Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) – Salient features of the new tax regime (optional) – Self declaration Form

Principal Controller of Defence Accounts (Central Command)

Cariappa Road, Lucknow Cantt.— 226002

No: AN/IV/Pay/IT/2020-21

Dated:66-12-2020

CIRCULAR

Sub:- Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22)

The Finance Act 2020 had made changes in respect of salaried class as compared to last year with an option for the individual to select tax calculation cither with Savings and standard deduction or to opt for tax calculation without these deductions.

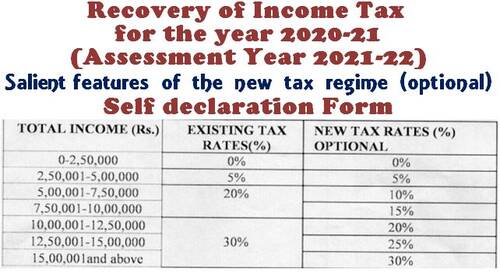

As per Sec.115BAC inserted by Finance Act 2020the tax rates as per new (optional) tax regime Vs old rates is as given in the table below:

| TOTAL INCOME (Rs.) | EXISTING TAX RATES (%) | NEW TAX RATES (%) OPTIONAL |

| 0-2,50,000 | 0% | 0% |

| 2,50,001-5,00,000 | 5% | 5% |

| 5,00,001-7,50,000 | 20% | 10% |

| 7,50,001-10,00,000 | 15% | |

| 10,00,001-12,50,000 | 30% | 20% |

| 12,50,001-15,00,000 | 25% | |

| 15,00,001 and above | 30% |

The few salient features of the new tax regime (optional) are mentioned below:

i. At the start of each financial year, the employee willing to opt new tax regime will have to intimate to employer to make TDS in accordance with the provisions of section 115 BAC.

ii. If such intimation is not made TDS will be deducted at old tax regime.

iii. Intimation once made cannot be modified during the year.

iv. The option at the time of filing of return of income could be different from the intimation made by the employee to the employer for that previous year.

v. Various allowances/investments will not be eligible for claiming deduction/ exemption.

vi. The following deductions will have to be foregone for tax calculation under new tax regime.

View: TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

- All deductions under Chapter VI-A (except the deduction under Section 80 CCD(2))

- Deductions under Section 10 (13A)HRA

- Section 24 (Interest on borrowed capital/income from House property)

- Standard Deduction, Professional Tax (Under section16).

In this connection, officials intending to opt for new tax regime for the FY 2020-21(AY 2021-22) may furnish the details to this section in the enclosed format. If the intention of deducting TDS in the new tax regime 1s not submitted within the due date it will be presumed that the officials are willing to remain in the old tax regime. Such of those officials who intend to remain in the old tax regime may please intimate on or before 20-12-2020 with relevant proof through proper channel. In absence of same Income [Tax will be deducted from the Pay and allowances of 12/2020 as per calculation of TULIP system.

Savings declared without relevant proof will not be considered for tax benefit.

Jt CDA has seen

Encl: as above

Sd/-

(SIDDARTH KUMAR)

Accounts Officer

Circulation to:-

All Officer-in-charge

1. All Sections in Main Office

2. All Sub offices under this organization

3. IFA(CC) Lucknow

4. CDA, RTC, Lucknow

5. AO NCC Directorate

6. OA Cell – for uploading on the website of PCDA(CC) Lucknow

Sd/-

Accounts Officer (AN-IV)

SELF DECLARATION

I, Shri /Smt / Kum ………………. Designation…………. Employee A/c NO. …………….. serving in the office of ………….. opt for the Old Tax Module / New Tax Module (Strike out whichever is not applicable) for the FY 2020-2021 (AY 2021-2022).

I may be allowed the following emptions claimed for Old Tax Module on production of relevant documents within 20/12/2020.

| Sl. No. | Types of Savings | Section | Policy No. Folio No. Bank A/c No. /Reference No. | Amount for the full Year |

| 1 | INTEREST ON HOME LOAN | 24 (b) | ||

| 2 | PRINCIPAL OF HOME LOAN | 80 C | ||

| 3 | PUBLIC PUBLIC PROVIDENT FUND | 80 C | ||

| 4 | NSC | 80 C | ||

| 5 | BOND | 80 C | ||

| 6 | MEDICAL PREMIUM | 80 C | ||

| 7 | LIC/PLI | 80 C | ||

| 8 | LIC/PLI | 80 C | ||

| 9 | LIC/PLI | 80 C | ||

| 10 | LIC/PLI | 80 C | ||

| 11 | ELSS | 80 C | ||

| 12 | BANK DEPOSIT UNDER TAX SAVINGS | 80 C | ||

| 13 | SUKANYA SAMRIDDHI | 80 C | ||

| 14 | DONATION | 80 C | ||

| 15 | RENT PAID | 80 G | ||

| 16 | IT EXEMPTION CERTIFICATE (AS APPLICABLE) | 10 (26) | ||

| 17 | OTHERS | |||

| 18 |

Note- The option once exercised is final and can not be changed during the current Financial Year.

Signature – ……………

Date – …………………..

COMMENTS