Tag: Income tax calculation

Income Tax – FAQs on Salary Income – Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Income Tax - FAQs on Salary Income - Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Frequently Asked Quest [...]

Exemption Free Income Tax Regime – Details छूट मुक्त आयकर प्रणाली – ब्यौरा

Exemption Free Income Tax Regime - Details छूट मुक्त आयकर प्रणाली - ब्यौरा

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

LOK SABHA

UNSTARRED

QUESTION N [...]

Income Tax Circular 4/2020 : Income Tax Deduction from Salaries during Financial Year 2019-20

Inocme Tax Circular 4/2020 dated 16-01-2020 Income Tax Rates of deduction of income-tax from the payment of income chargeable under the head "Salaries [...]

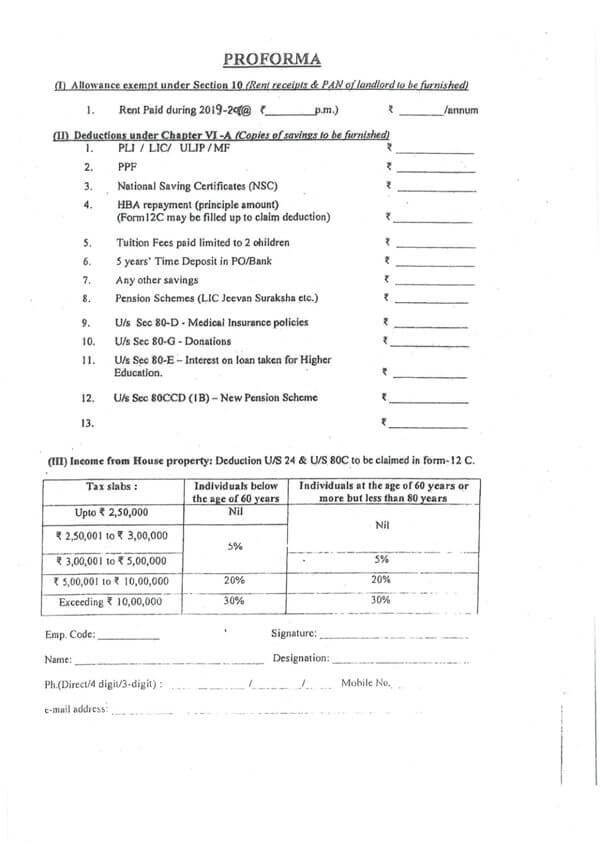

Income-Tax deduction at source from salaries during the financial year 2019 – 20 – Information regarding – Proforma

Income-Tax deduction at source from salaries during the financial year 2019 - 20 (U/S 192 of the Income Tax Act, 1961) -information regarding in profo [...]

![Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19] Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]](https://www.staffnews.in/wp-content/uploads/2018/05/income-tax-ay-2019-20-fy-2018-19-tax-rates-relief-exemption-deductions.jpg)

Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]

INCOME TAX

Benefits available only to Individuals & HUFs

Assessment Year 2019-20 [Financial Year 2018-19]

A. Tax Rates and Reli [...]

Calculation of Income Tax – Illustrations – FY 2015-16 AY 2016-17: IT Circular 20/2015

Calculation of Income Tax to be deducted -Illustrations - FY 2015-16 AY 2016-17: IT Circular 20/2015

9. CALCULATION OF INCOME-TAX TO BE DEDUCTED

[...]

Section 87A – Rebate of Rs. 2000 for Income upto Rs. 5 Lakh: IT Circular 20/2015

Section 87A - Rebate of Rs. 2000 for Income upto Rs. 5 Lakh: IT Circular 20/2015

6. REBATE OF Rs 2000 FOR INDIVIDUALS HAVING TOTAL INCOME UPTO R [...]

Section 80CCD – Contribution to NPS: Income Tax Circular 20/2015

Section 80CCD - Contribution to NPS: Income Tax Circular 20/2015

5.5.3 Deduction in respect of contribution to pension scheme of Central Go [...]

Section 80-C Deduction from Salaries: Income Tax Circular 20/2015

Section 80-C Deduction from Salaries: Income Tax Circular 20/2015

5.5.1 Deduction in respect of Life insurance premia, deferred annuity, cont [...]

Definition of Salary, Perquisite and Profit in Lieu of Salary: Section 17 IT Circular 20/2015

Definition of Salary, Perquisite and Profit in Lieu of Salary: Section 17 IT Circular 20/2015

5.2 DEFINITION OF “SALARY”, “PERQUISITE” A [...]