Tag: Income tax calculation

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune Message No. 13/2020

Income Tax Deduction from Salaries During F.Y. 2020-21 (A.Y. 2021-22): PCDA(O) Pune

Message No. 13/2020

DEDUCTION OF INCOME TAX AT SOURCE FROM S [...]

Processing of returns with refund claims under section 143(1) of the Income-tax Act beyond the prescribed time limits in non-scrutiny cases

Processing of returns with refund claims under section 143(1) of the Income-tax Act beyond the prescribed time limits in non-scrutiny cases

F. No.22S [...]

Change in TDS Return Form 26Q & Form 27Q – Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

Change in TDS Return Form 26Q & Form 27Q - Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

THE GAZETTE OF INDIA : EXTRAORDI [...]

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

No. 24/06/2020-Cash (MS) [...]

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

MINISTRY OF [...]

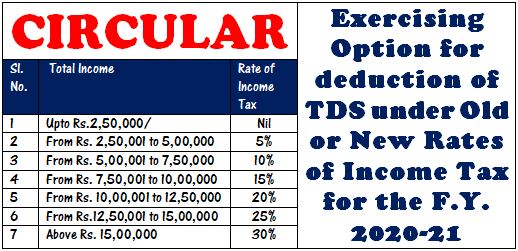

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

No.G-26028/4/2020-Cash

Government of India

Ministr [...]

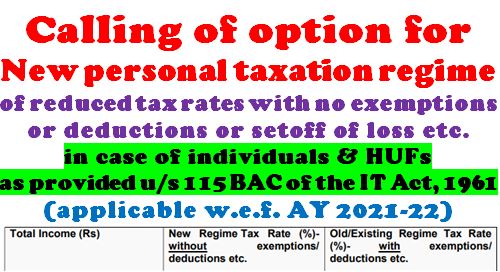

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Taxation Sect [...]

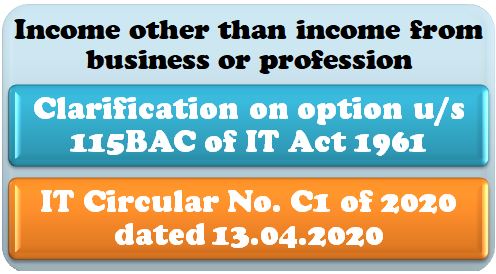

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

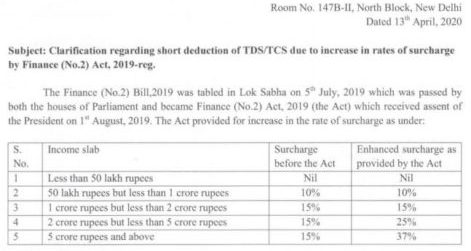

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Ready Reckoner – Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime i.r.o. Normal, Senior & Super Senior Citizen

Ready Reckoner - Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime calculated on Annual income starting from Rs.5 Lakh increas [...]