Tag: TDS Rates

Deduction of TDS under Section 115BAC – Option for intended tax regime be submitted by each employee : IT Circular 04 of 2023

Deduction of TDS under Section 115BAC - Option for intended tax regime be submitted by each employee under section 192 read with sub-section (1A) of s [...]

TDS Rate on EPF Withdrawals and benefits to the pensioners under EPFO ईपीएफ निकासी पर टीडीएस दर एवं ईपीएफओ के तहत पेंशनभोगियों को लाभ

TDS Rate on EPF Withdrawals and benefits to the pensioners under EPFO ईपीएफ निकासी पर टीडीएस दर एवं ईपीएफओ के तहत पेंशनभोगियों को लाभ

GOVERNMENT OF I [...]

Budget 2023-24 – Finance Bill, 2023 – Rates of Income Tax, Rates of TDS on Salaries and Rebate under Section 87A

Budget 2023-24 - Finance Bill, 2023 - Rates of Income Tax, Rates of TDS on Salaries and Rebate under Section 87A

FINANCE BILL, 2023

PROVISIONS R [...]

Income-Tax Deduction from Salaries during the Financial year 2022-23: IT Circular No. 24/2022

Income-Tax Deduction from Salaries during the Financial year 2022-23 under Section 192 of the Income Tax Act, 1961: CBDT IT Circular No. 24/2022

GOVE [...]

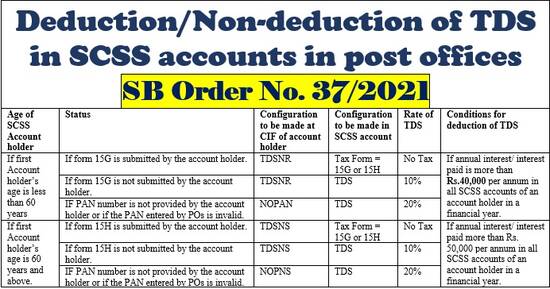

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

SB Order No. 37/2021

F. No. FS-13/7/2020-FS

Government of Ind [...]

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

MINISTRY OF FINANCE

(Depar [...]

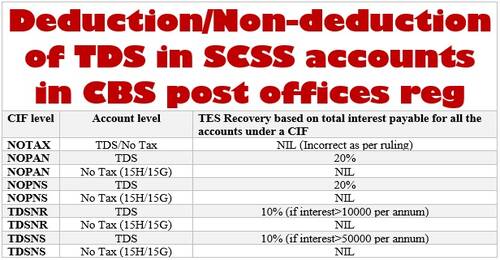

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices – Deptt. of Posts order dated 15.09.2021

No. FS-13/7/2020-FS

Government of India [...]

TDS deduction under section 194Q on purchase of goods w.e.f. 01.07.2021: Railway Board Order

TDS deduction under section 194Q on purchase of goods w.e.f. 01.07.2021: Railway Board Order

GOVERNMENT OF INDIA (भारत सरकार)

MINISTRY OF RAILWAYS ( [...]

Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961: Circular No. 11 of 2021

Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961

Circular No. 11 of 2021

F. No. 370133/7/2021-TPL

[...]

Income tax TDS & TCS rates effective from 01st April 2021: TaxGuru

Income tax TDS & TCS rates effective from 01st April 2021: TaxGuru-TDS Rates effective from 01st April 2021

The concept of TDS was introduced wit [...]