Standing Committee Report Summary on Pension Grievances: Recommendations on CPENGRAMS, CGEGIS, Additional Pension, Medical Facilities, Provisional Pension & Family Pension

Standing Committee Report Summary on Pension Grievances

The Standing Committee on Personnel, Public Grievances, Law and Justice (Chair: Mr. Sushil Kumar Modi) presented its report on ‘Pensioner’s Grievances -Impact of Pension Adalats and Centralised Pensioners Grievance Redress and Monitoring System (CPENGRAMS)’ on December 10, 2021. As on March 31, 2020, there were around 66.7 lakh central government pensioners (including family pensioners) in India. Key observations and recommendations of the Committee include:

Read also: Pensioner’s Grievances-Impact of Pension Adalats and CPENGRAMS: 110th Report by Department Related Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice

- CPENGRAMS:

CPENGRAMS is a mechanism for speedy redressal and effective monitoring of pension-related grievances of pensioners. Pensioners can submit their grievances online through pensioner associations, or by post. The Committee noted that around 20% of such grievances are not disposed within the stipulated period of 60 days. The core grievance prone areas (which account for majority of grievances lodged on CPENGRAMS) include delay or incorrect sanction of pension, and non-payment of arrears of pension. The Committee recommended constituting social audit panels to streamline the grievance redressal mechanism. It also recommended roping in Quality Council of India and enabling the agencies involved in sanctioning, processing and disbursement of pension to streamline their systems to mitigate the volume of grievances received.

Read also: Introduction – Category of Pensioners : Chapter 1 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

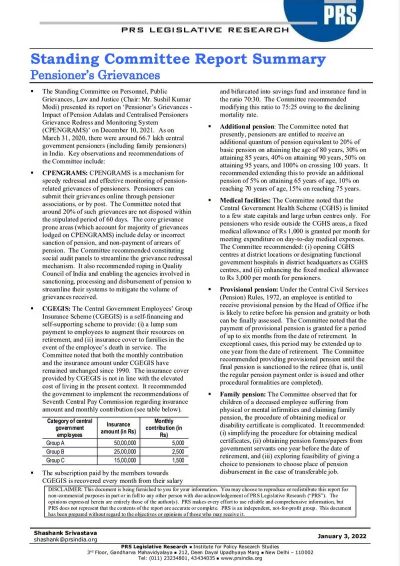

- CGEGIS:

The Central Government Employees’ Group Insurance Scheme (CGEGIS) is a self-financing and self-supporting scheme to provide: (i) a lump sum payment to employees to augment their resources on retirement, and (ii) insurance cover to families in the event of the employee’s death in service. The Committee noted that both the monthly contribution and the insurance amount under CGEGIS have remained unchanged since 1990. The insurance cover provided by CGEGIS is not in line with the elevated cost of living in the present context. It recommended the government to implement the recommendations of Seventh Central Pay Commission regarding insurance amount and monthly contribution (see table below).

Read also: Effectiveness of CPENGRAMS and Pension Adalats – Way Forward: Chapter 2 of of 110th Report of Parliamentary Committee on Pensioner’s Grievances

| Category of central government employees |

Insurance amount (in Rs) |

Monthly contribution (in Rs) |

| Group A |

50,00,000 |

5,000 |

| Group B |

25,00,000 |

2,500 |

| Group C |

15,00,000 |

1,500 |

The subscription paid by the members towards CGEGIS is recovered every month from their salary and bifurcated into savings fund and insurance fund in the ratio 70:30. The Committee recommended modifying this ratio to 75:25 owing to the declining mortality rate.

Read also: Grievances pertaining to Pension Policy, Pension Structure and other Retirement Benefits: Chapter 3 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

- Additional pension:

The Committee noted that presently, pensioners are entitled to receive an additional quantum of pension equivalent to 20% of basic pension on attaining the age of 80 years, 30% on attaining 85 years, 40% on attaining 90 years, 50% on attaining 95 years, and 100% on crossing 100 years. It recommended extending this to provide an additional pension of 5% on attaining 65 years of age, 10% on reaching 70 years of age, 15% on reaching 75 years.

Read also: Grievances pertaining to Authorization, sanction and processing of pension: Chapter 4 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

- Medical facilities:

The Committee noted that the Central Government Health Scheme (CGHS) is limited to a few state capitals and large urban centres only. For pensioners who reside outside the CGHS areas, a fixed medical allowance of Rs 1,000 is granted per month for meeting expenditure on day-to-day medical expenses. The Committee recommended: (i) opening CGHS centres at district locations or designating functional government hospitals in district headquarters as CGHS centres, and (ii) enhancing the fixed medical allowance to Rs 3,000 per month for pensioners.

-

Provisional pension:

Under the Central Civil Services (Pension) Rules, 1972, an employee is entitled to receive provisional pension by the Head of Office if he is likely to retire before his pension and gratuity or both can be finally assessed. The Committee noted that the payment of provisional pension is granted for a period of up to six months from the date of retirement. In exceptional cases, this period may be extended up to one year from the date of retirement. The Committee recommended providing provisional pension until the final pension is sanctioned to the retiree (that is, until the regular pension payment order is issued and other procedural formalities are completed).

Read also: Grievances pertaining to disbursement of pension: Chapter 5 of 110th Report of Parliamentary Committee on Pensioner’s Grievances

-

Family pension:

The Committee observed that for children of a deceased employee suffering from physical or mental infirmities and claiming family pension, the procedure of obtaining medical or disability certificate is complicated. It recommended: (i) simplifying the procedure for obtaining medical certificates, (ii) obtaining pension forms/papers from government servants one year before the date of retirement, and (iii) exploring feasibility of giving a choice to pensioners to choose place of pension disbursement in the case of transferable job.

Source: prsindia.org PDF

COMMENTS