: CBDT Order

Compulsory selection of returns for complete scrutiny during the Financial Year 2020-21 - Conduct of assessment proceedings in such cases: CBDT Order

[...]

Imposition of charge on the prescribed electronic modes under section 269SU of the Income-tax Act, 1961

Imposition of charge on the prescribed electronic modes under section 269SU of the Income-tax Act, 1961

Circular No. 16/2020

F .No .370142/35/2019-T [...]