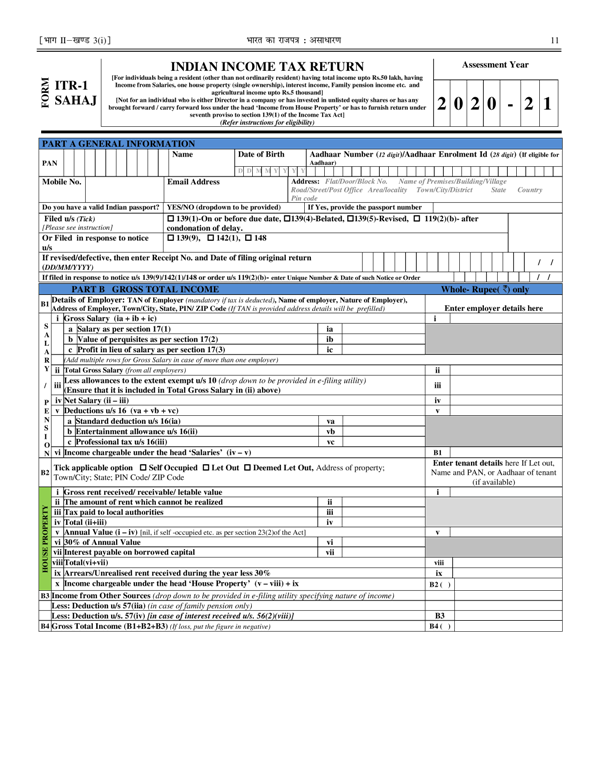

Income Tax: Notification 01/2020 CBDT notifies ITR-1 and ITR-4 for Assessment year 2020-21

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 3rd January, 2020

INCOME-TAX

G.S.R. 9(E).—In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. Short title and commencement.—(1) These rules may be called the Income-tax (1st Amendment) Rules, 2020.

(2) They shall come into force with effect from the 1st day of April, 2020.

2. In the Income-tax rules, 1962 (hereinafter referred to as the principal rules), in rule 12,−

(a) in sub-rule (1),-

(I) in the opening portion, for the figures “2019”, the figures “2020” shall be substituted;

(II) in clause (a), in the proviso,-

(i) in item (V), the word “or” occurring at the end shall be omitted;

(ii) after item (VI), the following items shall be inserted, namely:-

“(VII) owns a house property in joint-ownership with two or more persons; or

(VIII) is required to furnish a return of income under seventh proviso to sub-section (1) of section 139.”;

(III) in clause (ca), –

(ii) in the proviso, after item (V), the following item shall be inserted, namely:-

“(VI) owns a house property in joint-ownership with two or more persons.”;

(b) in sub-rule (5), for the figures “2018”, the figures “2019” shall be substituted.

3. In the principal rules, in Appendix II, for Form “Sahaj (ITR-1)” and “Sugam (ITR-4)”, the following Forms shall, respectively, be substituted, namely:-

[Notification No. 01/2020/F. No. 370142/32/2019-TPL]

ANKUR GOYAL, Under Secy.

Note : The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide notification number S.O.969(E), dated the 26th March, 1962 and last amended by the Income-tax (16th Amendment) Rules, 2019, vide notification number GSR. 960(E), dated 30th December, 2019.

Click here to view/download Notification & ITR-4

Source: Inocmetaxindia.gov.in

COMMENTS