Minimum wages for one day will be paid to all Guards & Other Staff employed by Director General of Resettlement (DGR) sponsored Security Agencies/ Companies/ Corporations throughout the country w.e.f. 01 April, 2016:

2112/SA/MINIMUM WAGES/EMP

DIRECTORATE GENERAL OF RESETTLEMENT MINISTRY OF DEFENCE

GOVERNMENT OF INDIA WEST BLOCK IV RK PURAM NEW DELHI 110066

NOTICE OF REVISION OF MINIMUM WAGES FOR ONE DAY W.E.F. 01 APR 16

1. REFERENCE GOVERNMENT OF INDIA, MINISTRY OF DEFENCE OFFICE MEMORANDUM NO

28(3)/2012-D(RES-l) DATED 09 JUL 2012 AND AMENDMENT ISSUED VIDE OM NO.

28(3)/2012/D(RES-l) DATED 16 JAN 2013 REGARDING GUIDELINES FOR FUNCTIONING OF

DGR EMPANELLED EX-SERVICEMEN SECURITY SERVICES.

28(3)/2012-D(RES-l) DATED 09 JUL 2012 AND AMENDMENT ISSUED VIDE OM NO.

28(3)/2012/D(RES-l) DATED 16 JAN 2013 REGARDING GUIDELINES FOR FUNCTIONING OF

DGR EMPANELLED EX-SERVICEMEN SECURITY SERVICES.

2 CONSEQUENT TO REVISION OF MINIMUM WAGES BY MINISTRY OF LABOUR AND EMPLOYMENT,

GOVERNMENT OF INDIA, FOR EMPLOYMENT OF PERSONNEL OF THE CENTRAL SPHERE, FOR

WATCH AND WARD DUTIES AND IBID OFFICE MEMORANDUM. THE UNDER MENTIONED MINIMUM

WAGES FOR ONE DAY ARE THE WAGES BELOW WHICH THE PAYMENT TO THE GUARDS & OTHER

STAFF EMPLOYED WILL NOT BE MADE BY DGR SPONSORED SECURITY AGENCIES/ COMPANIES/

CORPORATIONS THROUGHOUT THE COUNTRY WITH EFFECT FROM 01 APR 16

GOVERNMENT OF INDIA, FOR EMPLOYMENT OF PERSONNEL OF THE CENTRAL SPHERE, FOR

WATCH AND WARD DUTIES AND IBID OFFICE MEMORANDUM. THE UNDER MENTIONED MINIMUM

WAGES FOR ONE DAY ARE THE WAGES BELOW WHICH THE PAYMENT TO THE GUARDS & OTHER

STAFF EMPLOYED WILL NOT BE MADE BY DGR SPONSORED SECURITY AGENCIES/ COMPANIES/

CORPORATIONS THROUGHOUT THE COUNTRY WITH EFFECT FROM 01 APR 16

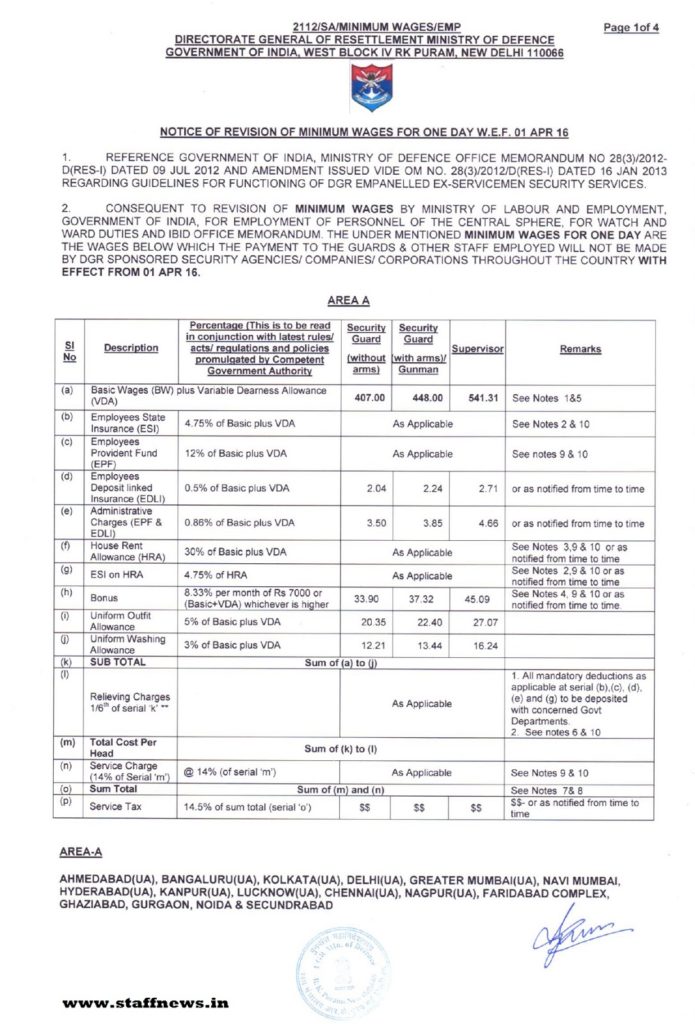

AREA A

|

Sl No

|

Description

|

Percentage (This is to be read in conjunction with

latest rules/ acts/ regulations and policies promulgated by Competent Governemnt Authority |

Security Guard (Without arms) |

Security Guard (With arms)/ Gunman |

Supervisor |

Remarks

|

| (a) | Basic Wages (BW) plus Variable Dearness Allowance (VDA) |

407.00 | 448.00 | 541.31 | See Notes 1&5 | |

| (b) | Employees State Insurance (ESI) | 4.75% of Basic plus VDA | As Applicable | See Notes 2 & 10 | ||

| (c) | Employees Provident Fund (EPF) | 12% of Basic plus VDA | As Applicable | See notes 9 & 10 | ||

| (d) | Employees Deposit linked Insurance (EDLI) | 0.5% of Basic plus VDA | 2.04 | 2.24 | 2.71 | or as notified from time to time |

| (e) | Administrative Charges (EPF & EDLI | 0.86% of Basic plus VDA | 3.50 | 3.85 | 4.66 | or as notified from time to time |

| (f) | House Rent Allowance (HRA) | 30% of Basic plus VDA | As Applicable | See Notes 3,9 & 10 or as notified from time to time |

||

| (g) | ESI on HRA | 4.75% of HRA | As Applicable | See Notes 2,9 & 10 or as notified from time to time | ||

| (h) | Bonus | 8.33% per month of Rs 7000 or Basic+VDA whichever is higher |

33.90 | 37.32 | 45.09 | See Notes 4. 9 & 10 or as notified from time to time. |

| (i) | Uniform Outfit Allowance | 5% of Basic plus VDA | 20.35 | 22.40 | 27.07 | |

| (j) | Uniform Washing Allowance | 3% of Basic plus VDA | 12.21 | 13.14 | 16.24 | |

| (k) | SUB TOTAL | Sum of (a) to (j) | ||||

| (l) | Relieving Charges 1/6th of serial ‘k’ ** | As Applicable | 1. All mandatory deductions as applicable at serial (b),(c), (d), (e) and (g) to be deposited As Applicable with concerned Govt. Departments. 2. See notes 6 & 10 |

|||

| (m) | Total Cost Per Head | Sum of (k) to (l) | ||||

| (n) | Service Charge (14% of Serial ‘m’) | @ 14% (of serial ‘m’) | As applicable | See notes 9 & 10 | ||

| (o) | Sum Total | Sum of (m) and (n) | See Notes 7 & 8 | |||

| (p) | Service Tax | 14.5% of sum total (serial ‘o’) | $$ | $$ | $$ | $$ or as notified from time to time |

AREA A

AHMEDABAD(UA), BANGALURU(UA), KOLKATA(UA), DELHI(UA), GREATER MUMBAI(UA), NAVI MUMBAI, HYDERABAD(UA), KANPUR(UA), LUCKNOW(UA), CHENNAI(UA), NAGPUR(UA), FARIDABAD COMPLEX, GHAZIABAD, GURGAON, NOIDA & SECUNDRABAD

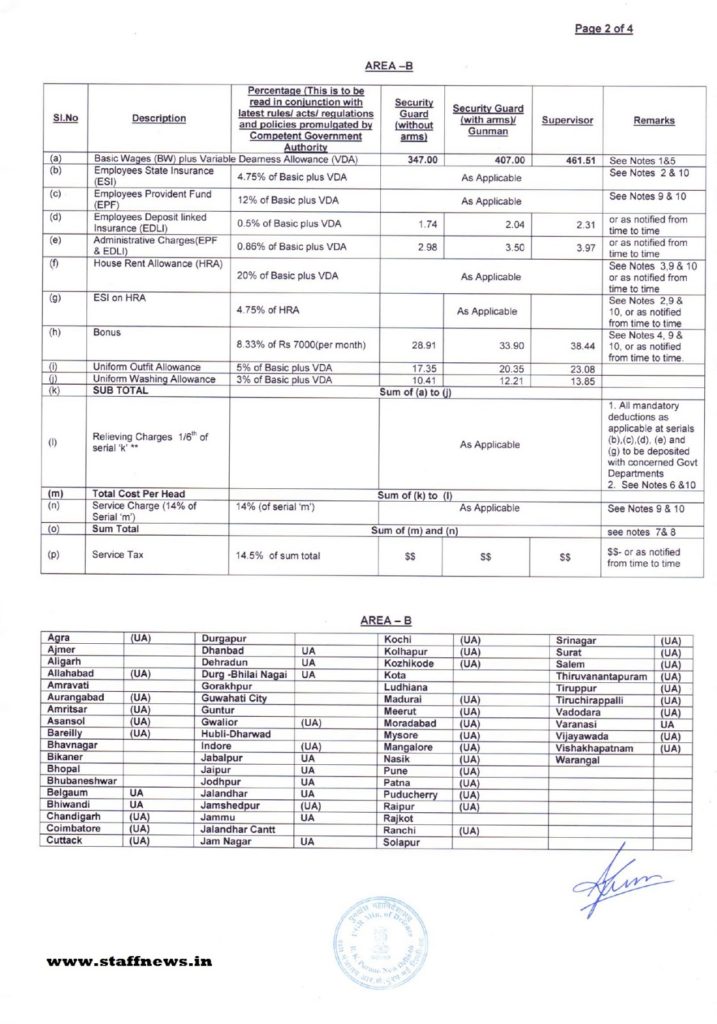

AREA B

|

Sl No

|

Description

|

Percentage (This is to be read in conjunction with

latest rules/ acts/ regulations and policies promulgated by Competent Governemnt Authority |

Security Guard (Without arms) |

Security Guard (With arms)/ Gunman |

Supervisor |

Remarks

|

| (a) | Basic Wages (BW) plus Variable Dearness Allowance (VDA) |

347.00 | 407.00 | 461.51 | See Notes 1&5 | |

| (b) | Employees State Insurance (ESI) | 4.75% of Basic plus VDA | As Applicable | See Notes 2 & 10 | ||

| (c) | Employees Provident Fund (EPF) | 12% of Basic plus VDA | As Applicable | See notes 9 & 10 | ||

| (d) | Employees Deposit linked Insurance (EDLI) | 0.5% of Basic plus VDA | 1.74 | 2.04 | 2.31 | or as notified from time to time |

| (e) | Administrative Charges (EPF & EDLI | 0.86% of Basic plus VDA | 2.98 | 3.50 | 3.97 | or as notified from time to time |

| (f) | House Rent Allowance (HRA) | 30% of Basic plus VDA | As Applicable | See Notes 3,9 & 10 or as notified from time to time |

||

| (g) | ESI on HRA | 4.75% of HRA | As Applicable | See Notes 2,9 & 10 or as notified from time to time | ||

| (h) | Bonus | 8.33% per month of Rs 7000 or Basic+VDA whichever is higher |

28.91 | 33.90 | 38.44 | See Notes 4. 9 & 10 or as notified from time to time. |

| (i) | Uniform Outfit Allowance | 5% of Basic plus VDA | 17.35 | 20.35 | 23.08 | |

| (j) | Uniform Washing Allowance | 3% of Basic plus VDA | 10.41 | 12.21 | 13.85 | |

| (k) | SUB TOTAL | Sum of (a) to (j) | ||||

| (l) | Relieving Charges 1/6th of serial ‘k’ ** | As Applicable | 1. All mandatory deductions as applicable at serial (b),(c), (d), (e) and (g) to be deposited As Applicable with concerned Govt. Departments. 2. See notes 6 & 10 |

|||

| (m) | Total Cost Per Head | Sum of (k) to (l) | ||||

| (n) | Service Charge (14% of Serial ‘m’) | @ 14% (of serial ‘m’) | As applicable | See notes 9 & 10 | ||

| (o) | Sum Total | Sum of (m) and (n) | See Notes 7 & 8 | |||

| (p) | Service Tax | 14.5% of sum total (serial ‘o’) | $$ | $$ | $$ | $$ or as notified from time to time |

AREA B

|

Agra

|

(UA)

|

Durgapur

|

Kochi

|

(UA)

|

Srinagar

|

(UA)

|

|

|

Ajmer

|

Dhanbad

|

UA

|

Kolhapur

|

(UA)

|

Surat

|

(UA)

|

|

|

Aligarh

|

Dehradun

|

UA

|

Kozhikode

|

(UA)

|

Salem

|

(UA)

|

|

|

Allahabad

|

(UA)

|

Durg-Bhilai Nagal

|

UA

|

Kota

|

Thiruvanantapuram

|

(UA)

|

|

|

Amravati

|

Gorakhpur

|

Ludhiana

|

Tiruppur

|

(UA)

|

|||

|

Aurangabad

|

(UA)

|

Guwahati City

|

Madurai

|

(UA)

|

Tiruchirappalli

|

(UA)

|

|

|

Amritsar

|

(UA)

|

Guntur

|

Meerut

|

(UA)

|

Vadodara

|

(UA)

|

|

|

Asansol

|

(UA)

|

Gwalior

|

(UA)

|

Moradabad

|

(UA)

|

Varanasi

|

UA

|

|

Bareilly

|

(UA)

|

Hubli-Dharwad

|

Mysore

|

(UA)

|

Vijayawada

|

(UA)

|

|

|

Bhavnagar

|

Indore

|

(UA)

|

Mangalore

|

(UA)

|

Vishakhapatnam

|

(UA)

|

|

|

Bikaner

|

Jabalpur

|

UA

|

Nasik

|

(UA)

|

Warangal

|

||

|

Bhopal

|

Jaipur

|

UA

|

Pune

|

(UA)

|

|||

|

Bhubaneshwar

|

Jodhpur

|

UA

|

Patna

|

(UA)

|

|||

|

Belgam

|

UA

|

Jalandhar

|

UA

|

Puducherry

|

(UA)

|

||

|

Bhiwandi

|

UA

|

Jameshedpur

|

(UA)

|

Raipur

|

(UA)

|

||

|

Chandigarh

|

(UA)

|

Jammu

|

UA

|

Rajkot

|

|||

|

Coimbatore

|

(UA)

|

Jalandhar Cantt

|

Ranchi

|

(UA)

|

|||

|

Cuttack

|

(UA)

|

Jamnagar

|

UA

|

Sholapur

|

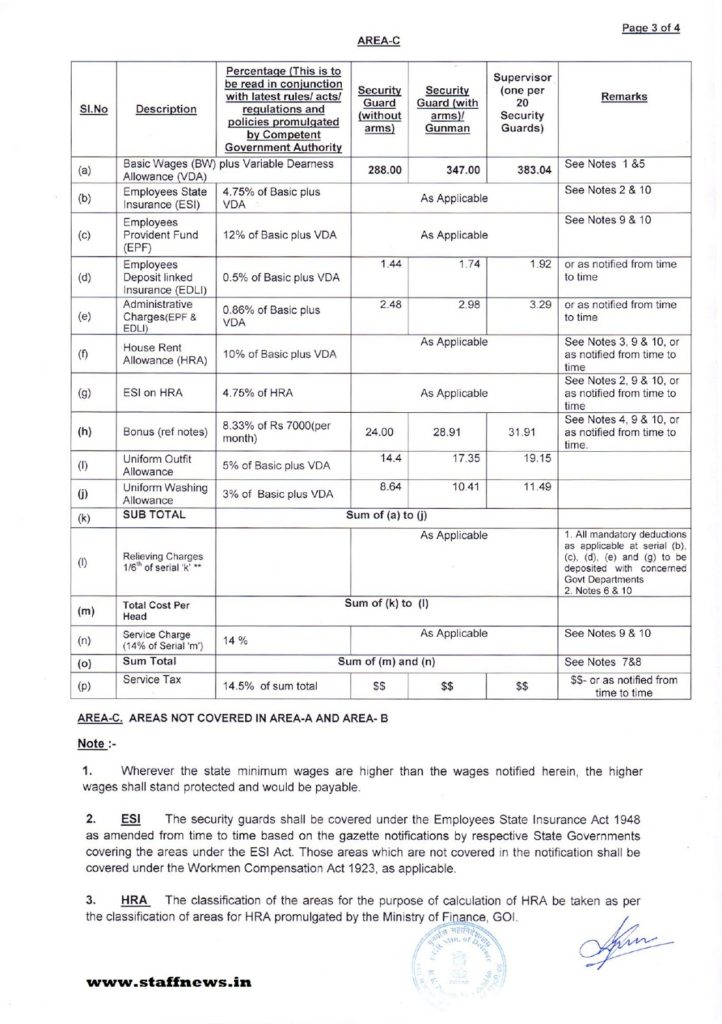

AREA-C

|

Sl No

|

Description

|

Percentage (This is to be read in conjunction with

latest rules/ acts/ regulations and policies promulgated by Competent Governemnt Authority |

Security Guard (Without arms) |

Security Guard (With arms)/ Gunman |

Supervisor |

Remarks

|

| (a) | Basic Wages (BW) plus Variable Dearness Allowance (VDA) |

288.00 | 347.00 | 383.04 | See Notes 1&5 | |

| (b) | Employees State Insurance (ESI) | 4.75% of Basic plus VDA | As Applicable | See Notes 2 & 10 | ||

| (c) | Employees Provident Fund (EPF) | 12% of Basic plus VDA | As Applicable | See notes 9 & 10 | ||

| (d) | Employees Deposit linked Insurance (EDLI) | 0.5% of Basic plus VDA | 1.44 | 1.74 | 1.92 | or as notified from time to time |

| (e) | Administrative Charges (EPF & EDLI | 0.86% of Basic plus VDA | 2.48 | 2.98 | 3.29 | or as notified from time to time |

| (f) | House Rent Allowance (HRA) | 30% of Basic plus VDA | As Applicable | See Notes 3,9 & 10 or as notified from time to time |

||

| (g) | ESI on HRA | 4.75% of HRA | As Applicable | See Notes 2,9 & 10 or as notified from time to time | ||

| (h) | Bonus | 8.33% per month of Rs 7000 or Basic+VDA whichever is higher |

24.00 | 38.91 | 31.91 | See Notes 4. 9 & 10 or as notified from time to time. |

| (i) | Uniform Outfit Allowance | 5% of Basic plus VDA | 14.40 | 17.35 | 19.15 | |

| (j) | Uniform Washing Allowance | 3% of Basic plus VDA | 8.64 | 10.41 | 11.49 | |

| (k) | SUB TOTAL | Sum of (a) to (j) | ||||

| (l) | Relieving Charges 1/6th of serial ‘k’ ** | As Applicable | 1. All mandatory deductions as applicable at serial (b),(c), (d), (e) and (g) to be deposited As Applicable with concerned Govt. Departments. 2. See notes 6 & 10 |

|||

| (m) | Total Cost Per Head | Sum of (k) to (l) | ||||

| (n) | Service Charge (14% of Serial ‘m’) | @ 14% (of serial ‘m’) | As applicable | See notes 9 & 10 | ||

| (o) | Sum Total | Sum of (m) and (n) | See Notes 7 & 8 | |||

| (p) | Service Tax | 14.5% of sum total (serial ‘o’) | $$ | $$ | $$ | $$ or as notified from time to time |

AREA C. AREAS NOT COVERED IN AREA-A AND AREA-B

Note :-

1. Wherever the state minimum wages are higher than the wages notified herein,

the higher wages shall stand protected and would be payable.

the higher wages shall stand protected and would be payable.

2. ESI The security guards shall be covered under the Employees State Insurance

Act 1948 as amended from time to time based on the gazette notifications by

respective State Governments covering the areas under the ESI Act. Those areas

which are not covered in the notification shall be covered under the Workmen

Compensation Act 1923, as applicable.

Act 1948 as amended from time to time based on the gazette notifications by

respective State Governments covering the areas under the ESI Act. Those areas

which are not covered in the notification shall be covered under the Workmen

Compensation Act 1923, as applicable.

3. HRA The classification of the areas for the purpose of calculation of HRA be

taken as per the classification of areas for HRA promulgated by the Ministry of

Finance, GOI.

taken as per the classification of areas for HRA promulgated by the Ministry of

Finance, GOI.

4. BONUS Bonus is mandatory as per Payment of Bonus Act 1965 (as amended).As per

Payment of Bonus Amendment Act 2015, concerned months wage as fixed by DGR or

State Govt or Rs 7000/- whichever is higher is payable to the Security

guard/Supervisor with effect from 01 April 14.

Payment of Bonus Amendment Act 2015, concerned months wage as fixed by DGR or

State Govt or Rs 7000/- whichever is higher is payable to the Security

guard/Supervisor with effect from 01 April 14.

5. ** Paid Rest Day. The security guards are entitled to a paid rest day in

every period of seven days (Refer Section 13 (b) of the Minimum Wages Act, 1948

and Rule 23 of the Wages (Central) Rules, 1950). When a security guard is

requisitioned by the Principal Employer to work for more than 48 hours in a week

he is entitled to wages on overtime rates for the additional period at double

the ordinary rates in addition to the wages for the rest day.

every period of seven days (Refer Section 13 (b) of the Minimum Wages Act, 1948

and Rule 23 of the Wages (Central) Rules, 1950). When a security guard is

requisitioned by the Principal Employer to work for more than 48 hours in a week

he is entitled to wages on overtime rates for the additional period at double

the ordinary rates in addition to the wages for the rest day.

6. Leave. Payment for leave relief during the leave as mandated by centre/state

govts /Principal employer/service recipient will also be admissible by the

Principal Employer / Service Recipients. This is not to be included in the

quotation for bidding purposes.

govts /Principal employer/service recipient will also be admissible by the

Principal Employer / Service Recipients. This is not to be included in the

quotation for bidding purposes.

7. Additional Charges. Additional charges will be levied in case of service

being provided in remote/disturbed/hazardous areas as Field Allowance @ 25

percent on Basic Pay plus VDA will be entitled to ESM security guards when

working in remote/disturbed area such as Northern Eastern States, J&K etc, or

when working in areas hazardous to health such as Coal Fields, Mines and

Pipelines.

being provided in remote/disturbed/hazardous areas as Field Allowance @ 25

percent on Basic Pay plus VDA will be entitled to ESM security guards when

working in remote/disturbed area such as Northern Eastern States, J&K etc, or

when working in areas hazardous to health such as Coal Fields, Mines and

Pipelines.

8. The daily wages shall be the minimum wages below which the security agencies

cannot bid. The security agencies shall acquaint themselves with the relevant

statutory provisions and carry out the market survey before bidding/ quoting the

rates of basic daily wage including the variable dearness allowance but the same

will not be below the minimum wages as given above.

cannot bid. The security agencies shall acquaint themselves with the relevant

statutory provisions and carry out the market survey before bidding/ quoting the

rates of basic daily wage including the variable dearness allowance but the same

will not be below the minimum wages as given above.

9. Wages are subject to amendments as and when promulgated by concerned

authorities from time to time.

authorities from time to time.

10. Paras 2(b), (c), (f), (g), (h), (I) and (n) shall be calculated by the

security agencies and PSUs/ Service recipients, as per the governing statutory

provisions, as applicable.

security agencies and PSUs/ Service recipients, as per the governing statutory

provisions, as applicable.

11. Any welfare measures laid down by the Central / State Enactments shall be

duly complied with by the security agencies and PSUs/ Principal employers.

duly complied with by the security agencies and PSUs/ Principal employers.

COMMENTS