Tag: Income tax calculation

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

Principal Controller of [...]

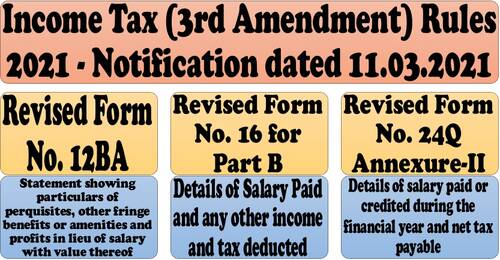

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

MINISTRY OF FINA [...]

Deduction of TDS in respect of aggregate Cash Withdrawal above Rs. 20 lakh – section 194N of I.T. Act 1961 – SB Order No. 05/2021

Deduction of TDS in respect of aggregate Cash Withdrawal above Rs. 20 lakh - section 194N of I.T. Act 1961 – SB Order No. 05/2021

SB Order No. 05/202 [...]

Deduction of Income Tax for the FY 2021-22: Form No. 12BB Statement showing particulars of claims for deduction

Deduction of Income Tax for the FY 2021-22: Form No. 12BB Statement showing particulars of claims for deduction

Principal Controller of Defence Accou [...]

Income Tax due dates : CBDT extends various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : CBDT extends various limitation dates - Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme [...]

Option for Calculation of Income Tax under Old Tax Regime or New Tax Regime: Clarification by PCDA – Message No. 04/2021

Option for Calculation of Income Tax under Old Tax Regime or New Tax Regime: Clarification by PCDA - Message No. 04/2021

Message No. 04/2021

Opt [...]

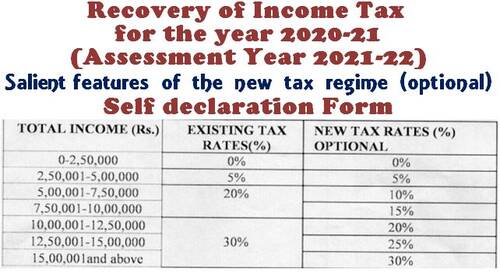

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) – Salient features of the new tax regime (optional) – Self declaration Form

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) - Salient features of the new tax regime (optional) - Self declaration Form

Pri [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

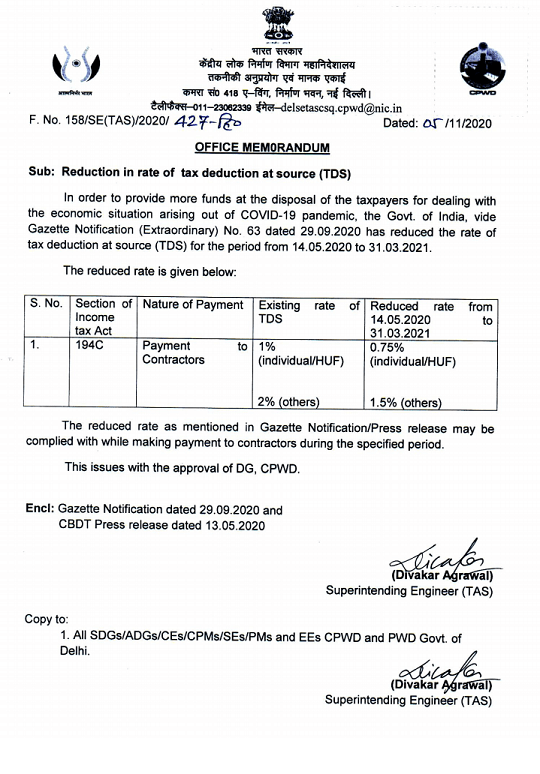

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Government of India

Directorate [...]

Compulsory selection of returns for complete scrutiny during the Financial Year 2020-21 – conduct of assessment proceedings in such cases: CBDT Order

Compulsory selection of returns for complete scrutiny during the Financial Year 2020-21 - Conduct of assessment proceedings in such cases: CBDT Order

[...]