Tag: e-filing

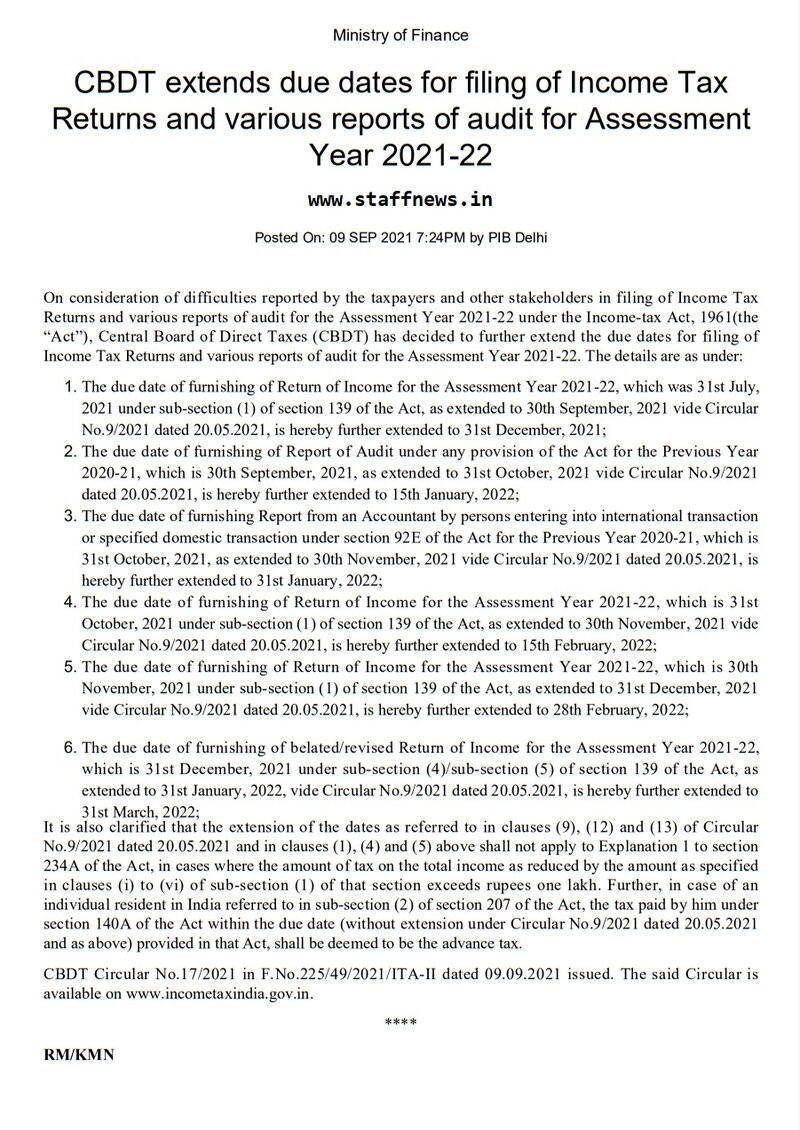

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Inc [...]

Extension of time lines for electronic filling of various Forms under the Income-tax Act,1961: IT Circular No. 16/2021

Extension of time lines for electronic fill of various Forms under the Income-tax Act,1961

Circular No. 16/2021

F NO.225/49/2021/ITA-T

Government o [...]

Extension of time lines for electronic filing of various Forms under the Income-tax Act,1961: IT Circular No. 15/2021

Extension of time lines for electronic filing of various Forms under the Income-tax Act,1961

Circular No. 15/2021

F.No.225/49/2021/ITA-II

Governmen [...]

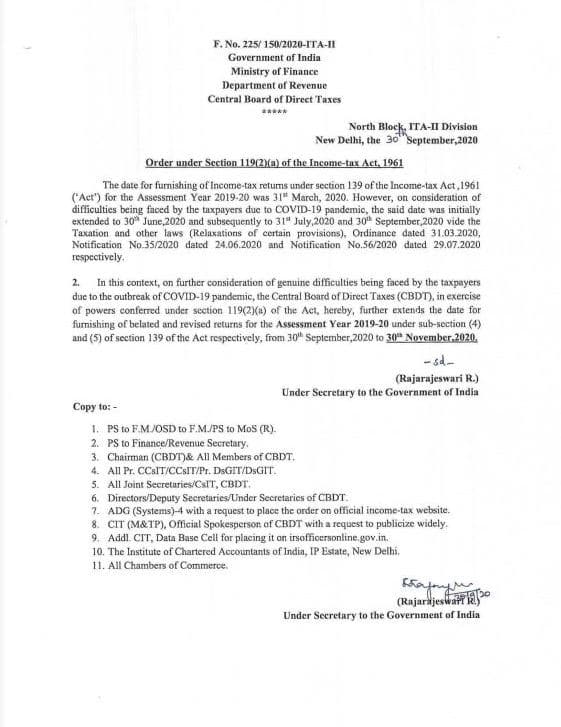

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

F. No. 225/ 150/2020-ITA-II

[...]

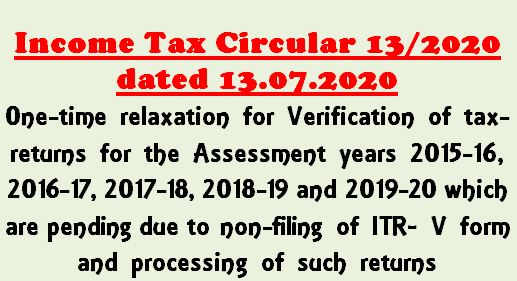

Verification of tax-returns :One-time relaxation for AY 2015-16 to 2019-20 pending due to non-filing of ITR V Form

Verification of tax-returns : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of such [...]

Filing of Income Tax Returns, TDS/TCS Returns, Investments etc. for AY 2020-21 & 2019-20: Extension of Timelines CBDT Notification No. 35/2020

Filing of Income Tax Returns, TDS/TCS Returns, Investments etc. for AY 2020-21 & 2019-20: Extension of Timelines CBDT Notification No. 35/2020

Go [...]

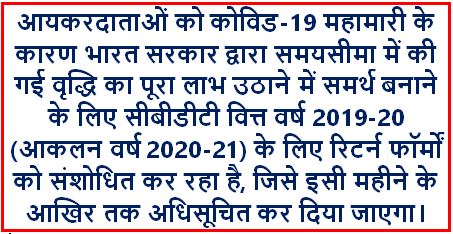

कोविड-19 महामारी के कारण वित्त वर्ष 2019-20 के लिए आयकर रिटर्न फॉर्मों को संशोधित कर रहा है सीबीडीटी

कोविड-19 महामारी के कारण करदाताओं के हित में वित्त वर्ष 2019-20 के लिए आयकर रिटर्न फॉर्मों को संशोधित कर रहा है सीबीडीटी

पत्र सूचना कार्यालय

भारत [...]

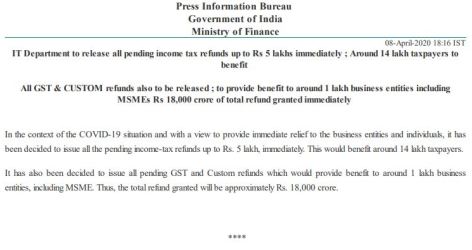

IT Deptt to release all pending Income Tax Refunds upto Rs.5 Lakh immediately – Around 14 Lakh taxpayers to benefit

Income Tax Department to release all pending Income Tax Refunds upto Rs.5 Lakh immediately - Around 14 Lakh taxpayers to benefit

Press Information Bu [...]

CBDT grants relaxation in eligibility conditions for filing of ITR Form-1 and Form-4 for AY 2020-21

CBDT grants relaxation in eligibility conditions for filing of Income-tax Return Form-1 (Sahaj) and Form-4 (Sugam) for Assessment Year 2020-21 [...]

Extension of date for filing of Income Tax Returns for taxpayers in Kerala upto 15.09.2018

MoF: Extension of date for filing Income Tax for taxpayers in Kerala - Press Release

Ministry of Finance

Extension of date for filing of Inco [...]