Tag: TDS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

TDS guidelines on payments to BSNL VRS 2019 Optees – TDS on ex-gratia/Leave Encashment, Form 16, Tax Exemption etc.

Tax Deduction at Source (TDS) guidelines - TDS on ex-gratia, TDS on Leave Encashment, Form 16, Tax Exemption on payments to BSNL VRS 2019 Optees

[...]

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020 under Section 192 of the Income-Tax Act, [...]

National Savings Schemes : Deduction of TDS in respect of Cash Withdrawal above Rs. 1 Crore

National Savings Schemes : Deduction of TDS in respect of Cash Withdrawal above Rs. 1 Crore

SB Order No. 02/2020

F.No 109-27/2019-SB

Govt. of I [...]

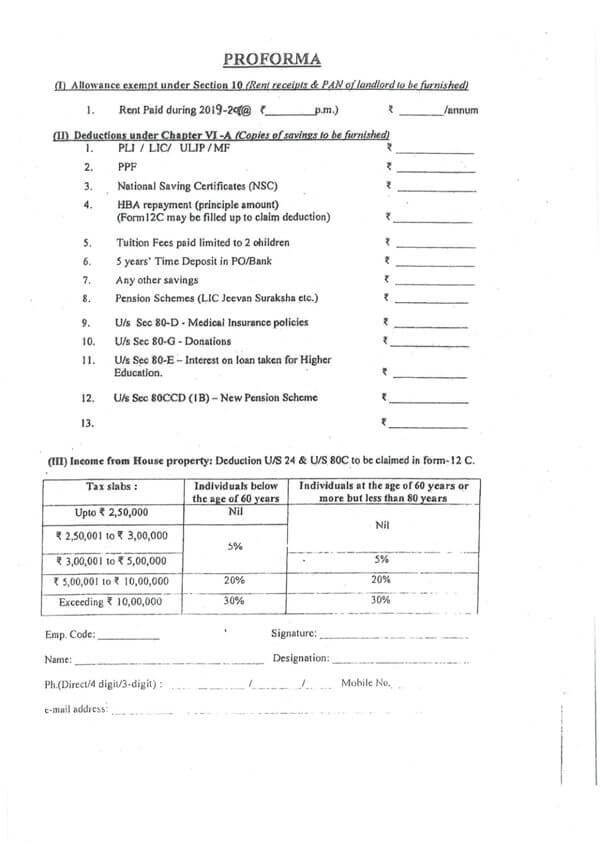

Income-Tax deduction at source from salaries during the financial year 2019 – 20 – Information regarding – Proforma

Income-Tax deduction at source from salaries during the financial year 2019 - 20 (U/S 192 of the Income Tax Act, 1961) -information regarding in profo [...]

Procedure for filing eTDS/TCS statement online through e-filing portal: CBDT Latest Notification No. 10/2019

Procedure for filing eTDS/TCS statement online through e-filing portal: CBDT Latest Notification No. 10/2019F. No. 1/3/7/CIT(OSD)/E-FILING/TDS/TCS FO [...]

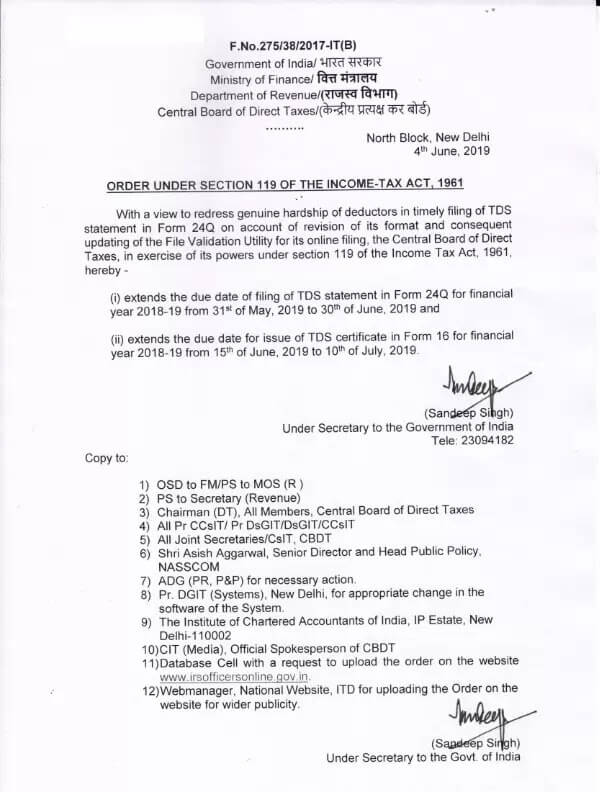

Last date of issue of Form 16 for FY 2018-19 extended upto 10th July, 2019

Last date of issue of Form 16 for FY 2018-19 extended upto 10th July, 2019

Extension of the due date of filing of TDS statement in Form 24Q [...]

Extension of due date of deposit of TDS, submission of quarterly statement of TDS and issue of Form 16 & 16A i.r.o. deductors of Odisha: CBDT Notification

Extension of due date of deposit of TDS, submission of quarterly statement of TDS and issue of Form 16 & 16A i.r.o. deductors of Odisha: CB [...]

Procedure, format and standards for issuance of TDS Certificate Form 16 Part B through TRACES: Income Tax Notification 09/2019

Procedure, format and standards for issuance of TDS Certificate Form 16 Part B through TRACES: Income Tax Notification 09/2019

F. No. Pr. DGIT(S) [...]