Tag: TDS

Tax Deduction at Source (TDS) guidelines on payments made to VRS 2019 Optees

Tax Deduction at Source (TDS) guidelines on payments made to VRS 2019 Optees

BHARAT SANCHAR NIGAM LIMITEDA

[A Government of India Enterprise]

Corpo [...]

Income tax TDS & TCS rates effective from 01st April 2021: TaxGuru

Income tax TDS & TCS rates effective from 01st April 2021: TaxGuru-TDS Rates effective from 01st April 2021

The concept of TDS was introduced wit [...]

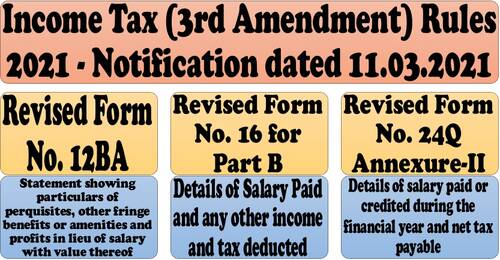

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

MINISTRY OF FINA [...]

TDS Rate Applicable for FY 2021-22 or AY 2022-23: ICAMI

TDS Rate Applicable for FY 2021-22 or AY 2022-23

RATES OF TDS APPLICABLE FOR FINANCIAL YEAR (FY) 2021-22 OR ASSESSMENT YEAR (AY) 2022-23 as compiled [...]

TDS deduction on payment of medical bills of Retired Employees

TDS deduction on payment of medical bills of Retired Employees

BHARAT SANCHAR NIGAM LIMITED

[A Government of India Enterprise]

CORPORATE OFFICE,TAX [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

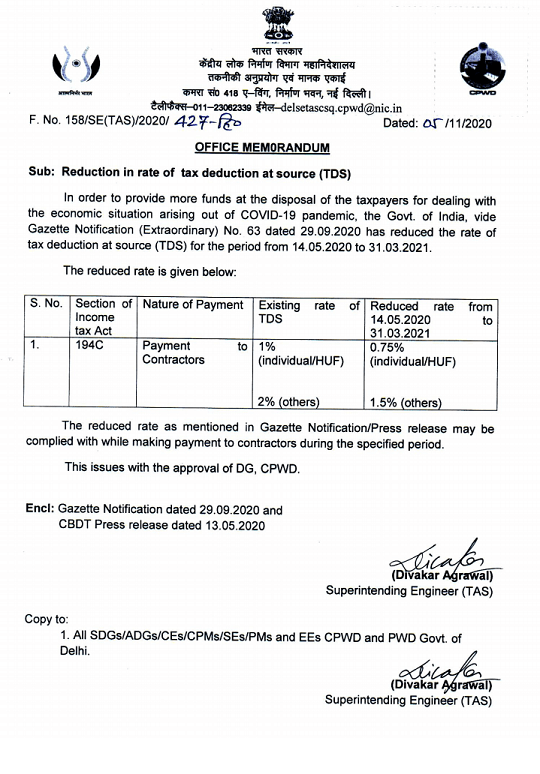

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Reduction in rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021: OM Dtd. 05 Nov 2020

Government of India

Directorate [...]

Income-tax (19th Amendment) Rules 2020 – Rules 114AAB and Form No.49BA

Income-tax (19th Amendment) Rules 2020 - Insertion of New Rules 114AAB and Form No.49BA for any income-tax due on income of non-resident has been dedu [...]

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

CBDT to start e-campaign on Voluntary Compliance of Income Tax for FY 2018-19 from 20th July, 2020: आयकर के स्वैच्छिक अनुपालन के लिए ई-अभियान

Press I [...]

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

New Form 26AS is the Faceless hand-holding of the Taxpayers: करदाताओं का ‘फेसलेस मददगार’ है नया फॉर्म 26एएस

Press Information Bureau

Government of [...]