Tag: Provident Fund

Rate of Interest on GPF and other similar funds for Q3 of FY 2023-2024 from 1st Oct, 2023 to 31st Dec, 2023: Resolution by FinMin dated 04.10.2023

Rate of Interest on GPF and other similar funds for Q3 of FY 2023-2024 from 1st Oct, 2023 to 31st Dec, 2023: Resolution by FinMin dated 04.10.2023

(T [...]

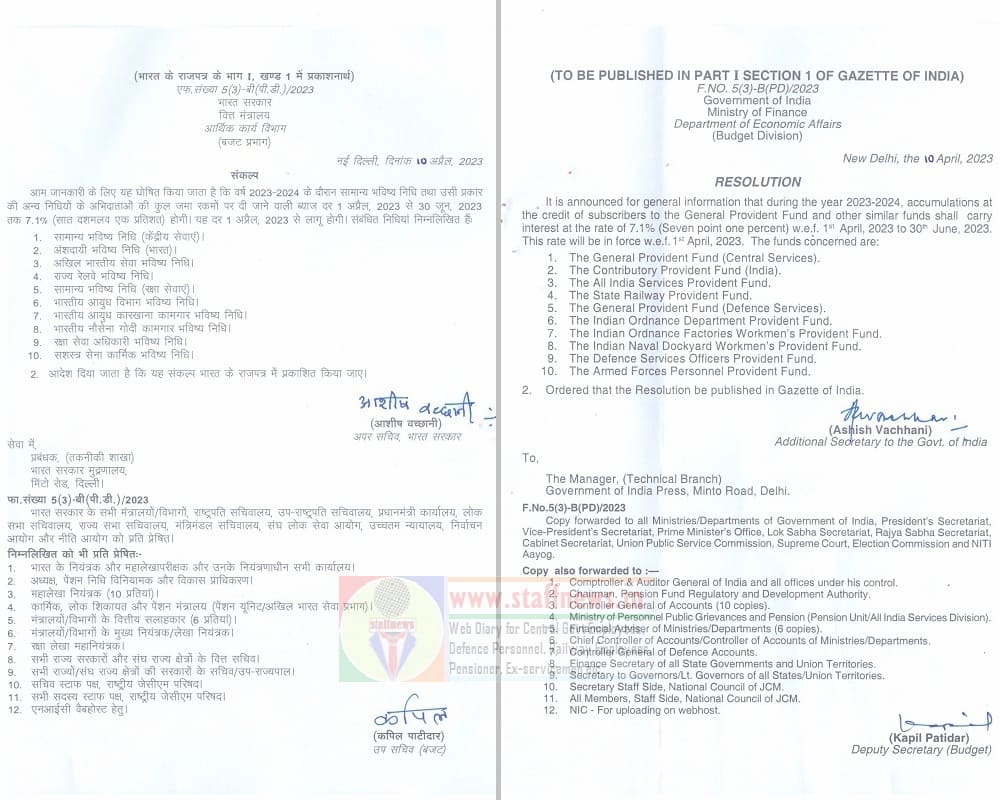

Rate of Interest on GPF and other similar funds for Q1 of FY 2023-2024 from 1st Apr, 2023 to 30th Jun, 2023

Rate of Interest on GPF and other similar funds for Q1 of FY 2023-2024 from 1st Apr, 2023 to 30th Jun, 2023

(TO BE PUBLISHED IN PART I SECTION 1 OF G [...]

महंगाई भत्ते में बढ़ोतरी तथा 2022-23 के लिए पीएफ पर ब्याज घोषणा 22 फरवरी या 1 मार्च की कैबिनेट की बैठक में संभावित

महंगाई भत्ते में बढ़ोतरी तथा 2022-23 के लिए पीएफ पर ब्याज घोषणा 22 फरवरी या 1 मार्च की कैबिनेट की बैठक में संभावित: अमर उजाला

होली से पहले पीएफ पर ब [...]

Provident Fund Rules – Amendment to Chapter 9 of the Indian Railway Establishment Code Vol.I: RBE No. 14/2023

Provident Fund Rules - Amendment to Chapter 9 of the Indian Railway Establishment Code Vol.I - Advance correction slip No. 144: RBE No. 14/2023 dated [...]

Ceiling of Rs. 5 Lakh on subscription to AIS (Provident Fund) Rules: DOP&T O.M.

Ceiling of Rs. 5 Lakh on subscription to AIS (Provident Fund) Rules: DOP&T O.M. 06.01.2023

e.F.No.11026/04/2022-AIS-III

Government of India

Min [...]

Multiple rejections of same PF claims for different reasons of rejections – EPFO guidelines to avoid abnormal delays

Multiple rejections of same PF claims for different reasons of rejections – EPFO guidelines to avoid abnormal delays

EPFO, HEAD OFFICE

MINISTRY OF L [...]

Misappropriation/manipulation of PF Ledgers: Railway Board RBA No. 46/2022

Misappropriation/manipulation of PF Ledgers – Railway Board RBA No.46/2022. Railway Board advised to take extreme precautions while providing access t [...]

Final withdrawal of PF for International Workers (IWs): Clarification by EPFO

Final withdrawal of PF for International Workers (IWs) from Non-SSA countries – Clarification by EPFO on processing of claim.

कर्मचारी भविष्य निधि स [...]

State Railway Provident Fund-Rate of interest during the 1st Quarter of financial year 2022-23

State Railway Provident Fund-Rate of interest during the 1st Quarter of financial year 2022-23 (1st April, 2022 — 30th June, 2022)

GOVERNMENT OF INDI [...]

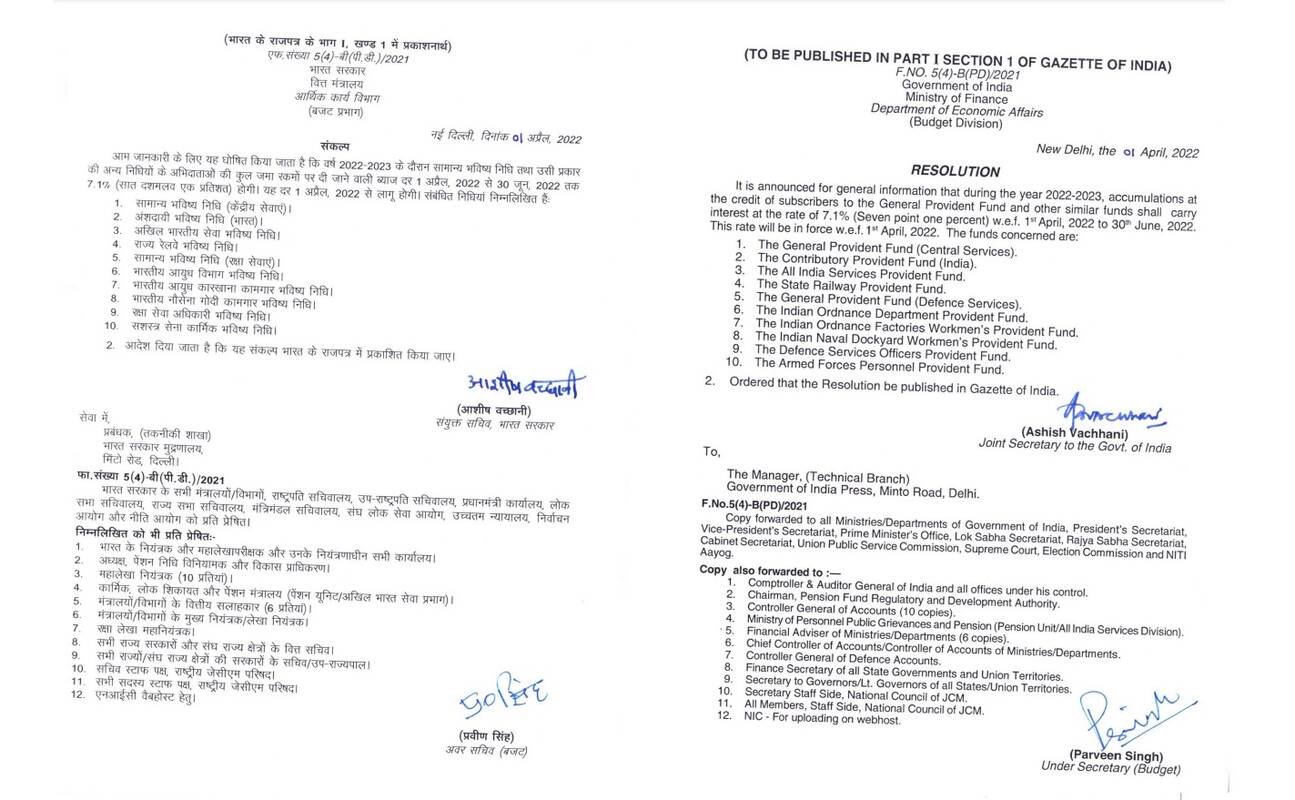

Rate of Interest on GPF and other similar funds for Q1 of FY 2022-2023 from 1st April, 2022 to 30th June, 2022

Rate of Interest on GPF and other similar funds for Q1 of FY 2022-2023 from 1st April, 2022 to 30th June, 2022

(TO BE PUBLISHED IN PART I SECTION 1 [...]