Tag: TDS

Income Tax deduction from salaries during the Financial Year-2021-22: Railway Board Order

Income Tax deduction from salaries during the Financial Year-2021-22: Railway Board Order No. No. F(X)I-2020/23/01 dated 05.04.2022

GOVERNMENT OF IN [...]

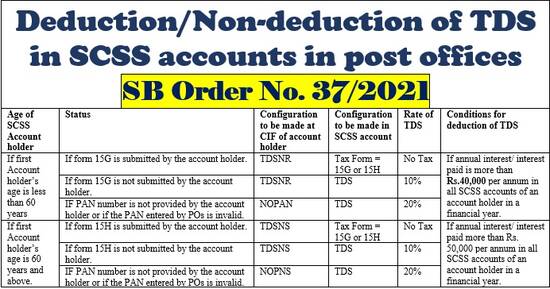

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

SB Order No. 37/2021

F. No. FS-13/7/2020-FS

Government of Ind [...]

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

MINISTRY OF FINANCE

(Depar [...]

Deduction of Income Tax at Source for the AY-2022-23 – Exercise of option reg

Deduction of Income Tax at Source for the AY-2022-23 – Exercise of option reg

Office of the Controller Of Defence Accounts

No.1 Staff Road [...]

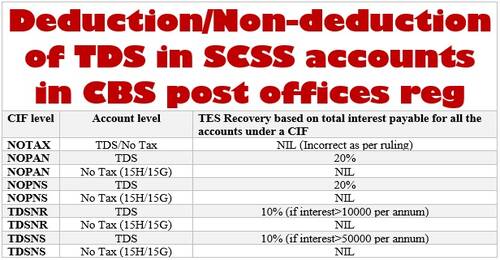

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices – Deptt. of Posts order dated 15.09.2021

No. FS-13/7/2020-FS

Government of India [...]

TDS deduction under section 194Q on purchase of goods w.e.f. 01.07.2021: Railway Board Order

TDS deduction under section 194Q on purchase of goods w.e.f. 01.07.2021: Railway Board Order

GOVERNMENT OF INDIA (भारत सरकार)

MINISTRY OF RAILWAYS ( [...]

Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961: Circular No. 11 of 2021

Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961

Circular No. 11 of 2021

F. No. 370133/7/2021-TPL

[...]

TDS and TCS Rules – Income-tax (17th Amendment) Rules, 2021

TDS and TCS Rules - Income-tax (17th Amendment) Rules, 2021.

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICA [...]

Non-Deduction of Income Tax at source from Pension in respect of Gallantry Awardee: CPAO

Non-Deduction of Income Tax at source from Pension in respect of Gallantry Awardee

GOVERNMENT OF INDIA

DEPARTMENT OF EXPENDITURE

CENTRAL PENSION AC [...]

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

Principal Controller of [...]