Tag: Form 16

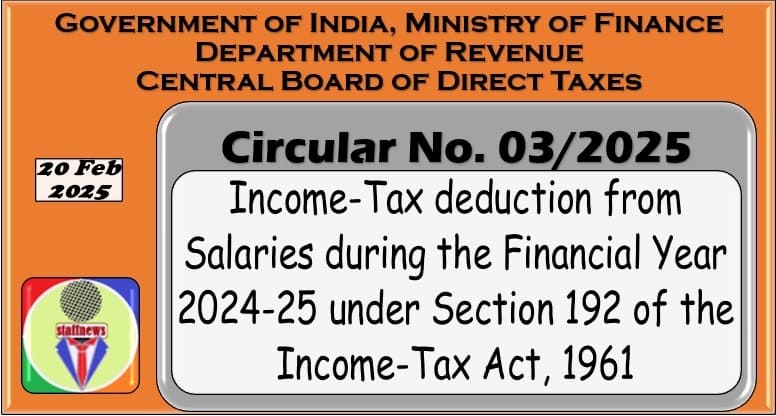

Income-Tax deduction from Salaries during the Financial Year 2024-25: IT Circular No. 3/2025

Income-Tax deduction from Salaries during the Financial Year 2024-25 under Section 192 of the Income-Tax Act, 1961: IT Circular No. 3/2025 dated 20.02 [...]

Providing Form 16 to all pensioners and family pensioners: Central Pension Accounting Office’s OM

Providing Form 16 to all pensioners and family pensioners: Central Pension Accounting Office

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF [...]

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2021-22 (AY 2022-23)

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2021-22 (AY 2022-23): PCDA Advisory No. 15 dated 14 [...]

Furnishing of declaration and evidence of claims by specified senior citizen under section 194P, Form No. 12BBA, Form No. 16 & Form No. 24Q

Furnishing of declaration and evidence of claims by specified senior citizen under section 194P, Form No. 12BBA, Form No. 16 & Form No. 24Q: Incom [...]

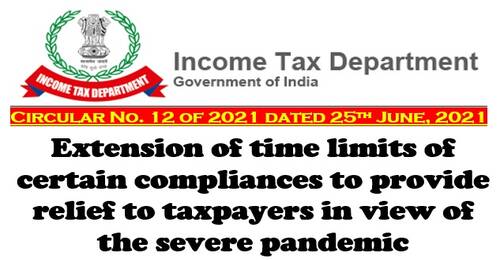

Extension of time limits of certain compliances to provide relief to taxpayers: Income Tax Circular No 12 of 2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic: Income Tax

Circular No 12 of 2021

F. [...]

Tax Deduction at Source (TDS) guidelines on payments made to VRS 2019 Optees

Tax Deduction at Source (TDS) guidelines on payments made to VRS 2019 Optees

BHARAT SANCHAR NIGAM LIMITEDA

[A Government of India Enterprise]

Corpo [...]

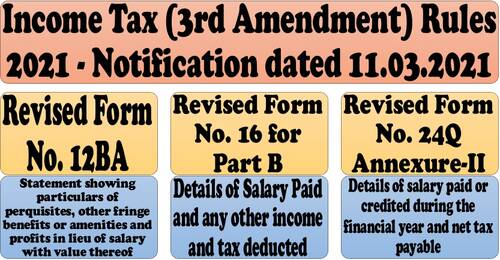

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

MINISTRY OF FINA [...]

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

Press Information Bureau

Government of [...]

TDS guidelines on payments to BSNL VRS 2019 Optees – TDS on ex-gratia/Leave Encashment, Form 16, Tax Exemption etc.

Tax Deduction at Source (TDS) guidelines - TDS on ex-gratia, TDS on Leave Encashment, Form 16, Tax Exemption on payments to BSNL VRS 2019 Optees

[...]

Income Tax – FAQs on Salary Income – Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Income Tax - FAQs on Salary Income - Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Frequently Asked Quest [...]