Report of Seventh Central Pay Commission

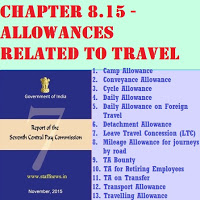

Chapter 8.15 – Allowances related to Travel

8.15.1 Alphabetical list of Allowances covered here is as under:

1. Camp Allowance

2. Conveyance Allowance

3. Cycle Allowance

4. Daily Allowance

5. Daily Allowance on Foreign Travel

6. Detachment Allowance

7. Leave Travel Concession (LTC)

8. Mileage Allowance for journeys by road

9. TA Bounty

10. TA for Retiring Employees

11. TA on Transfer

12. Transport Allowance13. Travelling Allowance

Here we deal with allowances relate to travel requirements of government employees.

Camp Allowance and TA Bounty

8.15.2 Both these allowances are granted to personnel of Territorial Army. Camp Allowance is paid to these personnel when they are called up for training, at a rate of Rs.10 per day. TA Bounty is paid when these personnel are embodied for training at the following rates:

| Officers |

Rs.450 pa |

| JCOs |

Rs.300 pa |

| OR |

Rs.175 pa |

8.15.3 There are demands to increase the rates of these allowances four-fold.

Analysis and Recommendations

8.15.4 The Territorial Army is an organization of nearly 40,000 volunteers whose role is to relieve the regular Army from static duties and assist civil administration in dealing with natural calamities and maintenance of essential services in situations where life of the communities is affected or the security of the country is threatened and to provided units for regular Army as and when required.

8.15.5 Considering its importance and the need to incentivize volunteers to join, it is recommended that the Camp Allowance and the TA Bounty should be merged into a singleallowance to be called Territorial Army Allowance, with the following rates:

| Officers |

Rs.2000 pa |

| JCOs |

Rs.1500 pa |

| OR |

Rs.1000 pa |

8.15.6 The amount of allowance will increase by 25 percent each time DA rises by 50 percent. As is the case with TA Bounty at present, 100 percent of the amount of Territorial Army Allowance shall be granted for completing full training and 75 percent of the amount will be granted for completing more than 80 percent of the training.

8.15.7 It is paid to Doctors for visits to hospitals and dispensaries outside normal duty hours as well as for making domiciliary visits. It is also paid to those employees who maintain their own Motor Car/Scooters/Motor Cycle/Moped and have to undertake frequent journeys on official business in their conveyance. The existing rates are as under:

| Average Monthly Travel on Official Duty |

For Journeys by Own Motor Car |

For Journeys by Other Mode of Conveyance |

| 201-300 km |

1680 |

556 |

| 301-450 km |

2520 |

720 |

| 451-600 km |

2980 |

960 |

| 601-800 km |

3646 |

1126 |

| >800 km |

4500 |

1276 |

8.15.8 There are demands to fully index this allowance with DA, as in the case of Transport Allowance.

Analysis and Recommendations

8.15.9 The demands lack merit. The Commission is of the view that the present rates of the allowance are adequate. Accordingly, status quo may be maintained. However, the allowance will go up by 25 percent each time DA rises by 50 percent.

8.15.10 It is paid where the duties attached to the post require extensive use of bicycle and the official concerned has to use and maintain his own cycle for official journeys. The existing rate is Rs.90 pm. No demands regarding Cycle Allowance have been received.

Analysis and Recommendations

8.15.11 The Commission is of the view that amount of this allowance is meagre and the allowance itself is outdated. Hence, it should be abolished.

8.15.12 Daily allowance is meant to cover living expenses when employees travel out of their headquarters for work. Presently it is in the form of reimbursement of staying accommodation expenses, travelling charges (for travel within the city) and food bills, payable at the following rates:

| GP>=10,000 |

Reimbursement for hotel accommodation/guest

house of up to Rs.7,500 per day, reimbursement of AC taxi charges of up

to 50 km for travel within the city and Reimbursement of food bills not

exceeding Rs.750 per day |

| 7600 <=GP<= 8900 |

Reimbursement for hotel accommodation/guest house of up to Rs.4,500

per day, reimbursement of non-AC taxi charges of up to 50 km per diem

(per day) for travel within the city and Reimbursement of food bills not

exceeding Rs.450 per day |

| 5400 <=GP<= 6600 |

Reimbursement for hotel accommodation/guest house of up to Rs.2,250

per day, reimbursement of non-AC taxi charges of up to Rs.225 per diem

(per day) for travel within the city and Reimbursement of food bills not

exceeding Rs.300 per day |

| 4200 <=GP<= 4800 |

Reimbursement for hotel accommodation/guest house of up to Rs.750

per day, reimbursement of non-AC taxi charges of up to Rs.150 per diem

(per day) for travel within the city and Reimbursement of food bills not

exceeding Rs.225 per day |

| GP < 4200 |

Reimbursement for hotel accommodation/guest

house of up to Rs.450 per day, reimbursement of non-AC taxi charges of

up to Rs.75 per diem (per day) for travel within the city and

Reimbursement of food bills not exceeding Rs.150 per day |

8.15.13 The existing dispensation is different for Railway employees who are paid a flat sum because they are currently not entitled to stay in any accommodation other than Railway rest houses. The lump-sum rates for Railway personnel are as follows:

For journeys on foot, undertaken in organizations like FSI, Survey of India, GSI, etc. for data collection purposes, an additional allowance of Rs.7.5 per km travelled on foot shall be payable.

| Entitlement for DA |

GP>=10,000 |

Rs.780 per day |

| 7600 <=GP<= 8900 |

Rs.690 per day |

| 5400 <=GP<= 6600 |

Rs.600 per day |

| 4200 <=GP<= 4800 |

Rs.510 per day |

| GP < 4200 |

Rs.316 per day |

|

|

If absence from HQ <6 hrs |

30% of DA |

| If absence from HQ is between 6-12 hrs |

70% of DA |

| If absence from HQ >12 hrs |

100% of DA |

8.15.14 Representations received regarding this allowance primarily deal with the reimbursement procedure, as it is claimed that getting hotel bills (in small towns) and food bills is not always practical.

Analysis and Recommendations

8.15.15 The Commission considered the present model of this allowance, followed both in Railways and in other ministries. It is proposed to adopt the best from both of them so that the administration of the allowance can be simplified. Accordingly the following is recommended:

a) Reimbursement of staying accommodation charges

( Rs. per day)

| Level |

Ceiling for Reimbursement |

| 14 and above |

7500 |

| 12 and 13 |

4500 |

| 9 to 11 |

2250 |

| 6 to 8 |

750 |

| 5 and below |

450 |

For levels 8 and below, the amount of claim (up to the ceiling) may be paid without production of vouchers against self-certified claim only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. The ceiling for reimbursement will further rise by 25 percent whenever DA increases by 50 percent. Additionally, it is also provided that for stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be Rs.1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers.

b) R e imbursement of travelling charges

| Level |

Ceiling for Reimbursement |

| 14 and above |

AC Taxi charges up to 50 km |

| 12 and 13 |

Non-AC Taxi charges up to 50 km |

| 9 to 11 |

Rs.338 per day |

| 6 to 8 |

Rs.225 per day |

| 5 and below |

Rs.113 per day |

Similar to Reimbursement of staying accommodation charges, for levels 8 and below, the claim (up to the ceiling) should be paid without production of vouchers against self-certified claim only. The self-certified claim should clearly indicate the period of travel, vehicle number, etc. The ceiling for levels 11 and below will further rise by 25 percent whenever DA increases by 50 percent. The rate of allowance for foot journeys shall be enhanced from the current rate of Rs.7.5 per km to Rs.12 per km travelled on foot. This rate also shall further rise by 25 percent whenever DA increases by 50 percent.

c) There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table 1 below and, depending on the length of absence from headquarters, would be regulated as per Table 2 below. Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates).

i. Lump sum amount payable

Table 1

( Rs. per day)

| Level |

Lump Sum Amount |

| 14 and above |

1200 |

| 12 and 13 |

1000 |

| 9 to 11 |

900 |

| 6 to 8 |

800 |

| 5 and below |

500 |

The Lump sum amount will increase by 25 percent whenever DA increases by 50 percent.

ii. Timing restrictions

| Table 2 |

| Length of absence |

Amount Payable |

| If absence from headquarters is <6 hours |

30% of Lump sum amount |

If absence from headquarters is between 6-12

hours |

70% of Lump sum amount |

| If absence from headquarters is >12 hours |

100% of Lump sum amount |

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per day basis.

8.15.16 All the above provisions will apply to Railway personnel also.

Daily Allowance on Foreign Travel

8.15.17 This allowance is granted to employees when they undertake foreign travel. The rate of the allowance varies from $60 to $100 per day, depending upon the country involved. No demands have been received regarding this allowance.

Analysis and Recommendations

8.15.18 Ministry of External Affairs and Ministry of Finance decide the rate of this allowance from time to time. Hence, the rates may be kept unchanged.

8.15.19 Detachment Allowance is granted to CAPF troops deployed continuously for operational considerations in situations away from permanent HQ. The present rates are as under:

| Pay in the Pay Band |

|

A-class Cities and

Specially Expensive Localities

|

B – class Cities and

Specially Expensive Localities

|

|

| >30500 |

780 |

630 |

510 |

405 |

| 15000<=Pay<30500 |

690 |

555 |

450 |

360 |

| 12500<=Pay<15000 |

600 |

480 |

390 |

315 |

| 8000<=Pay<12500 |

510 |

405 |

330 |

270 |

| <8000 |

315 |

255 |

210 |

165 |

8.15.20 Presently the rates of Detachment Allowance are enhanced by 75 percent in J&K theatre. Similar enhancement has been sought in LWE theatre as well.

8.15.21 Defence forces have demanded that Detachment Allowance should be extended to Defence personnel also.

Analysis and Recommendations

8.15.22 In the present setup, CAPF personnel are entitled to choose either of the following two packages:

a. Detachment Allowance (Full with loss of Ration Money Allowance OR Half of Detachment Allowance with full Ration Money Allowance) + Special Duty Allowance + Special Compensatory (Remote Locality) Allowance

b. Risk/Hardship Allowance + Full Ration Money Allowance

8.15.23 The Commission is of the view that Detachment Allowance already includes provisions for food. Hence, presenting a choice between Detachment Allowance and Ration Money Allowance is not logical. No Ration Money Allowance should be granted with Detachment Allowance. Where free rations are provided, only 50 percent of the Detachment Allowance should be granted. Since the allowance is already partially indexed to DA, the rates should be enhanced by a factor of 1.5 to the following:

( Rs. per day)

| Level |

|

A-class Cities and

Specially Expensive Localities

|

B – class Cities and

Specially Expensive Localities

|

|

|

>12

|

1170

|

945

|

765

|

608

|

|

9 to 12

|

1035

|

833

|

675

|

540

|

|

6 to 8

|

900

|

720

|

585

|

473

|

|

3 to 5

|

765

|

608

|

495

|

405

|

8.15.24 The rate of this allowance will increase by 25 percent each time the DA increases by 50 percent. The CAPF personnel will now have the following options to choose from:

a. Detachment Allowance + [Special Duty Allowance (as and where applicable) OR Tough Location Allowance (as and where applicable)]

OR

b. Risk and Hardship Allowance (as and where applicable) + Ration Money Allowance

8.15.25 The Detachment Allowance should be enhanced by 50 percent in both J&K as well as LWE theatres.

8.15.26 Detachment Allowance will be granted at full rate for first 10 days, at 75 percent of the full rate for next 10 days and at 50 percent of the full rate for the remaining period. The existing conditionality of return to HQ for continuation of the allowance beyond 180 days should be removed in case of CAPF personnel.

8.15.27 Regarding the demand for extension of the allowance to Defence personnel, the Commission is of the view that movements of Defence forces entail shifting of their Headquarters. Hence, grant of Detachment Allowance to Defence personnel cannot be considered.

Leave Travel Concession (LTC)

8.15.28 LTC is granted to Central Government employees to facilitate home travel as well as travel to different parts of the country. Presently two hometown visits are allowed in a block of four years with one hometown visit substitutable with “All India” visit. However, for the first two 4-year blocks, three hometown visits and one “All India” visit are permissible. LTC is not granted to an employee whose spouse is working in Indian Railways.

8.15.29 There are demands to increase the frequency of LTC, especially of the “All India” visit, and extend LTC to foreign countries also. Personnel posted on islands have requested the Commission that splitting of hometown LTC may be permitted so that their families can visit them from the mainland once a year and they (the employees) can also travel to the mainland once a year to visit the family. Personnel of Sashastra Seema Bal (SSB) have sought parity with other CAPFs for facility of Additional LTC. Railway employees have strongly represented that there are many places that are not connected by rail and in absence of LTC, they are not able to visit these places. Hence they should be allowed the facility of LTC in lieu of certain number of their free passes. Similar sentiments have also been expressed by employees whose spouses are Railway employees.

Analysis and Recommendations

8.15.30 Extension of LTC to foreign countries is not in the ambit of this Commission.

8.15.31 The proposal to split hometown LTC has merit and can be considered. Hence, it is recommended that splitting of hometown LTC should be allowed in case of employees posted in North East, Ladakh and Island territories of Andaman, Nicobar and Lakshadweep. This will enable these employee and their families to meet more often.

8.15.32 Presently, personnel of Defence forces serving in field/high altitude/CI Ops areas are granted one additional free railway warrant. This should be extended to all personnel of CAPFs and the Indian Coast Guard mutatis mutandis.

8.15.33 The facility of Additional LTC should be extended to SSB personnel, at par with other CAPFs.

8.15.34 Regarding bringing Railway employees (and employees whose spouses are Railway servants) into the fold of LTC, the following is recommended:

a. No hometown LTC will be admissible to Railway employees, only “All India” LTC will be granted once in four years.

b. For the grant of LTC, all passes for the current year will have to be surrendered.

c. If the employee has already availed of a pass in any year, then LTC will not be allowed in that year.

d. If both spouses are Railway servants, then surrender of passes of any one of them will suffice.

e. For the purposes of this allowance, year means Calendar year.

Mileage Allowance for Journeys by Road

8.15.35 It is more in the nature of entitlement for road journeys performed by different levels of employees. No demands have been received for any change.

Analysis and Recommendations

8.15.36 The Commission is of the view that present provisions are adequate. Hence, status quo may be maintained except at places where no specific rates have been prescribed. There the rates should be enhanced by 50 percent. Accordingly, the following is recommended:

| Kind of Place |

Level |

Mileage Allowance |

At places where specific rates have been

prescribed |

14 or above |

Actual fare by any type of

public bus including AC bus ORAt prescribed rates of AC taxi when

the journey is actually performed by AC taxi ORAt prescribed rates

for auto rickshaw for journeys by auto rickshaw, own scooter, motor

cycle, moped, etc.

|

|

6 to 13

|

Same as above with the

exception that journeys by AC taxi are not permissible

|

|

4 and 5

|

Actual fare by any type of

public bus other than AC bus ORAt prescribed rates for auto rickshaw

for journeys by auto rickshaw, own scooter, motor cycle, moped, etc.

|

|

3 and below

|

Actual fare by ordinary

public bus only ORAt prescribed rates for auto rickshaw for journeys

by auto rickshaw, own scooter, motor cycle, moped, etc.

|

|

At places where no specific rates have been

prescribed either by the Director of Transport of the concerned state or

of the neighbouring states

|

For journeys performed by own car/taxi

|

Rs.24 per km

|

For journeys performed by auto rickshaw, own

scooter, etc.

|

Rs.12 per km |

8.15.37 At places where no specific rates have been prescribed, the rate per km will go up by 25 percent each time DA rises by 50 percent.

8.15.38 Presently it has four components: (a) Travel entitlement similar to Travelling Allowance, (b) Composite Transfer and Packing grant (CTG), (c) Reimbursement of charges on transportation of personal effects, and (d) Reimbursement of charges on transportation of conveyance.

8.15.39 Personnel posted in Island Territories have sought higher CTG on account of greater expenditure involved in transferring their household goods to and from the mainland.

8.15.40 Besides other demands for increase in entitlements, it has been brought to the notice of the Commission that when transfer is from a Class Z city to another Class Z city, the reimbursement for transportation of personal effects is granted at a lower rate compared to when the transfer is to a Class X or Class Y city. Uniformity has been sought in this regard.

Analysis and Recommendations

8.15.41 Each of the four components is discussed separately:

a. Travel entitlement–This is discussed under the topic of “Travelling Allowance.”

b. Composite Transfer and Packing Grant (CTG)–The Commission notes that CTG is payable to both serving as well as retiring employees upon their transfer at a similar rate of one month’s Basic Pay last drawn. In line with our general approach of rationalizing the percentage based allowances by a factor of 0.8, it is recommended that CTG should be paidat the rate of 80 percent of last month’s Basic Pay. However,for transfer to and from the island territories of Andaman, Nicobarand Lakshadweep, CTG may continue to be paid at the rate of 100 percent of last month’s Basic Pay. Presently NPA and MSP are included as a part of Basic Pay while determining entitlement for grant of CTG. The Commission finds no justification for doing so, as the expenditure and inconvenience involved in relocation on transfer/retirement is similar for all employees. Hence, no other add-ons should be allowed in Basic Pay while calculating CTG.

c. Reimbursement of charges on transportation of personal effects–The following provisions are recommended:

| Level |

By Train/Steamer |

Rate for Transportation by

Road

|

| 12 and above |

6000 kg by goods train/4

wheeler wagon/1 double container

|

Rs.50 per km |

| 6 to 11 |

6000 kg by goods train/4

wheeler wagon/1 single container

|

Rs.50 per km |

| 5 |

3000 kg |

Rs.25 per km |

| 4 and below |

1500 kg |

Rs.15 per km |

The rates will further increase by 25 percent each time DA rises by 50 percent.

The Commission notes that rates for transportation by road are already on a per km basis, and finds no merit in differentiating between classes of cities for this purpose. Hence, considerations of class of city have been done away with.

d. Reimbursement of charges on transportation of conveyance–The present provisions to this effect are adequate. Accordingly, the following is recommended:

| Level |

Reimbursement |

| 6 and above |

One motor car etc. or one motorcycle/scooter |

| 5 and below |

One motorcycle/scooter/Moped/bicycle |

TA for Retiring Employees

8.15.42 As the name suggests, this allowance is granted to employees upon retirement. Presently it consists of (a) reimbursement of expenditure involved in transportation of conveyance, and (b)a Composite Transfer Grant (CTG) equal to last month’s Basic Paydrawn.

Analysis and Recommendations

8.15.43 The individual components of TA for retiring employees will be similar to TA on Transfer, as outlined above.

8.15.44 Transport Allowance (TPTA) is granted to cover the expenditure involved in commuting between place of residence and place of duty. The existing rates are as under:

| Employees Drawing |

|

|

| GP 5400 and above |

3200 + DA |

1600 + DA |

GP 4200 to GP 4800 and other employees drawing

GP<4200 but pay in the pay band equivalent to Rs.7440 and above |

1600 + DA |

800 + DA |

| GP<4200 and pay in the pay band below Rs.7440 |

600 + DA |

300 + DA |

8.15.45 Moreover, officers drawing GP 10000 and higher, who are entitled to the use of official car, have the option to avail themselves of the existing facility or to draw the TPTA at the rate of Rs.7,000+DA pm. Differently abled employees are granted this allowance at double the rate, subject to a minimum amount of Rs.1,000 plus DA.

8.15.46 Many representations have been received regarding Transport Allowance. Most of them advocate granting the allowance at the same rate to all employees, irrespective of their place of posting, on the grounds that fuel prices affect everybody equally.

Analysis and Recommendations

8.15.47 The Commission notes that TPTA is fully DA-indexed.

8.15.48 The first issue to be considered is whether the rate of Transport Allowance should be the same for all places. There are arguments both for and against this view.

8.15.49 Proponents of the idea argue that petrol prices are almost same everywhere. Moreover, public transport system is better developed in many of the A1/A Class cities, thereby reducing the cost of commuting significantly. The argument, therefore, is that A1/A category places do not need to have a higher rate.

8.15.50 Opponents point out that the categorization of A1/A has been abolished for other purposes (like HRA, CCA) but retained for Transport Allowance. Incidentally, only 13 cities fall under this categorization: six in A1, viz., Hyderabad, Delhi, Bengaluru, Greater Mumbai, Chennai, Kolkata and seven in A, viz., Ahmedabad, Surat, Nagpur, Pune, Jaipur, Lucknow and Kanpur. Recently, six more cities, viz., Patna, Kochi, Kozhikode, Indore, Coimbatore and Ghaziabad have been added to A1/A categories, making it nineteen in all. (Incidentally, vide a recent notification No. 21(2)/2015-E.II(B) dated 06.08.2015, the use of term “A1/A” has been dropped for these nineteen cities. Hence, the Commission will refer to these nineteen cities as “Higher TPTA cities.”). In all these places the commuting distances are far more than in other cities. Moreover, the public transport system is not as developed as it should be in all these places. Therefore, it is argued, the distinction should remain.

8.15.51 After considering both the viewpoints, the Commission is of the view that by and large the commuting distances and associated difficulties involved in Higher TPTA cities are much more compared to other places. Hence, the argument that the distinction should stay is a valid one.

8.15.52 The second issue is whether Transport Allowance should be the same for all personnel posted at the same place. Here the Commission feels that a question of status of employee is involved and hence, complete parity is not possible.

8.15.53 Regarding the optimal rate of Transport Allowance, the Commission notes that the allowance is already fully DA indexed. Therefore, since DA has already reached 119 percent and is likely to rise further before the implementation of our report, the following rates of Transport Allowance are recommended:

| Pay Level |

Higher TPTA Cities (Rs. pm)

|

Other Places (Rs. pm)

|

| 9 and above |

7200+DA |

3600+DA |

| 3 to 8 |

3600+DA |

1800+DA |

| 1 and 2 |

1350+DA |

900+DA |

8.15.54 Officers in Pay Level 14 and higher, who are entitled to the use of official car, will ave the option to avail themselves of the existing facility or to draw the TPTA at the rate of Rs.15,750+DA pm. Differently abled employees will continue to be paid at double rate, subject to a minimum of Rs.2,250 plus DA.

8.15.55 This allowance is in the nature of travel entitlements for different ranks of government employees. No demands have been received regarding this allowance.

Analysis and Recommendations

8.15.56 The Commission opines that the present provisions are adequate. Hence, status quo is recommended with the present system of differentiation based on Grade Pay duly substituted by the Levels of the Pay Matrix:

| Kind of Travel |

Level |

Travel entitlement |

Travel Entitlement within

the country

|

14 and above |

Business/Club class by air OR AC-I by train |

| 12 and 13 |

Economy class by air OR AC-I by train |

| 9 to 11 |

Economy class by air OR AC-II by train |

| 6 to 8 |

AC-II by train |

| 5 and below |

First Class/AC-III/AC Chair car by train |

| International Travel Entitlement |

17 and above |

First Class |

| 14 to 16 |

Business/Club class |

| 15 and below |

Economy class |

Entitlement for journeys by Sea or by River

Steamer |

9 and above |

Highest Class |

| 6 to 8 |

Lower class if there be two classes only on the

steamer |

| 4 and 5 |

If two classes only, the lower class. If three

classes, the middle or second class. If four classes, the third class |

| 3 and below |

Lowest class |

Entitlement for travel between the mainland and

the A&N and Lakshadweep Groups of Islands by ships operated by the

Shipping Corporation of Indian Limited |

9 and above |

Deluxe class |

| 6 to 8 |

First/’A’ Cabin class |

| 4 and 5 |

Second/’B’ Cabin class |

| 3 and below |

Bunk class |

8.15.57 It is suggested that Indian Railways reconsider its position regarding air travel to its employees, in light of the possible savings in terms of cost and man-hours, particularly after the pay revision as recommended by the Commission. The fact that additional seats will be released in trains for the public will be an added advantage.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Kindly let me know the ceiling limit for a month, how much auto fare/conveyance charges can be claimed by employee who is being sent for official duty to bank or other purpose from office or attending office on Saturday/Holidays in a month. At present we are paying Rs 300/- per month