Author: Pawan

List of Two Wheelers Listed with CSD as on 13 July 2020

List of Two Wheelers Listed with CSD as on 13 July 2020: Company-wise Details HARLEY DAVIDSON, ROYAL ENFIELD, Yamaha, TVS etc.

LIST OF TWO WH [...]

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

Press Information Bureau

Government of India

Ministry of Finance

[...]

Government employees can join rallies, freely post their opinions on social media platforms: Tripura HC

Government employees can join rallies, freely post their opinions on social media platforms: Tripura HC

AGARTALA: Dismissing an inquiry against a ret [...]

Ex-gratia compensation to the families of Central Government employees who died due to Covid-19 infection in performance of their duties

Ex-gratia compensation to the families of Central Government employees who died due to Covid-19 infection in performance of their duties

Ph.: 2338228 [...]

Payment of Transport Allowance to the Employees of National Library, Kolkata

Payment of Transport Allowance to the Employees of National Library, Kolkata.

The condition of one-day attendance in a month, for payment of Transpor [...]

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune Message No. 13/2020

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune

Message No. 13/2020

DEDUCTION OF INCOME TAX AT SOURCE FROM S [...]

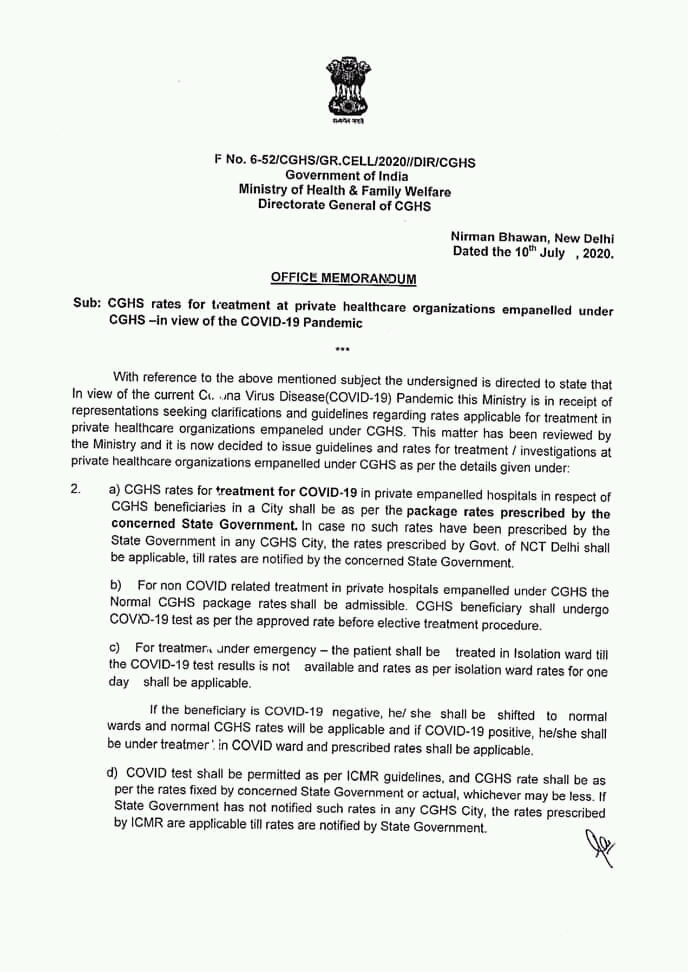

CGHS rates for Corona Virus Disease (COVID-19) treatment at private HCOs: CGHS OM Dt. 10th July, 2020

CGHS rates for Corona Virus Disease (COVID-19) treatment at private HCOs: CGHS OM Dt. 10th July, 2020

F No. 6-S2/CGHS/GR.CELL/2020/DIR/CGHS

Governme [...]

Summons via WhatsApp Email Telegram etc. is Legally valid now: Supreme Court okays

Summons via WhatsApp Email Telegram etc. is Legally valid now: Supreme Court okays

NEW DELHI: In a first, the Supreme Court on Friday agreed in pri [...]

Processing of returns with refund claims under section 143(1) of the Income-tax Act beyond the prescribed time limits in non-scrutiny cases

Processing of returns with refund claims under section 143(1) of the Income-tax Act beyond the prescribed time limits in non-scrutiny cases

F. No.22S [...]

Instructions regarding timely release/ payment of Gratuity (DCRG) for avoiding payment of interest on delayed payment of Gratuity

Instructions regarding timely release/ payment of Gratuity (DCRG) for avoiding payment of interest on delayed payment of Gratuity

Most Immediate

Cou [...]