Allowances

Payable

for

Additional/ Extra

Duty

Chapter

8.3

Allowances

covered

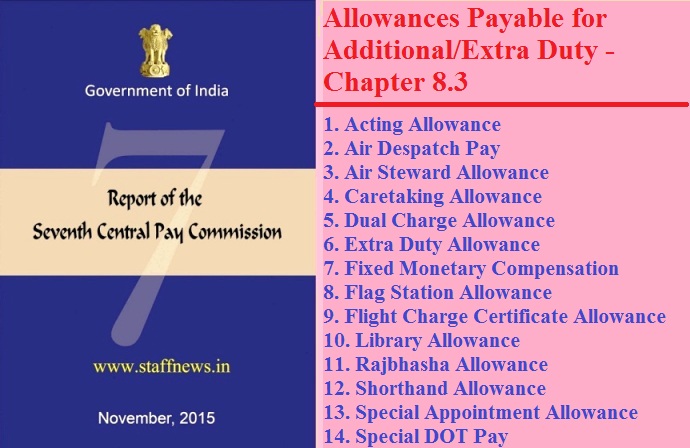

8.3.1 Alphabetical list of Allowances covered here is as under:

1. Acting Allowance

2. Air Despatch Pay

3. Air Steward Allowance

4. Caretaking Allowance

5. Dual Charge Allowance

6. Extra Duty Allowance

7. Fixed Monetary Compensation

8. Flag Station Allowance

9. Flight Charge Certificate Allowance

10. Library Allowance

11. Rajbhasha Allowance

12. Shorthand Allowance

13. Special Appointment Allowance

14. Special DOT Pay

allowances for performance of extra duty in addition to one’s core duty list, without any post sanctioned specifically for the extra duty so performed.

Allowances

for

holding

Additional

Charge

services who are appointed in Officers’ vacancies caused due to shortage of officers, but not caused by leave, temporary duty or courses of instructions.

The allowance is admissible only so long as the JCO performs the duty of an officer. The present rates are as under:

| For appointments tenable by Captain or equivalent |

Rs.900 pm |

| For appointments tenable by Major or equivalent | Rs.1200 pm |

8.3.4 Dual Charge Allowance, at the rate of 10 percent of Basic Pay, is granted to an officer in Indian

Railways when he is required to hold charge of a post in addition to his own post.

absentee postman. The present rates are as follows:

| When One Postman performs duty of an absentee Postman by combination of duties |

Rs.50 per day |

| When two Postmen perform duty of an absentee Postman by sharing the beat |

Rs.24 per day |

and Recommendations

dual charge of a higher post, they are entitled to the pay admissible in the higher post. However, no additional remuneration is admissible if the employee

is appointed to hold dual charge of a post carrying a scale of pay identical to his own.

also entitled to draw the pay admissible in the higher post. In addition, they are eligible to draw a Dual Charge Allowance at the rate of 10 percent of

their Basic Pay for holding formal charge of an identical level post, which is not permissible to employees governed by FR-49.

Also, this compensation should be a percentage of the Basic Pay of the employee since the value of time devoted for this “second”job differs with the

rank of employee. At the same time, proper safeguards should also be put in place so that such arrangements, are not continued for extensive lengths of time.

the pay that would be admissible to him if he was appointed to the higher post on regular basis OR 10 percent of his present Basic Pay per month, whichever

is higher, as Additional Post Allowance, provided the sum total of his Basic Payand Additional Post Allowance does not exceed the Apex Pay.

be entitled to draw 10 percent of his present Basic Pay per month as Additional Post Allowance, provided the sum total of his Basic Pay and Additional Post

Allowance does not exceed the Apex Scale.

irrespective of the duration of the current charge.

In addition, there shall be a minimum gap of 1 year between two such successive appointments of a particular employee.

absentee postman, he shall be paid 10 percent of his Basic Pay per month as Additional Post Allowance, while for two postmen sharing beats to perform the

duties of an absentee postman, each shall be paid 5 percent of his Basic Pay per month as Additional Post Allowance.

for

Performing

Extra

Duty

remuneration is in the form of various allowances as follows:

appointments in peace and war establishments. The present rates are:

| To Naiks holding the post of Havaldar | Rs.100 pm |

| To Havaldars holding the post of Naib Subedar |

Rs.160 pm |

borne helicopter flights in Defence forces, for discharging higher responsibilities of maintaining and clearing aircraft for air worthiness in the absence

of a Technical Officer. The existing rates of this allowance are:

| Chief Artificer/ Mechanician and above and equivalent |

Rs.600 pm |

| Air Artificier/Mechanician and equivalent | Rs.375 pm |

stations. The current rate of the allowance is Rs.120 pm.

existing rates are:

| Senior Scale |

Rs.600 pm |

| JAG | Rs.900 pm |

| SAG | Rs.1800 pm |

this allowance are:

| Primary School Teacher |

Rs.300 pm |

| School Teacher | Rs.450 pm |

| High/Hr. Secondary School Teacher |

Rs.600 pm |

addition to their core activity. The rates are:

Rs.

per

month)

| Appointment Held | Rate of Allowance |

| Inspector (Comn) | 320 |

| SI (Radio Operator) | 320 |

| SI (Cipher Operator) | 320 |

| SI (MT) | 240 |

| SI (Adjutant) | 240 |

| SI (Quarter Master) | 240 |

| HC (Radio Operator) | 320 |

| HC (Cipher Operator) | 320 |

| HC (BQMH) | 120 |

| HC (CQMH) | 80 |

| HC (CHM) | 120 |

| HC (Instructor) | 160 |

| HC (Armourer) | 160 |

| HC (BHM) | 80 |

| Constable (Bugular) | 40 |

| Constable (Storeman/Tech) | 80 |

in various ministries who are deployed for caretaking duties.

and

Recommendations

and as a percentage of the employee’s Basic Pay. Accordingly, it is recommended that these allowances should be covered under a new Extra Work Allowance, which shall be governed as under:

- a. Extra Work Allowance will be paid at a uniform rate of 2 percent of Basic Pay per month.

- b. An employee may receive this allowance for a maximum period of one year, and there should be a minimum gap of one year before the same employee can be

deployed for similar duty again. - c. This allowance should not be combined, i.e., if same employee is performing two or more such duties, and is eligible for 2 percent allowance for each

add-on, then the total Extra Work Allowance payable will remain capped at 2 percent.

Others

their regard are detailed below:

higher responsibility. No demands have been received regarding this allowance.

and

Recommendations

supplies in forward areas. The current rate is Rs.360 pm. Air Steward Allowance is granted to Group “Y” tradesmen of the Indian Air Force who are employed

on board VVIP flights for steward duties. The existing rate is Rs.900 pm. Shorthand Allowance is payable to PBORs of Indian Air Force and Indian Navy

employed on shorthand duties. The present rate is Rs.360 pm.

and

Recommendations

related job profile and additional allowance is not justified. Accordingly, it is recommended that these three allowances should be abolished.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

DUAL CHARGE IS ONLY ORAL BUT NEVER IN WRITING BY CONCERNED OFFICIALS WHO HAS TO ISSUE ORDERS.TO GET THE WORK DONE HIGHER OFFICIAL WILL GIVE ORAL ORDERS WITH NO CONFIRMATION.THIS HAS TO BE NOTED