Report of Seventh Central Pay Commission

Chapter 8.17 Other Allowances

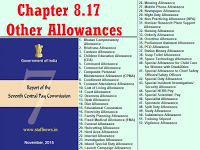

8.17.1 Alphabetical list of Allowances covered here is as under:

1. Bhutan Compensatory Allowance

2. Briefcase Allowance

3. Canteen Allowance

4. Children Education Allowance (CEA)

5. Command Allowance

6. Commercial Allowance

7. Composite Personal Maintenance Allowance (CPMA)

8. Condiment Allowance

9. Constant Attendance Allowance

10. Cost of Living Allowance

11. Court Allowance

12. Dearness Allowance

13. Desk Allowance

14. Diet Allowance

15. Educational Concession

16. Electricity Allowance

17. Family Planning Allowance

18. Fixed Medical Allowance (FMA)

19. Funeral Allowance

20. Haircutting Allowance

21. Hard Area Allowance

22. Internet Allowance

23. Investigation Allowance

24. Island Special Duty Allowance

25. Launch Campaign Allowance

26. Messing Allowance

27. Mobile Phone Allowance

28. Newspaper Allowance

29. Night Duty Allowance

30. Non-Practicing Allowance (NPA)

31. Nuclear Research Plant Support Allowance

32. Nursing Allowance

33. Orderly Allowance

34. Overtime Allowance

35. Parliament Assistant Allowance

36. PCO Allowance

37. Ration Money Allowance

38. Soap Toilet Allowance

39. Space Technology Allowance

40. Special Allowance for Child Care for Women with Disabilities

41. Special Allowance to Chief Safety Officers/Safety Officers

42. Special Duty Allowance

43. Special Incident/Investigation/Security Allowance

44. Special NCRB Pay

45. Special Scientists’ Pay

46. Specialist Allowance

47. Spectacle Allowance

48. Split Duty Allowance

49. Study Allowance

50. Subsistence Allowance

51. Training Stipend

52. Vigilance Allowance

Here we cover those allowances that do not fall in any of the other categories.

Bhutan Compensatory Allowance

8.17.2 Bhutan Compensatory Allowance is admissible to Defence Forces personnel posted to IMTRAT (Bhutan) with a depression in the standard rates promulgated by the Ministry of External Affairs. This was done because certain service concessions such as mess and canteen facilities were provided to Defence Forces personnel while in Bhutan. After September, 2005, the depression in the allowance has been removed but charges at the rate of 6 percent of the allowance from officers and 4 percent from PBORs are recovered for the free facilities provided. The existing rates are as follows:

| Grade Pay |

Rs. per month |

| >=10,000 |

1,20,445 |

| 8700 <=GP< 10,000 |

1,15,579 |

| 6600 <=GP< 8700 |

1,10,520 |

| Group `A’ officers with 5400 <=GP< 6600 |

99,065 |

| Group `B’ officers with 4600 <=GP< 6600 |

64,569 |

| Non-Gazetted Staff with 1900 <=GP< 4800 |

55,358 |

| Staff drawing GP< 1900 |

29,255 |

8.17.3 Demands have been received to the effect that Bhutan postings should be considered as normal foreign postings and Foreign Allowance as admissible in other countries be granted.

Analysis and Recommendations

8.17.4 The Commission recognizes this allowance as being singular in nature. The rates of this allowance are revised periodically–the last revision being done on 01.04.2013. As such, it is recommended that status quo should be maintained.

8.17.5 Certain categories of Central Government employees are entitled to reimbursement of expenditure incurred on purchase of briefcase/official bag/ladies’ purse as per the following provisions:

| Pay Band/GP |

Ceiling (Rs.) |

| Apex |

10000 |

| HAG, HAG+ |

8000 |

| GP 10000 |

6500 |

| GP 7600 to GP 8700 |

5000 |

| GP 4800 to GP 6600 |

4000 |

| GP 4200 to GP 4600 |

3500 |

8.17.6 The periodicity of reimbursement is restricted to once in three years. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.7 The Commission is of the view that the present rates are adequate However, the ceiling shall further increase by 25 percent each time DA increases by 50 percent.

8.17.8 This allowance is granted to General Manager and Manager-cum-Accountant of the Supreme Court Departmental Canteen at the rates of Rs.350 pm and Rs.300 pm respectively. Canteen allowance is also granted to certain categories of staff in Central Government ministries as per the following rates:

| Category of Staff |

Rate of Allowance |

| General Manager |

700 |

| Deputy General Manager |

600 |

| All Managers |

300 |

| All Assistant Manager-cum-Storekeepers |

200 |

8.17.9 There are demands for a four-fold rise in the allowance.

Analysis and Recommendations

8.17.10 It is recommended that the rates should be increased by a factor of 1.5. The rates shall further increase by 25 percent each time DA increases by 50 percent.

Children Education Allowance (CEA)

8.17.11 CEA is paid to government employees to take care of schooling and hostel requirements of their children. The rates of CEA are double for a differently abled child.

8.17.12 Many demands have been received regarding CEA. It has been requested that the amount be suitably raised and CEA should be extended for Graduation/Post Graduation level studies also. The Commission has received an overwhelming number of requests for simplification of the procedure for reimbursement.

Analysis and Recommendations

8.17.13 Before VI CPC recommendations, the scheme was known as Children Education Assistance and provided at the following rates:

| Component |

Class I-X

|

Class XI-XII

|

Requirement |

| Reimbursement of Tuition Fee (Rs. pm) |

40 |

50 |

– |

| Reimbursement of Tuition Fee for Disabled and mentally retarded children (Rs. pm) |

100 |

100 |

– |

| Children Education Allowance (Rs. pm) |

100 |

100 |

In case the government employee is compelled to send his child to a school away from the Station of his posting |

| Hostel Subsidy (Rs.pm) |

300 |

300 |

In case the employee is obliged to keep his children in a hostel away from the Station of his posting and residence on account of transfer. |

8.17.14 The VI CPC rationalized the structure to the following:

| Component |

Present Rates |

Remarks |

| CEA |

Rs.1500 pm |

Whenever DA increases by 50% CEA shall increase by 25% |

| Hostel Subsidy |

Rs.4500 pm |

Whenever DA increases by 50% Hostel Subsidy shall increase by 25% |

8.17.15 Effectively a 10-fold rise was given by VI CPC. This has led to high expectations, and consequently, vast number of demands for increasing the rates, expansion of scope and simplification for procedure of reimbursement of this allowance.

8.17.16 The various issues are examined seriatim:

- Has CEA kept pace with time? Presently CEA goes up by 25 percent each time DA increases by50 percent. Thus, since DA currently stands at 113 percent, CEA has gone up by 50 percent from its 2008 level. As against this, the movement of the All India Education Index33 is shown below:

The above chart shows that between 2008 and 2013, the Education Index has gone up from 134 to 154, i.e., by 14.9 percent, whereas CEA went up by 25 percent w.e.f. 01.01.2011 (when DA exceeded 50 percent). Thus, it can be concluded that increase in CEA has kept pace with (and in fact exceeded) the cost of education.

- What is the adequate level of compensation? Given the wide range of educational institutions, and the varying fee structure, the question of adequacy depends upon many factors. On the one hand we have government institutions like Kendriya Vidyalayas that charge fees to the tune of Rs.1,000 per month (including Vidyalaya Vikas Nidhi) and on the other hand there are private institutions where the monthly fee varies from Rs.5,000 to Rs.25,000 (or even more) per month.

8.17.17 On the whole, the Commission is of the view that quantum of CEA should be calibrated in such a manner that the main objective is met without the government entering into the field of subsidizing private education. Hence, taking into account the various items of expenditure that are reimbursed as a part of this allowance, the following is recommended:

| Component |

Recommended rate |

Remarks |

| CEA (Rs. pm) |

1500 x 1.5 = 2250 |

Whenever DA increases by 50%, CEA shall increase by 25% |

| Hostel Subsidy (Rs. pm) |

4500 x 1.5 = 6750 (ceiling) |

Whenever DA increases by 50%, Hostel Subsidy shall increase by 25 |

The allowance will continue to be double for differently abled children.

- What should be the scope of CEA? Presently CEA is payable up to Class XII. There is a strong demand for increasing the scope to Graduate and Post Graduate studies. However, due to the greatly varying nature of studies at the graduate level and beyond, the extension of scope of the allowance beyond Class XII cannot be accepted.

33 Source: All India Consumer Price Index (Industrial Workers)

- Simplification of Procedure for Reimbursement. This is a major area of concern. Many representations have been received by the Commission wherein employees have stated that due to cumbersome procedures, reimbursement has been held up for years. Another issue is the kind of voucher which will be accepted and which kind of voucher will not. The issue has been examined, and the apprehensions expressed are not without merit. It is recommended that reimbursement should be done just once a year, after completion of the financial year (which for most schools coincides with the Academic year). For CEA, a certificate from the head of institution where the ward of government employee studies should be sufficient for this purpose. The certificate should confirm that the child studied in theschool during the previous academic year. For Hostel Subsidy, a similar certificate from the head of institution should suffice, with the additional requirement that the certificate should mention the amount of expenditure incurred by the government servant towards lodging and boarding in the residential complex. The amount of expenditure mentioned, or the ceiling as mentioned in the table above, whichever is lower, shall be paid to the employee.

Command Allowance

8.17.18 This allowance is granted to certain personnel in CAPFs for shouldering higher responsibilities at the rate of Rs.100 pm. There are demands to raise this allowance five-fold.

Analysis and Recommendations

8.17.19 Not only is the amount of allowance meagre, there is no valid justification for its continuation. Accordingly, it is recommended that Command Allowance should be abolished.

Commercial Allowance

8.17.20 Commercial Allowance is granted to Announcers, ECRCs, Commercial clerks, TCs of Indian Railways for performing certain commercial duties at the rate of Rs.180 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.21 The amount of the allowance is meagre and no valid justification has been provided for its continuation. Hence, it should be abolished.

Composite Personal Maintenance Allowance (CPMA)

8.17.22 Composite Personal Maintenance Allowance(CPMA)is granted to PBORs of Defence Forces to take care of their daily needs. The existing rates are as follows:

| Hair Cutting Allowance |

30 |

| Washing Allowance |

90 |

| Soap Toilet Allowance |

30 |

| Clothing Maintenance Allowance |

30 |

| Rum Allowance |

Peace Areas |

45 |

| Field Areas below 3000 ft |

105 |

| Field Areas 3000 ft–4999 ft |

150 |

| Field Areas 5000 ft–8999 ft |

165 |

| High Altitude Areas |

240 |

8.17.23 There are demands to double the rate of CPMA and for parity among PBORs of all uniformed services.

Analysis and Recommendations

8.17.24 Washing Allowance and Clothing Maintenance Allowance have been subsumed in the Dress Allowance for PBORs. Other components of CPMA should be increased by 50 percent. The rates of the allowance will further increase by 25 percent each time DA rises by 50 percent.

8.17.25 Entire CPMA will be payable to the PBORs of Defence Forces.Except Rum Allowance, other components of CPMA will be payable to PBORs of CAPFs, Indian Coast Guard, RPFand Police forces of Union Territories. Rum Allowance will be granted to PBORs of CAPFs and Indian Coast Guard as per the existing guidelines.

Condiment Allowance

8.17.26 Condiment Allowance is paid to those non-gazetted personnel of Defence forces and CAPFs who dine in the mess, at the rate of Rs.89.78 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.27 Condiment Allowance is not an allowance in the true sense of the term, i.e., it is not paid to an individual, but to the Unit for collective purchase of condiments. As such, it is proposed to abolish this allowance, and the expenditure on condiments may be termed as Condiment expenditure and should be shown as such under the relevant budget head.

Constant Attendance Allowance

8.17.28 This allowance is sanctioned for 100 percent disablement, if in the opinion of competent medical authority, the retired employee needs the services of a Constant Attendant for at least a period of 3 months. This is subject to acceptance by the pension sanctioning authority and to the condition that the pensioner actually employs a paid attendant to look after him. The present rate of this allowance is Rs.4,500 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.29 The allowance may be increased by a factor of 1.5, i.e., to Rs.6,750 per month. The allowance shall further increase by 25 percent each time DA rises by 50 percent.

Cost of Living Allowance

8.17.30 This allowance is payable to employees recruited locally by MEA in foreign countries to compensate for the effect of inflation. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.31 This allowance is administered by MEA taking local factors into consideration. Hence, status quo is recommended.

Court Allowance

8.17.32 Court Allowance is granted to Legal Officers in National Investigation Agency (NIA) to meet the miscellaneous expenditure incurred in court. The present rates are Rs.1,500 pm to Public Prosecutor and Sr.Public Prosecutor, and Rs.2,000 pm to Dy.Legal Advisor. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.33 The Commission does not find the allowance justified. Hence, it is recommended that it should be abolished.

8.17.34 The Dearness Allowance (DA) is paid to Central Government employees to adjust the cost of living and to protect their Basic Pay from erosion in the real value on account of inflation. Presently, DA is based on the All India Consumer Price Index (Industrial Workers).

8.17.35 The JCM-Staff Side has suggested that the existing formula for the calculation of DA may continue.

Analysis and Recommendations

8.17.36 The VICPC had recommended that the National Statistical Commission may be asked to explore the possibility of a specific survey covering government employees exclusively, so as to construct a consumption basked representative of government employees and formulate a separate index. This has, however, not been done.

8.17.37 Keeping in mind that the present formulation of DA has worked well over the years, and there are no demands for its alteration, the Commission recommends continuance of the existing formula and methodology for calculating the Dearness Allowance.

8.17.38 Desk Allowance is granted to Desk Officers in CSS and other HQ services at a rate of Rs.900 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.39 This allowance is virtually non-existent since 2010 and there are very few instances of its payment now. Besides no valid justification has been provided in support of this allowance. Thus, it is recommended that Desk Allowance should be abolished.

8.17.40 Diet Allowance is granted to deputationists in Bureau of Immigration as compensation for food, at a rate of Rs.200 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.41 The amount of the allowance is meagre and no valid justification has been provided for its continuation. Hence, it is recommended that the allowance should be abolished.

8.17.42 Educational Concession is provided to children of Defence personnel who are missing/ disabled/killed in action. The allowance entails full reimbursement towards tuition and hostel fees and, in addition, compensation towards cost of books/stationery, uniform and clothing. The present rates are as under:

| Tution Fees |

Full Reimbursement |

| Hostel Charges |

Full Reimbursement |

| Cost of books/stationery |

Rs.1000 pa |

| Cost of Uniform |

Rs.1700 pa (First year) |

| Rs.700 pa (Subsequent year) |

| Clothing |

Rs.500 pa (First year) |

| Rs.300 pa (Subsequent year) |

8.17.43 There are demands to increase the amount of concession four-fold and to extend it to similarly placed personnel of CAPFs and Indian Coast Guard.

Analysis and Recommendations

8.17.44 The Commission finds merit in the argument that children of similarly placed personnel in other uniformed forces should not be denied education opportunities. Accordingly, it is recommended that the allowance should be extended to similarly placed personnel of CAPFs, Indian Coast Guard, RPF and police forces of Union Territories mutatis mutandis. Since this allowance is not DA indexed, the following rates are recommended:

| Tuition Fees |

Full Reimbursement |

| Hostel Charges |

Full Reimbursement |

| Cost of books/stationery |

Rs.2000 pa |

| Cost of Uniform |

Rs.2000 pa |

| Clothing |

Rs.700 pa |

8.17.45 The combined amount of Tuition Fees and Hostel Charges shall not exceed Rs.10,000 pm. The allowance shall go up by 25 percent each time DA rises by 50 percent.

8.17.46 Personnel belonging to the Defence Forces are permitted reimbursement of electricity charges for the first 100 units of electricity. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.47 This allowance is petty in nature and with the increase in pay proposed, there is no justification for its continuation. Hence, it should be abolished.

Family Planning Allowance

8.17.48 Family Planning Allowance (FPA) is granted to Central Government employees as an encouragement to adhere to small family norms. The existing rates are as under:

| Grade Pay |

Family Planning Allowance |

|

1300-2400

|

210

|

|

2800

|

250

|

|

4200

|

400

|

|

4600

|

450

|

|

4800

|

500

|

|

5400

|

550

|

|

6600

|

650

|

|

7600

|

750

|

|

8700

|

800

|

|

8900

|

900

|

| Grade Pay |

Family Planning Allowance |

|

>10,000

|

1000

|

8.17.49 There are demands to make it equal to one increment. Representations have also been received requesting that the allowance should be double for those employees who adopt family planning norms after just one child.

Analysis and Recommendations

8.17.50 The Commission recognizes the fact that most of the benefits related to children, viz., Children Education Allowance, Maternity Leave, LTC, etc., are available for two children only. Moreover the level of awareness regarding appropriate family size has also gone up among the government servants. Hence, a separate allowance aimed towards population control is not required now. Accordingly, it is recommended that Family Planning Allowance should be abolished.

8.17.51 It is granted to pensioners for meeting expenditure on day to day medical expenses that do not require hospitalization, presently payable at the rate of Rs.500 pm. Demands have been received to increase the rate of this allowance to Rs.2,000 pm.

Analysis and Recommendations

8.17.52 The Commission notes that this allowance was enhanced from Rs.300 pm to Rs.500 pm from 19.11.2014. As such, further enhancement of this allowance is not recommended. Detailed recommendations regarding health care of pensioners have been made in Chapter 9.5 of the Report.

8.17.53 When death of an employee occurs in peace areas, a funeral allowance of Rs.6,000 is granted and mortuary charges are reimbursed to Defence personnel. Demands have been received to extend that allowance to all civilian employees and for a four-fold increase in rates.

Analysis and Recommendations

8.17.54 The Commission is of the view that with the pay raises provided by successive Pay Commissions, this kind of an allowance has lost its meaning. Hence, it is recommended to be abolished.

8.17.55 This allowance is granted to PBORs of CISF to compensate for the cost of hair cutting, at the rate of Rs.5 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.56 The Commission took note of the fact that the amount of this allowance is the lowest among all allowances. This allowance has been subsumed in Composite Personal Maintenance Allowance and, therefore, should be abolished as a separate allowance.

8.17.57 Hard Area Allowance, at the rate of 25 percent of Basic Pay, is granted to Central Government employees on their posting to the Nicobar and Lakshadweep groups of Islands. This is paid in addition to ISDA. There are demands to increase the rate of this allowance.

Analysis and Recommendations

8.17.58 In line with our recommendations on percentage based allowances, Hard Area Allowance should be rationalized by a factor of 0.8 to 20 percent of Basic Pay.

Internet Allowance, Mobile Phone Allowance, Newspaper Allowance

8.17.59 These allowance are administered differently in ministries as per their requirements. Some ministries provide Mobile Phones and Internet connections to their employees, while others compensate their employees for these services in monetary terms, ranging from Rs.200 pm to Rs.3,000 pm. There are demands to raise these allowances.

Analysis and Recommendations

8.17.60 There is no doubt that these allowances are required in the present times. However, they should lead to efficiency in administration also. As such, it is suggested that all ministries should have a comprehensive database of their employees, including their mobile numbers and email addresses. This database should be available on the website of the concerned ministry.

8.17.61 The ministries should continue dealing with these allowances on their own, subject to the ceilings notified by the Ministry of Finance from time to time. The present ceilings should, however, be raised by 25 percent and the entire amount should be paid, lump sum, to the eligible employees without the need for production of vouchers.

8.17.62 Investigation Allowance is granted in Serious Fraud Investigation Office, Ministry of Corporate Affairs, to attract talent pool from other ministries. The existing rates are as under:

( Rs. per month)

|

Grade Pay

|

Rate

|

|

8700

|

2000

|

|

6600

|

1400

|

|

5400

|

1400

|

|

4800

|

1400

|

Analysis and Recommendations

8.17.63 There is no justification for continuation of this allowance. Accordingly, it is recommended that the allowance should be abolished.

Island Special Duty Allowance (ISDA)

8.17.64 ISDA is granted to Central Government employees on their posting to the Andaman and Nicobar Islands and Lakshadweep. The existing structure of this allowance is as under:

| Areas around capital towns (Port Blair in A&N islands, Kavaratti and Agatti in Lakshadweep) |

12.5% of Basic Pay |

| Difficult Areas (North and Middle Adaman, South Andaman excluding Port Blair, entire Lakshadweep except Kavaratii, Agatti and Minicoy) |

20% of Basic Pay |

| More Difficult Areas (Little Andaman, Nicobar group of Islands, Narcondum Islands, East Islands and Minicoy) |

25% of Basic Pay |

8.17.65 There are demands to increase the rate of ISDA.

Analysis and Recommendations

8.17.66 In line with our recommendations on percentage based allowances, ISDA should be rationalized by a factor of 0.8 to 10 percent, 16 percent and 20 percent of Basic Pay respectively.

Launch Campaign Allowance and Space Technology Allowance

8.17.67 Space Technology Allowance is granted to supporting scientific and technical staff in DOS/ISRO in recognition of the need for their retention and keeping in view the fact that they play a crucial role in the success of every mission. Considering that all missions/projects of ISRO are implemented in campaign mode and all categories of employees have to work with extra vigour, it was decided to give a lumpsum Launch Campaign Allowance to all administrative staff working in DOS/ISRO to appreciate and recognize their contribution to ISRO. Both the allowances are paid at the identical rate of Rs.7,500 per annum. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.68 The allowances are in the nature of an appreciation allowance. Since PRIS has already been implemented in ISRO, there is no justification for the continuation of these allowances. Hence it is recommended that both these allowances should be abolished.

Messing Allowance

8.17.69 This allowance is paid to “floating staff” under Fishery Survey of India, in lieu of free food on board floating vessels, at a rate of Rs.200 per day. Demands have been received to increase the amount of allowance to 15 percent of Basic Pay.

Analysis and Recommendations

8.17.70 It is recommended that the allowance should be increased to Rs.300 per day. The amount will further rise by 25 percent each time DA increases by 50 percent.

Night Duty Allowance

8.17.71 Night Duty Allowance (NDA) is granted to certain specified categories of employees for performance of duty between 22:00 hrs and 06:00 hrs. Presently, each hour of night work earns extra ten minutes of day work. There are demands to grant Night Duty Allowance between 18:00 hrs and 06:00 hrs and for doubling of rates by equating each hour of night work to extra twenty minutes of day work.

Analysis and Recommendations

8.17.72 This allowance was dealt extensively by Mia Bhoy tribunal in 1969 and the present dispensation is based on the recommendation of the said tribunal.

8.17.73 Presently, the allowance is administered as per DoPT’s OM No.12012/4/86-Estt. (Allowances) of 04.10.1989, wherein every 6 hours of night work earns 1 weighted hour of day work, or each hour of night work earns extra 10 minutes of day work.

8.17.74 The Commission examined the various arguments given for the grant of Night Duty Allowance:

- Night Work Convention, 1990 of International Labour Organization, states in Article 8: “Compensation for night workers in the form of working time, pay or similar benefits shall recognise the nature of night work.”

- There are studies to prove the deleterious effects on health of prolonged periods of continuous night duty.

- Sleep is more likely to be interrupted during day time compared to night time.

- Transportation and Entertainment are generally planned keeping day time in mind.

8.17.75 This Commission is, therefore, convinced that the need for compensating night work is widely recognized and should be continued.

8.17.76 However, the practice of arriving at the rates of NDA needs to be uniform. It is seen that in the Railways the rate of NDA has been broad-banded and all employees at each level of Grade Pay are given the same rate of NDA. For achieving this broad-banding, the average of Minimum and Maximum of the entire Pay Band has been taken to arrive at the average pay. This appears to be incorrect because running Pay Bands were intentionally kept wide by the VI CPC to avoid stagnation. Hence to use the extremities of the Pay Band for arrival at the average rate of NDA is not appropriate. Moreover, with the computerization of pay rolls, the amount of Night Duty Allowance can be easily calculated for each employee.

8.17.77 Taking the above into account, the following set of recommendations is made with regard to NDA:

- The present formulation of w eightage of 10 m inutes f or every h our of d uty performedbetween the h ours of 22:00 and 06:00 may be continued;

- The p resent p rescribed hourly rate of NDA equal to (BP+DA)/200 m ay be continued;

- This amount of NDA should, h owever, be w orked out separately f or each employee.With the computerization of pay rolls, working out the amount of NDA automatically foreach employee every month will not entail any difficulty. The existing formulation forgiving same rate of NDA for all employees with a particular GP should be abolished.

- This f ormulation w ill extend to all employees across all m inistries/departments whowere already in receipt of Night Duty Allowance.

- A certificate should b e given b y the s upervisor concerned that Night Duty i s essential.

8.17.78 Non Practicing Allowance (NPA), at the rate of 25 percent of Basic Pay, is paid to medical doctors occupying posts for which minimum qualification of a medical degree is prescribed. There are demands to raise this allowance to 40 percent of Basic Pay.

Analysis and Recommendations

8.17.79 The VI CPC had included a detailed rationale for the grant of NPA in its recommendations. Most of the reasons are still valid and there is no need to reiterate them here. However, in line with our general approach of rationalizing the percentage based allowances by a factor of 0.8, we recommend that NPA should be paid at the rate of 20 percent of Basic Pay, subject to the condition that Basic Pay + NPA should not exceed the average of Apex Level and the level of Cabinet Secretary.

Nuclear Research P lant Support Allowance

8.17.80 It is a composite allowance granted exclusively to staff at Research Unitsin the Bhabha Atomic Research Centre, to compensate for a variety of factors like round-the-clock shifts, overtime, risk of radiation, etc. The present rates are as under:

| Pay in the Pay Band |

Rate |

| Up to Rs.5580 |

Rs.480 pm |

| Rs.5581-Rs.16740 |

Rs.660 pm |

8.17.81 There are demands to increase the allowance four-fold.

Analysis and Recommendations

8.17.82 The Commission is of the view that the allowance needs to be continued. Moreover, since the allowance is already partially indexed to DA, it is recommended that the rates of the allowance should be increased by a factor of 1.5 to the following:

| Level of the employee |

Recommended Rate |

| 1-2 |

Rs.720 pm |

| 3 to 5 |

Rs.990 pm |

The rate shall further increase by 25 percent each time DA increases by 50 percent.

Nursing Allowance

8.17.83 Nursing Allowance is the composite term used for four allowances granted to nursing personnel: Nursing Allowance, Uniform Allowance, Washing Allowance, and Messing Allowance, presently granted at the following rates:

( Rs. per month)

| Nursing Allowance |

4800 |

| Uniform Allowance |

750 |

| Washing Allowance |

450 |

| Messing Allowance |

75 |

8.17.84 There are demands to increase the rate to three times its present value.

Analysis and Recommendations

8.17.85 The Commission is of the view that Nursing Allowance is already at an appropriate level. Hence, no change in the rate of Nursing Allowance is recommended. However, the rate of Nursing Allowance will go up by 25 percent each time DA rises by 50 percent.

8.17.86 Uniform Allowance and Washing Allowance have been subsumed in the newly recommended Dress Allowance for Nurses and will not be payable separately.

Messing Allowance is petty in nature. It is recommended that it should be abolished.

Orderly Allowance

8.17.87 Orderly Allowance is paid to Judicial Officers on deputation to Supreme Court Registry at the same rate that the Judicial Officer was getting in the parent office. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.88 It is recommended that status quo may be maintained.

Overtime Allowance (OTA)

8.17.89 Overtime Allowance(OTA)is granted to government employees for performing duties beyond the designated working hours. Presently, OTA is paid in several ministries/ departments, up to a certain level, at varying rates.

8.17.90 JCM-Staff Side has demanded that OTA should be paid to all government employees who are asked to work beyond office hours, on the basis of actual Pay, DA and Transport Allowance.

Analysis and Recommendations

8.17.91 Out of the total expenditure on OTA in Government of India in 2012-2013, over 90 percent is on account of just two ministries: MoR – Ministry of Railways and MoD – Ministry of Defence (Civilian employees). The Commission compared the OTA expenditure in these two ministries over the period 2006-07 to 2012-13.

8.17.92 In both the ministries, the amount of OTA is showing a rising trend.

8.17.93 The absolute numbers and amounts are as given below:

OT A and P ay (including DA) in MoR and MoD (Civilian Employees) 34

( Crore of Rs.)

|

2006-07 |

2012-13 |

CAGR of OTA

|

|

| OT A |

P ay |

(A)/(B) |

OT A |

P ay |

(X)/(Y) |

| (A) |

(B) |

(X) |

(Y) |

| MoR |

304.88 |

14563.01 |

2.09% |

791.65 |

30713.98 |

2.58% |

17.24% |

13.24% |

| MoD |

398.15 |

5035.94 |

7.91% |

732.73 |

11211.9 |

6.54% |

10.70% |

14.27% |

8.17.94 There are two noteworthy points here:

a. While OTA as a percentage of Pay is declining in MoD (6.54% in 2012-13 compared to 7.91% in 2006-07), it is on the rise in MoR (2.58% in 2012-13 compared to 2.09% in 2006-07).

34 Source: Brochure onPayand Allowances published byPayResearch Unit, DoE, Ministry of Finance.

b. The Compound Annual Growth Rate (CAGR) of OTA (17.24%) in MoR exceeds even the CAGR of Pay (13.24%), or in other words, OTA is rising faster than pay.

8.17.95 This clearly shows that while MoD has achieved some success in its efforts to control OTA, the efforts of MoR have not yielded the desired results. However, at the same time, it should also be kept in mind that OTA as a percentage of pay is already much higher in MoD compared to MoR.

8.17.96 The Commission also took note of the recommendations of the III, IV, V and VI CPCs that OTA should be abolished except where it is a statutory requirement. However, it is also a fact that despite these recommendations, OTA continues to be paid to certain categories of staff (at rates that are quite old) even when it is not a statutory requirement.

8.17.97 Hence, while this Commission shares the sentiments of its predecessors that government offices need to increase productivity and efficiency, and recommends that OTA should be abolished (except for operational staff and industrial employees who are governed by statutory provisions), at the same time it is also recommended that in case the government decidesto continue with OTA for those categories of staff for which itis not a statutory requirement, then the rates of OTA for such staff should be increased by 50 percent from their current levels.

8.17.98 A stricter control on OTA expenditure is also suggested.

Parliament Assistance Allowance

8.17.99 This allowance is granted in ministries to Assistants and UDCs who are wholly engaged in Parliament work during Parliament Sessions. The present rate of the allowance is Rs.1,500 pm for Assistants and Rs.1,200 pm for UDCs. The allowance is admissible at full rates for every calendar month in which the Parliament is in session for at least 15 days in that month. For months with shorter periods, the allowance is admissible at half the rates prescribed for the full month. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.100 The rate should be increased by a factor of 1.5. The rate shall further increase by 25 percent each time DA increases by 50 percent.

PCO Allowance

8.17.101 This allowance is granted to select staff of Production Control Organization (PCO) in Workshops and PUs of Indian Railways to compensate them for the loss in Incentive Bonus. The present rate is 7.5 percent of Basic Pay for eligible staff in GP 4600 and 15 percent of Basic Pay for eligible staff up to GP 4200. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.102 In line with our general approach of rationalizing the percentage based allowances by a factor of 0.8, the following rates of PCO allowance are recommended:

| Section Engineers and Sr. Section Engineers in level 7 |

6% of Basic Pay |

| Non-supervisory staff and Jr. Engineers up to level 6 |

12% of Basic Pay |

Ration Money Allowance (RMA)

8.17.103 Ration Money Allowance (RMA) is paid to all personnel of Defence forces and non-gazetted personnel of CAPFs, Delhi Police, IB, A&N police and such personnel of Indian Reserve Battalions (IRBn) as are posted in Andaman and Nicobar Islands and don’t dine in the mess. The existing rate of this allowance is Rs.95.52 per day for Non-Gazetted personnel and Rs.79.93 per day for Gazetted personnel.

8.17.104Therearedemands to extend RMA to gazetted officers of CAPFs in linewith Defence forces. Demands have also been received from some CAPFs that RMA should be exempted from the purview of income tax.

Analysis and Recommendations

8.17.105 Ration Money Allowance is revised periodically by Ministry of Defence and Ministry of Home for their personnel. Hence, it is proposed that status quo be maintained regarding the rates of this allowance.

8.17.106 However, regarding the admissibility of RMA, PBORs of CAPFs and Indian Coast Guard should be eligible to draw RMA irrespective of the place of posting (except when in receipt of the Detachment Allowance). Presently, officers of SSB who are posted in field areas at altitudes of less than 7000 feet are not eligible for RMA. This restriction of 7000 feet should be removed.

8.17.107 Regarding income tax exemption of RMA, the Commission, as part of its general approach, has refrained from making recommendations involving income tax. However, looking into the unique service conditions of CAPFs, the Commission is of the view that since RMA is granted in lieu of free rations, it should be exempt from income tax.

8.17.108 It is further recommended that the provision of free rations and the grant of Ration Money Allowance to officers of Defence forces posted in peace areas should be withdrawn.

Soap Toilet Allowance

8.17.109 This allowance is granted to Group `B’and `C’ combatised personnel of Assam Rifles at the rate of Rs.90 pm. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.110 The allowance is subsumed in Composite Personal Maintenance Allowance. Hence, it is recommended that this allowance should be abolished.

Special Allowance for Child Care for Women with Disabilities

8.17.111 As the name indicates, this allowance is granted to differently abled female employees for taking care of their newborn child. The present rate of this allowance is Rs.1,500 pm.

Analysis and Recommendations

8.17.112 The Commission recognizes the huge responsibility that these women shoulder while raising their children. Therefore, instead of the factor of 1.5 that we have mostly used for semi-DA indexed allowances, it is recommended that this allowance be raised by a factor of 2 to Rs.3,000 pm. The allowance shall further rise by 25 percent each time DA rises by 50 percent.

Special Allowance to Chief Safety Officers/Safety Officers

8.17.113 This allowance is granted to Senior Supervisors of workshop cadre (whether working in workshop or PCO) in Indian Railways, when they are deputed as Chief Safety Officers/Safety Officers. The existing rate is 7.5 percent of Basic Pay. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.114 In line with our general approach of rationalizing the percentage based allowances by a factor of 0.8, it is recommended that this allowance should, henceforth, be paid at the rate of 6 percent of Basic Pay.

Special Duty Allowance (SDA)

8.17.115 Special Duty Allowance (SDA) is granted to attract civilian employees to seek posting in North Eastern and Ladakh regions, in view of the risk and hardship prevailing in these areas. Currently, the rate of SDA is 37.5 percent of Basic Pay for AIS officers and 12.5 percent of Basic Pay for other employees.

8.17.116 There is a vociferous demand from employees (other than AIS officers) posted in these areas for parity with AIS officers.

Analysis and Recommendations

8.17.117 The Commission is of the view that AIS officers are allotted cadres, irrespective of their choice, and they are required to work in these cadres for considerable periods of time. As such, a higher rate of SDA for them is justified.

8.17.118 Accordingly, in line with our general approach of rationalizing the percentage based allowances by a factor of 0.8, SDA for AIS officers should be paid at the rate of 30 percent of Basic Pay and for other civilian employees at the rate of 10 percent of Basic Pay.

Special Incident/ Investigation/ Security Allowance

8.17.119 This allowance is provided to personnel of special security forces, both as compensation for risk and hardship as well as an incentive to attract talent. The present structure of these allowances is as under:

| Granted to personnel of |

P resent Rate |

| SPG (Operational Staff) |

50% of (BP+DA) |

| SPG (Non-Operational Staff) |

25% of (BP+DA) |

| NSG |

25% of (BP+DA) |

| NIA (Executive Staff) |

25% of (BP+DA) |

| NIA (Non-Executive Staff) |

15% of (BP+DA) |

| CBI (Officers up to the level of SP) |

25% of BP |

| CBI (Officers of the rank DIG and above) |

15% of BP |

| CBI (Non-Executive Cadres) |

15% of BP |

| IB |

15% of BP |

| RAF of CRPF |

10% of BP |

8.17.120 There are demands to rationalize the entire structure of this allowance. A proposal for extending this allowance at the rate of 25 percent of Basic+DA to personnel of Parliament Duty Group has also been forwarded to the Commission by the Ministry of Home Affairs.

Analysis and Recommendations

8.17.121 The Commission notes that these allowances were started at different points in time. There are varying rates that need to be rationalized. After due discussions with various stakeholders, the following structure of Special Security Allowances is recommended:

| Granted to Personnel of |

Recommended Rate |

| NSG |

40% of Basic Pay |

| SPG (Operational Staff) |

| SPG (Non-Operational Staff) |

20% of Basic Pay |

| IB |

| CBI |

| NIA |

| Parliament Duty Group (PDG) |

| RAF (CRPF) |

10% of Basic Pay |

8.17.122 The rationalized structure will be applicable only to those employees who were already in receipt of the allowance, except in case of PDG employees. No new categories of staff in other organizations may be made eligible for the grant of this allowance based on theserecommendations. No Deputation (Duty) Allowance w ill b e applicable along w ith thisallowance.

Special NCRB Pay

8.17.123 Special NCRB Pay is granted to Assistant Director in C&S division and Deputy Superintendent (Finger Print) in Central Finger Print Bureau of National Crime Records Bureau, on the premise that the feeder posts of both the above mentioned posts lie in the same GP which is an anomaly. A proposal to upgrade the post of Assistant Director to GP 7600 and that of Deputy Superintendent (Finger Print) to GP 5400 (PB-3) has been sent to VII CPC. Until then, the Bureau has itself taken steps to sort out this “pay anomaly” by providing this allowance of Rs.800 pm.

Analysis and Recommendations

8.17.124 The merger of certain V CPC pay scales by the VI CPC, led to similar situations in many cadres in which some posts and their feeder posts came to be in the same GP. The resolution to this has not been in the form of any such allowance. In fact, in many such cases there has been no resolution, as we have seen in the memoranda received. In this context, the presumption by NCRB that this constitutes an “anomaly,” to be “rectified” through an allowance is incorrect. Hence it is recommended that this pay should be immediately stopped.

Special Scientists’ Pay

8.17.125 Special Scientists’ Pay, at a rate of Rs.4,000 pm, is granted to Scientists/Engineers H with GP 10000 because it was felt that the pay scale accorded to them by the V CPC was not commensurate with their status and was adversely affecting their morale. No demands have been received regarding this pay.

Analysis and Recommendations

8.17.126 Since the V CPC recommendations, much time has passed and the pay scales of all employees have been revised upwards. There is no rationale for the continuation of this allowance. Hence, it is recommended that this allowance be abolished.

Specialist Allowance

8.17.127 This allowance is paid to specialist medical officers in Defence Services when posted to fill vacancies of specialists in the medical establishment. The present rates are as under:

| Graded Specialist |

Rs.2400 pm |

| Classified Specialist |

Rs.3000 pm |

| Consultant/Advisor/Professor |

Rs.3600 pm |

8.17.128 There are demands to raise the amount of this allowance four-fold.

Analysis and Recommendations

8.17.129 The rate of the allowance should be increased by a factor of 1.5. The rate shall further increase by 25 percent each time DA increases by 50 percent.

Spectacle Allowance

8.17.130 Spectacles are issued free to those Defence Forces personnel in whose case impairment of vision is either attributable to service or their sight is so defective that it interferes with their efficiency. When spectacles are not issued, reimbursement is permitted in the form of Spectacle Allowance, at the following rates:

| For spectacles with normal lenses |

Rs.130 |

| For spectacles with bifocal lenses |

Rs.250 |

8.17.131 There are demands that the Spectacle Allowance should be abolished and adequately compensated in Composite Personal Maintenance Allowance.

Analysis and Recommendations

8.17.132 The amount of this allowance is meagre. Hence, it is recommended that this allowance should be abolished.

Split Duty Allowance

8.17.133 This allowance is payable to Sweepers and Farashes in the Central Secretariat/allied offices performing split duties where the break in between the shift is at least two hours and who have not been provided residential accommodation within 1 Km. of the office premises. The existing rate is Rs.300 pm. There are demands to raise this allowance to Rs.2,000 pm.

Analysis and Recommendations

8.17.134 It is recommended that the allowance should be increased by a factor of 1.5 to Rs.450 pm. The rate will further rise by 25 percent each time DA rises by 50 percent.

Study Allowance

8.17.135 Study Allowance, ranging from 1 to 2.75 Pound (Sterling) per day, is granted to a government servant who has been granted study leave for studies outside India, for the period spent in prosecuting a definite course of study at a recognized institution or in any definite tour of inspection of any special class of work as well as for the period covered by the examination at the end of the course of study. This allowance has been referred by the government to VII CPC for consideration.

Analysis and Recommendations

8.17.136 The rate of this allowance is meagre and not revised since 1972. Accordingly, it is recommended that the allowance should be abolished.

Subsistence Allowance

8.17.137 Subsistence Allowance is payable to an employee under suspension or deemed to have been placed under suspension. No demands have been received regarding this allowance.

Analysis and Recommendations

8.17.138 Payment of Subsistence Allowance is as per CCS (CCA) rules. Status Quo is recommended.

Training Stipend

8.17.139 Non Gazetted Officers of Delhi Police, while undergoing training, are entitled for Training Stipend at the rate of Rs.80 pm.

Analysis and Recommendations

8.17.140 The stipend is meagre. Hence, it is recommended that Training Stipend should be done away with.

Vigilance Allowance

8.17.141 A Vigilance Allowance of Rs.2,500 pm is granted to Vigilance Inspectors in Indian Railways to attract experienced and talented staff.

Analysis and Recommendations

8.17.142 The Commission took note of two aspects regarding this allowance:

a. This allowance is paid only in Railways while there are posts of Vigilance Inspectors under other ministries as well.

b. No supporting evidence has been submitted by the Ministry of Railways to show that i. Employees were unwilling to join the vigilance organization before the

commencement of this allowance, and

ii. The position has improved after this allowance was introduced.

8.17.143 In such a situation, the Commission recommends abolishing this allowance.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS