Report of the Seventh Central Pay Commission

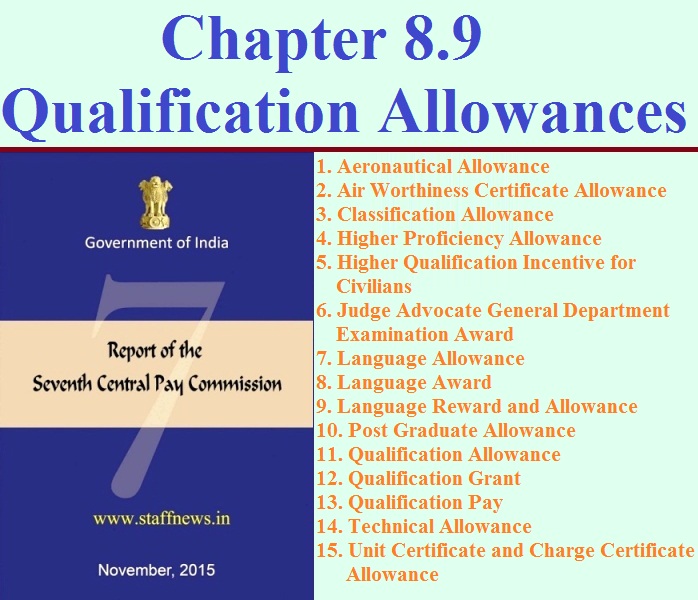

Chapter 8.9 Qualification Allowances

Allowances Covered

8.9.1 Alphabetical list of Allowances covered here is as under:

1. Aeronautical Allowance

2. Air Worthiness Certificate Allowance

3. Classification Allowance

4. Higher Proficiency Allowance

5. Higher Qualification Incentive for Civilians

6. Judge Advocate General Department Examination Award

7. Language Allowance

8. Language Award

9. Language Reward and Allowance

10. Post Graduate Allowance

11. Qualification Allowance 12. Qualification Grant

13. Qualification Pay

14. Technical Allowance

15. Unit Certificate and Charge Certificate Allowance

8.9.2 There are quite a few allowances that are meant to incentivize the acquisition of higher qualifications/skills. Majority of these allowances are paid to Defence force personnel, while a few of them are meant for civilians also.

Aeronautical Allowance

8.9.3 Aeronautical Allowance is admissible to those Defence technicians who have successfully qualified in Technical Type Training (TETTRA), Technical Type Conservation Unit (TTCU), Maintenance Conversion Flight (MCF) or similar courses. These technicians are authorized to maintain or service aircraft and related systems. Presently it is payable at the rate of Rs.300 pm. There are demands to increase the allowance to Rs.800 pm. Personnel of Indian Coast Guard are presently not entitled to this allowance. They have asked for parity.

Analysis and Recommendations

8.9.4 Since the allowance is already partially indexed to DA, it is recommended to raise it by a factor of 1.5 to Rs.450 pm. The amount will further rise by 25 percent each time DA increases by 50 percent.The allowance should also be extended to personnel of Indian Coast Guard mutatis mutandis.

Air Worthiness Certificate Allowance

8.9.5 This allowance was introduced in the year 2000 for the technical tradesmen in aircraft trades, based on the recommendations made by a Group of Officers. The existing rate is Rs.225 pm for aviation trade PBORs with service of 2-10 years and Rs.450 pm for PBORs with service exceeding 10 years. Defence Services have represented for a four-fold increase (from the base rate of 2008) in this allowance. Personnel of Indian Coast Guard are presently not entitled to this allowance. They have asked for parity.

Analysis and Recommendations

8.9.6 Since the allowance is already partially indexed to DA, it is recommended to raise it by a factor of 1.5. The amount will further rise by 25 percent each time DA rises by 50 percent. The allowance should also be extended to personnel of Indian Coast Guard mutatis mutandis.

Classification Allowance

8.9.7 Classification Allowance is granted to PBORs of all three services on attaining certain trade related qualifications in each group. When a sepoy enters service, he is categorized as C14. As he acquires skills, fore.g. weapons handling training, he moves up to C13, then further to C12 and ultimately to C11. For each stage, he receives this allowance at the following rates:

| Group | C14 to C13 | C13 to C12 | C12 to C11 |

| X | – | Rs.120 pm | Rs.120 pm |

| Y | Rs.100 pm | Rs.100 pm | Rs.100 pm |

Analysis and Recommendations 8.9.8 Demands have been made before the Commission that Classification Allowance should be termed as Classification Pay and amount should be made equal to one increment for each stage. Presently it is paid up to the rank of Havildar and equivalent only. The demand is to extend it to JCOs also.

8.9.10 The allowance is not DA indexed. Hence, it is recommended to raise it by a factor of2.25 to Rs.270 pm for each stage for X group and Rs.225 pm for each stage for Y group. Other demands do not hold merit.

Higher Qualification Incentive for Civilians

8.9.11 In general, civilian employees are governed by DoPT’s letter No.1/2/89-Estt.(Pay.I) dated 09.04.1999, wherein a lump-sum one-time incentive ranging from Rs.2,000 to Rs.10,000 is provided to the employee on obtaining higher qualifications. Many civilian organizations have approached the Commission to increase the quantum of this incentive, and bring it at par with that given to the Defence forces personnel.

Analysis and Recommendations

8.9.12 The Commission appreciates the need to encourage acquiring of higher qualifications. At the same time, it is important that the knowledge so acquired is directly relevant to the scope of the employee’s occupation. Hence, the following lump-sumrates of Higher Qualification Incentive are recommended for courses done in fields that are directly relevant to an employee’s job:

Higher Qualification Incentive for Civilians

| Qualification | Amount (Rs.) |

| Ph.D. or equivalent | 30000 |

| PG Degree/Diploma of duration more than one year, or equivalent | 25000 |

| PG Degree/Diploma of duration one year or less, or equivalent | 20000 |

| Degree/Diploma of duration more than three years, or equivalent | 15000 |

| Degree/Diploma of duration three years or less, or equivalent | 10000 |

8.9.14 Complete parity of civilian employees with Defence personnel, with regard to the grant of this incentive, is not feasible in view of the different service conditions, mode of recruitment and other factors.8.9.13 The existing conditions regarding the grant of this incentive, as mentioned in DoPT’s letter cited above, will continue to apply, except that Minsitries will be free to choose courses on their own. Moreover, the incentive shall be limited tomaximum two times in an employee’s career, with a minimum gap of two years between successive grants.

Judge Advocate General Department Examination Award

8.9.15 Officers of the three Services are granted a one-time award on qualifying the JAG Branch exam, which is presently Rs.9,600. In the Joint Services Memorandum (JSM) it has been argued that this award is admissible to very few officers every year. Hence, it should be abolished and merged with Cat-III courses of Qualification Grant.

Analysis and Recommendations

8.9.16 This allowance should be subsumed under Higher Qualification Incentive for Defence Personnel, dealt separately in this chapter.

Language Allowance

8.9.17 Service Officers and PBORs are granted Language Allowance to encourage them to learn foreign languages and carry out instructional translations and interpreter duties as and when required. The purpose of this allowance is to attract quality volunteers for meeting the requirements related to translation/interpreting of technical documents as most technologies available with the Defence Forces at present are imported with documentation in the foreign language which is needed to be translated urgently. The present rates of the allowance are as under:

| Category of Language | Amount of Allowance |

| Category I | Rs.1350 pm |

| Category II | Rs.1126 pm |

| Category III | Rs.900 pm |

Analysis and Recommendations 8.9.18 Services have sought a four-fold increase in the rate of this allowance.

8.9.19 Since the allowance is already partially indexed to DA, it is recommended to raise it by a factor of 1.5. The amount will further rise by 25 percent each time D Arises by 50 percent. As at present, the allowance should be payable subject to passing of an annual language examination.

Language Award

8.9.20 With a justification similar to that for the Language Allowance, Language Award is a one-time award for passing certain language related examinations. The existing rates are as follows:

| For passing Diploma-II Exam with >65% marks |

Category of Language

|

Sponsored Candidate

|

Non-Sponsored Candidate

|

| Category I | Rs.4500 | Rs.6750 | |

| Category II | Rs.3150 | Rs.4500 | |

| Category III | Rs.2250 | Rs.3150 | |

| For passing Interpreter ship Exam with >70% marks | Category I | Rs.9000 | Rs.13500 |

| Category II | Rs.6750 | Rs.9000 | |

| Category III | Rs.4500 | Rs.6750 |

Analysis and Recommendations 8.9.21 Besides a four-fold increase, the removal of minimum percentage clause has been requested.

8.9.22 Since the allowance is already partially indexed to DA, it is recommended to raise it by a factorof 1.5.The amount will further rise by 25 percent each time D Arises by 50 percent. Other demands do not hold merit.

Qualification Allowance

8.9.23 Qualification Allowance is granted to personnel of Indian Air Force for obtaining flying qualifications. The present rates are:

( Rs. per month)

| Master Aviation Instructor | 750 |

| Senior Aviation Instructor Cl-I | 600 |

| Senior Aviation Instructor Cl-II | 420 |

| Aviators holding Master Green Card | 600 |

| Aviators holding Green Card | 420 |

| Cat ‘A’ ATC/FC/HELO Controllers/Direction officers | 2400 |

| Cat ‘B’ ATC/FC/HELO Controllers/Direction officers | 1800 |

Analysis and Recommendations 8.9.24 Besides a six-fold increase, the extension of allowance to various other categories has been sought. Personnel of Indian Coast Guard are presently not entitled to this allowance. They have asked for parity.

8.9.25 Since the allowance is already partially indexed to DA, it is recommended to raise it by a factor of 1.5. The amount will further rise by 25 percent each time D Arises by 50 percent. The allowance should be extended to personnel of Indian Coast Guard also. Other demands do not hold merit.

8.9.26 For Defence officers, there are two allowances that are granted upon obtaining higher qualifications, viz., Qualification Grant and Technical Allowance. Since the purpose of these two allowances is similar, they are being dealt with together.

Qualification Grant and Technical Allowance

8.9.27 A lump-sum Qualification Grant is paid to officers who qualify in various specified courses. The present rates are as under:

| Category | Existing Grant |

| Category I Courses | Rs.30000 |

| Category II Courses | Rs.22500 |

| Category III Courses | Rs.13500 |

| Category IV Courses | Rs.9000 |

| MNS Officers | Rs.9000 |

8.9.29 Technical Allowanceis admissible to Defence Forces officers belonging to the technical branches for qualifying certain Tier-I and Tier-II courses. The present rates are as under:8.9.28 The general demand is to increase the rate to four times of the 2008 rate. Besides this, extension of the allowance to JCOs/ORs and Medical Officers has been sought. At present, there is a condition of two years having elapsed between two consecutive claims. Removal of this condition has been requested.

| For Tier-I courses | Rs.3000 pm |

| For Tier-II courses | Rs.4500 pm |

| For both courses | Rs.7500 pm |

Analysis and Recommendations

8.9.30 Defence forces have asked for a four-fold increase in the rate of this allowance, and sought extension to all officers and JCOs/ORs who undergo specified courses irrespective of the arm/service/branch of all three services. There are demands from the civilian side too, that this allowance should be extended to all civilian employees. Personnel of Indian Coast Guard have also asked for this allowance.

8.9.31 Regarding Qualification Grant, the Commission has carefully studied the list of various courses that fall in each of the categories and has the following observations:

- 1. In each of the four categories, the mix of courses is such that it does not lend itself to any pattern by way of level of difficulty, uniformity in duration or relevance to one’s field of work.

- 2. There is a fair degree of overlap between the list of courses under Categories I-IV and the broad list circulated by DoPT for the grant of Higher Qualification Incentive for civilians.

- 3. The quantum of incentive for civilians is at present significantly lower than the Qualification Grant for Defence employees.

8.9.32 Regarding Technical Allowance, the following observations are made:

- The allowance for Tier-I courses is admissible to all technical officers from the day they complete their professional qualification training and become available for full time professional employment in the service. Tier-II comprises various technical courses from recognized institutes in India or abroad.

- There is a vast difference in incentive provided to Defence officers vis-à-vis civilian employees for acquiring higher technical qualifications. Two factors stand out:

- a. To be eligible for the grant of incentive, the civilian employee should not have been sponsored by the government, while there is no such restriction for Defence officers, and

- b. While the highest amount of lump sum incentive for civilian employees is Rs.10,000 (for acquiring Ph.D. qualification) at present, Defence officers are entitled to a monthly allowance of Rs.4,500 even for much lower level courses.

8.9.33 Having considered the existing structure as brought out above, and particularly in view of the point 2(b), there is a strong case for bringing the entire structure of qualification related incentive/grant/allowance on a more equitable footing. Accordingly, the following is recommended:

1. Considering the difference in process of recruitment of Defence employees compared to their civilian counterparts, and the varying service conditions, the Technical Allowance for Tier-I courses maycontinue to be paid on a monthly basis at the existing level.

2. The list of courses under each category of Qualification Grant needs to be reviewed by an expert committee and only Defence specific courses need to be retained. It may be clarified here that the Commission is all for acquiring higher qualifications for the growth of an individual. However, the areas in which incentive is given should be such that they are directly relevant to one’s chosen field of occupation. Courses like M.Phil in any subject (presently a Cat-I course) or Bar-at-Law (presently a Cat-II course) are generic in nature and may be reviewed. Similarly, the desirability of including a course like Long Cookery Course (presently at Cat-II) should also be re-examined.

3. The list of courses under Tier-II of Technical Allowance also needs to be reviewed by an expert committee with a view to retaining the relevant ones only.

4. Once the reviews are completed, the list of courses which are to qualify for continuation of the incentive should be graded into five categories. They should then be combined into a single Higher Qualification Incentive for Defence Personnel with the following rates:

Higher Qualification Incentive for Defence Personnel

| Qualification | Amount (Rs.) |

| Grade I courses | 30000 |

| Grade II courses | 25000 |

| Grade III courses | 20000 |

| Grade IV courses | 15000 |

| Grade V courses | 10000 |

5. Summing up, only T ier-I of the Technical Allowance will continue to be paid on a monthly basis. Tier-II of the Technical Allowance as well as theQualification Grant will be merged into Higher Qualification Incentive for Defence Personneland will be paid as a lumpsum amount, on similar terms and conditions as Higher Qualification Incentive for Civilians.

6. Like civilians, this incentive will be applicable to all Defence forces personnel. Similarly, the incentive shall be limited to maximum two times in an employee’s career, with a minimum gap of two years between successive grants.

7. For Defence employees who have already availed of the full incentive now proposed, future payments should be stopped. For employees who have availed of the incentive only partly, the remaining amount should be paid as a lump sum immediately. No recoveries should be made for those employees who have already received more than the full amount.

Unit Certificate and Charge Certificate Allowance

8.9.34 This allowance is granted to Artificers and Mechanicians of the Navy after passing prescribed examinations. The existing rates are:

( Rs. per month)

| Unit Certificate Allowance | Lower Rate | 225 |

| Higher Rate | 450 | |

| Charge Certificate Allowance | Lower Rate | 450 |

| Higher Rate | 675 | |

| Special Rate | 810 |

Analysis and Recommendations 8.9.35 A four-fold increase in the rates of this allowance has been requested.

8.9.36 Since the allowance is already partially indexed to DA, it is proposed to raise it by a factor of 1.5. The rate of this allowance will increase by 25 percent each time the DA increases by 50 percent.

Higher Proficiency Allowance

8.9.37 This allowance is granted to IB personnel for acquiring higher skills in Language and Technical fields. The present rate varies from Rs.10,000 to Rs.25,000 and is decided by the Director, IB. No demands have been received regarding this allowance.

Analysis and Recommendations

8.9.38 For higher skills in language, IB personnel will be governed by the rates and conditions of Language Award, presently applicable only to Defence forces. For higher skills in technical fields, they will begoverned by Higher Qualification Incentive for Civilians. Accordingly, Higher Proficiency Allowance, as a separate allowance, should be abolished. Language Reward and Allowance

8.9.39 This allowance is payable to MEA officers who have learnt optional foreign language when posted in the region where the language is main language or widely used. The present rate varies from Rs.100 pm for being “proficient” to Rs.200 pm for being “above proficient.” No demands have been received regarding this allowance.

Analysis and Recommendations

8.9.40 The amount of the allowance is meagre. Hence, it should be abolished.

Post Graduate Allowance

8.9.41 This allowance is granted to doctors up to the level of NFSG who are PG Degree or PG Diploma holders. The existing rate of the allowance is Rs.1,500 pm for PG Degree holders and Rs.900 pm for PG Diploma holders. There are demands to raise the quantum of allowance three-fold.

Analysis and Recommendations

8.9.42 The allowance is partially indexed to DA. Hence, it is it is recommended to raise it by afactor of 1.5. The amount will further rise by 25 percent each time DA rises by 50 percent. The allowance should also be extended to medical doctors who are dentists and veterinarians.

Qualification Pay

8.9.43 It is granted to Accounts staff of Indian Railways for qualifying certain examinations. The existing rates are:

| Clerks Gr.II (Accounts Clerks)/Typists on passing App-II Examination | Rs.180 pm | |

| Sr.Accounts Assistant/Accounts Assistant/Stock Verifier/ Typist/Stenographer on passing App-III Examination | First Year | Rs.240 pm |

| Second Year | Rs.420 pm | |

Analysis and Recommendations

8.9.44 Demands have been received to increase the allowance to four times its present value.

8.9.45 Since the allowance is not indexed to DA, it is recommended to raise it by a factor of 2.25. The amount will further rise by 25 percent each time DA crosses 50 percent. The nomenclature should be changed to Railway Accounts Examination Allowance.

COMMENTS

where r three chiefs to address these issues..tier 2 courses r specifically related to the need of armed forces..systems specific..how it can b compared with civillan couses..the conditons in which armed personal r working on such systems cannot b imagined by these burocrats..who r shameless n discouraging moral of forces..this should b not acceptable to forces..or leave all technical jobs let civillans handle it..or top levels who r totally dump on such issues..

Furthermore, I would like to inform you that I had been stagnant in one position for Ten(10) years with my academic qualification of M.Sc.(Statistics), MPS,(Master in Population Studies, IIPS, Mumbai), Ph.D. (Population Studies, IIPS, Mumbai) but I was not given any promotion at all. Excepting me who were at that time in ISI, Kolkata promoted to next higher category for which they availed of higher scale and they are at present getting higher pension than me.This had happend to me due to lack of proper justice by the administration. May I seek its proper justice to the Honorable Prime Minister of India.

With best regards,

Anuj Kumar Saha

I, Anuj Kumar Saha,Formerly Associate Scientist-B at Population Studies Unit(PSU) at Indian Statistical Institute(ISI)< Kolkata, 203 B T Road, Kolkata 700108 acquired M.P.S. and Ph.D.relavant to my job after induction into service but I was not given any increment Or advance incentive for acquiring higher qualification at all though we, in general, moved the Director, ISI on May 2006. But in reality, all were in vain. We, all of that time were retired having no benefits. In this context can we expect such benefits of advance incentive which is proposed to be given to civilian employees at 7 CPC?

It is astonishing that a pay commission recommends to curtail benefits enjoyed by certain categories of Govt.employees especially armed force personals.If accepted and implemented, it will be great shame to the Govt. as well as the Heads of the three armed forces The three heads are bound to protect the interests of the cops and try to up hold the morale of armed force personals.

Technical Allowances are reduced from Rs. 7500 to Rs. 3000.It indicates that 7 CPC is trying adversely affecting morale and motivation of Defence Forces.The CPC doenot understand the scenario under which Technical Person works.They cannot be simply compared under any circumstances with Civilian.Like any other allowances it should also be multiplied by atleast 1.5 i.e. 7500 x 1.5 = 11250/=