LTC Rules – Relaxation to visit NER, J&K and A&N: Clarification on Settlement of LTC claims where non-entitled Govt. servants travel directly by air from his Headquarters

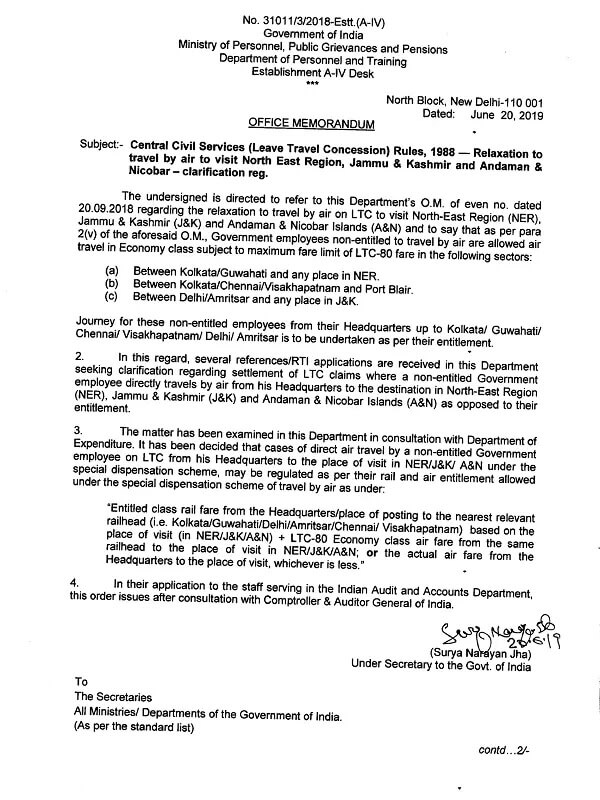

No. 31011/3/2018-Estt.(A-IV)

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel and Training

Establishment A-IV Desk

***

North Block, New Delhi-110 001

Dated: June 20, 2019

OFFICE MEMORANDUM

Subject:- Central Civil Services (Leave Travel Concession) Rules, 1988 – Relaxation to travel by air to visit North East Region, Jammu & Kashmir and Andaman & Nicobar – clarification reg.

The undersigned is directed to refer to this Department’s O.M. of even no. dated 20.09.2018 regarding the relaxation to travel by air on LTC to visit North-East Region (NER), Jammu & Kashmir (J&K) and Andaman & Nicobar Islands (A&N) and to say that as per para 2(v) of the aforesaid O.M., Government employees non-entitled to travel by air are allowed air travel in Economy class subject to maximum fare limit of LTC-80 fare in the following sectors:

(a) Between Kolkata/Guwahati and any place in NER.(b) Between Kolkata/ChennaiNisakhapatnam and Port Blair.(c) Between Delhi/Amritsar and any place in J&K.

Journey for these non-entitled employees from their Headquarters up to Kolkata/ Guwahati/ Chennai/ Visakhapatnam/ Delhi/ Amritsar is to be undertaken as per their entitlement.

2. In this regard, several references/RTI applications are received in this Department seeking clarification regarding settlement of LTC claims where a non-entitled Government employee directly travels by air from his Headquarters to the destination in North-East Region (NER), Jammu & Kashmir (J&K) and Andaman & Nicobar Islands (A&N) as opposed to their entitlement.

3. The matter has been examined in this Department in consultation with Department of Expenditure. It has been decided that cases of direct air travel by a non-entitled Government employee on LTC from his Headquarters to the place of visit in NER/J&K/ A&N under the special dispensation scheme, may be regulated as per their rail and air entitlement allowed under the special dispensation scheme of travel by air as under:

“Entitled class rail fare from the Headquarters/place of posting to the nearest relevant railhead (i.e. Kolkata/Guwahati/Delhi/Amritsar/Chennai/ Visakhapatnam) based on the place of visit (in NER/J&K/A&N) + LTC-80 Economy class air fare from the same railhead to the place of visit in NER/J&K/A&N; or the actual air fare from the Headquarters to the place of visit, whichever is less.”

4. In their application to the staff serving in the Indian Audit and Accounts Department, this order issues after consultation with Comptroller & Auditor General of India.

sd/-

(Surya Narayan Jha)

Under Secretary to the Govt. of India

Source: Click to view/download the PDF

COMMENTS