Tag: TDS

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

CBDT provides Utility to ascertain TDS Applicability Rates on Cash Withdrawals

Press Information Bureau

Government of India

Ministry of Finance

[...]

Change in TDS Return Form 26Q & Form 27Q – Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

Change in TDS Return Form 26Q & Form 27Q - Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

THE GAZETTE OF INDIA : EXTRAORDI [...]

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

No. 24/06/2020-Cash (MS) [...]

Filing of Income Tax Returns, TDS/TCS Returns, Investments etc. for AY 2020-21 & 2019-20: Extension of Timelines CBDT Notification No. 35/2020

Filing of Income Tax Returns, TDS/TCS Returns, Investments etc. for AY 2020-21 & 2019-20: Extension of Timelines CBDT Notification No. 35/2020

Go [...]

Extension of Quarterly TDS/TCS statement filing dates: NSDL TIN Operations Circular

Extension of Quarterly TDS/TCS statement filing dates: NSDL TIN Operations Circular

NSDL e-Governance Infrastructure Limited

TIN Operations

Circula [...]

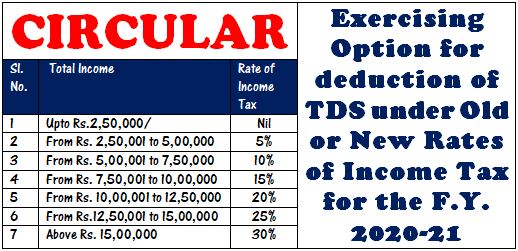

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

No.G-26028/4/2020-Cash

Government of India

Ministr [...]

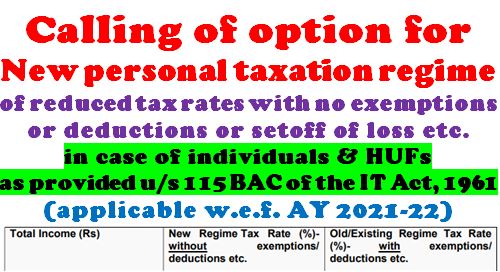

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Taxation Sect [...]

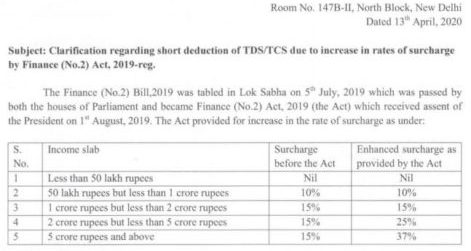

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

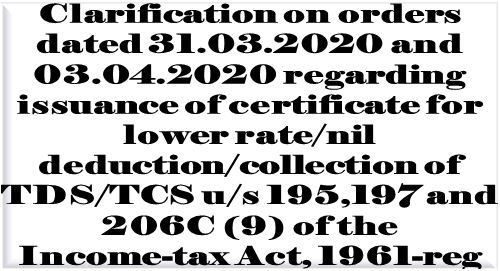

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS o [...]

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया CBDT issues orders u/s 119 of IT Ac [...]