to the

Seventh Pay Commission

Comptroller & Auditor General of India

Group ‘B’ and ‘C’ cadres

October, 2014

New Delhi

CONTENTS

| Page No. | ||

| Section – I | ||

| 1. | Overview of Indian Audit & Accounts Department | 2 |

| 2. | Organizational Set up | 3 |

| 3. | Status and Importance of IA &AD | 6 |

| Section – II | ||

| 4. | Human resources in IA &AD to carry out constitutional obligation entrusted to the Department. | 10 |

| Section – III : Submissions before the Pay Commission for Group B & C cadres | ||

| 5. | Mainstream cadres | 16 |

| 6. | Common cadres | 20 |

| 7. | Divisional Accountant cadre | 25 |

| Section – IV | ||

| 8. | Allowance and other benefits | 27 |

| Section – V | ||

| 9. | Miscellaneous Issues | 32 |

| Appendix – I : Organizational chart | 38 | |

1. Overview of Indian Audit & Accounts Department

Ø Audits the accounts of certain statutory corporations and bodies

2. Organizational Setup

2.2. The functions discharged by different wings of IA&AD vary in nature unlike the Secretariats of the different Ministries which are only concerned with the activities and functions of those Ministries. Further, IA&AD under the CAG is an independent department in our system of Parliamentary financial control and should be treated on the same footing as any other organization related to a Constitutional authority like the Supreme Court of India. This is logical as the CAG has been given the status of a Judge of the Supreme Court by an Act of Parliament. Also, a strong and committed audit department ensures better working and performance of the entire government. There is thus a very strong case to consider a special status for the organization, having regard to its position in the polity, the arduous judgmental role it performs, the breadth of its activity and the skills as well as the knowledge it must acquire and continuously upgrade.

2.3. The CAG is the auditor mandated by the Constitution of India and he discharges his duties through IA&AD. The office of the CAG is responsible for development of organisational objectives and policies, audit standards and systems, laying down policies for management of the manpower and material resources of the Department and final processing and approval of the Audit Reports. India has one of the largest public sectors in the world, within which there is a recognised need to strengthen performance, accountability for results and financial management systems. In this environment, the scale and complexity of the IA&AD’s work are formidable. IA&AD has around 49,000 staff and its auditing covers multiple levels in government and includes all government sectors and varied types of organisations. For carrying out these diverse responsibilities it is supported by 123 field offices spread across India and 04 overseas offices.

2.4. Several other features distinguish IA&AD’s working environment from that of many of its international peers as well as other Central Government departments.

Ø The extent and span of its audit work, which covers multiple levels of government and different types of organisations across India.

Ø Significant diversity in language, governance and development in the different states in which it works.

Ø IA&AD also prescribes the Accounting Standards for the Government of India. Three (03) Indian Government Accounting Standards (IGAS) had been notified by Government of India till March 2014. Two (02) IGAS and four (04) Indian Government Financial Reporting Standards (IGFRS) are under consideration of the Government of India.

2.5. An appreciation of the volume of work involved in the audit of the expenditure and receipts of the Union and States and Administration of the Union Territories is provided by the following facts relating to 2012-13.

Ø The IA&AD audited 50,738 units covering 98.28 percent and 91.11 per cent of planned audits at Union and State Level, respectively. IA&AD issued 47,595 inspection reports during 2012-13. 138 audit reports (including standalone performance audit reports) were prepared during 2012-13, out of which 132 were submitted to the Parliament and the State Legislature. Also 198 performance audit products were approved during 2012-13. Out of 1516 recommendations to the audited entities at Union and State level, 454 recommendations were accepted.

Ø Further, IA&AD certified 5,551 accounts of Union and State Governments, Public Sector Undertakings, Autonomous Bodies, externally aided projects and others.

Ø The Government accepted 14.42 percent of recoveries pointed out by audit.Of these,Rs.5,537 crores was actually recovered, which is more than double the total budget of IA&AD of Rs.2649.07 crores.

2.6. The accounts of the State Governments and certain Union Territories are compiled monthly in the Accounts and Entitlement (A&E) offices of IA&AD. Besides compiling accounts, the IA&AD is responsible for preparing and submitting the accounts to the President, Governors of State and Administrators of Union Territories having Legislative Assemblies. This does not involve only mechanically totaling up incomes and expenditures but also includes acting as financial advisers. IA&AD raises red flags if monies are being drawn in excess of authorization. It actively monitors expenditure patterns and issues advice on excess, surrender and lapse of funds.

2.7. The annual accounts of the State Governments in the form of Finance Accounts & Appropriation Accounts are prepared in the A&E offices. The A&E offices also maintain the provident fund accounts of most of State Governments Employees and authorize pensions and other retirement benefits.

3. Status and Importance of IA&AD

3.2. The CAG is appointed by the President by warrant under his hand and seal for a fixed tenure of six years. The Constitution safeguards his freedom and independence. The duties and powers of the CAG are laid down in the Comptroller and Auditor General (Duties, Powers and Conditions of Service) Act, 1971 enacted under Article 149 of the Constitution read with CAG’s Regulations on Audit and Accounts (2007). Keeping in view the fact that the CAG performs duties and exercises powers which are crucial to the accountability of the executive to Parliament and the control of Parliament over the accounts and finances of the Union and the States, the Constitution, through Articles 148, 149 and 151, has given a special status and protection to the CAG. In order to ensure his independent status, the CAG has been given by Article 148(5) of the Constitution, a special position in regard to the conditions of service of the persons serving in the Indian Audit and Accounts Department. Though these special powers given to the CAG in regard to persons serving in Indian Audit and Accounts Department are not as extensive as those given by Article 98 of the Constitution to the Speaker of the Lok Sabha and the Chairman of the Rajya Sabha and by Article 146 of the Constitution to the Chief Justice of India, the special powers given under Article 148(5) to the Comptroller and Auditor General have to be real and substantive. Commenting upon the appointment of and control over staff given to the Auditor General, Dr. B. R. Ambedkar in the Constituent Assembly Debated:

3.3. Comprehensive auditing requires higher auditorial skills-skills of understanding the complex programmes and activities, analysis and interpretation of data and objective assessment. They require a different approach in that it has to go into all aspects of a programme, project or activity of Government including their objectives and goals, feasibility or similar studies and project reports, planning, implementation through various stages, operation in all its aspects, performance, monitoring and evaluation. In turn, this calls for an examination of the procedures adopted at various stages like planning, sequence of operations, co-ordination of various elements involved in the programme, project or activity, laying down standards in respect of inputs and outputs, organizational aspects, and so on. Quite clearly, there has to be a systems approach as distinguished from the traditional transaction approach to enable an integrated review of the implementation of the programme or project or even performance of the activities of an organisation. The position obtaining in regard to the programmes, projects or activities will not also be uniform in the entire department or organisation. Naturally, the systems in vogue in each department or organisation will require in depth study and proper interpretation before making an objective assessment of their working. An audit of this type requires not merely a thorough knowledge of the essential elements of the programme, project or activity, but at the same time an appreciation of the practical aspects of implementation by the executive in order to make a worthwhile contribution to the understanding of the legislature and the public about the performance of the executive.

3.4. Comprehensive auditing as explained above would require not only proper organizational arrangements but also careful planning. What is required on the part of directing officials and other staff is not merely a sound accounting knowledge, but also a wide ranging financial and administrative background with an ability to understand and analyse various aspects of the programmes, projects and activity being executed and to appraise them with reference to well-understood managerial and financial principles, performance indicators and other data available within the audited organisation. Discussions with the executive at various stages also help in getting a better appreciation of the problems in implementing the programmes and projects. In the ultimate analysis, it is the ability and originality on the part of the directing officials and other staff, rather than elaborate text book guidelines that would determine the quality of audit and its findings.

3.5. The need, therefore, is to attract officers of very high calibre for induction into the IA&AD from the basic level. The officers in IA&AD have to continuously enrich their skills and keep themselves abreast of the latest developments. The ever expanding role of audit has placed increasingly exacting demands on the professional skills of the government auditors. Performance audit requires deep study and thorough knowledge of the organisation as well as the functional area taken up for examination. The work involved in such audit goes beyond examining the regularity and propriety of transactions of the audited organisations to expressing an opinion on the quality of performance thus entailing a much wider knowledge of the subject and related areas and complex evaluative skills. A professional auditor is expected to be equal to or even better than the management whose performance he/she is called upon to assess, appraise and express an opinion on. He must possess the power of quick assimilation and comprehension, critical and mature judgment, and evaluative skills of a very high order which alone can enable him to successfully handle any audit situation in a fast changing scenario. He has to arrive at correct, quick and balanced decisions, requiring a combination of knowledge, skills, mature judgment and ethics. These can be developed only as a result of professional knowledge, in-depth study, long experience and intensive training inputs. The requirement of continuous professional development is of paramount importance and the officials of the Indian Audit and Accounts Department ensure that they keep abreast of the evolving environment around them to enable them to meaningfully comment in their reports. It is therefore, clear that in order to be effective, an auditor has not only to be a trained professional, but a versatile, independent and balanced evaluator who brings to his work complete impartiality and a sense of balance. An audit report of a few pages hides behind it a wealth of information skillfully collected, collated, analyzed and reported upon. It is only then that it is possible to fulfil the audit mandate.

3.6. For this purpose, they have to be motivated by providing incentives in the form of better pay scales and promotional avenues. As discussed above, officials of the IA&AD should have knowledge and up-to-date information about not only the different departments of the Central Government but also of the State Governments. Performance of various complex tasks involved in comprehensive auditing requires competent and skilled personnel at lower formations with specialized knowledge in the different branches of audit, like Civil, Defence, Posts and Telecommunications, Railways, Scientific and Commercial etc. These tasks devolve on Sr. Accounts / Sr. Audit Officers, Accounts Officers / Audit Officers, Assistant Accounts Officers/Assistant Audit Officers and Auditors. The basic qualification for recruitment to the post of Auditor is a University degree. Thereafter, they have to pass several departmental examinations, the most important being the Subordinate Accounts / Audit Service Examination, which is widely recognized as one of the toughest departmental examinations in the Government of India.

3.7. The above arguments build a compelling and conclusive case for better status and pay scales for the Indian Audit and Accounts Service officers and for the other officers and staff of the Indian Audit and Accounts Department.

4. Human Resource in IA&AD to carry out the Constitutional obligations entrusted to the Department

(3) Divisional Accountants’ cadre

| Cadre/Post | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Auditor / Accountants | Group ‘C’ | Direct recruitment & Promotion | PB-1, GP Rs. 2800/- | 5843/6604 |

| Sr. Auditor/Sr. Accountant | Group ‘B’ Non-Gazetted | Promotion | PB-2, GP Rs. 4200/- | 25994/15606 |

| Asstt. Audit Officer / Asstt. Accounts Officer | Group ‘B’ Gazetted | Promotion, then deputation failing which by direct recruitment. | PB2, GP Rs. 4800/- | 12755/10105 |

| Audit Officer / Accounts Officer | Group ‘B’ Gazetted | Promotion | PB-2, GP Rs. 5400/- | 1124/1493 |

| Sr. Audit Officer/ Sr. Accounts Officer | Group ‘B’ Gazetted | Promotion | PB-3, GP Rs. 5400/- | 3935/3380 |

(2) Common cadres

(a) Multi-tasking staff /Clerk cum typists

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| MTS | Group ‘C’ | Direct recruitment | PB-1, GP Rs. 1800/- | 6871/5745 |

| Clerk cum Typist | Group ‘C’ | Direct recruitment & Promotion | PB-1, GP Rs. 1900/- | 5224/1428 |

(b) Stenographers cadre:

(i) In field Offices

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Stenographers | Group ‘C’ | Direct recruitment | PB-1, GP Rs. 2400/- | 452/44 |

| Personal Assistant | Group ‘B’ Non-Gazetted | Promotion | PB-2, GP Rs. 4200/- | 478/308 |

| Private Secretary | Group ‘B’ Gazetted | Promotion | PB-2, GP Rs. 4600/- | 105/83 |

| Sr. Private Secretary | Group ‘B’ Gazetted | Promotion | PB-2, GP Rs. 4800/- After 04 years PB-2, GP Rs. 5400/- |

39/38 |

(ii) In CAG’s headquarters office

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Stenographers | Group ‘C’ | Direct recruitment | PB-1, GP Rs. 2400/- | 09/09 |

| Personal Assistant | Group ‘B’ Non-Gazetted | Promotion | PB-2, GP Rs. 4200/- | 12/08 |

| Private Secretary | Group ‘B’ Gazetted | Promotion | PB-2, GP Rs. 4800/- After 04 years PB-3, GP Rs. 5400/- |

25/21 |

| Principal Private Secretary | Group ‘A’ Gazetted | Promotion | PB-3, GP Rs. 6600/- | 22/11 |

| Sr. Principal Private Secretary | Group ‘A’ Gazetted | Promotion | PB-3, GP Rs. 7600/- | 05/05 |

(c) EDP cadre:

| Posts | Classification | Mode of appointment (As per model RR notified by DoPT) |

Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Data Entry Operator Grade ‘A’ (Data Entry Operator In IA&AD) | Group ‘C’ | Direct Recruitment | PB -1 Rs 5,200-20,200, Grade Pay 2,400 | 2593/939 |

| Data Entry Operator Grade ‘B’ (Console Operator In IA&AD) | Group ‘C’ | Promotion, Deputation, failing which by Direct Recruitment | PB -1 Rs 5,200-20,200, Grade Pay 2,800 | 502/09 |

| Data Entry Operator Grade ‘C’ (Sr. Console Operator In IA&AD) | Group ‘B’ Non-Gazetted | -do- | PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,200 | 438/119 |

| Data Entry Operator Grade ‘D’ System (Data Processor In IA&AD) | Group ‘B’ Gazetted | -do- | PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,600 | 107/05 |

| Data Entry Operator Grade ‘E’ (Sr. Data Processor in IA&AD) |

Group ‘B’ Gazetted | -do- | PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,800 | 81/05 |

| Senior Programmer DEO Grade ‘F’ (Data Manager in IA&AD) | Group ‘A’ Gazetted | -do- | PB-3 Rs 15,600-39,100 plus Grade Pay Rs 5,400 | 13/00 |

(d) Staff car driver:

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Staff Car Driver (Ordinary Grade) (30%) | Group ‘ C’ | Initial recruitment | Pay Band 1, Grade Pay Rs. 1,900/- | 46/27 |

| Staff Car Driver (Grade II) (30%) |

Group ‘ C’ | By promotion | Pay Band 1, Grade Pay Rs. 2,400/- | 46/26 |

| Staff Car Driver (Grade I) (35%) |

Group ‘ C’ | By promotion | Pay Band 1, Grade Pay Rs. 2,800/- | 54/53 |

| Staff Car Driver (Special Grade) (5%) | Group ‘ B’ Non-Gazetted |

By promotion | Pay Band 2, Grade Pay Rs. 4,200/- | 08/08 |

(e) Rajbhasha Cadre:

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Jr. Translator | Group ‘ B’ Non-Gazetted |

Direct Recruitment | Pay Band 2, Grade Pay Rs. 4,200/- | 301/131 |

| Sr. Translator | Group ‘ B’ Non-Gazetted |

Promotion | Pay Band 2, Grade Pay Rs. 4,600/- | 60/19 |

| Hindi Officer | Group ‘ B’ Gazetted |

Promotion | Pay Band 2, Grade Pay Rs. 4,800/- | 118/30 |

(3) Divisional Accountant Cadre:

| Posts | Classification | Mode of appointment | Pay band and Grade Pay (6th CPC) |

SS/PIP as on 01.01.2014 |

| Divisional Accountant | Group ‘ B’ Non-Gazetted |

Direct Recruitment | Pay Band 2, Grade Pay Rs. 4,200/- | 1696/681 |

| Divisional Accountant Grade – II | Group ‘ B’ Non-Gazetted |

Promotion | Pay Band 2, Grade Pay Rs. 4,600/- | 1187/678 |

| Divisional Accountant Grade – I | Group ‘ B’ Gazetted |

Promotion | Pay Band 2, Grade Pay Rs. 4,800/- | 1185/1036 |

| Sr. Divisional Accountant Accounts Officer | Group ‘ B’ Gazetted |

Promotion | Pay Band 3, Grade Pay Rs. 5,400/- | 708/680 |

5. Main Stream cadres:

Deemed pay scale (corresponding to the 6th CPC): PB-2 (Rs. 9,300 – 34,800), Grade Pay Rs. 4200/-.

Deemed pay scale (corresponding to the 6th CPC): PB-2 (Rs. 9,300 – 34,800) Grade Pay Rs. 4600/-.

Further, both Sr. Auditors/Sr. Accountants and the Assistants in CSS were placed in the same grade pay of Rs. 4,200/- by the 6th Central Pay Commission with effect from 01.01.2006. However, the Ministry of Finance vide OM No. F. No. 1/1/2008-IC dated 13.11.2009 unilaterally increased the grade pay of the Assistants of the CCS to Rs. 4,600 with effect from 01.01.2006. Therefore, the grade pay of Sr. Auditors/Sr. Accountants should also be enhanced to Rs. 4,600/- to restore the parity provided by the 6th Central Pay Commission.

Deemed pay scale (corresponding to the 6th CPC): PB-2 (Rs. 9,300 – 34,800) Grade Pay Rs. 4800/-.

After 04 years: PB-2(Rs. 9,300 – 34,800), Grade Pay Rs. 5400/-

Deemed pay scale (corresponding to the 6th CPC): PB-3, Grade Pay Rs. 6600/-

Deemed pay scale (corresponding to the 6th CPC): PB-3(Rs. 15,600 – 39,100), Grade Pay Rs. 7600/-.

Ø It may be noted that the following three posts are in the same grade pay of Rs. 5400/-

Ø In 5th Central Pay Commission, the Sr. Divisional Accounts Officers were in the same pay scale as that of the Audit/Accounts Officers. The 6th Central Pay Commission, up gradated and recommended given the pay scale equivalent to that of the Sr. Audit/Accounts Officers to the Sr. Divisional Accounts Officers. However, the Audit/Accounts Officers and Sr. Audit/Accounts Officers of the main stream cadres of the Indian Audit and Accounts Department were not given a commensurate up gradation. This has disturbed the horizontal relativity in the Department

6. Common cadres

Deemed pay scale (corresponding to the 6th CPC): PB-1(Rs. 5,200 – 20,200), Grade Pay Rs. 2400/-.

| Posts | Pay band and Grade Pay (6th Central Pay Commission) |

| Stenographers | PB-1, GP Rs. 2400/- |

| Personal Assistant | PB-2, GP Rs. 4200/- |

| Private Secretary (Field Offices) |

PB-2, GP Rs. 4600/- |

| Private Secretary (Hqrs. Offices) |

PB-2, GP Rs. 4800/- After 04 years PB-3, GP Rs. 5400/- |

| Sr. Private Secretary (Field Offices) |

PB-2, GP Rs. 4800/- After 04 years PB-3, GP Rs. 5400/- |

| Principal Private Secretary | PB-3, GP Rs. 6600/- |

| Sr. Principal Private Secretary | PB-3, GP Rs. 7600/- |

6.3. EDP cadre

| Name of the post | Pay band and Grade Pay | Method of recruitment |

| Data Entry Operator Grade ‘A’ (Data Entry Operator In IA&AD) | PB -1 Rs 5,200-20,200, Grade Pay 2,400 | Direct Recruitment |

| Data Entry Operator Grade ‘B’ (Console Operator In IA&AD) | PB -1 Rs 5,200-20,200, Grade Pay 2,800 | Promotion failing which by deputation, failing both by direct recruitment. |

| Data Entry Operator Grade ‘C’ (Sr. Console Operator In IA&AD) | PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,200 | Promotion failing which by deputation, failing both by direct recruitment. |

| Data Entry Operator Grade ‘D’ System (Data Processor In IA&AD) | PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,600 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment. |

| Data Entry Operator Grade ‘E’ (Sr. Data Processor in IA&AD) |

PB-2 Rs 9,300-34,800, Grade Pay Rs. 4,800 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment |

| Senior Programmer DEO Grade ‘F’ (Data Manager in IA&AD) | PB-3 Rs 15,600-39,100 plus Grade Pay Rs 5,400 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment. |

| Senior System Analyst (EDP)/ Data Processing Manager. |

PB-3 Rs 15,600-39,100, Grade Pay Rs 6,600 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment. |

| Joint Director (EDP)/ System Supervisor/ Principal System Analyst (EDP) | PB-3 Rs 15,600-39,100, Grade Pay Rs 7,600 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment. |

| Director (EDP) | PB-4 Rs 37400-67,000, Grade Pay Rs 8,700 | Promotion failing which by deputation (including short-term contract), failing both by direct recruitment. |

At present, the EDP cadre in IA&AD consists of six levels from DEO (GP Rs. 2,400) to Data Manager (GP 5,400). In order to attract appropriate candidates it is imperative that the pay scales be suitably upgraded to draw better talent and more appropriately reflect the qualifications required for the respective posts

6.4. Staff Car Drivers

| S. No. | Grade | Pay Band and Grade Pay | % | Mode of recruitment |

| 1. | Staff Car Driver (Ordinary Grade) | Pay Band 1, Grade Pay Rs. 1,900/- | 30 | Initial recruitment |

| 2. | Staff Car Driver (Grade II) | Pay Band 1, Grade Pay Rs. 2,400/- | 30 | By promotion |

| 3. | Staff Car Driver (Grade I) | Pay Band 1, Grade Pay Rs. 2,800/- | 35 | By promotion |

| 4. | Staff Car Driver (Special Grade) | Pay Band 1, Grade Pay Rs. 4,200/- | 5 | By promotion |

The post of Staff Car Driver (Special Grade) is only to the extent of 5% of the total strength in the cadre of Staff Car Drivers. Therefore, strictly speaking, the minimum strength in the cadre of Staff Car Drivers required for placing one post of Staff Car Driver in the special grade would be 20. In respect of cadres where the strength of Staff Car Drivers is between 10 and 19, one post of Staff Car Driver in the special grade can be allowed as the percentage of post computed @ 5% of the total strength comes to 0.5 and above which may be rounded off to one. However, where the strength of Staff Car Drivers in a cadre/organization is below 10 and thus the percentage fraction is below 0.5, there can be no case for introducing the special grade.

Therefore, the 7th Central Pay Commission is urged that posts of Staff Car Driver (Special Grade) should be increased from 5% to 10% so that at least one post of Staff Car Driver (Special Grade) would be allowed in the cadre where the total sanctioned strength of Staff Car Drivers is 5 and above. The proposed revised percentage in the cadre of Staff Car Driver may be as tabulated below:

| S. No. | Grade | Pay Band and Grade Pay | Percentage | Mode of recruitment |

| 1. | Staff Car Driver (Ordinary Grade) | Pay Band 1, Grade Pay Rs. 1,900/- | 30% | Initial recruitment |

| 2. | Staff Car Driver (Grade II) | Pay Band 1, Grade Pay Rs. 2,400/- | 30% | By promotion |

| 3. | Staff Car Driver (Grade I) | Pay Band 1, Grade Pay Rs. 2,800/- | 30% | By promotion |

| 4. | Staff Car Driver (Special Grade) | Pay Band 1, Grade Pay Rs. 4,200/- | 10% | By promotion |

6.5. Rajbhasha Cadre

| Category of post | Existing pay scales | Recommended deemed pay scales |

| Jr. Translator | PB -2, with Grade Pay of Rs. 4200/- | – |

| Sr. Translator | PB -2, with Grade Pay of Rs. 4600/- | – |

| Hindi Officer | PB -2, with Grade Pay of Rs. 4800/- | PB -2, with Grade Pay of Rs. 4800/- After 04 years PB-2 with Grade Pay of Rs. 5400/- (i.e in line with the Assistant Audit/Accounts Officer of main stream cadres) |

7. Divisional Accountants cadre

| Category of post | Distribution of posts in the cadre | Existing pay scales | Deemed scales before revision with which to be treated at par | Justification |

| Divisional Accountant | 35% | PB-2 with Grade Pay of Rs. 4200/- | PB-2 with Grade Pay of Rs. 4600/- | As detailed in Note -01 below |

| Divisional Accounts Officer Grade-II | 25% | PB-2 with Grade Pay of Rs. 4600/- | PB-2 with Grade Pay of Rs. 4800/- | As detailed in Note -02 below |

| Divisional Accounts Officer Grade-I (Group B gazetted) | 25% | PB-2 with Grade Pay of Rs. 4800/- | PB-2 with Grade Pay of Rs. 5400/- | As detailed in Note -03 below |

| Sr. Divisional Accounts Officer | 15% | PB-3 with Grade Pay of Rs. 5400/- | PB-3 with Grade Pay of Rs. 6600/- | As detailed in Note -04 below |

| Note No. | Justification for higher deemed pay scales |

| Note -01 | Traditionally there has been parity between Sr. Accountant of main stream cadre and Divisional Accountants. Since, a higher grade pay for Sr. Accountants has been proposed, it is recommended that the same higher deemed pay may also be allowed to the Divisional Accountants. |

| Note -02 | Divisional Accounts Officer-II is the promotion post of Divisional Accountant cadres and therefore, need to be placed in the next higher grade pay of Rs. 4800/- . |

| Note -03 | Divisional Accounts Officer–I is the next higher promotional post and therefore needs to be placed in the next higher pay scale i.e PB-2 with grade pay of Rs. 5400/- |

| Note -04 | Sr. Divisional Accounts Officer is the next higher promotional post and therefore needs to be placed in the next higher pay scale i.e PB-3 with grade pay of Rs. 6600/- |

Section-IV

8. Allowances & Other Benefits

8.2. Dearness Allowance

8.3. Transfer Lump Sum Grant

8.3.1. Periodical transfers are part of the service career for IAAS Officers and some other officers in the department. The fixed transfer grant and packing allowance presently paid are not adequate. The actual expenses that have to be incurred in packing and transporting personal effects to the new station of posting and in setting there are only fractionally met by the allowances presently admissible, even if imponderable/invisible costs are ignore. It is suggested that the existing rates of transfer lump sum grant be increased appropriately and it may also include the Dearness Allowance applicable at the time of transfer.

8.3.2. Further, quite often the Government servant is unable to move immediately with his family. The reason is mostly non-availability of accommodation although other factors such as difficulty in securing school admission for children etc. also come in the way. In such circumstances, personal inconvenience apart, the government servant is subjected to a considerable financial strain till the family is shifted. To take care of this burden caused by severe dislocation in the initial days after transfer, daily allowance for the first 10 days at the new station, at that station rate, should be paid in addition to transfer lump sum grant.

8.4. Accommodation

8.4.1. One of the major problems faced by officers with all-India transfer liability is the lack of residential accommodation. Most of the accommodation provided by Government comes under the category of General Pool accommodation, in which both transferable and non-transferable staff stands on equal footing though the two groups are not similarly placed. The artificial distinction created between tenure pool and general pool accommodation is getting extended to the detriment of officers getting posted to stations on temporary postings. The personnel belonging to the various groups of central services who have an All India transfer liability face acute problem of securing accommodation in a new place of posting especially if it is a metropolitan city such as New Delhi, Mumbai. Since such officers also get posted to such cities for a specific period of time only, they eminently fulfil the eligibility criteria for tenure pool. We, therefore, urge the pay commission to make appropriate recommendation that the officers of the Central Services with All India transfer liability be also made eligible for tenure pool.

8.4.2. Since the capability of the Government to provide residential accommodation to its employees is limited, most Government servants, whether transferable or non-transferable, have no option but to reside in rented private accommodation. The present rates of HRA are inadequate to compensate for the high rents prevailing in most metropolitan cities. It is, therefore, proposed that the rates of HRA may be increased to levels commensurate to the higher rents which the Government servant has to pay.

8.5. Reimbursement of Children Education Allowance:

The annual ceiling limit for reimbursement of Children Education Allowance needs to be enhanced to take care of the sharp hike in school fees in the recent years. A survey should be conducted across the country to evaluate the hike in school fees. The procedure of reimbursement needs to be simplified to reduce paper work and discourage submission of fake bills.

8.6. Hostel Subsidy

Of the many problems created by frequent transfers, one of the most significant, sometimes involving unacceptable long term negative consequences is the dislocation in the education of children. Some of the places of posting in India do not have suitable education facilities. Sometimes transfers take place during the academic sessions. As distinct from those with somewhat limited transferability in practical terms, such as between a State Capital and the Union Capital, the degree of hardship of those with transfer liability all over the country needs to be recognized. At school level, the State Boards are different with varying curricula and medium of instruction. Seats are not easily available in the few schools affiliated with the Central Board and with two or three children to be educated, for a decade or more, the Government servant has to handle this problem every 2-3 years on an average. Under the circumstances, the number of the Government servants who are forced to admit their children in boarding schools is on the rise. Efforts should, therefore, be made to mitigate this hardship, at least in financial terms. In such cases, the 7th CPC is urged to recommend a suitable method of compensating the government servant for this extra financial strain due to hostel expenses for the first two children till atleast the +2 level.

8.7. LTC Facilities

A Government employee is entitled to a Home Town LTC in a block year of two years for self and dependent family members. He is also entitled to All India LTC, in lieu of one Home Town LTC in a block of four years. In the past it has been seen that there were many cases of fake reimbursements of LTC claims in some of the departments. To simplify the process and avoid fake claims, this facility can be monetized and government employee paid a lump sum equivalent to 20% of Basic Pay plus Grade Pay drawn during the preceding twelve months. This will not only reduce paper work and man hours in settlement of LTC claims but also reduce fake claims cases. Such lump-sum payments would be subject to Income-tax as per Income Tax law. However, if a government employee wishes to claim the actual reimbursement of journey performed availing LTC, he may be allowed to do so, in which case such reimbursement will not be subject to income-tax deduction as is the case at present.

8.8. Telephone/Internet / Mobile charges:

8.8.1. Audit personnel are required to be in frequent touch with their headquarters offices and higher officials in connection with their nature of work irrespective of their place of posting even during transit. Also, audit personnel are on regular tour. Maintenance of mobile phone will reduce delay in communication with higher officials. This facility will also help them to maintain a fair relationship with their family and the society.

8.8.2. Further, Internet has become a vital resource in today’s world. Knowledge up gradation is an inevitable part of audit work. In the present scenario, Internet provides information which helps the audit employees in executing their work with greater effectiveness. Moreover, audit findings have to be transmitted to the higher officials and instructions from them are also to be communicated quickly to their subordinates. Hence, being the fastest, easiest, cheapest, most omnipresent, and universal means of communication, audit employees must be equipped with Internet facility. Therefore, the Pay Commission is urged to recommend adequate compensation towards telephone/mobile/internet charges to all gazetted officers as is already available to officers above a particular rank.

8.9. Reimbursement of newspapers at residence.

9. Miscellaneous Issues

| Pay band | Grade Pay | Applicable to the posts | Difference in the Grade Pay | % age of difference in Grade Pay |

| PB-1 (Rs.5,200-20,200/-) |

Rs. 1800/- | MTS | – | – |

| Rs. 1900/- | Clerk/Typists (LDC) | Rs. 100 | 05.55 | |

| Rs. 2400/- | DEO, Steno | Rs.500/- | 26.31 | |

| Rs. 2800/- | Auditor/ Accountants | Rs. 400/- | 16.66 | |

| PB-2 (Rs.9,300-34,800/-) |

Rs. 4200/- | Sr. Auditor/Sr. Accountants/PA/JHT/DA | Rs. 1400/- | 50.00 |

| Rs. 4600 | PS/DAO-II | Rs. 200/- | 09.52 | |

| Rs. 4800/- | AAO, Supervisors, Sr. PS/DAO-I | Rs. 200/- | 04.34 | |

| Rs. 5400/- | AO | Rs. 600/- | 12.50 | |

| PB-3 (Rs. 15,600-39,100) |

Rs.5400/- | Sr. AO/Sr. DAO | — | 00.00 |

It is evident that there are wide variations (00.00% to 50.00%) in the grade pays and there is no uniformity in change from one grade pay to next higher grade pay. The 7th Central Pay Commission may look into this and evolve a rational method while formulating the Grade Pays of different cadres.

9.2 Annual Increments

9.2.2 It is proposed that there should be two dates of increment i.e. 1st January and 1st July. Those recruited or promoted between 02nd working day of January and 30th June will have their increment date on 1st January of next year and those recruited or promoted between 1st July and 31st December may be granted the increment on 1st July next year.

9.2.3 Apart from the above, one notional increment should be granted to the employee on his superannuation, if he has completed more than six months of qualifying service in the Grade after his last increment, for calculating retirement benefits.

9.3 Fixation of Pay on promotion

9.3.1 The 6th Central Pay Commission introduced the system of Pay Bands and Grade Pays to address the anomalies arising due to merger of pay scales, whereby promotion and feeder cadres were placed in identical pay scales. But the aim could not be achieved without the merger of posts as the merger of promotion and feeder cadre and merger of pay scales have different meanings. Further, Rule 8 of Central Civil Service (Revised Pay) Rules, 2008 on fixation of pay in the revised pay structure of employees appointed as fresh recruits on or after 01.01.2006 provides that the pay of direct recruits to a particular post carrying a specific grade pay will be fixed as mentioned in Section II of Part A of the First Schedule of these Rules for entry level pay in pay band. Whereas Rule 13 of Central Civil Service (Revised Pay) Rules, 2008 deals with fixation of pay on promotion on or after 01.01.2006 which stipulates that in case of promotion from one grade pay to another in revised pay structure, the fixation will be done by granting one increment equal to 3% of the sum of the pay in the pay band and the existing grade pay and this will be added to the existing pay in band and the grade pay corresponding to the promotion post will thereafter be granted in addition to this pay in pay band.

9.3.2 Due to above rules, an employee may draw less pay on promotion in comparison to a direct recruit who joins later in the same grade pay and pay band. For example, a person ‘X’ drawing the grade pay Rs. 1800/- and promoted to grade pay 1900 or 2000 or 2400 or 2800 may draw less pay in pay band in comparison to a person ‘Y’ who is directly recruited in grade pay 1900 or 2000 or 2400 or 2800 even if ‘Y’ is recruited after a few years of the promotion of ‘X’.

9.3.3 To remove the anomaly which arose due to introduction of Grade Pay, Rule 13 of CCS (RP) Rules, 2008 may be amended as under:

9.4 Central Government Employees Group Insurance Scheme (CGEGIS)

9.4.1 The Central Government Employees Group Insurance Scheme (CGEGIS) which came into force with effect from Ist January 1982 is applicable to all Central Govt. employees. The Scheme is intended to provide for the Central Government employees, at a low cost and on a wholly contributory and self-financing basis, the twin benefits of an insurance cover to help their families in the event of death in service and a lump sum payment to augment their resources on retirement, death, resignation etc. The scheme has got two funds, namely Insurance Fund and Saving Fund in which subscription is apportioned at the rate of 30% and 70% respectively. Both the said funds are held in the Public Accounts of the Central Government. The rate of apportionment of subscription is based on the mortality rate which was revised from 3.75 per thousand per annum till 31-12-1987 to 3.60 per thousand per annum with effect from 01-01-1988. The amount of Insurance fund is to be paid to the families of those employees who unfortunately die due to any cause including suicide while in Government service. The total accumulation of savings together with interest thereon is payable to member on his retirement after attaining the age of superannuation or on cessation of his employment with the Central Government or to his family on his death while in service. Due to advancement in medical sciences and improvement in health care facilities, life expectancy has gone up and mortality rate adopted in 1988 may not be relevant any longer. Therefore, the contribution to the Insurance Fund @ 30% appears to be very high and needs review, as it will have an overall effect on all the Central Government employees.

9.4.2 In light of increase in life expectancy in the last 32 years, the 7th Central Pay Commission is urged to review the operation of Insurance Fund as well as revision of ratio of contribution to Insurance Fund and Saving Fund under Central Government Employees Group Insurance Scheme.

9.4.3 Further, the existing rate of monthly subscription and amount of insurance cover are as mentioned below:

| Group to which employee belongs | (A) For those who subscribe at the old rates | (B) For those who subscribe at the revised rates | |||

| Rate of contribution | Amount of Insurance cover |

Rate of Subscription

|

Amount of Insurance cover | ||

| Before enrolment as a member | After enrolment as a member | ||||

| (Rs.) | (Rs.) | (Rs.) | (Rs.) | (Rs.) | |

| ‘A’ | 80 | 80,000 | 40 | 120 | 1,20,000 |

| ‘B’ | 40 | 40,000 | 20 | 60 | 60,000 |

| ‘C’ | 20 | 20,000 | 10 | 30 | 30,000 |

| ‘D’ | 10 | 10,000 | 15 | 15 | 15,000 |

9.4.4 It may be seen that the subscription as well the corresponding amount of insurance cover is very less as compared to the current inflation index. Therefore, the rate of subscription, corresponding amount of insurance cover and contribution towards insurance fund needs to be revisited and re-fixed appropriately.

9.5 Modified Assured Career Progression Scheme (MACPS)

9.6 Entitlement on tour/transfer, allotment of government accommodation, transport allowance etc. based on pay in the pay band instead of grade pay

| Pay in the pay scale as per 5th CPC | Entitlements | Corresponding grade pay as per 6th CPC | Entitlements | Remarks |

| Rs. 8750/- (Rs.7500-250-12,000) |

(i) AC Taxi (ii) Type-IV (iii) TA (A1 city) – Rs. 800/- |

Rs. 4800/- | (i) Not entitled for AC Taxi (ii) Type-III (iii) TA (A1 city) -Rs.1600+DA |

(i)Entitlement for taxi has been downgraded, (ii)Entitlement for accommodation has been downgraded ; and (iii)Entitlement for TA has been lowered from corresponding to Rs. 3200+DA to Rs. 1600+DA |

9.6.3 Though the entitlements mentioned in the above paragraph are based on the grade pay, entitlement of an official for Personal Computer/Motor Car Advance and entitlement of rooms in hospital continue to be based on pay in the pay band.

9.6.4 Due to implementation of MACPS, some officials, though holding lower post, have been placed in higher grade pay due to 2nd /3rd financial up gradation under MACPS, making them eligible them for higher entitlement than officers actually senior in rank to him. This anomaly has been causing great heartburning to the seniors in rank. The Pay Commission is urged to make appropriate recommendations to protect the interest of the individuals so that they are not put to a disadvantageous position.

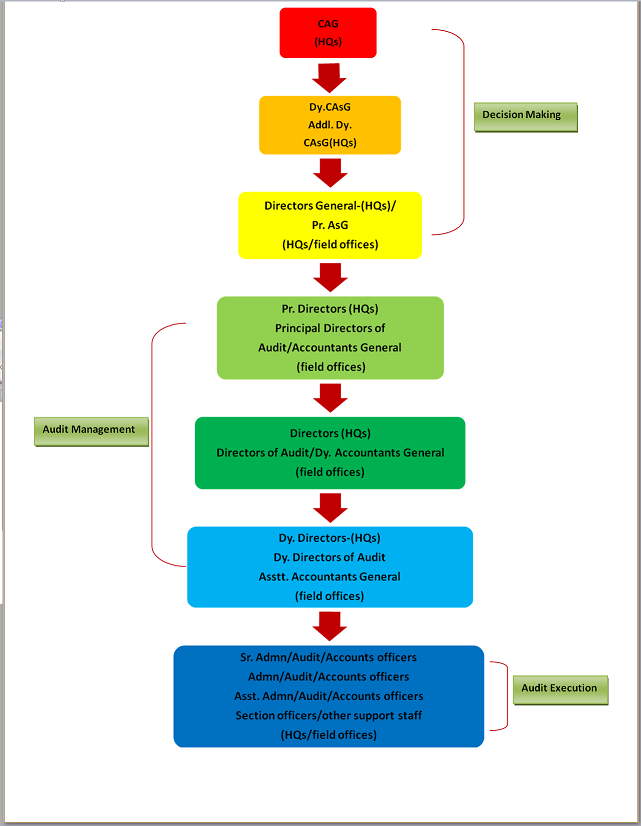

Organization of IA&AD

Source: https://drive.google.com/file/d/0B73sRTsOopXYQ1dsVktOV0YxUEE/view

[Confederation]

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS