Tag: CBDT Order

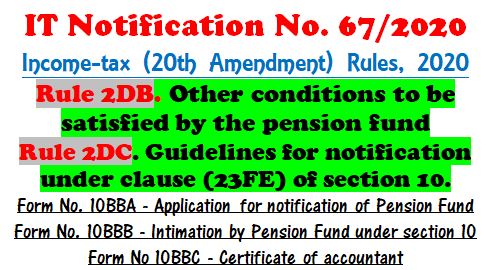

IT Rules 2DB & 2DC – Other conditions to be satisfied by the pension fund, Form 10BBA, Form 10BBB and Form 10BBC – IT Notification 67/2020

IT Rules 2DB & 2DC - Other conditions to be satisfied by the pension fund, Form 10BBA, Form 10BBB and Form 10BBC - IT Notification 67/2020

MINIST [...]

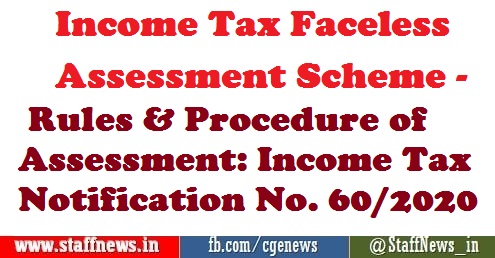

Income Tax Faceless Assessment Scheme – Rules & Procedure of Assessment: Income Tax Notification No. 60/2020

Income Tax Return Faceless Assessment Scheme - Rules & Procedure of Assessment: Income Tax Notification No. 60/2020

MINISTRY OF FINANCE

(Departm [...]

Income Tax Return Faceless Assessment Scheme – Exceptions, Modifications and Adaptations: IT Notification 61/2020

Income Tax Return Faceless Assessment Scheme - Exceptions, Modifications and Adaptations: IT Notification 61/2020 dated

NOTIFICATION

New Delhi, the [...]

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

Press I [...]

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

MINISTRY OF [...]

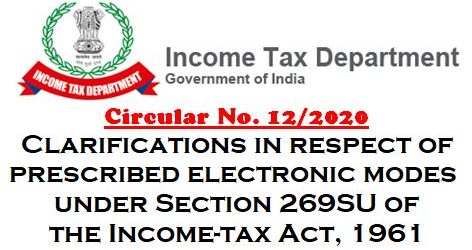

Section 269SU of the Income-tax Act 1961: Clarifications in respect of prescribed electronic modes

Section 269SU of the Income-tax Act 1961: Clarifications in respect of prescribed electronic modes

Circular No. 12/2020

F.No.370142/35/2019-TPL

Gov [...]

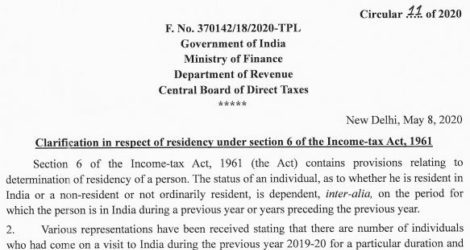

CBDT Clarification in respect of residency under section 6 of the Income-tax Act, 1961 during COVID-19 lockdown

CBDT Clarification in respect of residency under section 6 of the Income-tax Act, 1961 during COVID-19 lockdown

Circular 11 of 2020

F. No. 370142/1 [...]

Donation of one days salary to PM Cares Funds, every month till March 2021. Format of Intimation by CBDT

Donation of one days salary to PM Cares Funds, every month till March 2021. Format of Intimation by CBDT

Directorate of Human Resource Development

[...]

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

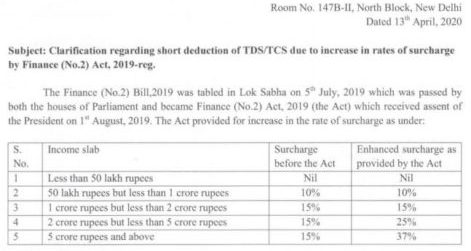

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]