Tag: Income Tax Exemption Limit

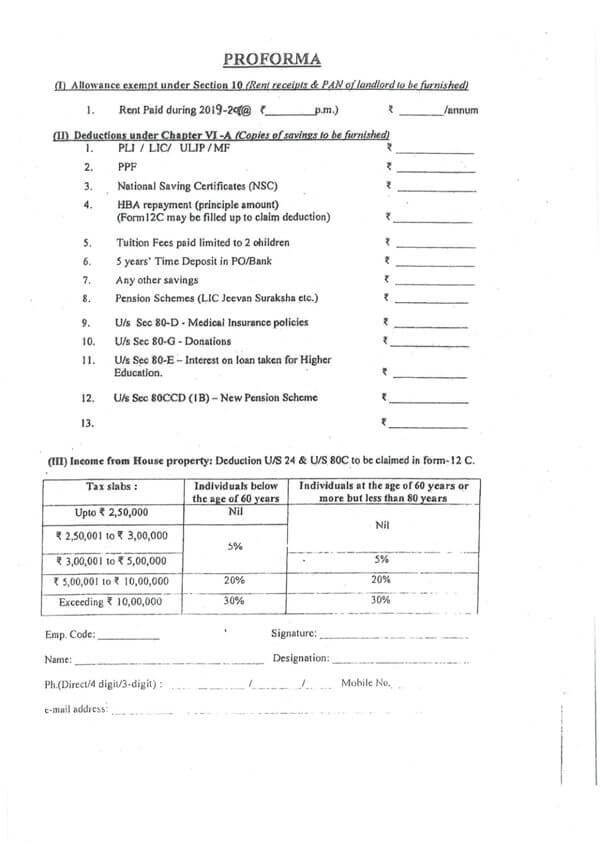

Income-Tax deduction at source from salaries during the financial year 2019 – 20 – Information regarding – Proforma

Income-Tax deduction at source from salaries during the financial year 2019 - 20 (U/S 192 of the Income Tax Act, 1961) -information regarding in profo [...]

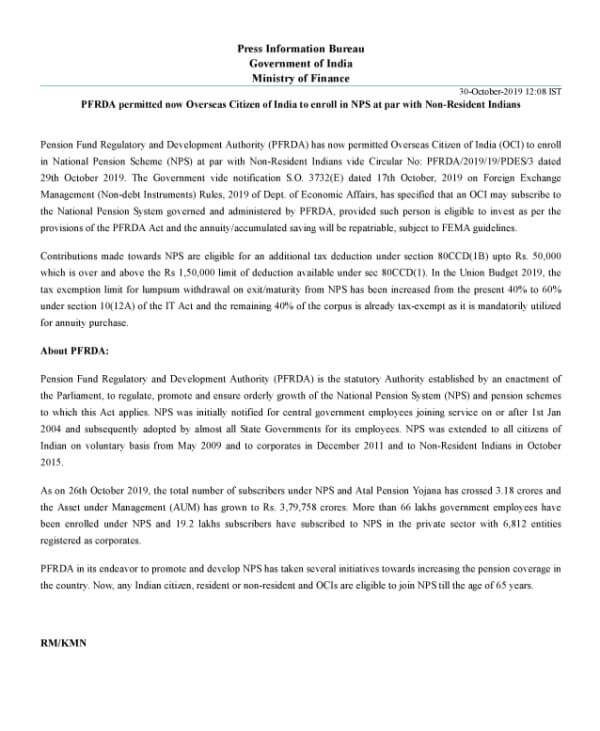

Overseas Citizen of India can enroll in NPS at par with NRI – Benefit of exemption u/s 80CCD of IT Act

Overseas Citizen of India can enroll in NPS at par with NRI - Benefit of exemption u/s 80CCD of IT Act

Press Information Bureau

Government of India

[...]

Tax on disability pension for military personnel सैन्य कर्मियों हेतु निःशक्तता पेंशन पर कर

Tax on disability pension for military personnel सैन्य कर्मियों हेतु निःशक्तता पेंशन पर कर

GOVERNMENT OF INDIA

MINISTRY OF DEFENCE

RAJYA [...]

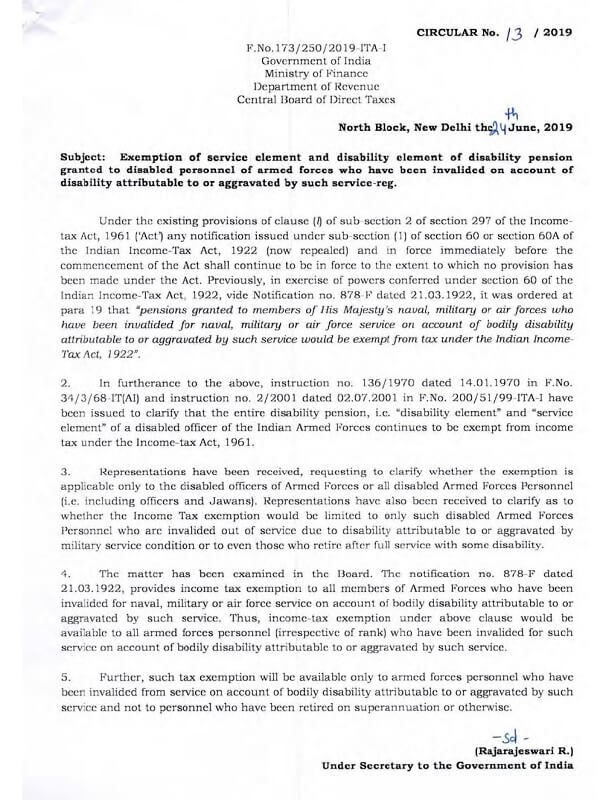

IT Circular 13/ 2019: Exemption of service element and disability element of disability pension granted to disabled personnel of Armed Forces

IT Circular 13/ 2019: Exemption of service element and disability element of disability pension granted to disabled personnel of Armed Forces

CIR [...]

Exemption from payment of income tax to Pensioners who have attained age of 80 years or more: Agenda Item 47th NC(JCM) Meeting

Exemption from payment of income tax to Pensioners who have attained age of 80 years or more: Agenda Item 47th NC(JCM) Meeting

[Part of the Minute [...]

Exempt the Island Special Duty allowance, NER Special Duty Allowance from the purview of income tax: Agenda Item 47th NC(JCM) Meeting

Exempt the island special duty allowance, special duty allowance granted to employees in the north eastern region from the purview of income tax: Ag [...]

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

[Part of the Minutes of the 47th Meeting of N [...]

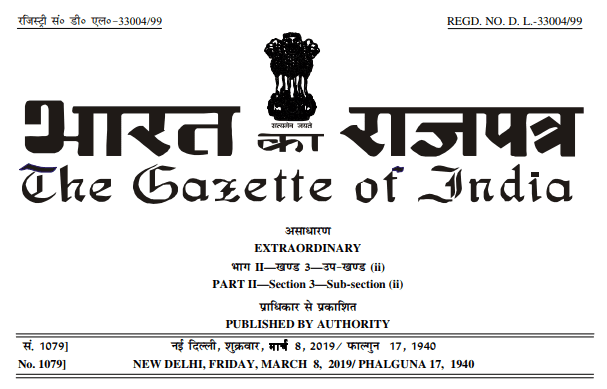

Gazzette Notification: Exemption u/s 10 of Income Tax – Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

Gazzette Notification: Exemption u/s 10 of Income Tax - Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

असाधारण

EXTRAORDINARY

भाग 1---खण्ड 3 [...]

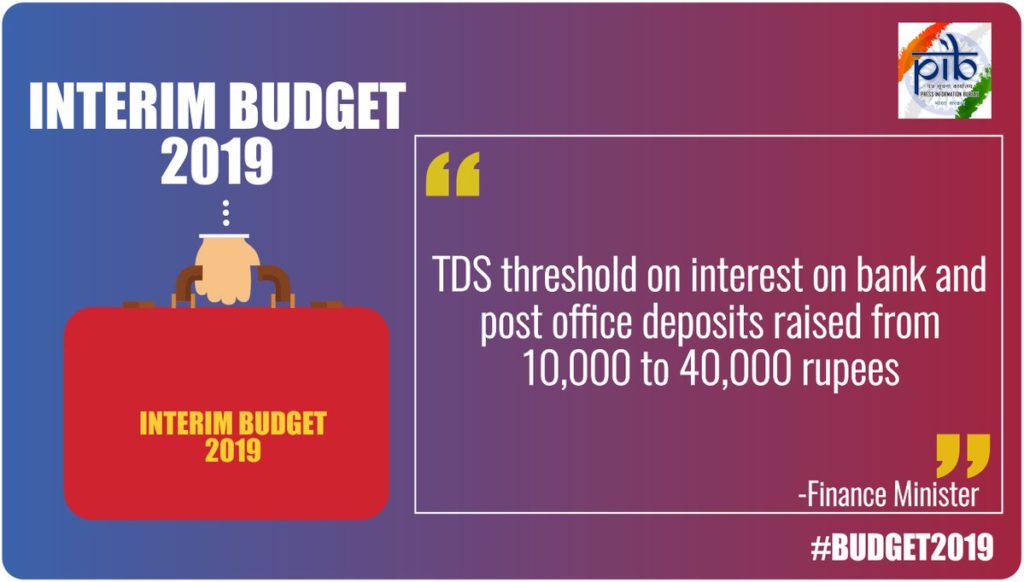

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Indi [...]

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years.

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years..

MINISTRY OF FI [...]