Tag: Provident Fund

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

TA-3-07001/7/202 [...]

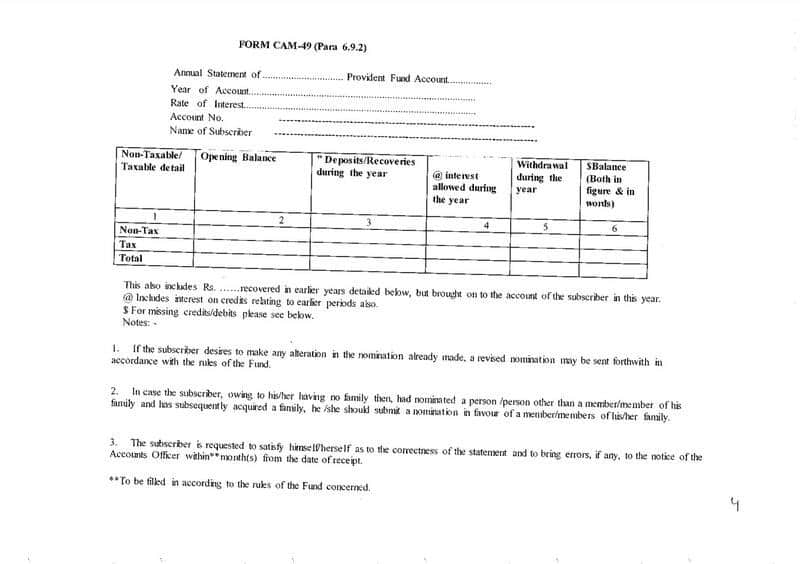

Calculation of taxable interest relating to contribution in a provident fund w.e.f F.Y 2021-22: CGA, FinMin

Calculation of taxable interest relating to contribution in a provident fund w.e.f F.Y 2021-22: CGA, FinMin

No. TA-3-07001/7/2021-TA-III-Part(1)/cs80 [...]

State Railway Provident Fund — Rate of interest during 1st January, 2022 — 31st March, 2022

State Railway Provident Fund — Rate of interest during 1st January, 2022 — 31st March,2022

GOVERNMENT OF INDIA

MINISTRY OF RAILWAYS

(RAILWAY BOARD) [...]

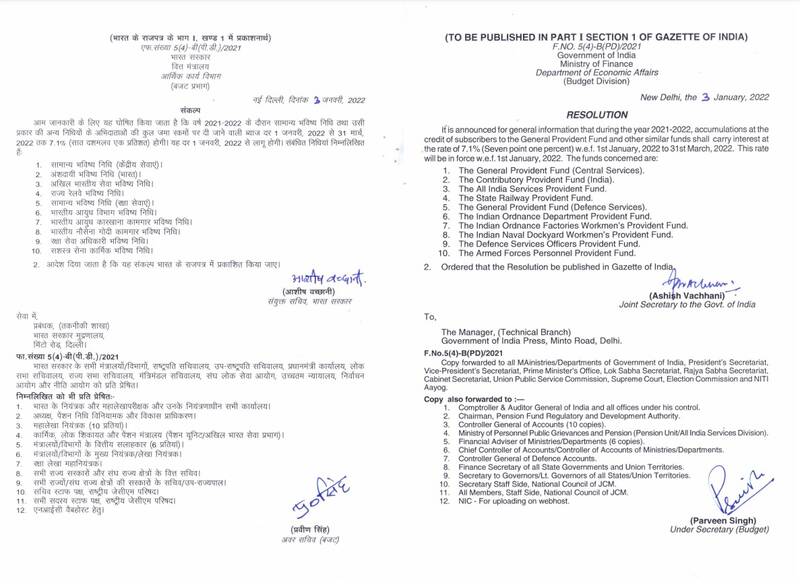

Rate of Interest on GPF and other similar funds for Q4 of FY 2021-22 from 1st January 2022 to March 2022

Rate of Interest on GPF and other similar funds for Q4 of FY 2021-22 from 1st January 2022 to March 2022

GPF Resolution Quarter 4 for FY 2021-22: Rat [...]

Rate of interest on Special Deposit Scheme for Non-Government Provident, Superannuation and Gratuity Funds for Q3 FY 2021-22

Rate of interest on Special Deposit Scheme for Non-Government Provident, Superannuation and Gratuity Funds for Q3 FY 2021-22

MINISTRY OF FINANCE

(De [...]

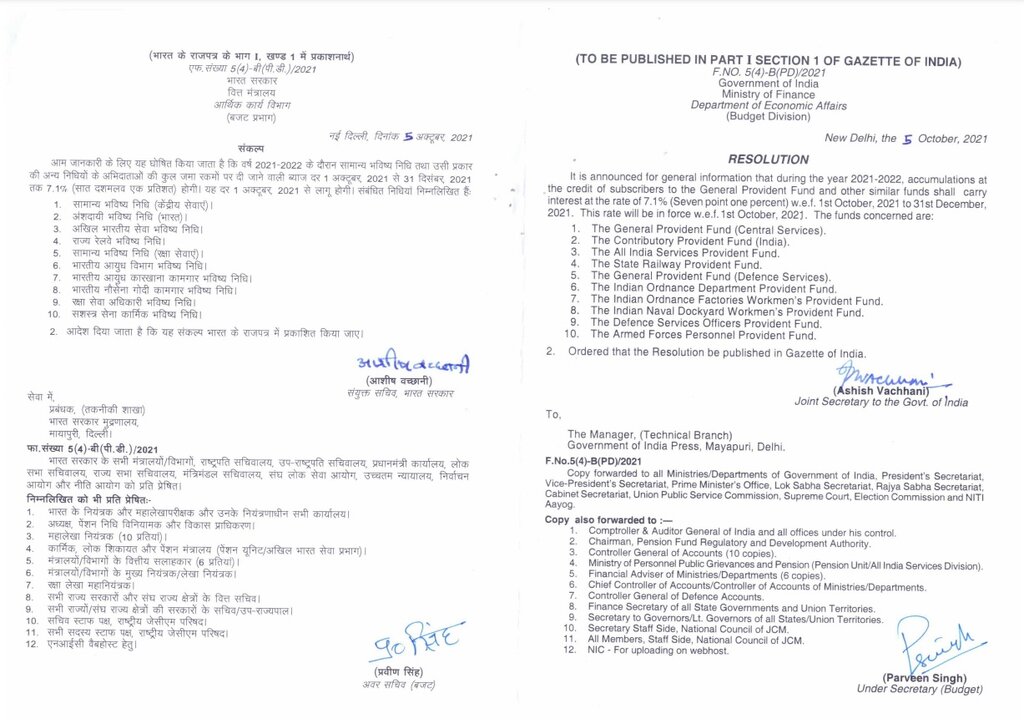

Rate of Interest on GPF and other similar funds for Q3 of FY 2021-22 from 1st Oct 2021 to 31st Dec 2021

Rate of Interest on GPF and other similar funds for Q3 of FY 2021-22 from 1st Oct 2021 to 31st Dec 2021

(TO BE PUBLISHED IN PART I SECTION 1 OF G [...]

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 - IT 25th Amendment Rules 2021

MINIST [...]

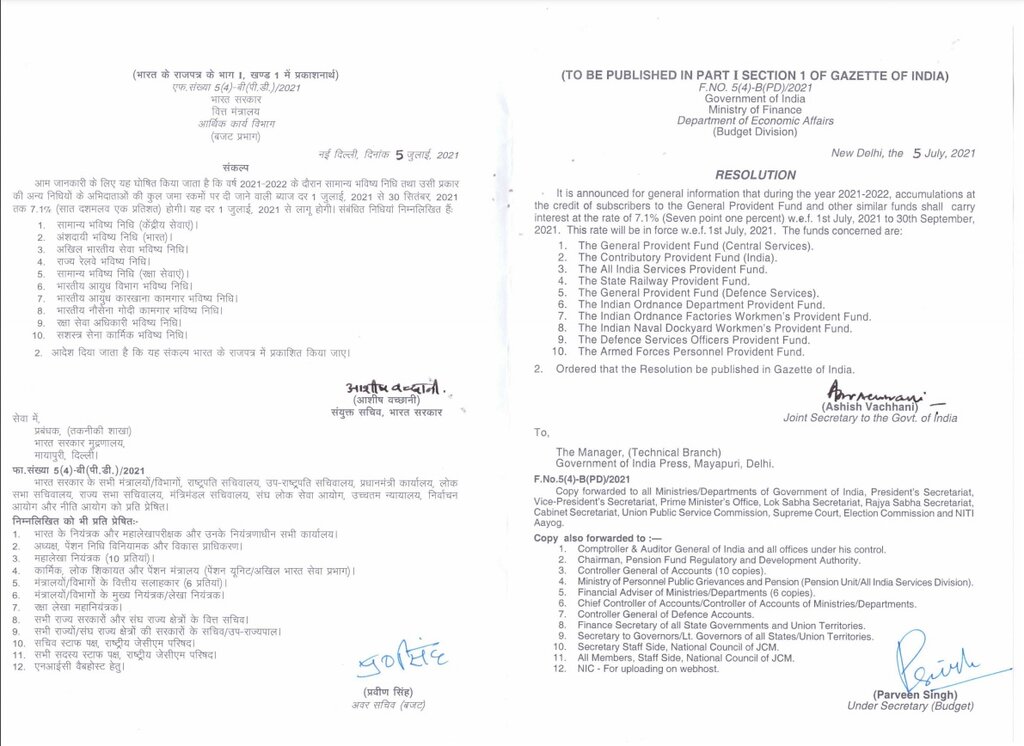

Rate of Interest on GPF and other similar funds w.e.f. 1st July, 2021 for 2nd Quarter of financial year 2021-2022

Rate of Interest on GPF and other similar funds w.e.f. 1st July, 2021 for 2nd Quarter of financial year 2021-2022

(TO BE PUBLISHED IN PART I SECTION [...]

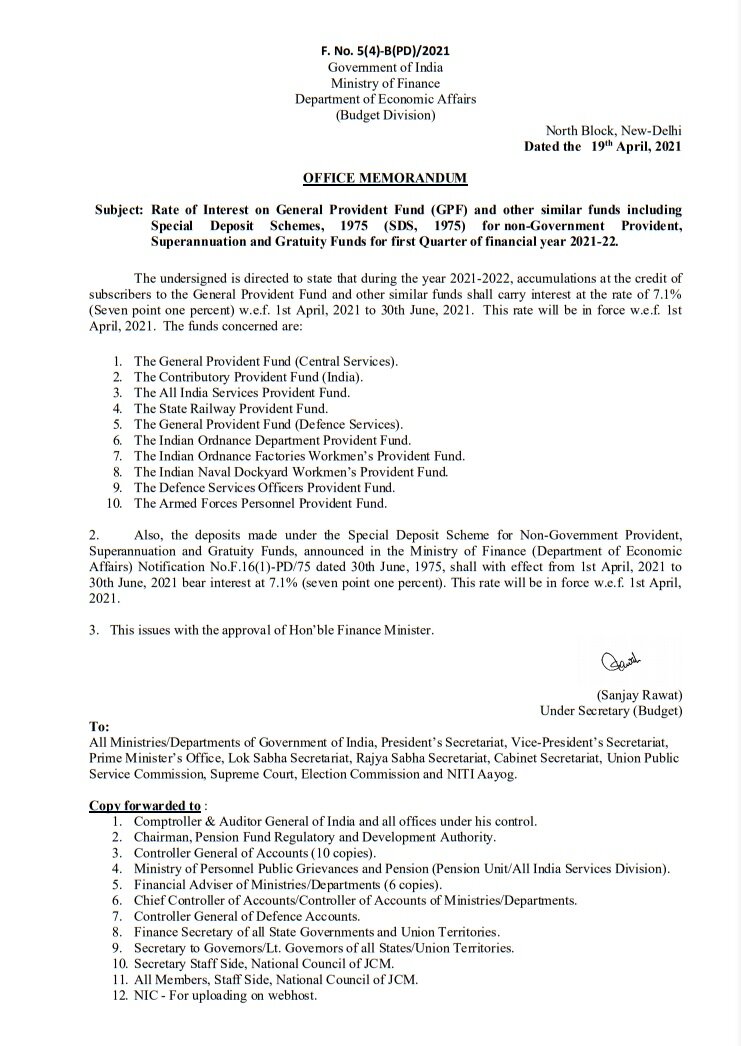

Rate of Interest on GPF and other similar funds including SDS, 1975 w.e.f. 1st April, 2021 for 1st Quarter of financial year 2021-22.

Rate of Interest on GPF and other similar funds including SDS, 1975 w.e.f. 1st April, 2021 for 1st Quarter of financial year 2021-22.

F. No. 5(4)-B(P [...]

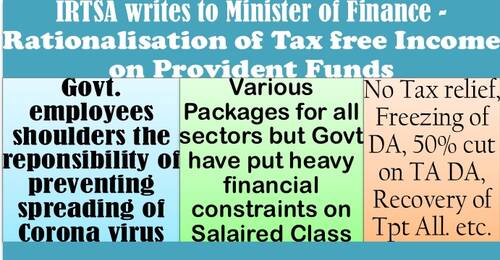

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to FinMin showing displeasure on freezing of DA, recovery of Tpt Allowanace etc.

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to FinMin showing displeasure on freezing of DA, recovery of Tpt Allowanace etc.

[...]