Tag: TDS

Changes in accounting of POSB TDS transactions – SB Order No. 16/2025

Changes in accounting of POSB TDS transactions - SB Order No. 16/2025 dated 02.12.2025

SB Order No. 16/2025

No. FS-16/2/2024-FS-DOP

Government of I [...]

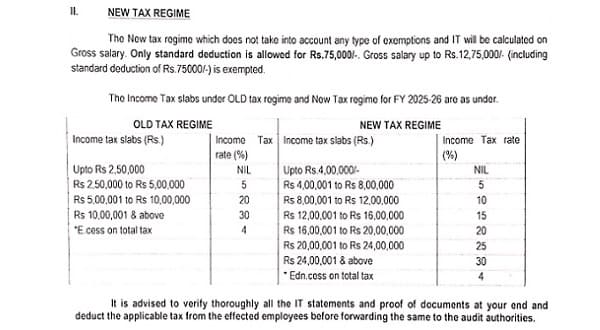

Deduction of Income Tax and Submission of IT Statements for FY 2025-26

Deduction of Income Tax and Submission of IT Statements for FY 2025-26: CDA, Secunderabad Order dated 15.09.2025

OFFICE OF THE CONTROLLER OF DEFENCE [...]

Income-tax (Eleventh Amendment) Rules, 2025: TCS on sale goods of the value exceeding ten lakh rupees: Notification

Income-tax (Eleventh Amendment) Rules, 2025: TCS on sale Wrist Watch, Painting, antiques, sculpture, coin, stamp, yacht, rowing boat, canoe, helicopte [...]

Exemption from Tax Deduction on Withdrawals under Section 80CCA – Income Tax Notification No. 27/2025

Exemption from Tax Deduction on Withdrawals under Section 80CCA - Income Tax Notification No. 27/2025 dated 04.04.2025

The Gazette of India

CG-DL-E- [...]

Amendments related to Tax Deduction at Source (TDS) deductions notified in the Finance Act 2025 w.e.f. 01 April, 2025: SB Order No. 06/2025

Amendments related to Tax Deduction at Source (TDS) deductions under various sections of Income Tax Act 1961 notified in the Finance Act 2025 w.e.f. 0 [...]

Income-Tax deduction from Salaries during the Financial Year 2024-25: IT Circular No. 3/2025

Income-Tax deduction from Salaries during the Financial Year 2024-25 under Section 192 of the Income-Tax Act, 1961: IT Circular No. 3/2025 dated 20.02 [...]

Non-applicability of higher rate of TDS/TCS in the event of death of deductee/collectee before linkage of PAN and Aadhaar: IT Circular No. 08/2024

Non-applicability of higher rate of TDS/TCS as per provisions of section 206AA/206CC of the Income-tax Act, 1961, in the event of death of deductee/co [...]

Sr. Citizen Savings Scheme holders complain about April 2024 TDS deductions and direction by Deptt. of Posts

Sr. Citizen Savings Scheme Account Holders complaints raised regarding deduction of TDS in the month of April 2024 - Direction for refund the same by [...]

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

HIGHLIGHTS OF FINANCE BIL [...]

Deduction of Income Tax on Medical Reimbursement: Clarification

Deduction of Income Tax on Medical Reimbursement: Clarification issued by Principal Chief Commissioner of Income Tax, UP(East) on a RTI requisition [...]