Chapter 8.10 – Allowances

related

to

Risk

and Hardship

Allowances

Covered

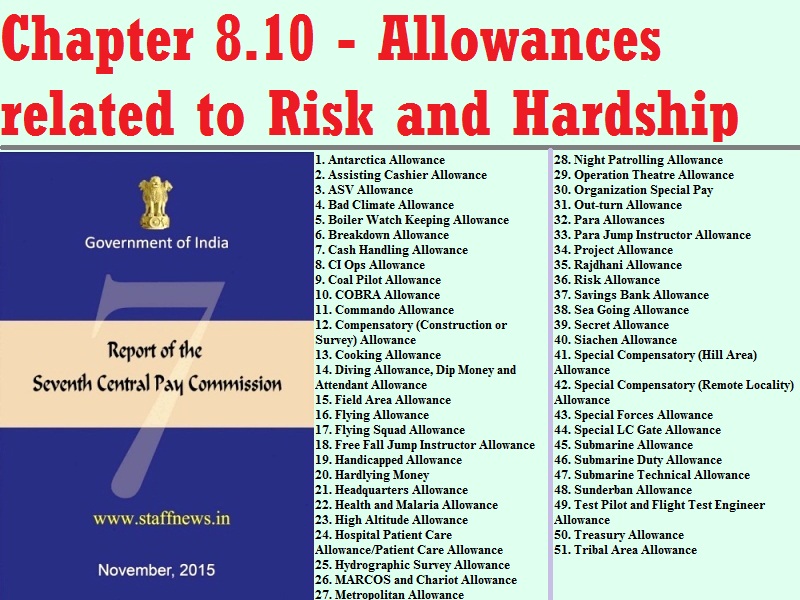

8.10.1 Alphabetical list of Allowances covered here is as under:

1. Antarctica Allowance

2. Assisting Cashier Allowance

3. ASV Allowance

4. Bad Climate Allowance

5. Boiler Watch Keeping Allowance

6. Breakdown Allowance

7. Cash Handling Allowance

8. CI Ops Allowance

9. Coal Pilot Allowance

10. COBRA Allowance

11. Commando Allowance

12. Compensatory (Construction or Survey) Allowance

13. Cooking Allowance

14. Diving Allowance, Dip Money and Attendant Allowance

15. Field Area Allowance

16. Flying Allowance

17. Flying Squad Allowance

18. Free Fall Jump Instructor Allowance

19. Handicapped Allowance

20. Hardlying Money

21. Headquarters Allowance

22. Health and Malaria Allowance

23. High Altitude Allowance

24. Hospital Patient Care Allowance/Patient Care Allowance

25. Hydrographic Survey Allowance

26. MARCOS and Chariot Allowance

27. Metropolitan Allowance

28. Night Patrolling Allowance

29. Operation Theatre Allowance

30. Organization Special Pay

31. Out-turn Allowance

32. Para Allowances

33. Para Jump Instructor Allowance

34. Project Allowance

35. Rajdhani Allowance

36. Risk Allowance

37. Savings Bank Allowance

38. Sea Going Allowance

39. Secret Allowance

40. Siachen Allowance

41. Special Compensatory (Hill Area) Allowance

42. Special Compensatory (Remote Locality) Allowance

43. Special Forces Allowance

44. Special LC Gate Allowance

45. Submarine Allowance

46. Submarine Duty Allowance

47. Submarine Technical Allowance

48. Sunderban Allowance

49. Test Pilot and Flight Test Engineer Allowance

50. Treasury Allowance

51. Tribal Area Allowance

8.10.2 This section covers the allowances payable to Central Government employees to compensate for the risk and/or hardship they face on account of their

working conditions. For our discussion, the allowances appearing in this section come under the category of Risk and Hardship Allowances (RHAs).

Present

Position

The existing structure of the allowances covered is detailed below:

Antarctica

Allowance

8.10.3 The Indian Antarctic Program is a multi-disciplinary, multi-institutional program under the control of Ministry of Earth Sciences, wherein studies

are conducted in atmospheric, biological, earth, chemical, medical and other sciences by sending teams to the Antarctica. To compensate for the hardship

that those undertaking this expedition face during their sojourn in Antarctica, this special allowance is granted. The present rates are:

| Team Leader | Winters | Rs.1856.80 per day |

| Summers | Rs.1237.50 per day | |

| Other Members | Winters | Rs.1688.00 per day |

| Summers | Rs.1125.00 per day |

Assisting

Cashier

Allowance

cash from banks. The current rate is Rs.90 pm.

ASV

Allowance

pm.

Bad

Climate

Allowance

time. The present rates are:

| Grade Pay > Rs.5400 |

Others |

| Rs.600 pm | Rs.360 pm |

Watch

Keeping

Allowance

personnel on board Coast Guard and survey ships. The aim of this allowance is to compensate such personnel for the hardship they face through constant

exposure to high temperature. The current rate is Rs.3,000 pm.

Breakdown

Allowance

Rs.

per

month)

| Grade Pay |

Rate |

| Up to Rs.1800 | 120 |

| Rs.1900 | 180 |

| Rs.2400-Rs.2800 | 240 |

| Rs.4200 and above (limited to non-gazetted staff) | 300 |

Cash

Handling

Allowance

Rs.

per

month)

| Amount of Average Monthly Cash Disbursed |

Rate |

| < Rs.50,000 | 230 |

| Over Rs.50,000 and up to Rs.2,00,000 | 450 |

| Over Rs.2,00,000 and up to Rs.5,00,000 | 600 |

| Over Rs.5,00,000 and up to Rs.10,00,000 | 750 |

| > Rs.10,00,000 | 900 |

CI

Ops

Allowance

Rs.

per

month)

| P osts |

CI

Operations in Field Areas |

CI

Operations in Modified Field Areas |

CI

Operations in Peace Areas |

| Lt. Col and Above/equ. | 11700 | 9000 | 7800 |

| Major/equ. | 10800 | 8310 | 7200 |

| Captain/equ. | 9900 | 7620 | 6600 |

| Lt./equ. | 9450 | 7260 | 6300 |

| JCO’s/equ. | 8100 | 6240 | 5400 |

| Hav/equ. | 5400 | 4140 | 3600 |

| Sep/Nk/equ. | 4500 | 3450 | 3000 |

Coal

Pilot

Allowance

and similar other duties. The present rates are:

| For First Trip | Rs.45 per trip |

| For every subsequent Trip | Rs.15 per trip |

COBRA

Allowance

them for their risk and hardship. The present rate is 80 percent of Marcos and Chariot Allowance.

Commando

Allowance

| SI | Rs.100 pm |

| Head Constable | Rs.75 pm |

| Constable | Rs.50 pm |

Compensatory

(Construction

or

Survey

Allowance)

‘surveys’ or ‘doubling’ (with Railway Board’s approval). The present rates are:

| Grade Pay > Rs.5400 |

Others |

| Rs.1500 pm | Rs.1000 pm |

Cooking

Allowance

Diving

Allowance,

Dip

Money

and

Attendant

Allowance

depending on depth and time spent under water. An Attendant Allowance is also paid at the rate of one- fifth of Dip Money to Divers’ Attendants. These

allowances are also applicable to IAF and Army personnel on pro-rata basis as and when they are involved in such duties. The current rates are:

| Diving A l l o w ance |

Deep Diving Officers | Rs.1200 pm |

| Clearance Diver – CI | Rs.900 pm | |

| Clearance Diver – CII | Rs.780 pm | |

| Clearance Diver – CIII | Rs.660 pm | |

| Ships Diving Officer | Rs.600 pm | |

| Dip Money |

Depth-fathoms | Rs. per minute |

| <20 | 1.80 | |

| 20-30 | 2.70 | |

| 30-40 | 3.60 | |

| 40-50 | 5.40 | |

| 50-60 | 7.20 | |

| 60-75 | 10.20 | |

| 75-100 | 11.40 | |

| Attendant Allowance |

1/5th of Dip Money | |

Field

Area

Allowance

further classified as Highly Active Field Areas, Field Areas and Modified Field Areas.

-

Highly

Active

Field

Area:

Where grave danger exists to troops, airmen, fixed-wing aircraft and helicopters due to deployment in close proximity of enemy. -

Field

Area:

Where troops are deployed near the borders for operational considerations, and where hostilities and risk to life are imminent. -

Modified

Field

Areas:

Where defence personnel/isolated detachments are deployed/ stationed/mobilized in support of military duties and where imminence of hostilities/violence and risk exist. Such areas may have severe infrastructural deficiencies causing deprivation and/or mental strain.

Rs.

pm

)

| P ost |

Highly

Active Field Areas |

Field Areas |

Modified

Field Areas |

| Lt.Col.& above & Equ. | 7800 | 3000 | |

| 12600 | |||

| Maj.& Equ. | 7200 | 2790 | |

| 11640 | |||

| Capt & Equ. | 6600 | 2580 | |

| 10650 | |||

| Lt. & Equ. | 6300 | 2400 | |

| 10170 | |||

| JCOs & Equ. | 5400 | 1800 | |

| 8730 | |||

| Hav & Equ. | 3600 | 1380 | |

| 5820 | |||

| Sep/Nk & Equ. | 4860 | 3000 | 1200 |

Flying

Allowance

Force and to corresponding aviation personnel of the Indian Army and the Indian Navy. The present rates are:

Rs.

per

month)

| P ost |

Rate |

| Air Commodore & Eq. & above (Capt IN with> 3yrs seniority) | 15750 |

| Squadron Leader to Group Captain & Eq. (Capt IN with< 3 yrs seniority) | 21000 |

| Flight Lt. and Eq. | 16500 |

| Flying Officer and Eq. | 13500 |

| Warrant Ranks | 12600 |

| Senior NCO | 10500 |

Flying

Squad

Allowance

constituted for surprise ticket checking in trains. The current rate is Rs.300 pm.

Free

Fall

Jump

Instructor

Allowance

officers and Rs.1,800 pm for PBORs.

Handicapped

Allowance

challenged, orthopedically challenged and staff suffering from spinal deformity. The present rate is 5 percent of Basic Pay, subject to a maximum of Rs.100

pm.

Hardlying

Money

minesweepers, ocean going tugs and submarines, it is paid at full rates and in relatively more comfortable vessels at half rates. The current rates are as

under:

| Category | Existing Rates |

|

| F u ll |

H alf |

|

| Officers including Mid shipment & Cadets | Rs.600 pm | Rs.300 pm |

| Sailors | Rs.420 pm | Rs.210 pm |

Headquarters

Allowance

Rs.225 pm.

Health

and

Malaria

Allowance

is Rs.600 pm.

High

Altitude

Allowance

Rs.

per

month)

| P ost |

Cat-I Areas |

Cat-II Areas |

Cat-III Areas |

| Lt.Col. & above & Equ. | 3180 | 4800 | 16800 |

| Maj. & Equ. | 2790 | 4200 | 16800 |

| Capt & Equ. | 1980 | 3000 | 16800 |

| Lt. & Equ. | 1590 | 2400 | 16800 |

| JCOs & Equ. | 1440 | 2160 | 11200 |

| Hav & Equ. | 1110 | 1680 | 11200 |

| Sep/Nk & Equ | 810 | 1200 | 11200 |

above 15000 ft. in height. Cat-III Areas comprise certain specified areas that have especially uncongenial climate. The rate in Cat-III Areas is 80 percent

of Siachen Allowance.

Hospital

Patient

Care

Allowance

(HPCA)/Patient

Care

Allowance

(PCA)

delivery institutions/establishments (other than hospitals) with less than 30 beds, subject to the condition that no Night Weightage Allowance and Risk

Allowance, if sanctioned by the Central Government, will be admissible to these employees. Similarly placed employees working in hospitals are eligible for

Hospital Patient Care Allowance (HPCA). This allowance is not admissible to Group `C’ and D (Non-Ministerial) employees working in the headquarters. The

rules provide that only Group `C’ and `D’, non- Ministerial employees whose regular duties involve continuous and routine contact with patients infected

with communicable diseases or those who have to routinely handle infected materials, instruments and equipment, which can spread infection, as their

primary duty can be considered for grant of Hospital Patient Care Allowance. It is further provided that HPCA shall not be allowed to any of those

categories of employees whose contact with patients or exposure to infected materials is of an occasional nature. The present rates of these allowances

are: Hospital Patient Care Allowance@ Rs.2,100 pm for Group `C’ staff and Rs.2,085 pm for Group `D’ Staff. Patient Care Allowance @ Rs.2,070 pm for both

Group `C’ and ‘D’ staff.

Hydrographic

Survey

Allowance

Rs.

per

month)

| Surveyors Class-IV | 1200 |

| Surveyors Class-III | 1500 |

| Surveyors Class-II | 1800 |

| Surveyors Class-I | 2100 |

| Non-Surveyor Officers on ships | 600 |

| Surveyor Recorder-III | 300 |

| Surveyor Recorder- II | 450 |

| Surveyor Recorder–I (PO and Below) | 600 |

| Surveyor Recorder–I (CPO and above) | 750 |

| Non-Surveyor Sailors serving on ships | 150 |

MARCOS

and

Chariot

Allowance

Rs.

per

month)

| Capt (with >3yrs service in the rank) and above | 15750 |

| Lt Cdr/Cdr/Capt (with < 3 years’ service in the rank) | 21000 |

| Lt. | 16500 |

| Sub Lt. | 13500 |

| MCPO II/I | 12600 |

| CPO and Below | 10500 |

Metropolitan

Allowance

| Sub-Inspector (SI) | Rs.180 pm |

| Constable, Head Constable, ASI | Rs.120 pm |

Night

Patrolling

Allowance

patrolling.

Operation

Theatre

Allowance

is Rs.240 pm.

Organization

Special

Pay

Rs.

per

month)

| Subedar (Senior) | 100 |

| SM/Inspector | 100 |

| Sub-Inspector | 60 |

| Head Constable | 40 |

| Lance Naik/Naik | 40 |

| Constable | 30 |

Out-turn

Allowance

worked in excess of the specified number of messages during the normal duty hours on a nominated circuit. The current rates are:

| Rs.0.10 for each message in excess of 250 messages handled over the minimum number of messages sent or received in eight or six hour shift. | P ost |

No.

of Minimum Messages |

| Telegraph Signaller | 100 | |

| Teleprinter Operator | 250 | |

| Wireless Operator Link (Two Stations) | 80 | |

| Wireless Operator Net (> Two Stations) | 60 |

Para

Allowances

establishments. The reserves are those who have shifted out but must again do the refresher course to qualify for the grant of these allowances. The

allowances are granted after doing a parachute refresher course and a minimum of two jumps. The extant rates are:

Rs.

per

month)

| P ara Allowance |

For Officers | 1800 |

| For JCO/OR (Army) | 1200 | |

| P ara Reserve Allowance |

For Officers | 450 |

| For JCO/OR (Army) | 300 |

Para

Jump

Instructor

Allowance

is Rs.3,600 pm for officers and Rs.2,700 pm the PBORs.

Project

Allowance

facilities at the places of construction of major projects. This is mainly paid to Railway employees whose offices are in project area and who have to

reside within a nearby locality. The current rates are:

| GP > Rs.5400 |

Ot hers |

| Rs.2250 pm | Rs.1500 pm |

Rajdhani

Allowance

nature of their jobs. The current rate is Rs.900 pm for TS and Rs.360 pm for Dy.TS.

Risk

Allowance

time. Risk Allowance is also paid to Sweepers and Safaiwalas engaged in cleaning of underground drains, sewer lines as well as to the employees working in

trenching grounds and infectious diseases hospitals. The extant rate is Rs.60 pm.

Savings

Bank

Allowance

Savings Bank work. Postal Assistants need to qualify an Aptitude Test to get this allowance. The current rates are Rs.300 pm for fully engaged staff and

Rs.150 pm for partially engaged staff.

Sea

Going

Allowance

pro rata basis, with the condition that the sea vessels should be deployed for a minimum of 12 hours a day. The extant rates are:

Rs.

per

month)

| Cdr & above | 7800 |

| Lt. Cdr | 7200 |

| Lt. | 6600 |

| Sub-Lt. | 6300 |

| CPO & abv. PBORS | 5400 |

| PO | 3600 |

| Ldg Seaman & below | 3000 |

Secret

Allowance

paid as a flat sum per month based on the post held by the concerned official.

Siachen

Allowance

rate is Rs.21,000 pm for officers and Rs.14,000 pm for PBORs.

Special

Compensatory

(Hill

Area)

Allowance

| Grade Pay > Rs.5400 |

Ot hers |

| Rs.900 pm | Rs.720 pm |

Special

Compensatory

(Remote

Locality)

Allowance

Rs.

per

month)

| Class o f Remote Locality |

GP > Rs.5400 |

Ot hers |

| Part A | 3900 | 3000 |

| Part B | 3150 | 2400 |

| Part C | 2250 | 1800 |

| Part D | 600 | 480 |

Special

Forces

Allowance

Rs.

per

month)

| Brigadier and above and equivalent | 15750 |

| Major to Colonel and equivalent | 21000 |

| Captain and equivalent | 16500 |

| Lieutenant and equivalent | 13500 |

| JCOs and equivalent | 12600 |

| Havaldars and below and equivalent | 10500 |

Special

LC

Gate

Allowance

rate is Rs.450 pm.

Submarine

Allowance

arduous conditions of service on-board submarines. The current rates are:

Rs.

per

month)

| Capt (with >3 years’ service in the rank) and above | 15750 |

| Lt Cdr/Cdr/Capt (with < 3 years’ service in the rank) | 21000 |

| Lt. | 16500 |

| Sub Lt. | 13500 |

| MCPO II/I | 12600 |

| CPO and Below | 10500 |

Submarine

Duty

Allowance

present rate is Rs.135 per day for officers and Rs.45 per day for PBORs.

Submarine

Technical

Allowance

pm.

Sunderban

Allowance

Rs.

per

month)

| P ay i n the P ay Band |

Rate |

| <5600 | 90 |

| 5600-8400 | 180 |

| 8401-11200 | 270 |

| 11201-16800 | 360 |

Test

Pilot

and

Flight

Test

Engineer

Allowance

units for Test Pilot duties. The current rate is Rs.3,000 pm for Test Pilots and Rs.1,500 pm for Flight Test Engineers.

Treasury

Allowance

for handling of cash. The present rate is Rs.360 pm for handling cash up to Rs.2 lakh and Rs.480 pm for handling cash more than Rs.2 lakh.

Tribal

Area

Allowance

| GP > Rs.5400 |

Others |

| Rs.600 pm | Rs.360 pm |

Observations

have established relativities. Overall, however, the entire system is quite haphazard and quite a few of the allowances have rates that seem to vary at

random. There are some allowances that have lost their significance in the present era and some for whom adequate justification has not been provided by

the ministry concerned.

Demands

Received

of Defence forces, for parity in the payment of these allowances on the contention that higher ranked officials get higher pay, but the risk/hardship faced

is largely comparable. Hence, they claim that there is no justification for slab-wise variation in the quantum of these allowances (there are as many as

seven slabs in some cases).

and

Recommendations

have recommended just two slabs for each allowance–with one rate for officers and a lower rate for PBORs. Most of the existing relativities have been

maintained.

employees posted at such places. It is proposed to subsumetheseallowances under theumbrellaof “Tough Location Allowance” as follows:

Allowance–III.

Allowance will, however, not be admissible along with Special Duty Allowance.

Risk

and

Hardship

Matrix

and

Hardship

Matrix

|

RH-Max

Level >=9: Rs.31500 pm

Level <=8: Rs.21000 pm

|

HARDSHIP

|

|||

|

High

|

Medium

|

Low

|

||

|

R

I

S

K

|

High

|

R1H1

Level >=9: Rs.25000 pm

Level <=8: Rs.17300 pm

|

R1H2

Level >=9: Rs.16900 pm

Level <=8: Rs.9700 pm

|

R1H3

Level >=9: Rs.5300 pm

Level <=8: Rs.4100 pm

|

|

Med

ium

|

R2H1

Level >=9: Rs.16900 pm

Level <=8: Rs.9700 pm

|

R2H2

Level >=9: Rs.10500 pm

Level <=8: Rs.6000 pm

|

R2H3

Level >=9: Rs.3400 pm

Level <=8: Rs.2700 pm

|

|

|

Low

|

R3H1

Level >=9: Rs.5300 pm

Level <=8: Rs.4100 pm

|

R3H2

Level >=9: Rs.3400 pm

Level <=8: Rs.2700 pm

|

R3H3

Level >=9: Rs.1200 pm

Level <=8: Rs.1000 pm

|

|

and sub-categories that exist today. It would make the administration of these allowances simple and provide a framework for the government for future

inclusion of any new allowance, which can be placed in the appropriate cell depending upon the severity of the risk and hardship involved.

Salient

Features

of

Risk

and

Hardship

Matrix

- · The matrix is divided into 9 cells, based on Low, Medium and High risk juxtaposed with Low, Medium and High hardship. One extra cell has been added to

the top: RH-Max to include Siachen Allowance. The Commission is of the view that the combination of risk/hardship in Siachen area is the maximum that any

government employee faces. Hence, this cell is meant to serve as the ceiling for risk/hardship allowances and the amount of no individual RHA should be more than this

allowance. - · The rates in each cell are in the nature of Rupees per month (Rs.pm). The rates will increase further by 25 percent each time DA rises by 50 percent.

- · Equal weightage has been given to Risk and Hardship. Hence, rates in cell R1H2 are similar to those in cell R2H1. Similarly, rates in cell R1H3 are

identical to cell R3H1 and rates of cell R2H3 are at par with cell R3H2. The matrix is, therefore, symmetrical. - · Since the severity of Risk/Hardship decreases as we move from left to right or top to bottom, the rates of allowance follow the same path.

- · Various allowances, currently payable, have been subsumed in different cells of the matrix. While the allowances shall maintain their names and

conditions attached with their admissibility (unless otherwise stated), they will be paid as per the rate of the cell under which they have been placed. - · It should be clearly understood that this matrix only aims to compensate for risk and hardship involved in jobs/work environments. It does not determine the status in any way.

- · The grouping of allowances in different cells is based on (a) present rates, (b) representations received, and (c) firsthand experience of the Commission

during visits to various places.

- Rate recommended:

jawans posted in Siachen Glacier. Hence, no RHA can have a value higher than this allowance.

- Rate recommended:

High Altitude Allowance-CAT III.

e.g. for GP>=5400, the average of Rs.15,750, Rs.21,000, Rs.16,500 and Rs.13,500 comes to Rs.16,688.

adopted will have the intended consequence of benefitting the junior officers and ranks more compared to higher officers and ranks. For e.g. the allowance

for a Sepoy will go up from Rs.10,500 to Rs.17,300 pm, while it would have been only Rs.15,750 if a simple factor of 1.5 was applied to his rate of

allowance.

been kept intact.

conscious decision in view of the threat of Left Wing Extremism and a strong demand for parity in this regard.

allowance on an hourly basis should be done away with.

- Rate recommended:

below GP 5400 and then applying a factor of 1.5.

is again done having regard to the importance of Counter Insurgency Operations in view of the threat of Left Wing Extremism.

- Rate recommended:

Allowance.

communicable diseases. This practice should be stopped and HPCA/PCA should be admissible to only those employees who come in continuous and routine contact

with the patients.

- Rate recommended:

- Rate recommended:

FreeFall Jump Instructor Allowance, Para Allowance.

Allowance, or 60 percent of the rate of this cell. There is a strong demand from CAPFs that the classification of Field Areas into Highly Active, Field or

Modified, which is presently done by Ministry of Defence, should be done jointly by Ministry of Defence and Ministry of Home Affairs for places where CAPFs

are deployed. The Commission finds the demand reasonableafter takinginto account the first-hand experience duringits visits at various places. Hence, it is

recommended that a joint committee of Ministry of Home Affairs and Ministry of Defence should revisit the present classification of places, and future

categorizations should also be done as a joint exercise for places where CAPFs are posted.

require a foot march of five days or more should be enhanced by further 25 percent.

Special Forces Allowance. Post VI CPC recommendations; the government increased Special Forces Allowance but left the other allowances untouched. Due to

this the percentage was reduced from 30-40 percent to about 8-10 percent, which has caused resentment especially because the personnel drawing these

allowances are drawn from the same regiment, viz., the Para regiment. The traditional relationship has been restored now. Para Reserve allowance will

continue to be one-fourth of the rate of Para Allowance.

they are deployed in disaster or disaster like situations.

reduced to 4 hours for Sea Going Allowance.

employee posted in such areas proceeds on leave for more than fifteen days, the payment of these allowances is stopped. This ceiling should be raised from

fifteen days to thirty days.

- Rate recommended:

- Rate recommended:

DutyAllowance.

- Rate recommended:

Survey) Allowance, and Hydrographic Survey Allowance (except non-surveyors).

categories of employees.

8.10.76 Cell Name: R3H3

- Rate recommended:

Special LC Gate Allowance, Submarine Technical Allowance, Hydrographic Survey Allowance (for non-surveyors)

increase on the consideration that the minimum rate of RHA should be Rs.1,000 pm.

Linked

Allowances

percent. The rate will further rise by 25 percent each time DA crosses 50 percent.

and risk/hardship allowances like CI Ops Allowance, etc. as far as CAPFs are concerned. The government has also referred this linkage to the Commission for

consideration. The views of the Commission on this issue have been brought out under the discussion of Detachment Allowance, under Allowances Related to

Travel.

Risk Allowance is not required.

General

Recommendations

mutandis to CAPF personnel posted in field areas.

Commission has attempted to study all such existing allowances, grade them in order of severity, and have a structured approach for compensation on this

count, it feels that there is scope for a more scientific approach. Accordingly, this Commission endorses the suggestion made by the V

remoteness, etc.) and map out the entirecountryaccordingly.TheRemoteness Indexof Australiamaybestudied forthis purpose. The risk involved in jobs should

also be assessed scientifically. The risk/hardship allowances can then be rationalized further.

Allowances

Recommended

to

be

Abolished

- Assisting Cashier Allowance, Cash Handling Allowance, and Treasury Allowance– With the technological advances and growing emphasis on banking, these

allowances have lost their relevance. Here it is recommended that not only all salary be paid through banks, but ministries/departments should work out

plans to first minimize and then eliminate all sorts of cash transactions. - Commando Allowance, Handicapped Allowance, Night Patrolling Allowance, Operation Theatre Allowance, Organization Special Pay, Risk Allowance–These

allowances have meagre rates. With the rise in pay proposed by the Commission, these allowances are no longer required. - Coal Pilot Allowance, Out-turn Allowance–These allowances have become outdated. ·

- ASV Allowance, Flying Squad Allowance, Headquarters Allowance,

Metropolitan Allowance, Rajdhani Allowance, Savings Bank Allowance, Secret Allowance–The justification provided by the concerned ministry for the grant of these

allowances is not sufficient for their continuance. - Breakdown Allowance–Ministry of Railways has referred this allowance to the Commission for consideration. In the Commission’s view, responding to

emergencies is part of the duties of any government servant. Hence, granting a separate allowance for this purpose does not appear justified. - Special Compensatory (Hill Area) Allowance–There is hardly any hardship involved at altitudes of 1000 metres above sea level. Hence, it is recommended

that this allowance should be abolished. Instead, High Altitude Allowance should be extended to Civilian employees in case Tough Location Allowance or any

other RHA is not admissible at the location covered by High Altitude Allowance.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS