Tag: CBDT Order

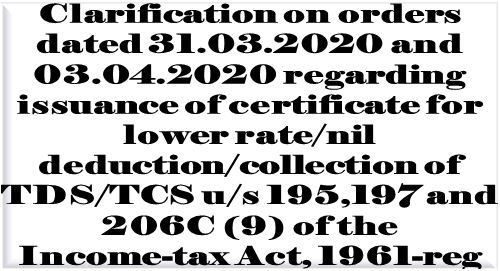

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS o [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

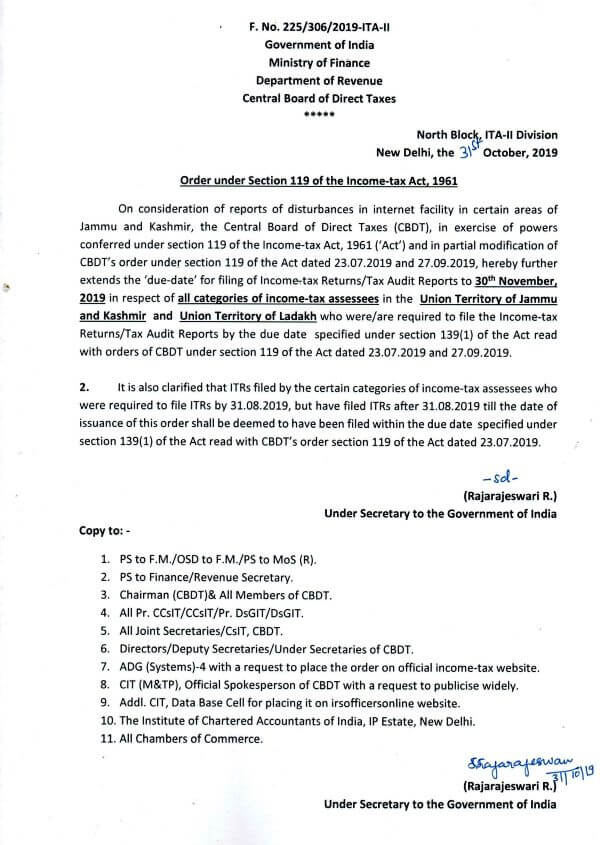

Extension of due date for filing of IT Return/Tax Audit Reports to 30th November, 2019 i.ro. UT of J&K & Ladakh

Extension of due date for filing of Income-tax Returns/Tax Audit Reports to 30th November, 2019 in respect of Union Territory of Jammu and Kashmir and [...]

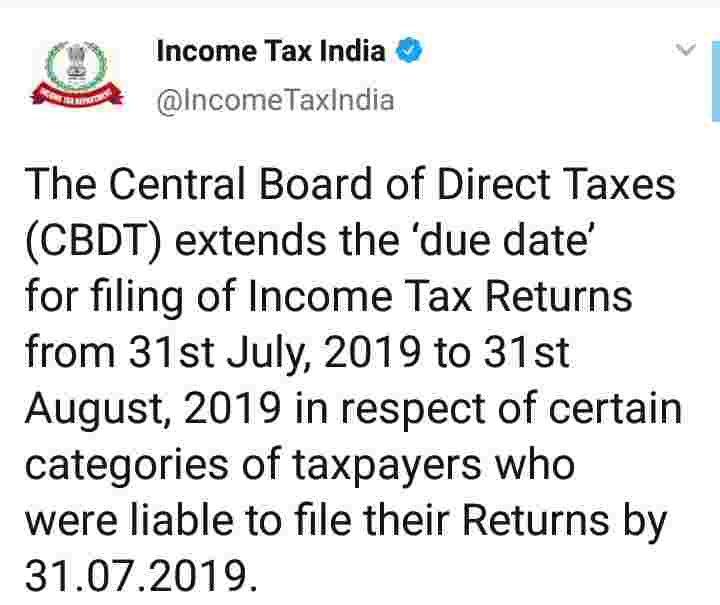

Extension of due date for filing of ITRs for the A.Y 2019-20 from 31st July, 2019 to 31st August, 2019 – Order u/s. 119 of the income-tax Act, 1961

Extension of due date for filing of ITRs for the A.Y 2019-20 from 31st July, 2019 to 31st August, 2019 - Order u/s. 119 of the income-tax Act, 1961 [...]

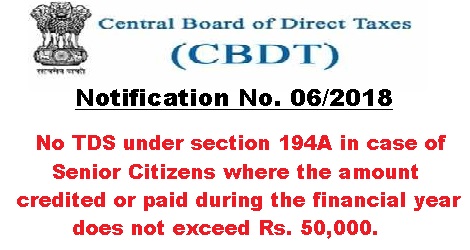

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

F. No. Pr. DGIT(S)/CPC(TDS)/Notification/2018-19 [...]

Tax Return Preparer Scheme – Amendment in Eligibility Qualification, Age, Fee and Remuneration

Tax Return Preparer Scheme - Amendment in Eligibility Qualification, Age, Fee and Remuneration

MINISTRY OF FINANCE

(Department of Revenue)

(CEN [...]

TDS certificates in the name of the deceased depositor is not in accordance with law: CBDT notification on TDS on interest on deposits made under the Capital Gains Accounts Scheme, 1988

TDS certificates in the name of the deceased depositor is accordance with law: CBDT notification on TDS on interest on deposits made under the Capita [...]

Requirement of tax deduction at source in case of entities whose income is exempted under Section 10 of the Income-tax Act, 1961 – Exemption thereof.

Requirement of tax deduction at source in case of entities whose income is exempted under Section 10 of the Income-tax Act, 1961 – Exemption thereof [...]

CBDT issues PAN and TAN within 1 day to improve Ease of Doing Business

CBDT issues PAN and TAN within 1 day to improve Ease of Doing Business

Press Information Bureau

Government of India

Ministry of Finance

11-Apr [...]

Observance of “Joy of Giving Week” between 2nd and 8th of October, 2016

Observance of “Joy of Giving Week” between 2nd and 8th of October, 2016-Appeal to officers and staff members.

F. No. 385/ 17/2016-IT (B)

Governmen [...]