Voluntary Donation to PM CARES Fund: 2 Days Salary (Basic Pay+DA) by Director and 1 Days’ by Executive/Non-executive: BSNL Order. Voluntary contribution by the Employees of BSNL in PM CARES FUND in view of the spread of COVID-19 pandemic in India.

|

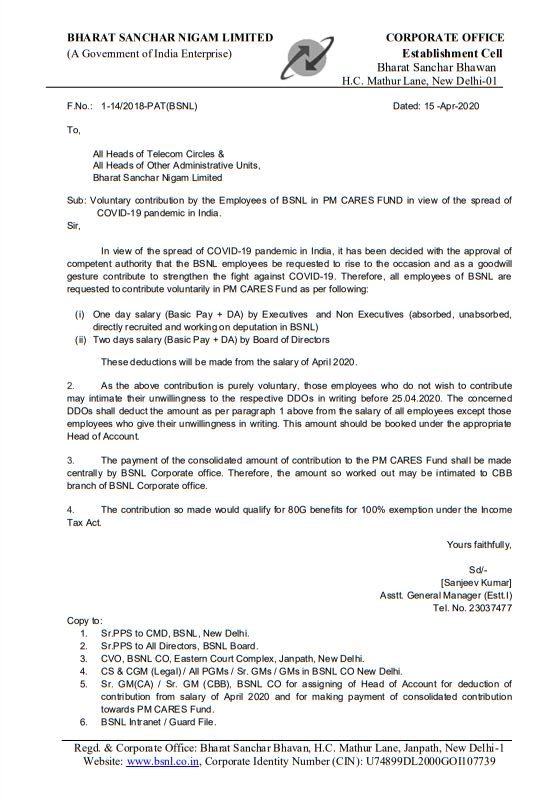

BHARAT SANCHAR NIGAM LIMITED |

CORPORATE OFFICE |

F.No.: 1-14/2018-PAT(BSNL)

Dated: 15 -Apr-2020

To,

All Heads of Telecom Circles &

All Heads of Other Administrative Units,

Bharat Sanchar Nigam Limited

Sub: Voluntary contribution by the Employees of BSNL in PM CARES FUND in view of the spread of COVID-19 pandemic in India.

Sir,

In view of the spread of COVID-19 pandemic in India, it has been decided with the approval of competent authority that the BSNL employees be requested to rise to the occasion and as a goodwill gesture contribute to strengthen the fight against COVID-19. Therefore, all employees of BSNL are requested to contribute voluntarily in PM CARES Fund as per following:

(i) One day salary (Basic Pay + DA) by Executives and Non Executives (absorbed, unabsorbed, directly recruited and working on deputation in BSNL)

(ii) Two days salary (Basic Pay + DA) by Board of Directors These deductions will be made from the salary of April 2020.

2. As the above contribution is purely voluntary, those employees who do not wish to contribute may intimate their unwillingness to the respective DDOs in writing before 25.04.2020. The concerned DDOs shall deduct the amount as per paragraph 1 above from the salary of all employees except those employees who give their unwillingness in writing. This amount should be booked under the appropriate Head of Account.

3. The payment of the consolidated amount of contribution to the PM CARES Fund shall be made centrally by BSNL Corporate office. Therefore, the amount so worked out may be intimated to CBB branch of BSNL Corporate office.

4. The contribution so made would qualify for 80G benefits for 100% exemption under the Income Tax Act.

Yours faithfully,

Sd/-

[Sanjeev Kumar]

Asstt. General Manager (Estt.I)

Tel. No. 23037477

Copy to:

- Sr.PPS to CMD, BSNL, New Delhi.

- Sr.PPS to All Directors, BSNL Board.

- CVO, BSNL CO, Eastern Court Complex, Janpath, New Delhi.

- CS &CGM (Legal) / All PGMs / Sr. GMs / GMs in BSNL CO New Delhi.

- Sr. GM(CA) / Sr. GM (CBB), BSNL CO for assigning of Head of Account for deduction of contribution from salary of April 2020 and for making payment of consolidated contribution towards PM CARES Fund.

- BSNL Intranet / Guard File.

Source:

[https://www.bsnleu.in/images/postimage/postfile/PAT%20Letter-15-4-2020%20(1).pdf]

COMMENTS