Tag: CBDT Order

Income Tax e-Settlement Scheme, 2021: Notification No. 129/2021

Income Tax e-Settlement Scheme, 2021: Notification No. 129/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NO [...]

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Inc [...]

Extension of time limits of certain compliances to provide relief to taxpayers: Income Tax Circular No 12 of 2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic: Income Tax

Circular No 12 of 2021

F. [...]

Processing of Death/Retirement benefits/family pension papers and Compassionate appointment in the case of deceased employees: CBDT

Processing of Death/Retirement benefits/family pension papers and Compassionate appointment in the case of deceased employees: CBDT

Office of the Pr. [...]

Statement of Financial Transactions (SFT) for Interest income – Format, Procedure and Guidelines for submission: Notification No. 2 of 2021

Statement of Financial Transactions (SFT) for Interest income - Format, Procedure and Guidelines for submission: Notification No. 2 of 2021

DGIT(S)/A [...]

Statement of Financial Transactions (SFT) for Dividend income – Format, Procedure and Guidelines for submission: IT Notification No. 1 of 2021

Statement of Financial Transactions (SFT) for Dividend income - Format, Procedure and Guidelines for submission: IT Notification No. 1 of 2021

DGIT(S [...]

CBDT notifies New Income Tax Return Forms for AY 2021-22 – नए आयकर रिटर्न फॉर्म

CBDT notifies New Income Tax Return Forms for AY 2021-22: वर्ष 2021-22 के लिए नए आयकर रिटर्न फॉर्म

Ministry of Finance

प्रविष्टि तिथि: 01 APR 2021

[...]

Income Tax due dates : CBDT extends various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : CBDT extends various limitation dates - Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme [...]

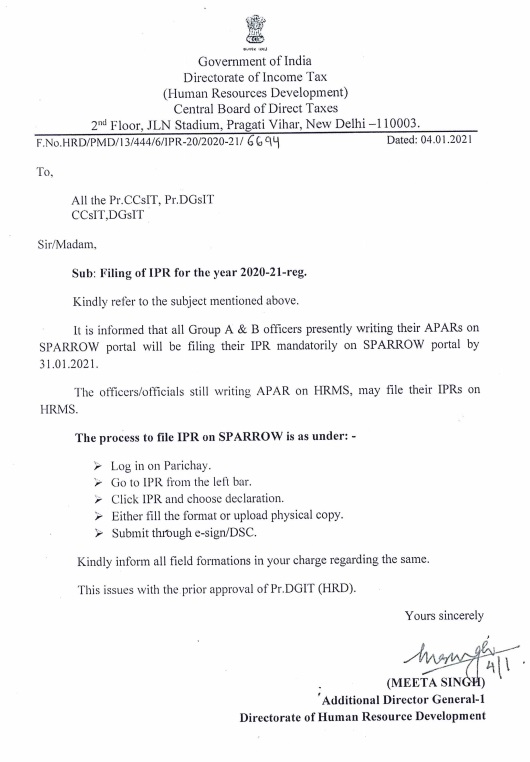

Filing of IPR for the year 2020-21: CBDT Order

Filing of IPR for the year 2020-21: CBDT Order

Government of India

Directorate of Income Tax

(Human Resources Development)

Central Board of Direct [...]

Aaykar Kutumb – An E-Diary functionality for Income Tax Officer and above : Instructions to download ‘Aaykar Kutumb’ Version 4.2

Aaykar Kutumb - An E-Diary functionality for Income Tax Officer and above : Instructions to download ‘Aaykar Kutumb’ Version 4.2

DIRECTORATE OF INCOM [...]