Tag: TDS Rates

Deduction of TDS in respect of aggregate Cash Withdrawal above Rs. 20 lakh – section 194N of I.T. Act 1961 – SB Order No. 05/2021

Deduction of TDS in respect of aggregate Cash Withdrawal above Rs. 20 lakh - section 194N of I.T. Act 1961 – SB Order No. 05/2021

SB Order No. 05/202 [...]

TDS Rate Applicable for FY 2021-22 or AY 2022-23: ICAMI

TDS Rate Applicable for FY 2021-22 or AY 2022-23

RATES OF TDS APPLICABLE FOR FINANCIAL YEAR (FY) 2021-22 OR ASSESSMENT YEAR (AY) 2022-23 as compiled [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

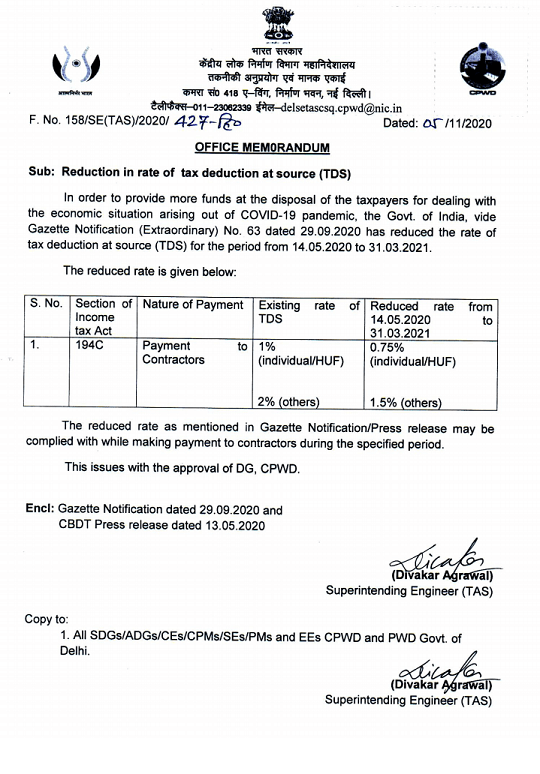

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Government of India

Directorate [...]

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

Press Information Bureau

Government of India

Ministry of Finance

[...]

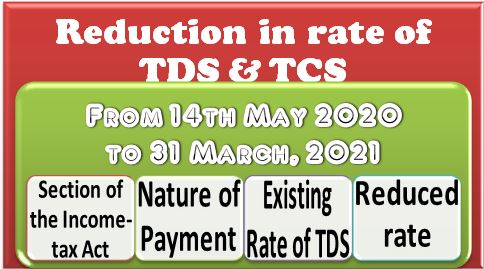

Reduction in rate of TDS & TCS from 14th May, 2020 to 31st March, 2021

Reduction in rate of TDS & TCS from 14th May, 2020 to 31st March, 2021 for non-salaried specified payments made to residents has been reduced by [...]

TDS/TCS Rate Reduction and Due date of all Income Tax Return extension under Self-Reliant India Movement Package

TDS/TCS Rate Reduction and Due date of all Income Tax Return extension under Self-Reliant India Movement Package

आत्मनिर्भर भारत अभियान पैकेज Self-Re [...]

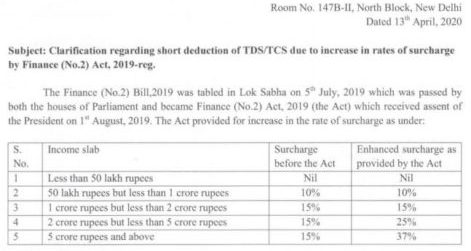

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020 under Section 192 of the Income-Tax Act, [...]

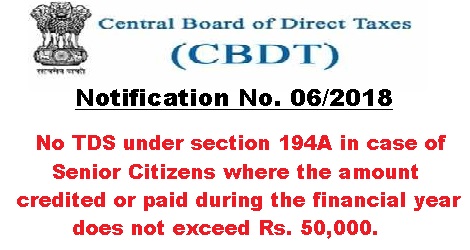

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

F. No. Pr. DGIT(S)/CPC(TDS)/Notification/2018-19 [...]