Anomaly in Pay Matrix levels of 7th CPC

NFIR

National Federation of Indian Railwaymen

3, CHELMSFORD ROAD, NEW DELHI – 110 055

No.IV/NAC/7th CPC/2016

Dated:10/08/2017

The Secretary (E), Railway Board, New Delhi

Dear Sir,

Sub: Anomaly in Pay Matrix levels of 7th CPC.

****

NFIR brings to the kind notice of Railway Board the anomaly arisen due to non-grant of 3% of pay towards annual increment, pursuant to implementation of 7th CPC pay matrix levels as explained below:-

(a) Clause (c) of terms of reference of the National Anomaly Committee says that the Official Side and Staff Side are of the opinion that any

recommendation is in contravention of the principle or the policy enunciated by the 7th CPC itself without the commission assigning any

reason, constitutes an anomaly.

recommendation is in contravention of the principle or the policy enunciated by the 7th CPC itself without the commission assigning any

reason, constitutes an anomaly.

(b) The recommendations of 7th CPC regarding Annual Increment are as follows:

(i) 7th CPC Report —Highlights of recommendations- Annual Increment- The rate of annual increment is being retained at 3%.

(ii) 7th CPC Report Forward:-

Para 1.19- The prevailing rate of increment is considered satisfactory and has been retained.

(iii) 7th CPC Report —Chapter 4.1-Principles of pay determination –

Para-4.1.17 —The various stages within a pay level moves upwards at the rate of 3% per annum.

(iv) 7th CPC Report -Chapter -5.1 —Pay structure (Civilian employees)

Para 5.1.38-Annual Increment.

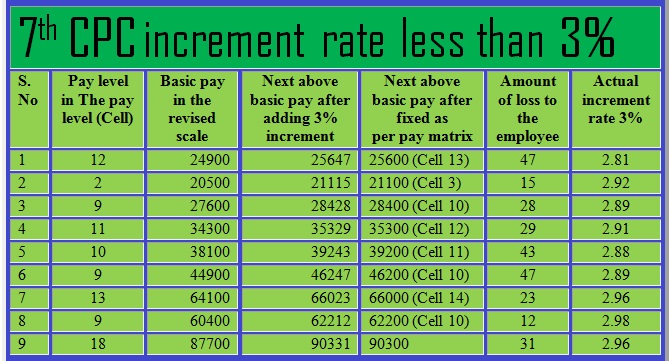

“The rate of annual increment is being retained at 3%” Para 5.1.21-The vertical range of each level denotes pay progress within that level. That indicates steps of annual financial progression of 3% within each level. However, contrary to the above principle laid down by 7th CPC, the actual increment rate in the following pay level of the pay matrix are less than 3% as illustrated in the following table.

| S.No | Pay level in The pay

level (Cell) |

Basic pay in the revised scale | Next above basic pay after adding 3% increment | Next above basic pay after fixed as per pay matrix |

Amount of loss to the employee |

Actual increment rate 3% |

| 1 | 12 | 24900 | 25647 | 25600 (Cell 13) | 47 | 2.81 |

| 2 | 2 | 20500 | 21115 | 21100 (Cell 3) | 15 | 2.92 |

| 3 | 9 | 27600 | 28428 | 28400 (Cell 10) | 28 | 2.89 |

| 4 | 11 | 34300 | 35329 | 35300 (Cell 12) | 29 | 2.91 |

| 5 | 10 | 38100 | 39243 | 39200 (Cell 11) | 43 | 2.88 |

| 6 | 9 | 44900 | 46247 | 46200 (Cell 10) | 47 | 2.89 |

| 7 | 13 | 64100 | 66023 | 66000 (Cell 14) | 23 | 2.96 |

| 8 | 9 | 60400 | 62212 | 62200 (Cell 10) | 12 | 2.98 |

| 9 | 18 | 87700 | 90331 | 90300 | 31 | 2.96 |

(d) From the above table it can be concluded that:

1. The recommendations of 7th CPC regarding increment rate is in contravention of the principle or policy enunciated by 7th CPC, hence it

constitutes an anomaly .

constitutes an anomaly .

2. In many stages even though the increment rate shown is 3%, it is rounded off to next below amount causing financial loss to the employees.

3. In the 6th CPC, while calculating increment, if the last digit as one or above, it used to be rounded off to next 10. So in this pay matrix, if the amount is 10 and above, it should be rounded off to next 100.

NFIR therefore requests the Railway Board to take necessary action for rectification of anomaly so as to ensure that the increment @ 3% of pay is granted to employees in whose cases where the actual amount is less than 3%.

Yours faithfully,

(Dr M. Raghavaiah)

General Secretary

Source – NFIR

COMMENTS

Dear Sri Raghavaiah garu,

The Implementation Cell of the 7th CPC in Fin Ministry has clarified in OM dated 3rd Aug 2017 that bunching benefit may be allowed while revising pay from 6th CPC pay band to 7th CPC pay matrix.This benefit should be limited at the rate of 1 increment for every 2 increments got bunched. Further it was stated that the increment has to be calculated @ 3% only. However this benefit is also needs to be extended to pre-2016 pensioners too, while fixing their pay under 7th CPC for giving modified parity of pension. You may appreciate that these old pensioners have already lost heavily due to rejection of original recommendation of 7th CPC on rationalized parity,Option-I, and they deserve at least this small mercy.So,Sir, kindly take up this issue with the Finance Ministry from your level to get the bunching benefit extended to pre-2016 pensioners. All the pensioner fraternity will be grateful to you, Sir. if this small mercy is extended to them.

Thank you. sir.