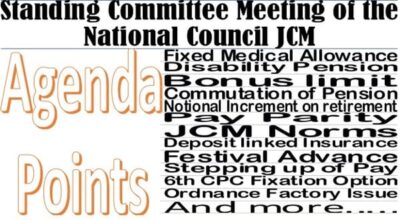

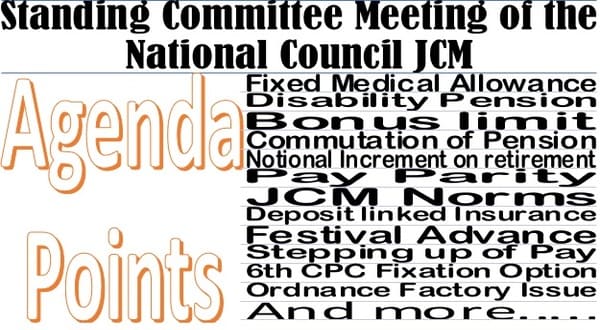

Standing Committee Meeting of the National Council JCM – Agenda points for discussion and settlement includes MACP, Notional Increment, FMA, Bonus, Festival Advance, Stepping up of Pay etc.

Shiva Gopal Mishra

Secretary

National Council (Staff Side)

Sint Consultative Machinery

13-C, Ferozshah Road, New Delhi – 110001

E-Mail : nc.jcm.np[at]gmail.com

No.NC-JCM-2022/ SC

July 24, 2023

The Dy. Secretary-JCA,

&

Member Secretary – JCM

Department of Personnel & Training,

North Block,

New Delhi

Dear Sir,

Sub: Forwarding of agenda points for discussion and settlement in the next Standing Committee Meeting of the National Council JCM.

Sir,

In continuation of this office letter of even number dated 19/06/2023 addressed to Secretary (P), Department of Personnel and Training, we are hereby submitting the enclosed 13 agenda points for the ensuing Standing Committee Meeting of the NC JCM. Apart from this, 13 Agenda’s we also would like to discuss the following issues (enclose in Annexure) which we have discussed in the last Standing Committee Meeting of the NC JCM held on 22/09/2022. We will be also forwarding additional fresh agenda points within a week as and when received from the Staff Side.

Thanking you,

Yours faithfully,

(Shiva Gopal Mishra)

Secretary

Encl:- as above

Annexure

| Item No. 14/SC/22:- | Payment of FMA to Pensioners of the National Institute of Ayurveda and bring the employees of the institutes within the ambit of CCS (MA) Rules. |

| Item No. 28/SC/22:- | Restoration of facilities and concession withdrawn by Railways to Senior Citizens. |

| Item No. 11/SC/22:- | Pension to be exempted from the purview of income taxation. |

| Item No. 24/SC/22:- | Disability pension of war heroes to be exempted from Income tax. |

| Item No. 3/19/SC:- | Revision of the benefit of Deposit Linked Insurance Coverage from GPF. |

| Item No. 29/19/SC:- | Enhancement Of Bonus Ceiling Limit Of Casual Labourers Consequent On enhancement Of Bonus Calculation Ceiling Of Central Govt Employees |

| Item No. 17/SC/22:- | Modification for grievance redressal mechanism. |

| Item No. 21/21/SC:- | Implementation of Govt. decision on 7th CPC recommendations on Risk Allowance to the Central Govt. Employees including Defence Civilian Employees |

| Item No. 6/SC/22: | Restoration of the commuted portion of pension after 12 years |

| Item No. 8/SC/22:- | MACP to be made effective from 1.12006 in implementation of the judgment of the Supreme Court |

| Item No. 9/SC/22:- | Grant of one notional increment for those who retired on superannuation on 30th June, |

| Item No. 10/SC/22:- | Applicability of the 7th CPC. Pay revision benefit for those retired on 31.12.2015. |

| Item No. 23/SC/22:- | To specify time frame for the completion of disciplinary cases in the case of pensioners. |

Agenda Item No. 1:

Restoration of historic Pay-Parity between Income Tax Inspector and analogous posts in Department of Revenue and Inspector of CBI/ ACIO Gr.-I of IB:

A historic pay parity had earlier been maintained between Income Tax Inspector (ITI)/ Inspector (Central Excise)/Preventive Officer/ Examiner in the Department of Revenue (DoR) and the Inspector of CBI/ ACIO Grade-I of IB (formerly Inspector of IB). The 5th CPC recommendations restored inter alia the horizontal parity, disturbed in the interim, by placing Inspector of CBI/ ACIO Grade-II of IB to the replacement scale of Rs.1,640 – Rs.2,900, i.e. making them on par with ITI and analogous posts of the Department of Revenue. But the Government of India, while implementing the recommendations, placed Inspector of CBI/ ACIO Gr.-I of IB in the pay scale of Rs.6,500 – Rs.10,500, whereas ITI and others in DoR were awarded with the pay scale of Rs.5,500 – Rs.9,000. However, the pay anomaly was set right by the order of the Implementation Cell, Department of Expenditure from F.No.6/37/98-IC dated 21.04.2004, when ITI and analogous posts in DoR too were upgraded to the (at par) pay scale of Rs.6,500-Rs.10,500. The 6th CPC again disturbed the horizontal parity by awarding the pay scale of Grade Pay Rs. 4,600 in Pay Band-2I to Inspector of CBI/ ACIO Gr-I of IB. But the anomaly was soon set right by the Implementation Committee of the Department of Expenditure vide its OM from F. No. 1/1/2008-IC dated 13.11.2009 granting parity in the pay scales of ITI and analogous posts in the DoR by upgrading to the Grade Pay to Rs.4600 from Rs.4,200.

However, 7th CPC once again disturbed the re-established parity, apparently mis-appreciating the spirit of 5 CPC’s observations and recommendations, which was also accepted by the Government of India. Therefore, when ITI and analogous posts in DoR were awarded the replacement scale at Pay Level 7, Inspector of CBI/ ACIO Gr.-I of IB were upgraded to Pay Level 8. The issue of Anomaly was placed before the Departmental Anomaly Committee, which was accepted and decided to forward the proposals to the Department of Expenditure (DoE). However, Deptt of Revenue didn’t accept the recommendation of Anomaly committee as well as didn’t find merit in the proposals of CBDT and CBIC and never forwarded the same to DoE. But DoR too clearly mis-appreciated the spirit of the observations and recommendations of SCPC and failed to take note that the DoE had already accepted the horizontal pay-parity between these two groups while upgrading the pay scale of DoR employees on 21.04.2004. Moreover, there have been no significant changes of duties for both the groups since then. Hence, DoR employees have clearly been denied justice and the historic horizontal pay-parity needs to be restored before we move to the next CPC regime.

######

Agenda Item No. 2 :

Subversion of JCM norms with misuse of CCS(RSA) Rules, 1993

The JCM has been functioning since 1966 for maintaining harmonious relation between Government of India and its Employees. Efforts were made to continuously improve the position. At the end of the day, it is found that this mechanism contributed immensely for the betterment of the employees. But recently employees of different Departments witnessed unfortunate attempts to dismantle the system, mostly by uncalled for misuses of some provisions of CCS (RSA) Rules, 1993. There are so many organizations facing the problems regarding recognition as per CCS (RSA) Rules 1993.

Some of the organizations like National Federation of Postal Association (NFPE) and All India Postal Employees Union (Group C) organization, the representative of highest number of employees have been derecognized for a charge, which was duly clarified by the Federation based on logic and genuine documents. The withdrawal of recognition is not only unjustified but also motivated. Withdrawal of the recognition of a major employee’s organization of Central Govt. Department will definitely hamper the industrial relations and harmony of that department, which is not in the interest of the employees-employer relationship. The arbitrary order regarding derecognition is required to be withdrawn and the recognition of both the organization may be restored back.

The organization like ISRO earned global reputation with the active cooperation of the employees. The JCM mechanism served well in this organization since long. Recently JCM mechanism has been replaced by Grievance Redressal Mechanism by the department. This is gross irregularity and infringement of Constitutional Right to form Association. Reversion to a lawful mechanism i.e. recognition of employees organization may be restored.

######

Agenda No.3

Necessary clarification to ensure that the service Associations which are governed by the CCS (RSA) Rule 1993, are kept out of the purview of Rule 15 (1) (c).

The provisions of DoPT clarifications for holding elective office under Rule 15 (1) (c) of CCS (Conduct) Rules are erroneously being applied on the different associations governed by the CCS (RSA) Rule 1993. The Rule 15 of CCS (Conduct) Rules is with regard to private trade and employment and Rule 15 (1) (c) talks about “hold an elective office or canvass for a candidate or candidates for an elective office, in any body, whether incorporated or not”. There is a proviso to Rule- 15 which, as mentioned above, refers to private trade or employment and hence, the office bearers of the service associations are in no way coming under its ambit. The service Associations are governed by CCS (RSA) Rules 1993, where they have to adhere to the provisions of their Constitution as approved by their respective departments. A fine reading of Rule 15 of CCS (Conduct) Rule 1964 and the DoPT instructions thereon leaves no ambiguity that the proviso thereto is in respect of private bodies and holding elective office in such bodies and not applicable to Service Associations and employees of Cooperative Societies / Banks/Consumer Stores etc.

In this regard kindly refer to DOPT O M F.N.11013/11/2007-Estt. (A) Dated 13/11/2007 where in it is clearly stated with regard to the restrictions on tenure/ number of Terms of holding office in a cooperative society in accordance with the relevant Cooperative Acts and bye-laws of the Cooperative Societies. In the Cooperative Societies Act there is no such provision for restricting the tenure /number of terms for holding elected office. Similarly the service Associations are recognized Under CCS (RSA) Rules 1993, in which there is no restriction on tenure / number of terms. Therefore the position taken by the Department of Atomic Energy in this regard is incorrect.

In the light of the above, it is requested to issue necessary clarification to ensure that the service Associations which are governed by the CCS (RSA) Rule 1993, are kept out of the purview of Rule 15 (1) (c) of CCS(Conduct) Rules and the employees Cooperative Societies / Banks / Consumer Stores which are governed by Central & State Government Acts and Rules framed by Central and respective State Government.

######

Item No. 4

Revision of Deposit linked Insurance Scheme under the GPF for Central Government Employees

The above issue was under discussion in the Standing Committee Meetings of the National Council – JCM. The Deposit Linked Insurance Scheme limit is periodically increased whenever the ministry of Labour and employment increases the limit of DLIS in the EPF Scheme. The Ministry of labour has enhanced the benefit to Rs.600,000/- for the depositors in the EPF Scheme. At present the DLIS benefit available to the GPF subscribers is only Rs. 60,000/- therefore the Staff Side in the Meetings of the Standing Committee held on 07/03/2019 raised this issue and in the meeting we were informed that the Department of Pension and Pensioners Welfare have recommended the matter to the Department of Expenditure and that the matter is under consideration in the Department of Expenditure. We were expecting the government orders for increasing the DLIS benefit from Rs. 60,000 to 600,000 for the GPF subscribers. However the Staff Side is shocked to note that the Department of Expenditure have rejected the same. This is not justified since this insurance benefit is a social security coverage given to the family of deceased employees who are subscribers of GPF. Therefore this needs to be reconsider by the Department of Expenditure.

######

Item No. 5

Revision of calculation Ceiling Limit of PLB and Ad hoc Bonus for the Central Government Employees

The Last revision of the enhancement of the calculation ceiling for the purpose of payment of PLB and adhoc Bonus was revised during the year 2014-15 vide Department of Expenditure OM dated 29/08/2016. The ceiling was raised from Rs.3500 to Rs.7000/-. It is now almost 10 years after the revision of the calculation ceiling limit of PLB and adhoc bonus. After the implementation of 7th CPC pay scales w.e.f 01.01.2016, the minimum basic pay of Central Government Employees is Rs. 18000/-. Therefore there is no justification in keeping the ceiling limit of payment of Bonus ( PLB & Adhoc Bonus) as Rs. 7000/-. It needs to be revised and enhanced. It is therefore demanded that the calculation ceiling limit of PLB and Adhoc Bonus may be revised in consultation with the Staff Side. We reiterate that the Bonus for 30 days should be one month basic pay of the employees.

Item No. 6

Restoration of festival advance to the Central Government Employees

Kindly refer to the decision taken in the Standing Committee meeting Held on 07/03/2019 and 26/02/2021 where in the demand of restoration interest free advances recommended by the 7th CPC. After discussion it was mutually agreed that the Govt. will consider the issue of Restoration of Festival Advance to the Central Government Employees. In the meeting held 0n 26.02.2021 Secretary (P) stated that there is no restriction on what to do of the amount of advance, but there is restriction on how to disburse it. It was further decided that the matter may be discussed by the Staff Side with the then AS (Pers) DOE separately. It is regretted to inform that so far no discussion with the Staff Side has taken place on the subject matter. It is therefore demanded that one month basic pay of the employees may be given as interest free festival advance to be recovered in ten monthly instalments.

######

Item No.7

Stepping up of pay of seniors promoted prior to 31.12.2015 getting lesser basic pay than the juniors promoted after 01.01.2016

After the implementation of Ministry of Finance / Department of Expenditure OM dated 31st July, 2018 wherein it is clarified “that in case an employee is promoted or granted financial upgradation including upgradation under the MACP scheme on ist January or ist July, where the pay is fixed in the Level applicable to the post on which promotion is made in accordance with the Rule 13 of the CCS(RP) Rules, 2016, the first increment in the Level applicable to the post on which promotion is made shall accrue on the following 1st July or 1st January, as the case may be, provided a period of 6 months’ qualifying service is strictly fulfilled. The next increment thereafter shall, however, accrue only after completion of one year”.

Due to the above benefit of granting the 1st increment within 6 months after promotion it has been observed that an anomaly was caused to the senior employees in the same category promoted prior to 31st December, 2015 is getting lesser Basic Pay than those who are promoted on or after 01.01.2016 due to the benefit availed by the junior in accordance with the Department of Expenditure OM dated 31.07.2018. Similar anomaly has happened in the case of Service Personnel in the Armed Forces and the Ministry of Defence / Department of Military Affairs has taken up the matter with Defence Finance and Ministry of Finance and the MOD vide Letter referred above dated 26.09.2022 have now issued the clarification for stepping up of the pay of the senior at par with the junior as under :-

(a) DNI is an inherent part of pay as duly clarified by Ministry of Finance, while defining equal pay vide Ministry of Finance Letter 1(14)-III/89 dated 16th June, 1989.

(b) Accordingly, Ministry of Finance has applied the same rule in the extant anomaly noticed in VII CPC. It has now been clarified that after 01st January, 2016, in case a junior who is drawing less / same pay as a senior, starts drawing more Basic Pay after six/ months of his promotion due to DNI provision extended in VII CPC, pay of such senior shall be stepped up, equal to junior’s pay w.e.f. 01st January, or O1st July as the case may be.

The above benefit of stepping up of pay the senior employees who are promoted prior to 31.12.2015, at par with the junior’s promoted after 01.01.2016 has not been extended to the Central Government Employees. This is a discrimination, since any instruction related to Pay Commission Anomalies are equally applicable to the Civilian Employees also. Therefore, it is requested that the DOPT and Department of Expenditure may kindly arrange to issue instructions as already issued to the Service Personnel for stepping up of pay of the seniors who were promoted prior to 31.12.2015 at par with the junior’s promoted after 01.01.2016.

######

Item No. 8

Extending the benefit of option to Central Government Employees to switch over to the 7th CPC Pay Scale from a date! beneficial to the employees and also for extending revised option for the employees who were given entry pay benefit on promotion in the 6th CPC Pay Scale to switch over to 6th CPC Pay Scale w.e.f. 01.01.2006.

At the outset we are thankful to the Department of Expenditure for issuing an Instruction dated 04.07.2023 allowing another opportunity to Government employees to exercise / re-exercise option for pay fixation as allowed under O.M. dated 28.11.2019 within a period of three months from the date of issue of this Office Memorandum. However, the following two issues represented by the Secretary / Staff Side of the National Council (JCM) is remaining unsettled despite our repeated request in the meetings of the Standing Committee of National Council (JCM).

1) Granting of one more option to switch over to 7th CPC Pay Scale from a date subsequent to 25th of July, 2016 (Ref. Minutes of National Anomaly Committee Meeting held on Tuesday, 17th July, 2018 circulated vide DOP&T OM No. 11/2/-JCA-1 (Pt.) dated 31st of January, 2019). Kindly refer also to Secretary / Staff Side / National Council (JCM) Letter No. NC-JCM-2017/Fin dated 05th of March, 2019.

2) Grant of revision of option after grant of Entry Pay to the promotes in accordance with Department of Expenditure OM No. 8-23/2017- E.III dated 28th of September, 2018. Kindly refer to Secretary / National Council (JCM) Letter No. NC-JCM-2022/Fin. (Opt) dated 23rd of June, 2022.

Since, the above two major issues are not yet settled, the employees are agitated and some of them are planning for litigation in the matter. As these two demands are genuine and there is no much financial implication in both the cases it is requested that the Department of Expenditure may kindly consider our request favourably and arrange to issue necessary instructions for extending the benefit of option as a onetime measure so that a major outstanding issues pending in the National Council (JCM) stands resolved.

######

Item No. 9

Extension of LTC-80 one time relaxation in the case of employees who availed LTC to Andaman & Nicobar Island (A&N) by purchasing air tickets from other than authorized agents

The Staff Side has been repeatedly demanding that a onetime relaxation as given to LTC – 80 journey performed by Central Government Employees to NER States and J&K State may be extended to the Central Government employees who have availed LTC-80 and have travelled to A&N Islands by purchasing Air Tickets from other than authorized Agents. This the Staff Side has demanded as a onetime measure. However it is unfortunate that the Department of Personnel & Training has not agreed our demand. Having given one time relaxation in the case of NER States and J&K States and denying the same benefit to the employees who traveled to A&N Islands by availing LTC -80 and purchased Air ticket from other than authorized agents is not justified. Since the one time

relaxation is not given huge amount with penal interest from the employees including from the retiring employees are being effected. This has subjected to the employees to undue hardship. Since the Air fare will be restricted to the actual LTC-80 fare on the day of travelling by the employee, the remaining amount of Ticket fare will be refunded by the employees. Moreover since this is only a one time measure DOPT may kindly consider the request of the Staff Side in its true perspective and arrange to issue orders for one time relaxation of LTC-80 to the employees who have travelled A&N Islands at per with the employees who travelled to NER states and J&K state.

######

Item No. 10

Empanelment of Private Day Care Therapy Centers for Ayurveda, Yoga & Naturopathy under CGHS in all the CGHS governed cities / towns.

The Ministry of Health and Family Welfare vide OM referred at 1 above have issued instructions for empanelment of Private Day Care Therapy Centers for Ayurveda, Yoga & Naturopathy under CGHS in Delhi / NCR Region. Subsequently, Ministry of Health and Family Welfare vide OM referred at 2 above has extended the empanelment of the Private Day Care Therapy Centers for Ayurveda, Yoga & Naturopathy under CGHS in Delhi for a further period of one year. However, the same benefit has not been extended in the other CGHS governed cities and towns.

This office has been receiving representations from all over the country for extending the CGHS empanelment of Private Day Care Therapy Centers for Ayurveda, Yoga & Naturopathy in all the CGHS governed cities and towns. This demand is justified since the Government policy is to encourage the indigenous medical system of Ayurveda, Yoga, Naturopathy, Unani and Siddha, the Ministry of Health and Family Welfare may kindly arrange to empanel Private Day Care Therapy Centers for Ayurveda, Yoga, Naturopathy, Unani and Siddha and necessary Orders for empanelment of CGHS recognized hospitals / day care Centres for the above indigenous system of medicines may please be issued.

######

Item No. 11

Extension of CGHS facilities to the Civilian Employees of left out Industrial Establishment under Western Command of Navy Mumbai.

The Staff side of the National Council (JCM) have represented to Ministry of Health & F.W. for extending the coverage of CGHS facilities to the Defence Civilian Employees posted in the various Naval Industrial Establishments under the Western Naval Command Mumbai. The Ministry of Health have already extended the benefit to the Industrial Establishment in the Naval Dockyard Mumbai under the control of Western Naval Command. Therefore denying the same benefit for the employees working in other Industrial Establishments in Mumbai under the Western Naval Command is not justified. It is understood that after our representation to Ministry of Health, the matter is under active consideration at Ministry of Health / CGHS. However till date Ministry of Health have not issued any instruction in this regard. Since the Naval Civilian Employees of Mumbai are pressing hard, it is requested that you may kindly appreciate the situation and arrange to issue necessary instructions in this regard to the CGHS Authorities of Mumbai and to Ministry of Defence at the earliest for extending the coverage of CGHS Facility to the Defence Civilian Employees posted in the Industrial Establishments under Western Naval Command Mumbai.

######

Item No. 12

Provision to book two rooms through e-Sampada Portal in CPWD Guest Houses / Holiday Homes

The Central Government Employees are booking rooms in CPWD Gust Houses / Central Government Holiday Homes through e Sampada Portal. As of now the employees are allow to book only one room (most of the rooms in CPWD Guest Houses are Two Bed Rooms only). Employees those who are travelling with their Parents and Children’s are enable to manage in one room. Therefore employees are forced to book the 2 room through their colleagues which is costing three times than the ordinary rent. Therefore the existing system may be review and an employee should be allowed to book two rooms in CPWD Guest Houses / Holiday Homes through e-Sampada which will help in accommodating the family members of the employees.

######

Item No. 13

Item No. 13 : to retain the status of more than 70,000 Defence Civilian Employees who are on deemed deputation with the newly created 7 Ordnance Factory Corporations as Central Government Employees / Defence Civilian Employees till their Superannuation.

The Government of India in violation of all the previous written assurances given to the Recognized Federations of Defence Civilian Employees have unilaterally taken a decision to splinter the more than 222 years old Indian Ordnance Factories in to 7 Corporations. Accordingly the Cabinet have taken decision to convert the Ordnance Factory Board into 7 Corporations / DPSU’s with effect from 01.10.2021. All the then existing more than 78,000 Defence Civilian Employees of Ordnance Factories were forcibly posted on deemed deputation for a period of 2 years i.e. upto 30.09.2023 in the newly formed 7 DPSU’s. The Cabinet while deciding the same have also taken a decision that during the period of deemed deputation all the Defence Civilian Employees of Ordnance Factories will continue to remain as Central Government Employees / Defence Civilian Employees and all their service conditions and benefits would be protected. The All India Defence Employees Federation have challenged the Governments decision in the Madras High Court. The Government of India in its counter affidavit have assured the following before the Hon’ble High Court:

‘Para 55 A and B : It is humbly reiterated that employees will continue to be Central Government employees on deemed deputation to the new corporations unless they themselves opt to get permanently absorbed in these new corporations Hence, there is no violation of any fundamental right or Article of the Constitution including Article 14 and Article 311.

Para 47 : Unless the OFB employees chose to opt for permanent absorption in the new DPSU’s, they would continue as Central Government servants and their pay scales, allowances, leave, medical facilities, Career progression and other service conditions will also continue to be governed the extant rules, regulations and orders, as are applicable to the Central Government servants.

Para 48 : The employees will continue to be Central Government employees while on deemed deputation to the corporations and until they themselves opt to get permanently absorbed in the new corporations. Hence, it is denied that the article 14 of the Constitution is violated.”

The above issue was also discussed in the 48th Meeting of National Council JCM held on 26/06/2021 and after discussion the Chairman desired that the Ministry of Defence will regularly discuss the matter of all Service related matters of the employees with the Staff Side and employees interest would be protected. The Federations have already represented to the Ministry of Defence to issue a notification for retaining the employees of Ordnance Factories who are on deemed deputation in the newly created 7 DPSU’s as Central Government Employees / Defence Civilian Employees till their Superannuation / Retirement from service as assured by the Government in the Hon’ble High Court of Madras.

The deemed deputation period is going to come to an end on 30.09.2023. Till date the Ministry of Defence have not issued any notification in this regard despite repeated representations by the recognized Federations. It is therefore requested that DOP&T may kindly arrange to issue necessary instructions to the MoD for publishing notification for retaining the status of the employees of Ordnance Factories as Central Government Employees / Defence Civilian Employees till their Superannuation / Retirement from service as assured by the Government in the Hon’ble High Court of Madras.

######

View/Download the PDF

COMMENTS

“Absolutely love the insights shared in this article! Building a solid financial foundation is key, and you’ve outlined the essential steps beautifully.

Budgeting is where it all starts – understanding where your money goes is crucial for making informed decisions. And having that emergency fund? It’s like having a safety net that provides peace of mind during uncertain times.