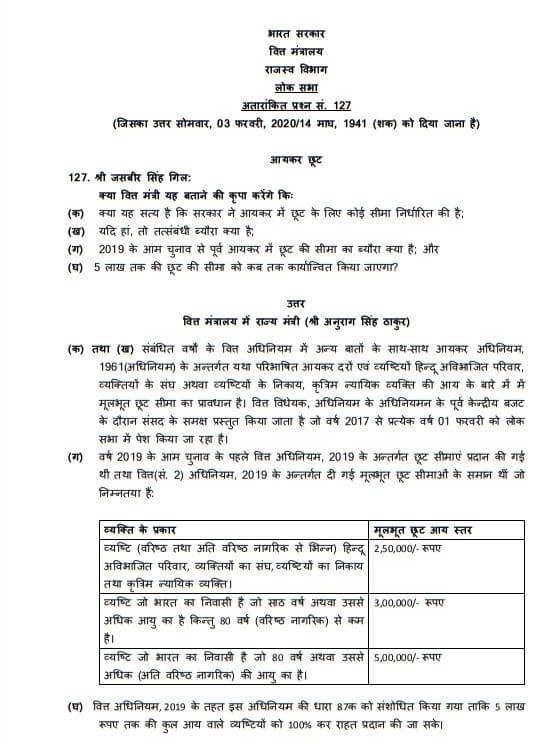

Tag: Income Tax Exemption Limit

Income Tax: Basic exemption limit on the income under the Finance Act, 2019

Income Tax: Basic exemption limit on the income under the Finance Act, 2019

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

LOK SABH [...]

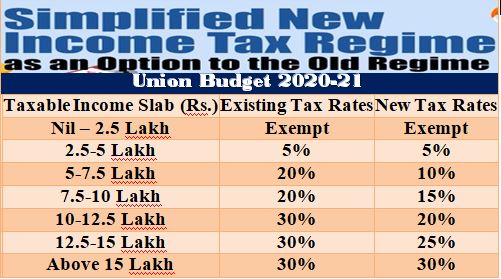

केन्द्रीय बजट 2020-2021: नई वैकल्पिक आयकर व्यवस्था – कर योग्य आय का स्लैब – नई कर दरें

केन्द्रीय बजट 2020-2021: नई वैकल्पिक आयकर व्यवस्था - कर योग्य आय का स्लैब - नई कर दरें

पत्र सूचना कार्यालय

भारत सरकार

वित्त मंत्रालय

01-फरवरी-2 [...]

Budget 2020 – Income Tax Relief for Individuals

Budget 2020 - Income Tax Relief for Individuals

#Budget2020 Finance Minister #NirmalaSithraman announces major tax relief for individuals

Income [...]

Income Tax Circular 4/2020 : Income Tax Deduction from Salaries during Financial Year 2019-20

Inocme Tax Circular 4/2020 dated 16-01-2020 Income Tax Rates of deduction of income-tax from the payment of income chargeable under the head "Salaries [...]

आईटीआर फॉर्म में कई बदलाव – इस बार चार महीने पहले फार्म अधिसूचित – टैक्स सेविंग के विकल्प

आईटीआर फॉर्म में कई बदलाव - इस बार चार महीने पहले फार्म अधिसूचित - टैक्स सेविंग के विकल्प

आईटीआर फॉर्म में इन पांच बदलाव को जानना जरूरी

आयकर विभाग [...]

No Tax upto Rs.15 Lakh for Senior Citizen, Additional Pension from 70 Years, 05 days extra Casual Leave & FMA Rs. 3,000 and more in NFIR Proposal in General Budget 2020-21

No Tax upto Rs.15 Lakh for Senior Citizen, Additional Pension from 70 Years, 05 days extra Casual Leave & FMA Rs. 3,000 and more in NFIR Proposal [...]

Income Tax – List of benefits available to Salaried Persons – AY 2020-2021

Income Tax on Salaries

List of benefits available to Salaried Persons

[AY 2020-2021]

S. N.

Section

Particulars

Benefits

A.

Allowan [...]

Minimum Wages, 7th CPC, Pension for All, Withdraw NPS, Tax exemption upto 10 Lakh: Issues in Trade Union view point – Pre-budget consultation 2020-2021

Minimum Wages, 7th CPC, Ordinance Factories, Labour Law, EPF, ESIC, Pension for All, Withdraw NPS, Gratuity, Tax exemption upto 10 Lakh: Issues in Tra [...]

Clarification on tax benefit – Enrollment of Overseas Citizen of India in NPS

Clarification on tax benefit – Enrollment of Overseas Citizen of India in NPS

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

B-14/A, Chhatr [...]

Waive off income tax on the disability pension for Defence personnel दिव्यांगता पेंशन पर आयकर से छूट

Waive off income tax on the disability pension for Defence personnel दिव्यांगता पेंशन पर आयकर से छूट

GOVERNMENT OF INDIA

MINISTRY OF DEFENCE

DEPART [...]