Tag: TDS Rates

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained. The Indian government provides tax exemptions and benefits to b [...]

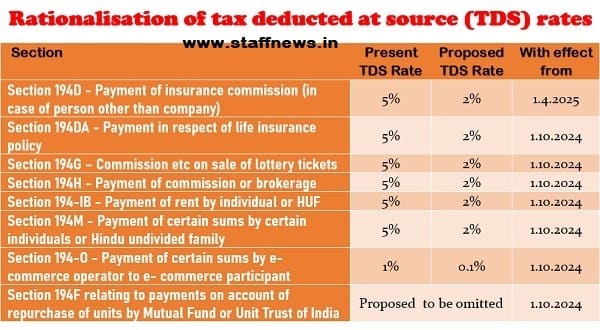

Simplification and Rationalisation of tax deducted at source (TDS) rates: Union Budget 2024-25

Simplification and Rationalisation of tax deducted at source (TDS) rates, Widening and deepening of tax base and anti-avoidance and Tax Administration [...]

THE FINANCE ACT, 2024: Rates of Income Tax & Surcharges, Rates for TDS, Direct Taxes and Central Goods and Services Tax

THE FINANCE ACT, 2024: Rates of Income Tax & Surcharges, Rates for TDS, Direct Taxes and Central Goods and Services Tax

MINISTRY OF LAW AND JUSTI [...]

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

HIGHLIGHTS OF FINANCE BIL [...]

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 – e-Brochure by Income Tax Department

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 - e-Brochure by Income Tax Department

Benefits for Senior Citizens a [...]

Clarification regarding applicability of section 194Q

Clarification regarding applicability of section 194Q - CGDA Order on new section 194Q inserted vide Finance Act, 2021, which took effect from 1st day [...]

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-ta [...]

Deduction of TDS on payment of PLI/RPLI policies, as applicable, under section 194DA of IT Act’ 1961 – Clarification / guidelines regarding

Deduction of TDS on payment of PLI/RPLI policies, as applicable, under section 194DA of IT Act’ 1961 - Clarification / guidelines regarding

F. No. 65 [...]

Income-tax (Seventeenth Amendment) Rules, 2023 – Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

Income-tax (Seventeenth Amendment) Rules, 2023 - Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

[...]

Tax Deduction at Source (TDS) in respect of Mahila Samman Savings Certificate (MSSC) – SB Order No. 13/2023

Tax Deduction at Source (TDS) in respect of Mahila Samman Savings Certificate (MSSC) – SB Order No. 13/2023

SB Order No. 13 / 2023

No. FS-13/1/2023- [...]