Tag: Interest of GPF

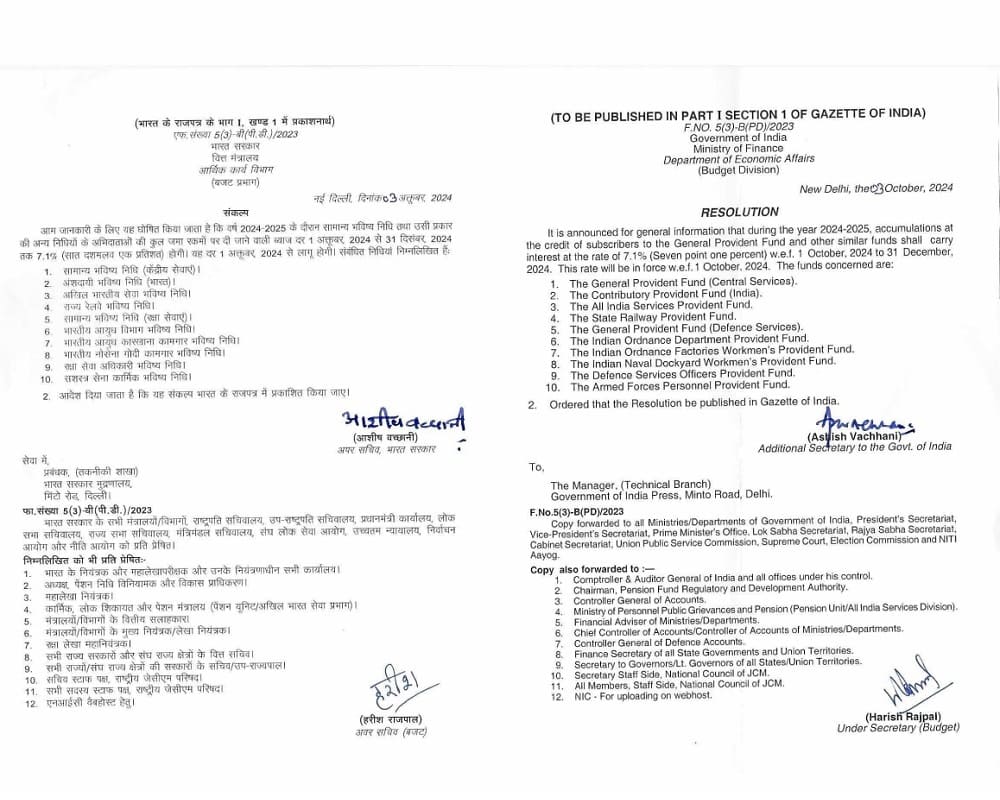

Rate of Interest on GPF and other similar funds for Q3 of FY 2024-2025 Oct-Dec, 2024: FinMin Resolution

Rate of Interest on GPF and other similar funds for Q3 of FY 2024-2025 Oct-Dec, 2024: FinMin Resolution dated 03.10.2024

(TO BE PUBLISHED IN PART I S [...]

State Railway Provident Fund-Rate of interest during the 2nd Quarter of financial year 2024-25 (1st July, 2024 — 30th September, 2024)

State Railway Provident Fund-Rate of interest during the 2nd Quarter of financial year 2024-25 (1st July, 2024 — 30th September, 2024)

GOVERNMENT O [...]

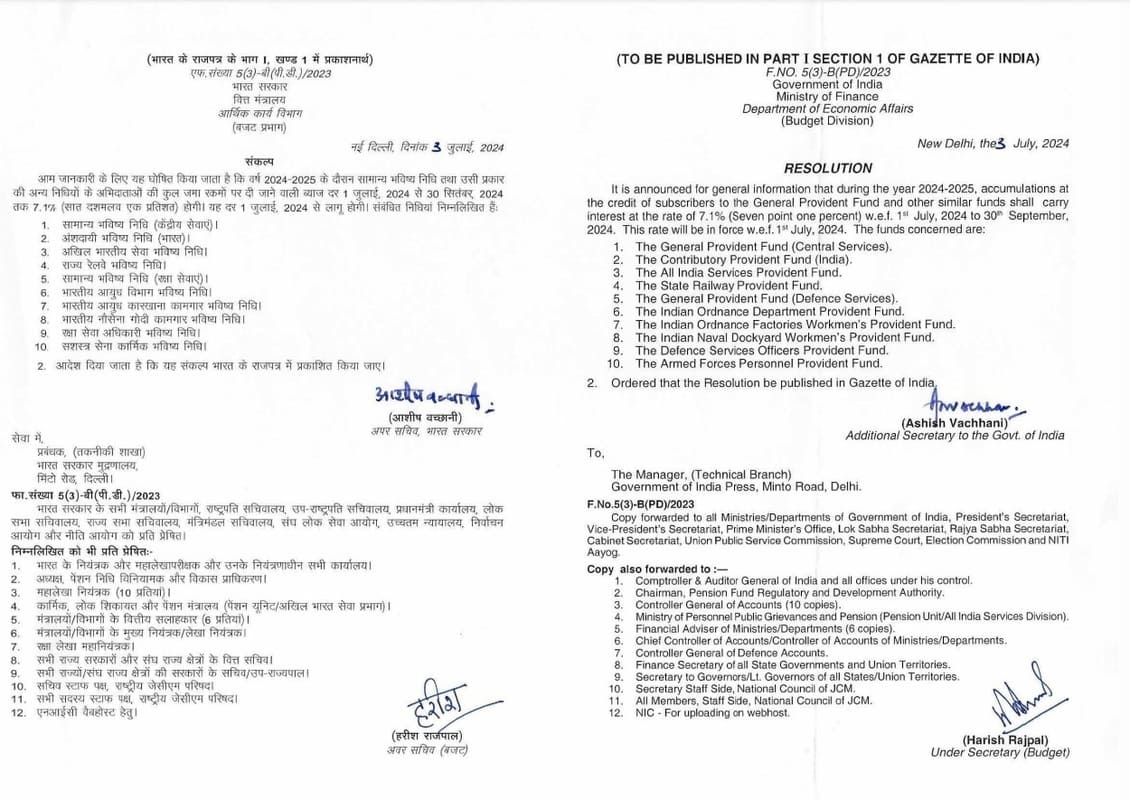

Rate of Interest on GPF and other similar funds for Q2 of FY 2024-2025 July-Sep, 2024: FinMin Resolution

Rate of Interest on GPF and other similar funds for Q2 of FY 2024-2025 01st July, 2024 to 30th September, 2024: FinMin Resolution dated 03.07.2024

(T [...]

Rate of Interest on GPF and other similar funds for Q1 of FY 2024-2025 April-June, 2024: FinMin Resolution

Rate of Interest on GPF and other similar funds for Q1 of FY 2024-2025 @ 7.1% from 1st April, 2024 to 30th June, 2024: Resolution by FinMin dated 10.0 [...]

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: DoPPW OM dated 02.05.2024

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: Do [...]

State Railway Provident Fund-Rate of interest during the 4th Quarter of financial year 2023-24 (1st January, 2024 – 31st March, 2024)

State Railway Provident Fund-Rate of interest during the 4th Quarter of financial year 2023-24 (1st January, 2024 - 31st March, 2024): Railway Board [...]

Rate of Interest on GPF and other similar funds for Q3 of FY 2023-2024 from 1st Oct, 2023 to 31st Dec, 2023: Resolution by FinMin dated 04.10.2023

Rate of Interest on GPF and other similar funds for Q3 of FY 2023-2024 from 1st Oct, 2023 to 31st Dec, 2023: Resolution by FinMin dated 04.10.2023

(T [...]

State Railway Provident Fund-Rate of interest during the 2nd Quarter of financial year 2023-24 (1st July, 2023 — 30th September, 2023)

State Railway Provident Fund-Rate of interest during the 2nd Quarter of financial year 2023-24 (1st July, 2023 — 30th September, 2023)

GOVERNMENT OF [...]

Clarification regarding admissibility of interest over and above the threshold limit of Rupees Five Lakhs on GPF by DoPPW

Clarification regarding admissibility of interest over and above the threshold limit of Rupees Five Lakhs on GPF by DoPPW via Department of Posts OM d [...]

Rate of Interest on GPF and other similar funds for Q2 of FY 2023-2024 from 1st Jul, 2023 to 30th Sep, 2023: Resolution by FinMin

Rate of Interest on GPF and other similar funds for Q2 of FY 2023-2024 from 1st Jul, 2023 to 30th Sep, 2023: Resolution by FinMin

(TO BE PUBLISHE [...]