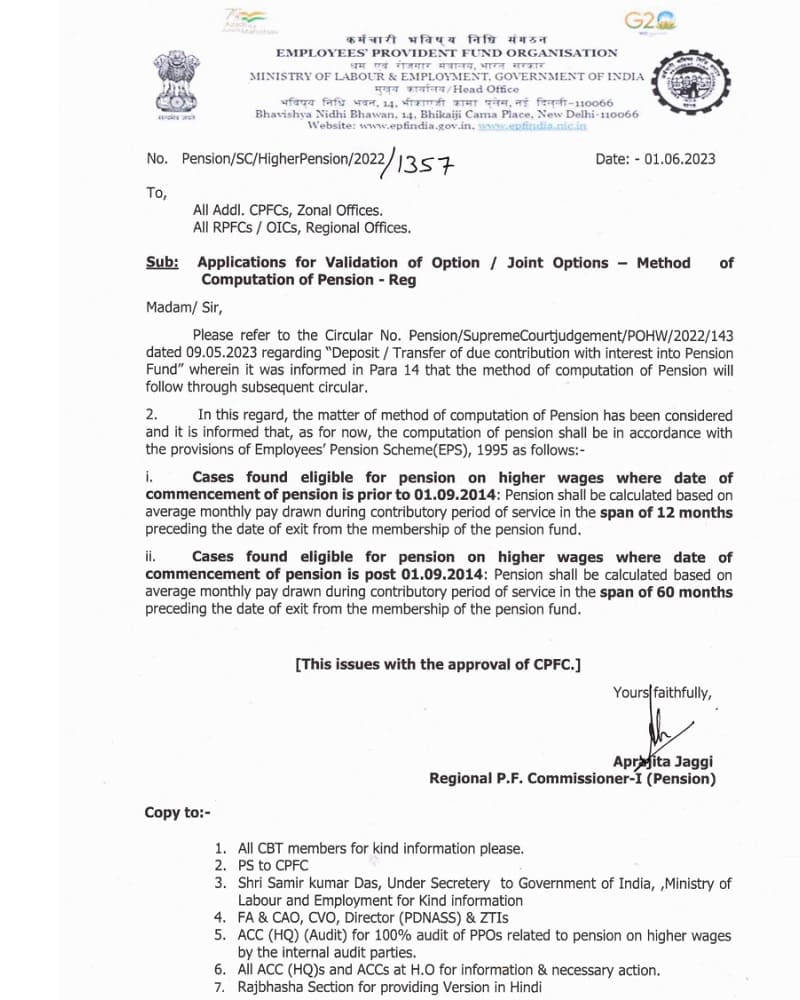

Applications for Validation of Option / Joint Options — Method of Computation of Pension: EPFO

EMPLOYEES PROVIDENT FUND ORGANISATION

MINISTRY OF LABOUR & EMPLOYMENT, GOVERNMENT OF INDIA

Bhasishva Nidhi Bhawan. 14. Bhikaiji Cama Place, New Delhi-110066

No. Pension/SC/HigherPension/2022 / 1357

Date: – 01.06.2023

To,

All Addl. CPFCs, Zonal Offices.

All RPFCs / OICs, Regional Offices.

Sub: Applications for Validation of Option / Joint Options — Method of Computation of Pension – Reg

Madam/ Sir,

Please refer to the Circular No. Pension/SupremeCourtjudgement/POHW/2022/143 dated 09.05.2023 regarding “Deposit / Transfer of due contribution with interest into Pension Fund” wherein it was informed in Para 14 that the method of computation of Pension will follow through subsequent circular.

2, In this regard, the matter of method of computation of Pension has been considered and it is informed that, as for now, the computation of pension shall be in accordance with the provisions of Employees’ Pension Scheme(EPS), 1995 as follows:-

- Cases found eligible for pension on higher wages where date of commencement of pension is prior to 01.09.2014: Pension shall be calculated based on average monthly pay drawn during contributory period of service in the span of 12 months preceding the date of exit from the membership of the pension fund.

- Cases found eligible for pension on higher wages where date of commencement of pension is post 01.09.2014: Pension shall be calculated based on average monthly pay drawn during contributory period of service in the span of 60 months preceding the date of exit from the membership of the pension fund.

[This issues with the approval of CPFC.]

Yours faithfully,

Aprajita Jaggi

Regional P.F. Commissioner-I (Pension)

COMMENTS

I was drawing Rs.65000/=pm approx now, I am drawing Rs.4870 as pension after putting up of 34yrs of Service.

Pension and other facilities to EPFO employees should be stopped immediately as they’re good for nothing else wastage of public hard earned money

I am taken vrs in the year of 2001.

I think i am eligible for higher pension. Pls let me know how much amount get me as pension monthly.

Eps 95 higher pension to pre 2014.

Cases found eligible. My question direct to issuing authority. 1.what is the criteria of finding eligibility please define clearly sir as to why there is a hidden agenda for non eligibility of higher pension As to why EPFO authorities are not allowing to opt to those eps pensioners who have not opted for higher pension n their contribution was not paid over n above the ceiling when the retired eps pensioners and their employer are willing to pay their share of contribution with interest to get higher pension. What is the hitch to not allow to opt higher pension to such eps pensioners. You want the pensioners to go to court and bring orders to that effect and thereafter you will agree.Am I right sir. The labour department was created for welfare of workmen but it is working against their interest. Is this not inhumanity torture to old aged pensioners.

Correct, my opinion is to dissolve the epfo body. They want higher salary and higher pension from our contribution so they put some hidden policy to stop the higher pension of employees hence my request to government to be dissolve the epfo body.