Tag: Income Tax Exemption Limit

Income Tax FY 2022-2023/AY 2023-2024 – Proforma for submission of Income Tax Savings Documents

Income Tax FY 2022-2023/AY 2023-2024 - Proforma for submission of Income Tax Savings Documents for the purpose of calculation of Taxable Income

GOVER [...]

Conditions for exemption of money received from employer or any person for Covid-19 Treatment under Section 56 (2)(x): IT Notification No. 92/2022

Conditions for exemption of money received from employer or any person for Covid-19 Treatment under Section 56 (2)(x): IT Notification No. 92/2022

[...]

Forms and Declaration for amount received from any person for Covid-19 – Tax Relief under Section 56 (2)(x): IT Notification No. 91/2022

Forms and Declaration for amount received from any person for Covid-19 - Tax Relief under Section 56 (2)(x): IT Notification No. 91/2022

CBDT speci [...]

Documents to be submitted by Employees for Tax Relief in the repercussion of Covid-19 under Section 56 (2)(x): IT Notification No. 90/2022

Documents to be submitted by Employees for Tax Relief in the repercussion of Covid-19 under Section 56 (2)(x): IT Notification No. 90/2022

CBDT speci [...]

Treatment of Income from Different Sources AY 2023-24 (FY 2022-23) under Income Tax as amended by Finance Act, 2022

Treatment of Income from Different Sources AY 2023-24 (FY 2022-23) under Income Tax as amended by Finance Act, 2022

Treatment of Income from Differen [...]

List of benefits available to Salaried Persons for AY 2023-24 (FY 2022-23) under Income Tax as amended by Finance Act, 2022

List of benefits available to Salaried Persons for AY 2023-24 (FY 2022-23) under Income Tax as amended by Finance Act, 2022

List of benefits availabl [...]

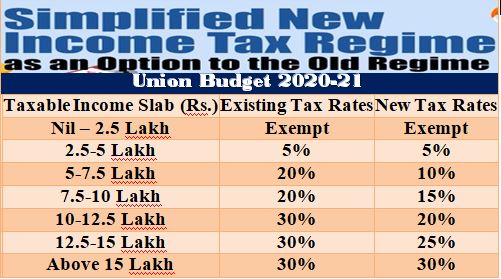

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development.

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development.

GOVERNMENT OF INDIA

MINISTRY [...]

Income-Tax Deduction from Salaries during the Financial Year 2021-22: Circular No. 04/2022

Income-Tax Deduction from Salaries during the Financial Year 021-22: Circular No. 04/2022

GOVERNMENT OF INDIA MINISTRY OF FINANCE

(DEPARTMENT OF [...]

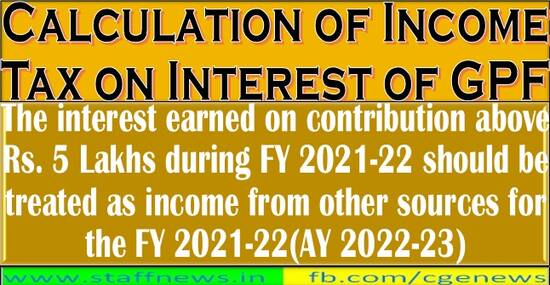

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Defence Accounts Department (DAD) Headquarters

Ulan Batar Road, Palam [...]

Budget 2022-23: Income Tax – Download Finance Bill 2022 – No changes in Slab, Updated return facility, Relief to PwD, NPS contribution deduction 14%

Budget 2022-23: Income Tax - Download Finance Bill 2022 - No changes in Slab, Updated return facility, Relief to PwD, NPS contribution deduction 1 [...]