Calculation of Gratuity and Leave Encashment as per Notional DA rates for CPSEs Employees retired between 01.10.2020 to 30.06.2021: DPE OM

W-02/0029/2021-DPE (WC)-GL-Xl21

Government of India

Ministry of Finance

Department of Public Enterprises

Public enterprises Bhawan,

Block No. 14, CGO Complex,

Lodhi Road, New Delhi – 110003.

Dated, the 25 October, 2021

OFFICE MEMORANDUM

Subject :- Calculation of Gratuity and Cash payment in lieu of leave for the employees of CPSEs following IDA pattern (2017, 2007, 1997, 1992 and 1987 pay scales) retired on or after 01.10.2020 and up to 30.06.2021 – reg..

The undersigned is directed to refer to this Department’s OM No. 02/0039/2014- DPE(WC) dated 19.11.2020, in regard to payment of Dearness Allowance (DA) during the freezing period from 01.10.2020 up to 30.06.2021 and to say that in terms thereof the rate of DA during the said period will continued to be paid at the rates applicable w.e.f. 01.07.2020 .

2. . In view of the above order calculation of Gratuity and Cash payment in lieu of leave for CPSE employees IDA pattern who retired on or after 01 October, 2020 and up to 30.06.2021 have been made as per the above order.

3. . Keeping in view that gratuity and cash payment in lieu of leave are one-time retirement benefits admissible to employees on retirement , the matter has been considered sympathetically . It has been decided that in respect of CPSE employees (IDA pattern) who retired on or after 01 .10.2021 and up to 30.06.2021 , the amount of DA to be taken into account for calculation of gratuity and cash payment in lieu of leave will be deemed to be as per the notional DA rates indicated in the annexure(s) to the OPE OMs dated 02.08.2021 and 03 .08 .2021 for different pay revision. The notional DA rates for calculation purpose are given below for different pay scales.

a) 2017 pay scale

| Employees retiring during the period | Notional percentage of Dearness Allowance (DA) for calculation purpose |

| From 01.10.2020 to 31.12.2020 | 20.9% of basic pay |

| From 01.01.2021 to 31.03.2021 | 23.7% of basic pay |

| From 01.04.2021 to 30 .06.2021 | 23.2% of basic pay |

b) 2007 pay scale

| Employees retiring during the period | Notional percentage of Dearness Allowance (DA) for calculation purpose |

| From 01 . 10.2020 to 31.12.2020 | 165.4% of basic pay |

| From 01.01 .2021 to 31 .03.2021 | 171.7% of basic pay |

| From 01.04.2021 to 30.06 .2021 | 170.5% of basic pay |

c) 1997 pay scale

| Employees retiring during the period | Notional percentage of Dearness Allowance (DA) for calculation purpose |

| From 01.10.2020 to 31.12.2020 | 348.1% of basic pay |

| From 01.01.2021 to 31.03.2021 | 358.7% of basic pay |

| From 01.04.2021 to 30.06.2021 | 356.7% of basic pay |

(d) For 1992 and 1987 pay scale

As per DA rates mentioned at Annx-I (1992 IDA pay scale) and Annx-II (1987 IDA pay scale) of OPE OM No. W-02/0003/20214-DPE (WC) dated 03.08.2021.

4. All administrative Ministries I Departments of the Government of India are requested to bring the foregoing to the notice of the CPSEs under their administrative control for necessary action at their end.

5. This issues with the approval of the competent Authority .

(Samsul Haque)

Under Secretary

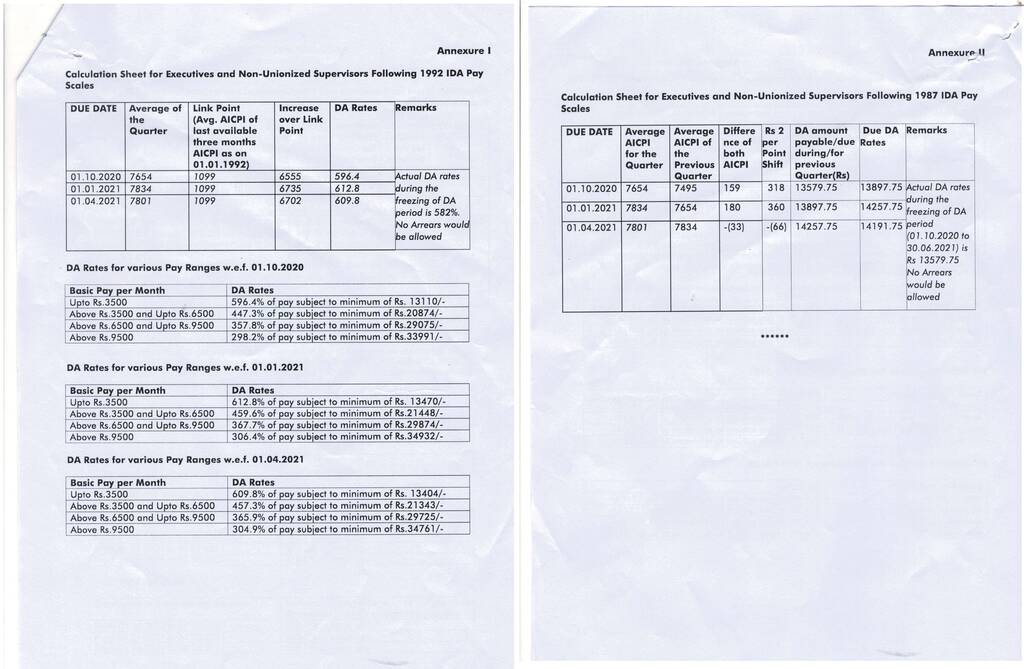

Calculation Sheet for Executives and Non-Unionized Supervisors Following 1992 IDA Pay Scales

| DUE DATE | Average of the Quarter | Link Point (Avg. AICPI of last available three months AICPI as on 01.01.1992) | Increase over Link Point | DA Rates | Remarks |

| 01.10.2020 | 7654 | 1099 | 6555 | 596.4 | Actual DA rates during the freezing of DA period is 582%. No Arrears would be allowed |

| 01.01.2021 | 7834 | 1099 | 6735 | 612.8 | |

| 01.04.2021 | 7801 | 1099 | 6702 | 609.8 |

DA Rates for various Pay Ranges w.e.f. 01.10.2020

| Basic Pay per Month | DA Rates |

| Upto Rs.3500 | 596.4% of pay subject to minimum of Rs. 13110/- |

| Above Rs.3500 and Upto Rs.6500 | 447.3% of pay subject to minimum of Rs. 20874/- |

| Above Rs.6500 and Upto Rs.9500 | 357.8% of pay subject to minimum of Rs. 29075/- |

| Above Rs.9500 | 298.2% of pay subject to minimum of Rs. 33991/- |

DA Rates for various Pay Ranges w.e.f. 01.01.2021

| Basic Pay per Month | DA Rates |

| Upto Rs.3500 | 612.8% of pay subject to minimum of Rs. 13470/- |

| Above Rs.3500 and Upto Rs.6500 | 459.6% of pay subject to minimum of Rs. 21448/- |

| Above Rs.6500 and Upto Rs.9500 | 367.7% of pay subject to minimum of Rs. 29874/- |

| Above Rs.9500 | 306.4% of pay subject to minimum of Rs. 34932/- |

DA Rates for various Pay Ranges w.e.f. 01.04.2021

| Basic Pay per Month | DA Rates |

| Upto Rs.3500 | 609.8% of pay subject to minimum of Rs. 13404/- |

| Above Rs.3500 and Upto Rs.6500 | 457.3% of pay subject to minimum of Rs.21343/- |

| Above Rs.6500 and Upto Rs.9500 | 365.9% of pay subject to minimum of Rs.29725/- |

| Above Rs.9500 | 304.9% of pay subject to minimum of Rs.34761/- |

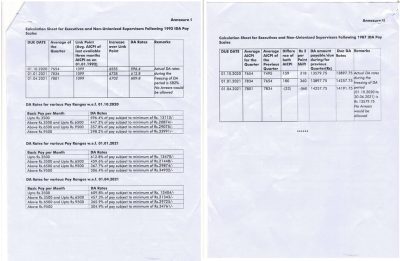

Annexure-II

Calculation Sheet for Executives and Non-Unionized Supervisors Following 1987 IDA Pay Scales

| DUE DATE | Average AICPI for the Quarter | Average AICPI of the Previous Quarter | Differe nce of both AICPI | Rs 2 per Point Shift | DA amount payable/due during/for previous Quarter(Rs) | Due DA Rates | Remarks |

| 01.10.2020 | 7654 | 7495 | 159 | 318 | 13579.75 | 13897.75 | Actual DA rates during the freezing of DA period (01.10.2020 to 40.062021) is Rs. 13579.75 No Arrears would be allowed |

| 01.01.2021 | 7834 | 7654 | 180 | 360 | 13897.75 | 14257.75 | |

| 01.04.2021 | 7801 | 7834 | -(33) | -(66) | 14257.75 | 14191.75 |

******

COMMENTS