MTNL Voluntary Retirement Scheme – 2019: Objective, Eligibility, Benefit & Sample Application Form

Mahanagar Telephone Nigam Ltd.

(A Government of India Enterprise)

CIN: L32101DLl 986GOI023501

MTNL/CO/ GM(HR)NRS/NE/2016-17

4th Nov., 2019

OFFICE ORDER

Sub.:MTNL VOLUNTARY RETIREMENT SCHEME-2019

In pursuance of the DoT OM No. 30-04/ 2019- PSU Affairs dtd. 29th October 2019 and the decision of Board of Directors in MTNL through Circular Resolution on-04.11.2019, the MTNL Voluntary Retirement Scheme- 2019 is hereby introduced with effect from 04.11.2019 and it shall remain in force till the 5:30 PM of 03.12.2019.

The details of the Scheme are enclosed for necessary action.

General Manager (HR & Legal)

To,

Executive Director

MTNL, Delhi/ Mumbai

Copy to:-

- Chairman, Telecom Commission, DoT

- Additional Secretary (T) DoT

- CMD, MTNL I CMD, BSNL I CMD, TCIL I CMD, ITI

- All Board of Directors, MTNL

- Secretary (OPE)

- Member (Services) I Member (Finance), DoT

- Sr. DDG(Estd) I Sr. DDG(SU) – DoT

- GM(Finance) CO/ DU/MU.

- GM(Admn.), Delhi/ Mumbai – For wide circulation and n/a

- Company Secretary

- DD(OL) for arranging Hindi Translation of the Scheme

- GS of Majority Union DU/ MU.

- Spare Copy

VOLUNTARY RETIREMENT SCHEME FOR MTNL EMPLOYEES

1. SHORT TITLE

This scheme shall be called the ‘MTNL Voluntary Retirement Scheme -2019’.

2. OBJECTIVE

The scheme aims at optimising and right-sizing of Human Resource of MTNL by providing attractive benefits to the eligible employees opting for voluntarily retiring before the normal date of superannuation.

3. DEFINITIONS

In this scheme, unless the context otherwise requires,

(a) “Absorbed employee” means a Government servant permanently absorbed in MTNL.

(b) “Controlling Officer” means the officer of the rank of SDE/Dy. Manager (or equivalent) or above under whom the employee is posted.

(c) “Competent Authority” means appointing authority for respective category of employee as per rules of MTNL.

(d) “Date of Superannuation” for purpose of this scheme means the date of Superannuation as per existing rules considering 60 years as the age of superannuation.

(e) “Direct Recruitee” means an employee directly recruited by MTNL on or after 01.04.1986.

(f) “Effective date of Voluntary retirement” means the date as stated in Clause 4.

(g) “Eligible Employee” means an employee who is eligible to opt for voluntary retirement as per the eligibility criteria of this Scheme as defined in Clause 5 and shall include all eligible MTNL employees on deputation to other organisation or posted outside MTNL on loan basis on the date of notification of the Scheme.

(h) “Existing Rules” means MTNL Rules in force as on the date of notification of this Scheme or GoI Rules as applicable to MTNL employees.

(i) “Family” means family as defined in the CCS Pension Rules, 1972.

(j) “Salary” means Basic Pay plus Dearness allowance thereon as applicable on the effective date of Voluntary retirement.

(k) “Service” means the length of qualifying service for the purpose of CCS Pension Rules 1972 and further as defined in clause 6 of this scheme for respective category of employee(s).

(l) “Scheme” means ‘MTNL Voluntary Retirement Scheme -2019’.

4. OPERATION OF THE SCHEME:

The effective date of Voluntary Retirement under this scheme shall be 31-01- 2020.The Scheme shall come into force from the date of issue of notification inviting option for voluntary retirement under the scheme and shall remain in operation as per the dates mentioned below:

(a) Date of start of option: 04-11-2019

(b) Date of closing of option: 03-12-2019 up to 05:30PM.

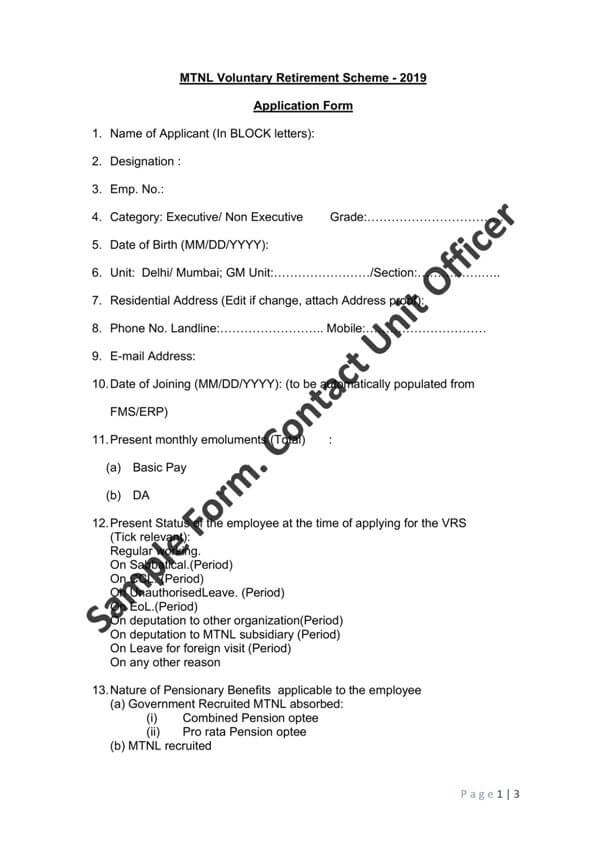

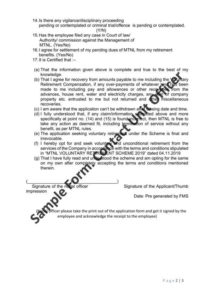

For Filling On line Application Form Please Contact your controlling unit. Sample Form attached.

5. ELIGIBILITY CRITERIA:

All regular and permanent employees (both absorbed employees and direct recruits) of MTNL, including those on deputation to other organisation or posted outside MTNL on loan/informal/deputation basis on the date of notification of the option for voluntary retirement under the Scheme, who has attained the age of 50 years or above as on the notified effective date of voluntary retirement scheme shall be eligible to seek voluntary retirement under this Scheme.

Explanation: Employees belonging to the following categories shall not be eligible to seek voluntary retirement under the Scheme:

(i) Government employees/ employees of other organisations working in MTNL on deputation/ deemed deputation/ loan basis.

(ii) Employees whose services are permanently transferred in public interest to Central/ State Government/ Autonomous Bodies/ Public Sector Undertakings or other entities.

(iii) Employees permanently absorbed in other organisation before the Scheme comes into force.

(iv) Casual Workers and Contractual employees.

(v) Employees retired/ retiring on superannuation/ resigned from service/ voluntarily retired under existing rules on or before effective date of voluntary retirement notified under the Scheme.

6. BENEFITS

An eligible employee(s) voluntarily retiring under the Scheme shall be entitled to the following benefits and no other benefits:

6.1 Lump-sum compensation or Ex-Gratia

(a) The amount of Ex-Gratia for any eligible employee will be equal to 35 days salary of such employee for each completed year of service plus 25 days salary of such employee for every year of service left, until superannuation.

Provided further that this Ex-Gratia compensation shall not exceed the sum of salary that such employee would draw at the existing level (i.e. Basic Pay plus Dearness Allowance on the effective date of Voluntary retirement) during the service period left till superannuation from the effective date of VRS.

Provided further that this Ex-Gratia compensation shall be subject to provisions in clause 6.1(c) & 6.1(d).

(b) For the purpose of calculation, the salary per day shall be equal to monthly salary of such employee divided by 30 days. For fraction of a year of service rendered / left, calculation of Ex-Gratia will be made on pro-rata basis.

(c) Payment of Ex-gratia to combined service pensioners absorbed in MTNL under rule 37A: The amount of Ex-Gratia payable to the eligible employee(s) entitled to pension for combined service rendered in DoT and MTNL under Rule 37-A of CCS Pension Rules, 1972 shall be further restricted to the amount which would be ascertained after taking together with total amount of pension (Basic Pension without commutation plus Dearness Relief as on the date following the effective date of voluntary retirement) that such eligible employee would be drawing for the balance period left till date of superannuation.

In case of employees regularised through Temporary Status Mazdoor (TSM) Scheme, for ex-gratia calculation, 50% of their total length of service as TSM will be counted.

Provided further that amount of Ex-Gratia payable to the eligible employee(s) does not exceed 125% of the sum of salary at prevailing level that the employee would have drawn till superannuation from the effective date of VRS.

(d) Payment of Ex-gratia to Pro-rata service. : In respect of those employees who had opted for Government pension for the period of service rendered in DoT prior to their absorption in MTNL and are already getting pro-rata pension from GOI, the ex-gratia amount to the eligible employee shall be calculated based on combined qualifying service rendered in Central Government and MTNL and shall not exceed the ex- gratia receivable by the similarly placed combined service pensioners (in terms of years of service completed and remaining). The Ex-gratia for eligible absorbed Pro-rata pensioners shall be calculated by taking their pension notionally as applicable for combined service pensioners having same years of service completed and remaining, taking into account entire service in GoI and MTNL.

In case of employees regularised through Temporary Status Mazdoor (TSM) Scheme, for ex-gratia calculation, 50% of their total length of service as TSM will be counted.

(e) Payment of Ex-gratia to Direct Recruit Employees, recruited by MTNL on or after 01.04.1986 including appointed under Rule 37: In respect of the employee(s) directly recruited by MTNL on or after 01.04.1986, the amount of Ex-gratia will be calculated in terms of para 6.1 (a) and (b) for the service rendered after their appointment in MTNL.

Provided further that the provision with respect to further restricting the Ex- Gratia as per clause 6.1 (c) and 6.1 (d) shall not apply in the case(s) of said employee(s).

(f) An employee retiring voluntarily under the scheme shall be paid the amount of Ex-gratia in two equal instalments of 50% each. The first instalment shall be paid in FY 2019-20 and the second instalment in first quarter of FY 2020-21.

(g) Payment of the amount of Ex-Gratia and gratuity shall be subject to recovery of dues outstanding against the employee and deduction of tax at source as per provisions of Income Tax Act, 1961 in force on the date of payment.

6.2 TERMINAL BENEFITS:

In addition to the lump-sum compensation or the amount of Ex-gratia as per Clause 6.1 of the Scheme, the employee(s) voluntarily retiring under the Scheme shall be entitled to terminal and other benefits, as applicable to the said employee(s) under existing rules. The payment of such benefits shall be made in the following manner:

(a) Pension/ Family pension: The employee(s) retiring under the Scheme shall be entitled to Pension/ Family pension, as applicable, with effect from the date following the effective date of voluntary retirement and shall be authorised as per existing procedure.

Provided that the employee(s) governed by the EPF and Miscellaneous Provisions Act 1952 and EPS 1995, the pension shall be administered as per applicable rules.

(b) Retirement Gratuity :

(i) Payment of deferred Gratuity to employee(s) who opted for combined service pension and were absorbed in MTNL under rule 37A: The gratuity payable to the employee(s) who were absorbed from Central Government to MTNL and opted for Combined Service Pension, shall be calculated based on combined qualifying service rendered in Central Government and MTNL, till the effective date of voluntary retirement:

Provided that for the employee(s) who have attained more than 55 years the age on the effective date of Voluntary retirement, the payment of gratuity will be made after such employee attains the age of 60 years (superannuation age on the date of offer of VRS):

Provided that such payment of gratuity shall be made within one month from date of attaining 60 years.

Provided further that for the employees currently aged 55 years or less, on the effective date of Voluntary retirement, the gratuity shall be paid in month of February, 2025.

(ii) Payment of Gratuity to Pro-rata service pensioners. : Gratuity payable to the employees who took absorption from Government to MTNL and opted for pro-rata Service Pension shall be calculated based on qualifying service rendered in the MTNL till the date of voluntary retirement.

The gratuity shall be paid to these employee(s) by MTNL after voluntary retirement under this scheme without any deferment and within the existing prescribed time limit as per existing rules and procedures applicable to them.

(iii) Payment of Gratuity to directly recruited employee and those appointed under Rule 37: The gratuity payable to the employee(s) directly recruited by MTNL, shall be calculated based on qualifying service rendered after their appointment in the MTNL till the date of voluntary retirement:

Provided that the service rendered in previous organisation(s) before joining MTNL by such employee(s) shall not be taken into account for calculation of Gratuity benefit.

Provided that the gratuity shall be paid to such employee(s) by MTNL after voluntary retirement under this scheme without any deferment and within the existing prescribed time limit as per existing rules and procedures applicable to them.

(iv) Simple interest at the prevailing GPF rates (currently 7.9%), from the date of voluntary retirement under this scheme till the gratuity is released, shall be paid on the deferred gratuity amount for employees covered under clause 6.2 (b) (i).

(v) In the event of death of the employee(s) retired under the Scheme before the due date of payment, the deferred gratuity amount will be released immediately to the family of such pensioner or to the nominee/ legal heir (in the absence of family pensioner), as the case may be, along with applicable interest till the date of payment as per Clause 6(b) (iv) of this Scheme.

(vi) The amount of Gratuity payable to the employee on the effective date of voluntary retirement under the scheme shall be communicated to the employee by the concerned pension sanctioning authority.

(c) Commutation of Pension:

The absorbed employees who have attained more than 55 years of age on the effective date of voluntary retirement and had opted for pension on the basis of combined service in DOT and MTNL, on opting for voluntary retirement, will be eligible for commutation of pension only when such employee(s) attains the age of 60 years (superannuation age on the date of offer of VRS).

Provided that other employees currently aged 55 years or less, on the effective date of voluntary retirement, the commutation of pension shall be permitted with effect from 01-02-2025, in partial relaxation to extant rules of CCS (Commutation of pension) Rules, 1981. For commutation of pension, the retired employee will be required to make an application to the pension sanctioning authority as per the rules prevailing at that time.

Provided that till the employee opts for commutation of pension, he/ she shall be paid full pension amount as admissible.

Once employee(s) becomes eligible for pension commutation as per above guidelines, commutation of pension shall be governed by the CCS (Commutation of pension) Rules, 1981 and such employee(s) shall be eligible for commutation of pension without submission of medical fitness certificate up to one year from the date of becoming eligible for commutation.

Provided further that on producing medical fitness certificate beyond one year, the commutation factor shall be applicable as per age of such employee(s) on date of commutation.

(d) Encashment of Earned Leave/ Half Pay Leave: The employee(s) retired under the Scheme shall be entitled to ‘Encashment of Earned Leave/ Half Pay Leave’ as per existing rules of MTNL.

(e) TA/ DA for journey to place of settlement after Voluntary retirement: The employee(s) retired under this Scheme shall be entitled to TA/ DA for journey to the place of settlement as per existing rules.

(f) Retention of staff quarter: The employee(s) retiring under the Scheme shall be entitled to retention of staff quarter as per existing rules, as amended from time to time.

(g) Other Facilities/ entitlements (Residential Telephone Connection, Post- retirement medical facilities etc.) shall be governed by the existing rules and procedures, as amended from time to time.

7. PROCEDURE:

(i) Eligible employee(s) shall be required to submit option to voluntarily retire from service under the Scheme during the prescribed period and as per the procedure prescribed in the scheme.

(ii) The VRS option of employee(s) facing Departmental / Judicial proceedings shall be accepted. Leave encashment, Transfer grant, GPF/ CPF and pension as applicable will be released provisionally as per Rule 69 of CCS Pension Rule 1972.

Provided that the payment of Ex-gratia and Gratuity, shall be released only on the conclusion of and based on, the outcome of Departmental/ Judicial proceedings.

(iii) The option once exercised under this Scheme shall be final and decision of the competent authority shall be binding on the concerned employee(s).

Provided that the employee(s) will be allowed to withdraw the option only once at any time, till the closing time and date of option.

Provided further that the request for withdrawal of option shall be submitted online along with signed copy in writing.

(iv) The authority for acceptance of option under this scheme shall be the competent authority as defined in clause 3(c).

8. GENERAL CONDITIONS:

(i) The Scheme is not negotiable and shall not be a subject matter of any industrial dispute.

(ii) There shall be no recruitment in MTNL against the posts falling vacant on account of voluntary retirement under the Scheme, and these posts will be abolished.

(iii) The employee(s) retired under this Scheme, shall not be eligible for Re- employment in any other CPSE.

Provided that in case any employee desires to take up re-employment in any CPSE, such employee shall have to refund the entire amount of ex- gratia received under the Scheme to MTNL before joining such CPSE. MTNL shall remit the refunded amount to the government.

(iv) All payments under the scheme and any other benefit payable to an employee(s) by MTNL shall be subject to prior settlement/re-payment in full of loans, advances, returning of property and any other dues payable by such employee(s) to MTNL.

Provided that such employee can give an option to settle the pending dues to MTNL from the amount of payment under Ex-gratia, Gratuity or other retirement benefits.

(v) In the event of the death of an employee after submission of option but before the effective date of voluntary retirement under this Scheme, the amount of Ex-gratia payment shall not be released to the family / legal heirs of deceased employee:

Provided that other retirement benefits as applicable according to the existing rules, shall be paid to the family / legal heirs.

(vi) All payments made under the scheme shall be subject to deduction of tax at source as per Income Tax Act 1961 wherever applicable.

(vii) The Competent Authority shall have absolute discretion either to accept or reject the request of an employee seeking Voluntary Retirement under the scheme without assigning any reasons.

(viii) The benefits payable under this scheme shall be in full and final settlement of all claims of whatsoever nature, whether arising under the scheme or otherwise.

(ix) An employee who voluntarily retires under this scheme or his/ her family or legal heirs shall have no claim or compensation except the benefits under the Scheme.

9. In case of any doubt or ambiguity over the meaning / interpretation of any of the terms of this scheme, the decision of CMD MTNL shall be final and binding.

COMMENTS