Tag: CBDT Order

Income Tax Return Filing Due Date for J&K extended upto 31st August, 2016

Income Tax Return Filing Due Date for J&K extended upto 31st August, 2016: CBDT Order

F.No. 225/195/2016/ITA.II

Government of India

Ministry [...]

Income Tax Return Filing – the Due date extended upto 5th August, 2016 – CBDT Order

Income Tax Return Filing - the Due date extended upto 5th August, 2016 - CBDT Order

F.No. 225/195/2016/ITAJI

Government of India

Ministry of Fi [...]

Income Tax Offices will remain open on 30th & 31st July with additional receipt counters: CBDT Order

Income Tax Offices will remain open on 30th & 31st July with additional receipt counters: CBDT Order

F.No.225/195/2016/ITA.II

Government of I [...]

Clarification regarding attaining prescribed Age of 60 years/ 80 years on 31st March itself, in case of Senior/Very Senior Citizens

Clarification regarding attaining prescribed Age of 60 years/ 80 years on 31st March itself, in case of Senior/Very Senior Citizens: CBDT Order

Circ [...]

Regularization of Casual Labourers engaged in the Income-Tax Department

Regularization of Casual Labourers engaged in the Income-Tax Department-reg.

GOVERNMENT OF INDIA

DIRECTORATE OF INCOME TAX

HUMAN RESOURCE DEVEL [...]

Payment of interest on refund under section 244A of excess TDS deposited: CBDT Circular No. 11

Payment of interest on refund under section 244A of excess TDS deposited under section 195 of the Income tax Act, 1961- reg: CBDT Circualr

Circular [...]

Inter-Charge Transfers of non-gazetted staff of Income Tax Department: Latest CBDT Order

Inter-Charge Transfers of non-gazetted staff of Income Tax Department: Latest CBDT Order

GOVERNMENT OF INDIA, MINISTRY OF FINANCE

DEPA [...]

Notice for strike on 8th October, 2015 given by Joint Council of Action, Income Tax: Instructions by CBDT

Notice for strike on 8th October, 2015 given by Joint Council of Action, Income Tax: Instructions by CBDT

F.No. B.12020/01I2013-Ad.lX

Government o [...]

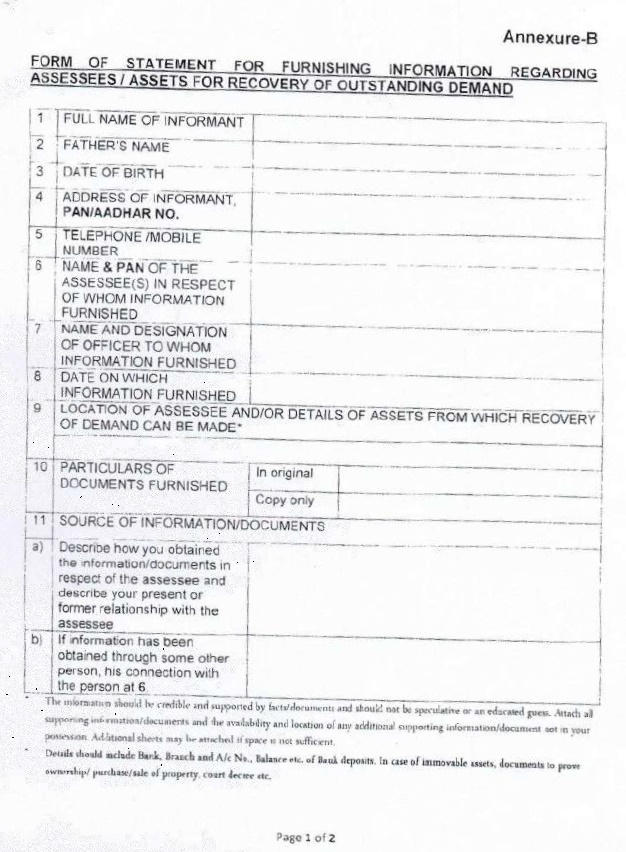

Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015: CBDT Instruction No.07

Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015

Instruction No.07/2015

F .No.385/21/2015-IT(B)

Govern [...]

Migration of PAN lying in Old/Orphan/Defunct Jurisdiction

Presence of PAN in old/orphan/defunct jurisdiction leads to problem in timely processing of returns. The Directorate of Income Tax (Systems) has issu [...]