Tag: Income Tax Exemption Limit

PF tax ceiling will be applicable to GPF as well: CBDT chairman

PF tax ceiling will be applicable to GPF as well: CBDT chairman

Budget 2021-22 has rationalised tax-free income on provident fund contribution by hig [...]

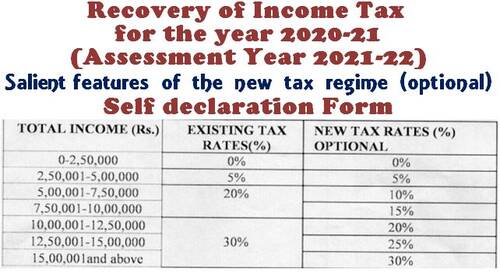

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) – Salient features of the new tax regime (optional) – Self declaration Form

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) - Salient features of the new tax regime (optional) - Self declaration Form

Pri [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Ministry of Finance

Income-tax E [...]

Rule 12CB of IT Act 1961 – Income-tax (18th Amendment) Rules, 2020.: Statement of income paid or credited by an investment fund to its unit holder

Rule 12CB of IT Act 1961 - Income-tax (18th Amendment) Rules, 2020.: Statement of income paid or credited by an investment fund to its unit holder

MI [...]

Section 194N of the Income-tax Act, 1961: Clarification in relation to notification issued under clause (v)

Section 194N of the Income-tax Act, 1961: Clarification in relation to notification issued under clause (v)

Circular no. 14/2020

F.No. 370142/27/202 [...]

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune Message No. 13/2020

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune

Message No. 13/2020

DEDUCTION OF INCOME TAX AT SOURCE FROM S [...]

![National Pension Scheme Tier II- Tax Saver Scheme, 2020 under Section 80C: IT Notification No. 45/2020 dated 07-07-2020 [Hindi & English] National Pension Scheme Tier II- Tax Saver Scheme, 2020 under Section 80C: IT Notification No. 45/2020 dated 07-07-2020 [Hindi & English]](https://www.staffnews.in/wp-content/uploads/2020/07/national-pension-scheme-tier-ii-tax-saver-scheme-2020-notification-page-1-hindi-e1594178999106.jpg)

National Pension Scheme Tier II- Tax Saver Scheme, 2020 under Section 80C: IT Notification No. 45/2020 dated 07-07-2020 [Hindi & English]

National Pension Scheme Tier II- Tax Saver Scheme, 2020 under Section 80C: IT Notification No. 45/2020 dated 07-07-2020 [Hindi & English]

MINISTR [...]

Change in TDS Return Form 26Q & Form 27Q – Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

Change in TDS Return Form 26Q & Form 27Q - Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

THE GAZETTE OF INDIA : EXTRAORDI [...]

Income Tax Deduction from Salaries F.Y. 2020-21 (A.Y. 2021-22): Format for Self Declaration for Option (Old/New Regime)

Income Tax Deduction from Salaries F.Y. 2020-21 (A.Y. 2021-22): Format for Self Declaration for Option (Old/New Regime) and intimation of savings for [...]